Do The Inflation Targets Set By The Central Banks Really Matter?

Recent announcements by the Federal Reserve and the European Central Bank feature tweaking the 2 % inflation target as if this provides any insight into what to expect from future monetary policy. Recognizing the recent spike in consumer prices, the Fed has rightly taken the position that is just that--- a spike in prices--- not a steady acceleration that would prompt the Bank to adjust its policy. So, we have an acceptance that consumer prices will be allowed to overshoot the 2% target, temporarily, in the absence of any change in monetary policy. In a similar vein, the ECB has set a 2% inflation target and it, too, will tolerate some slight overshooting.

In a rare admission, Chairman Powell in a recent press conference said "this is an extraordinarily unusual time and we really don't have a template", for how to deal with an economy struck down by a global pandemic. Nonetheless, both central banks provide investors with forward guidance regarding future rate increases. Many investors have anchored on the Fed initiating rate hikes in 2023, earlier than previously expected. In Canada, many observers read into the Bank of Canada statements and conclude that we can expect a rate hike as early as 2022. Growth optimists argue we can expect output rates exceeding 6% annually for the balance of 2021 with accompanying higher rates of inflation.

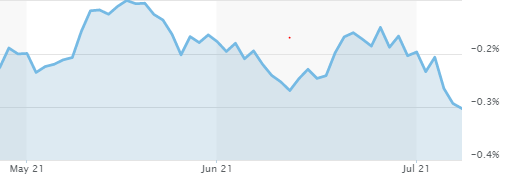

Meanwhile, back at the ranch, bond investors are having no part of this reflation trade so frequently mentioned in the press. The 10-yr UST yield has fallen dramatically from a recent high of 1.7% in mid-May to today’s yield of 1.35% (Figure 1). The German 10-yr bond yield has dropped deeper into negative territory, from -0.1% to -0.3% The reflation trade is in retreat everywhere as there is growing awareness that the recovery process, let alone, future expansion is falling short of expectations.

Figure 1 US 10-yr bond yield

Figure 2 German 10-yr bond yield

So, central banks will deliberate on how best to convey a message about inflation targets. And, observers will continue to speculate on what this means for interest rates in the future. Meanwhile, the bond market has staked out a position that rapid growth and accompanying inflation are no longer revealed in the tea leaves.

Unfortunately the central banks" certainly appear to have only concerns about the profits made by their "friends", and no concern at all about that bottom 80% of the population. Launching actions that push inflation with what appears to be either no understanding or no concern as to the effect on all of those who can't increase their incomes at will. That theory that inflation will somehow magically boost incomes is not proven to actually work in the real world, but rather only in the Kingdom of Utopia, a monarchy where real people are not found to reside. Thus inflation does harm a whole lot of people residing in the real world.