Fed Hasn’t Stopped GDP From Growing

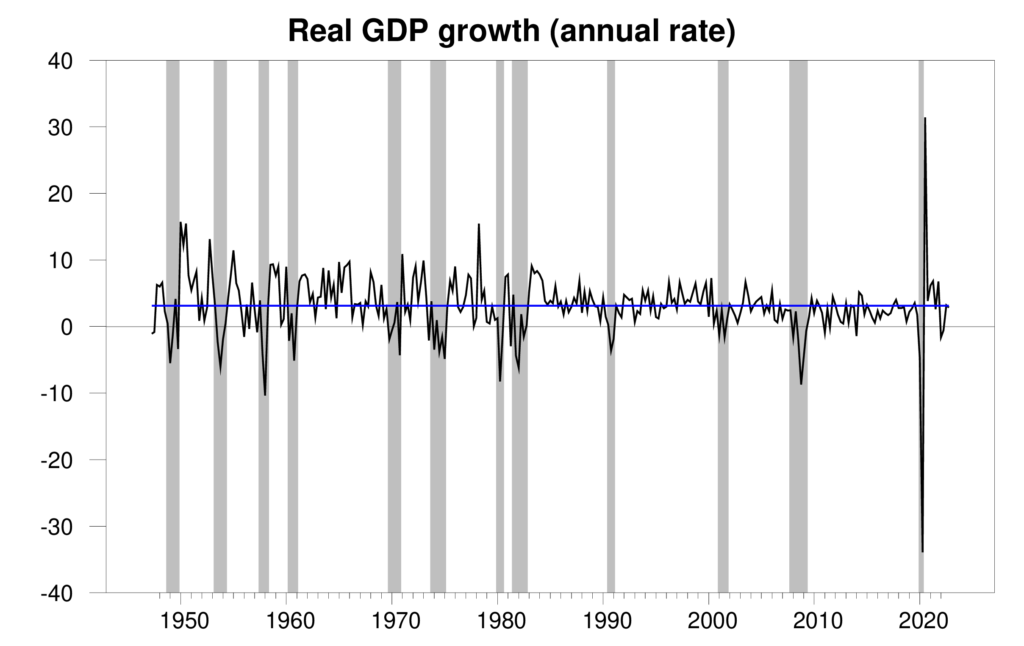

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.9% annual rate in the third quarter. That makes two quarters in a row with values close to the historical average, a welcome relief from the modestly negative growth rates with which we started last year.

Real GDP growth at an annual rate, 1947:Q2-2022:Q4, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

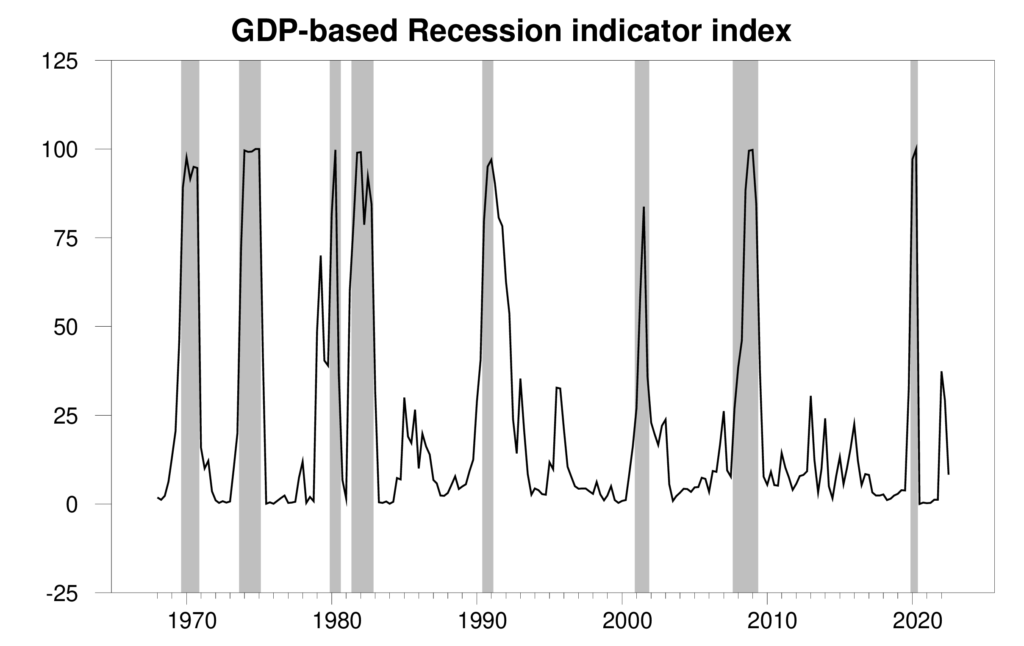

The new data caused the Econbrowser recession indicator index to ease down to 8.3%, undoing the caution signal from the two previous quarters. This is an assessment of the situation of the economy in the previous quarter (namely 2022:Q3). Although some observers thought the U.S. might have entered a recession last year, the facts didn’t end up supporting their pessimism.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q3 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

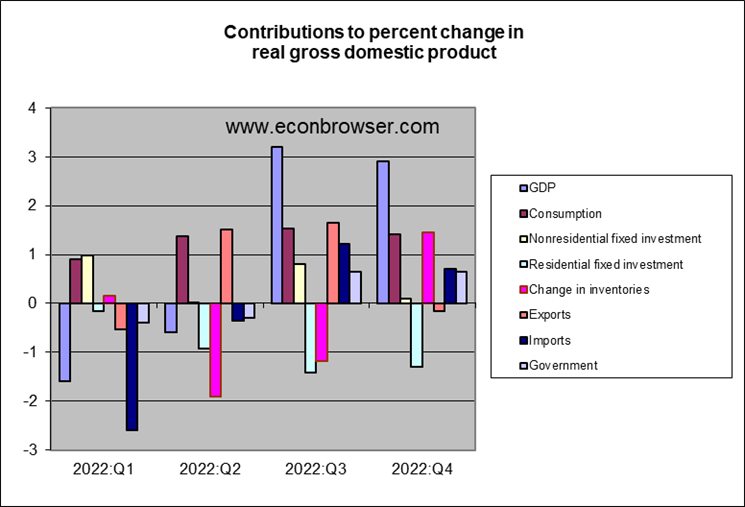

Notwithstanding, all is not well with the housing sector, which is ground zero for the Fed’s war on inflation. Drops in construction of new homes subtracted an average of 1.2% from the annual GDP growth rate over each of the last three quarters. The Fed’s hikes in interest rates are defintely holding back growth.

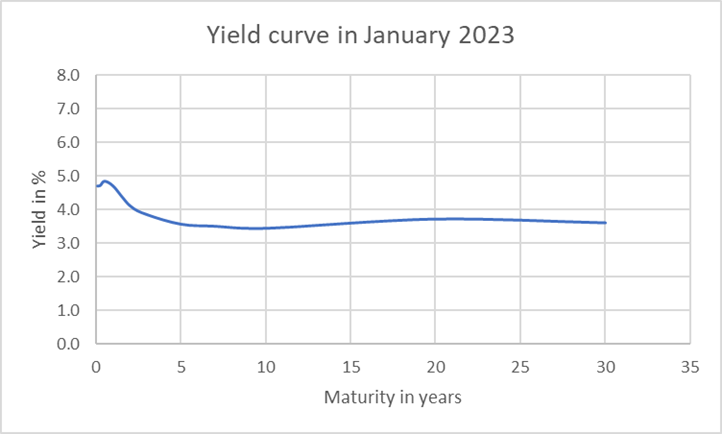

The yield curve says the market is betting on one or two additional modest hikes from the Fed, but by the end of the year, it will have reversed course and be bringing rates down.

More By This Author:

Instantaneous InflationWhy Friends Don’t Let Friends Calculate 18 Month Not-Seasonally Adjusted Growth Rates

A Graphic Exposition On Seasonality In Key Macro Indicators

Disclosure: None.