Fed Emergency Bank Bailout Facility Usage Tops $100 Billion For First Time As Money-Market Inflows Soared Again

Following Friday's farcical Fed data on commercial bank deposits - which turned $28.4 billion on NSA outflows into $102 billion of SA inflows - tonight's money-market fund flows and Fed balance sheet data should be pretty bloody heroic or The Fed's "adjustments" tomorrow night are going to astronomical.

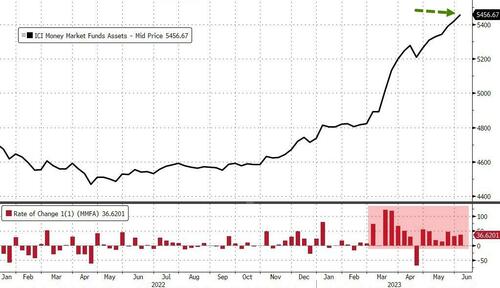

Sadly, for The Fed, things don't look good as money market funds saw $36.6 billion of inflows to a new record high of $5.457 trillion. This is the 7th straight week of inflows (and the 12th of the last 13 weeks)...

Source: Bloomberg

The last 15 weeks - since SVB - has seen over $635 billion of inflows into money-market funds - by far the fastest inflows outside of COVID lockdowns ever.

Institutional funds saw $24 billion of inflows while retail inflows topped $12.5 billion again...

Source: Bloomberg

Which, as we noted above, means The Fed has some 'splainin' to do as deposits magically decouple from money-market flows...

Source: Bloomberg

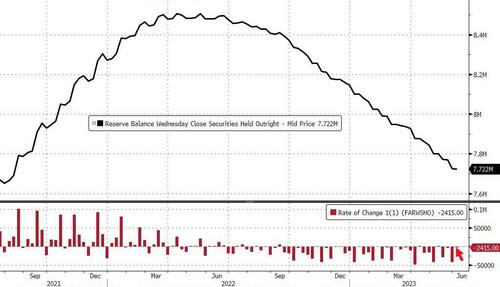

The Fed's balance sheet surprisingly expanded by $3.47 billion last week - its biggest rise since the SVB bailout...

Source: Bloomberg

As far as QT is concerned, The Fed sold a very modest $2.4 billion to its lowest since August 2021...

Source: Bloomberg

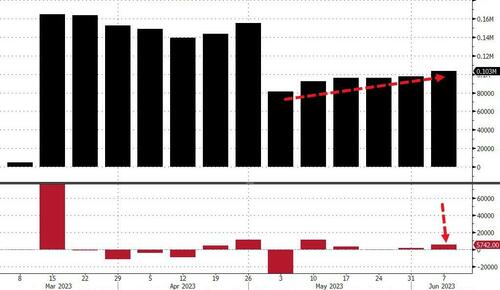

The US central bank had $103 billion of loans outstanding to financial institutions through its two backstop lending facilities, up $5.742 billion from last week...

Source: Bloomberg

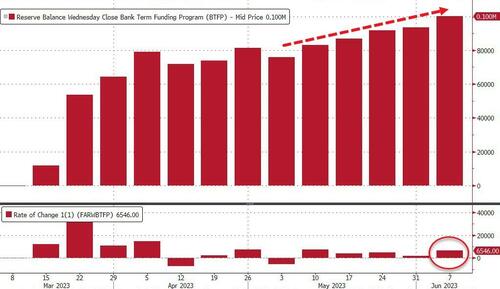

With the Fed's Emergency Bank Term Funding Program surging to over $100 billion...

Source: Bloomberg

Finally, we note that as US equities have soared in recent weeks, US Bank reserves at The Fed rose once again...

Source: Bloomberg

How will all this change now that Janet's trillion-dollar Bill-Bomb looms?

If everything is so awesome - with regional banks at 3-month highs - why are they needing to borrow $100 billion from The Fed?

More By This Author:

WTI Drops Below Pre-Saudi-Cut Levels After API Signals Big Product BuildsJunk Firms Face Steepest Debt Costs In Decade As Economic Reckoning Arrives

History Suggests VIX Is Poised For Sharp Reversal