Yes, Combining Value And Momentum Can Be Effective

In their paper, "Value and Momentum in Anomalies," Anginer, Ray, Seyhun, and Xu "find favorable anomalies based on combined momentum and value principles outperform unfavorable anomalies by about 90 bp per month."

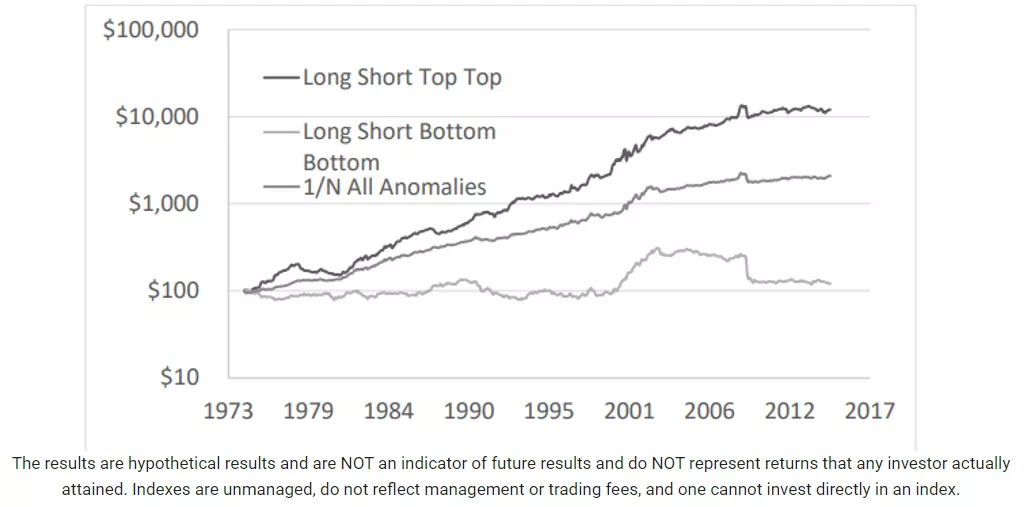

The graph below displays the results of a $100 investment in anomalies that are "super winners" and "super losers," which are rebalanced monthly (top 7 of 13 for both momentum and value, and bottom 6 of 13 of both momentum and value, respectively).

Cumulative return logs are displayed and they are designated as "Long-Short top-top" (growing abnormally to $12,010) and "Long-Short bottom-bottom" (growing unnaturally to $121 in 2014).

The graph also shows the performance of a portfolio that equally weights "each of the 13 anomalies that we took into account while selecting our sample ("1/N All Anomalies (increasing abnormally to $2,082 in 2014)".

Summary

The authors are the first to document that anomaly-value and anomaly-momentum can be coupled to build an effective trading strategy.

They find with momentum, when leveraged to time investment decisions, can reduce tail risk.

Their research adds to the body of evidence indicating that adopting investment vehicles that combine both value and momentum strategies can help investors increase the efficiency of their portfolios.

More By This Author:

Are We Truly In A Bear In Stocks?

The Fed's Inflation Policy Appears To Be Working As Planned

An Effective Approach To Utilizing The 200 DMA

These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker

Good read, thanks.