Deflation Has Begun

On an annual basis, the balance sheet of the European Central Bank is contracting.

The Federal Reserve and the Bank of England's balance sheets are both experiencing the same deflation process.

Although central banks have been creating money, the benefits of the upbeat social climate that propelled markets higher during the past ten years have vanished.

The total amount of money in circulation in the United States is currently deflationary proof.

Different methods are used to calculate the "money" stock.

M1 is made up of cash that is not kept in the vaults of depository institutions, the Federal Reserve Banks, or the U.S. Treasury, as well as demand deposits at commercial banks and other liquid deposits, such as savings and other checkable deposits (including money market deposit accounts).

A broader index, known as M2, is made up of M1 plus balances in retail money market funds and small-denomination time deposits (time deposits with sums under $100,000).

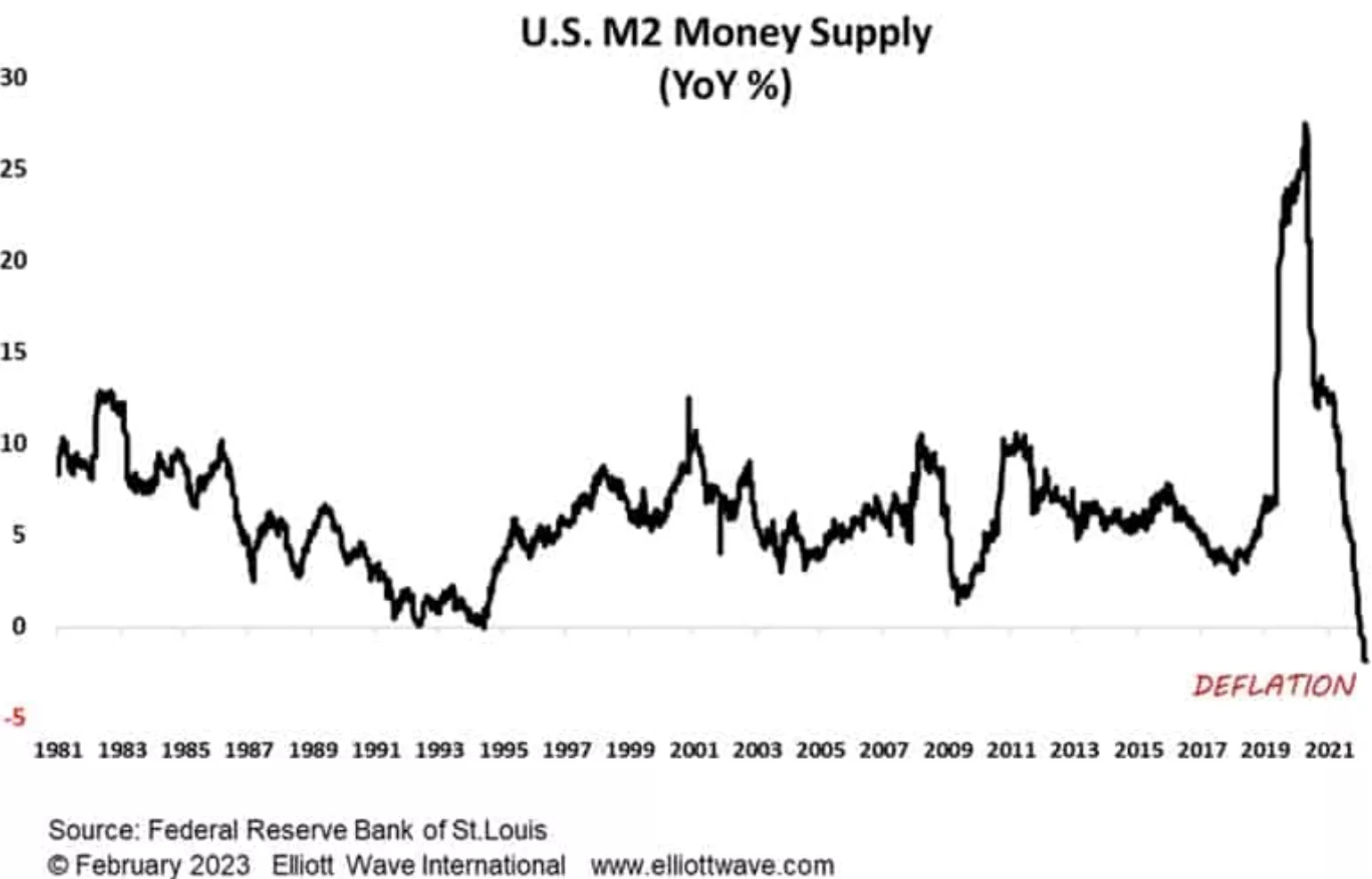

The annualized percentage change in M2 since 1981 is depicted in the graph below. Apar.

At the moment, the money supply is shrinking by 2% on an annual basis.

This historic money contraction, which has been going on for seven weeks, appears to be taking root.

Money is experiencing deflation.

(Click on image to enlarge)

More By This Author:

Expect Equities To Improve Before The Economy In 2023

The Strategic Asset Allocation Dilemma

Yield Spread Translates Into Greater Than 50% Chance Of Recession

These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker