Expect Equities To Improve Before The Economy In 2023

Photo by Yiorgos Ntrahas on Unsplash

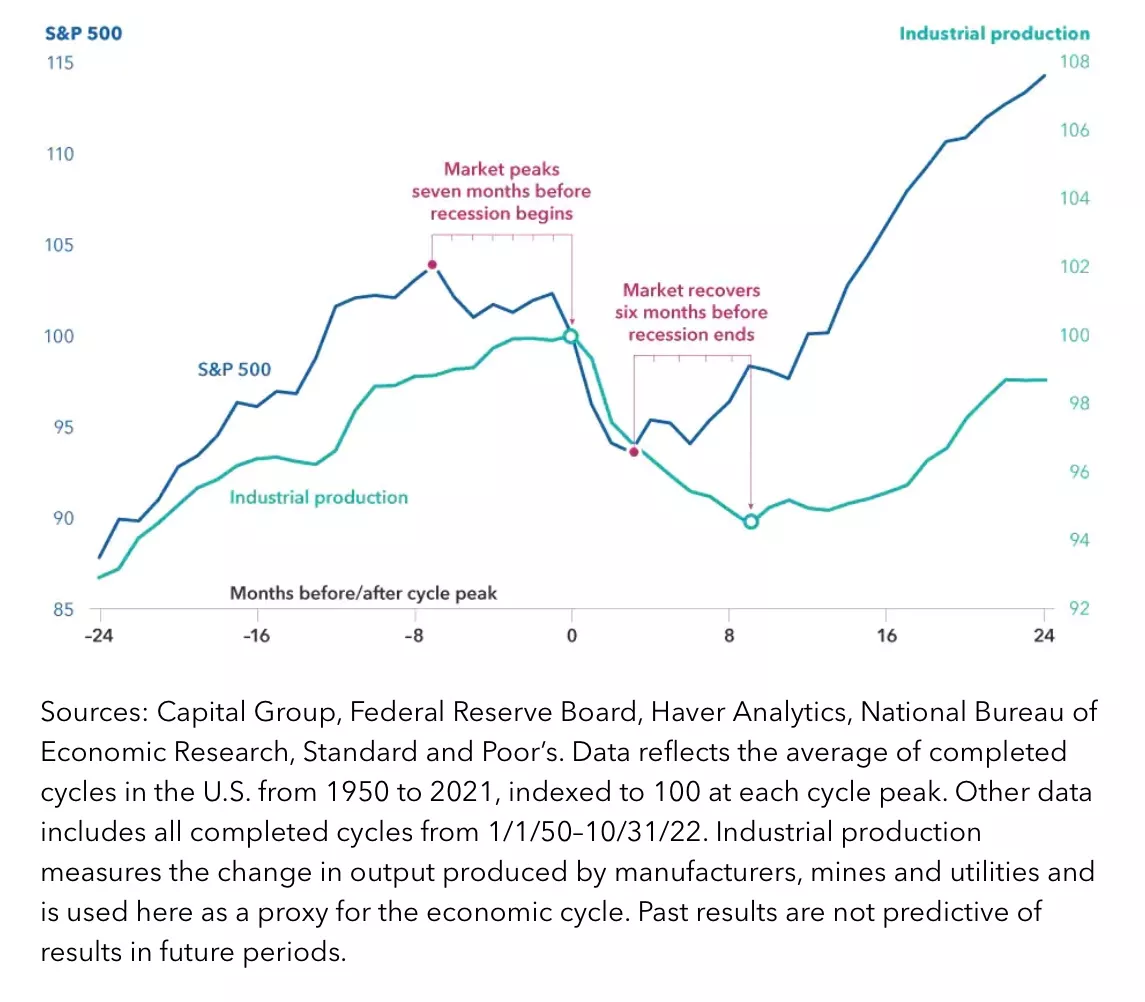

Every recession is terrible in its own unique manner, but one possible plus is that historically speaking, they don't last very long.

Recessions have lasted anything from two to 18 months, according to our examination of 11 U.S. cycles since 1950, with an average of roughly 10 months.

Additionally, stock markets typically begin to rebound before a recession comes to an end.

By the middle of 2022, nearly all of the major equity markets would have entered the bear market territory, with stocks already having led the economy on the way down in this cycle.

And if past performance is any indication, they might recover roughly six months before the economy does.

Instead of attempting to time the rebound, investors could be better off staying invested.

Taking advantage of a complete market recovery can have significant advantages. Since 1950, bull markets have generated an average return of 265% compared to bear markets' loss of 33% over all cycles.

The largest gains frequently happen right after a bottom.

As a result, waiting for the economy to turn around is not a wise course of action.

Link to research.

More By This Author:

The Strategic Asset Allocation Dilemma

Yield Spread Translates Into Greater Than 50% Chance Of Recession

Sustainability Ratings Appear To Be A Drag On Fund Performance

These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker