History Suggests VIX Is Poised For Sharp Reversal

Image Source: Unsplash

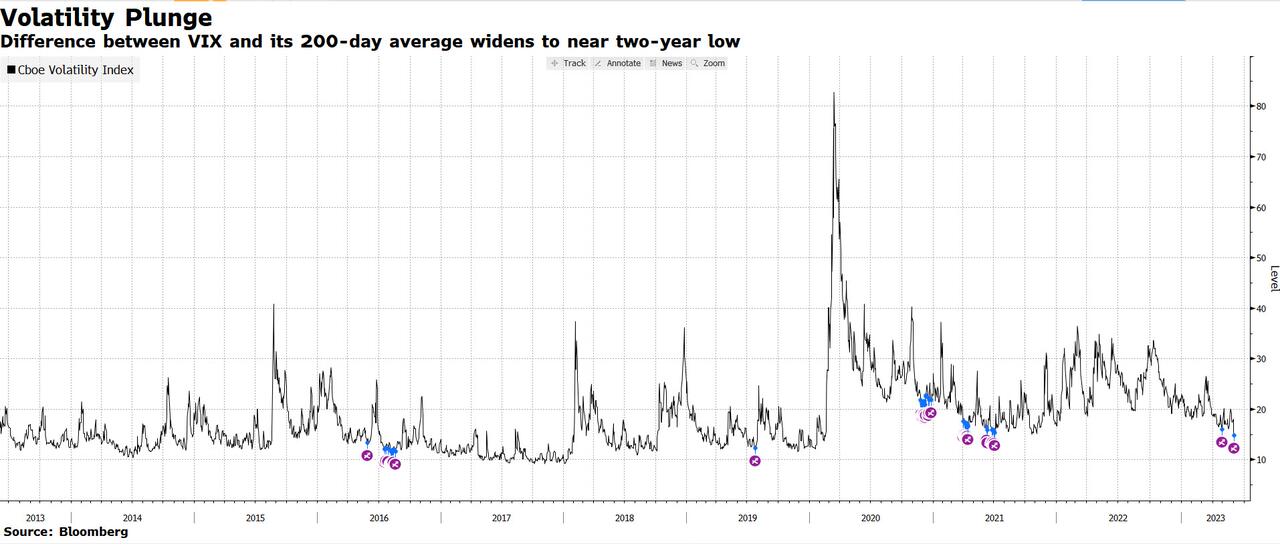

As discussed yesterday, the VIX may be getting close to a bottom after hitting the lowest level in more than three years.

(Click on image to enlarge)

As Bloomberg's Akshay Chinchalkar writes, the VIX collapsed by ~19% last week, the largest drop this year, as the debt-ceiling standoff was resolved and the mixed payrolls data for May diluted the odds of a rate hike this month.

The retreat means the VIX is more than 34% below its widely-followed 200-DMA. Such a significant divergence has typically marked a trough.

The VIX averaged a jump of 17% over the following 20 trading days when it hit or exceeded a difference of more than 30%, a decade of data show. More significantly, the index was higher after 20 days in 42 out of 44 instances where the difference was at least 30 percentage points.

VIX hopefuls also have seasonality on their side this month, with the volatility index pushing higher 80% of the time in June over the past 10 years.

(Click on image to enlarge)

More By This Author:

Allstate Drops California; Will Not Write New Insurance Policies Over Wildfires, Construction Costs

OPEC+ Discussing 1 Million Bpd Output Cut

Planned Layoffs Are Up Fourfold So Far This Year