Does The Confidence Index Say We’re In A Recession?

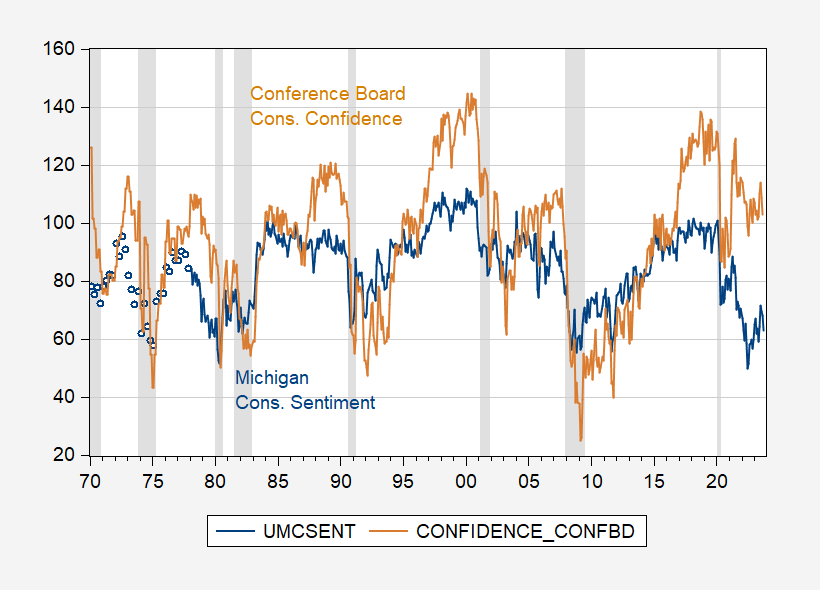

Title of the last Conference Board post on the index reads: “Expectations Index Declined for the Second Straight Month, Sinking Back Below Recession Threshold”. Here’s a picture of this index, compared against the University of Michigan Consumer Sentiment index.

Figure 1: University of Michigan Consumer Sentiment index (blue), and Conference Board Consumer Confidence index (tan). NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan via FRED, Confidence Board via TradingEconomics, and NBER.

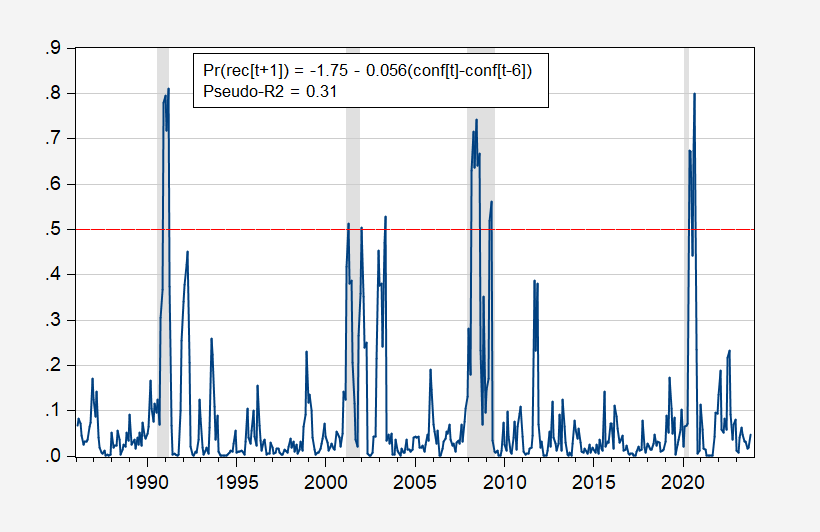

A regression using the Michigan index doesn’t predict NBER-defined recession dates well, so I rely on the Conference Board measure. The six-month change, lagged one month, has a pseudo-R2 of 0.31 over the 1986-2023 period (assuming no recession has occurred as of 2023M10). The prediction indicates no recession as of October 2023.

Figure 2: Recession probabilities from probit regression of NBER recession dates on one month lagged 6 month change in Consumer Confidence index. NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

I’m exploiting a correlation between an index of sentiment and recession dates, nothing more, nothing less here. A low confidence index is not the same as a recession (a recession is a broad sustained decrease in economic activity, which might result in a reduction in sentiment, or be presaged by a reduction in sentiment, but is not in itself the same thing).

More By This Author:

Consumer Spending Is Up, Saving Is Down. What Does This Mean For The Economy?More On China Q3 GDP

China GDP Growth In Q3