Buy When The Cannons Thunder And Sell When The Angels Sing...

The US elections are over and with the 'Red Sweep' there is probably no need for much discussion about the winner. It is the best possible result: whenever the Republicans controlled not only the president but also Congress, Wall Street performed best. This has been the case since the First World War over 100 years ago.

However, Wall Street's euphoric reaction is not based on historical facts. Uncertainty ahead of this year's election was so great that investors made an above-average number of hedging transactions. These had to be closed out as quickly as possible after the result. And that was much faster today with computer trading than it used to be.

The uncertainty was reflected in the very high level of the volatility index, which, despite a relatively calm pre-election Wall Street performance, was close to 20. After the election, it fell by no less than 25%, which is also a historic move. However, this was no surprise given the unwinding of the hedges.

The unwinding of these many hedges was the main reason for the massive appreciation of Wall Street. The question, however, is whether investors will continue to invest at this massively higher level in the following days – which is necessary for even higher stock prices. Let us therefore analyze the appropriate indicators and charts...

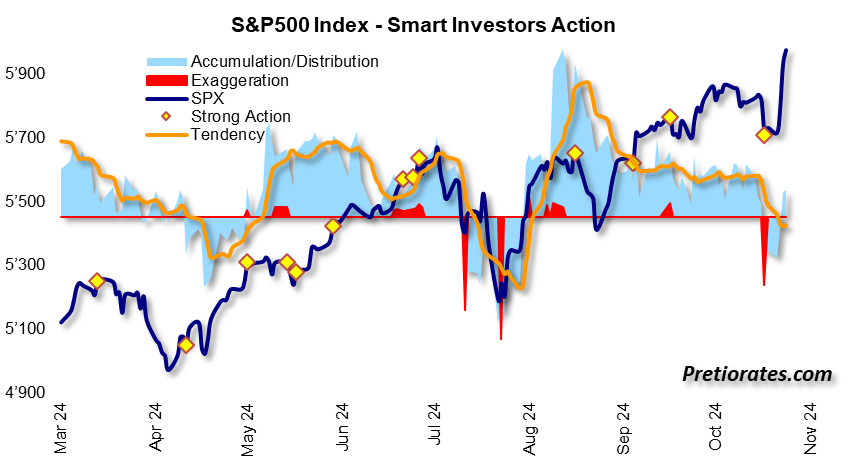

During the days before the election, the 'smart investors' still sold quite a few positions - which led to an exaggeration (red area). These have the property that a countermovement occurs shortly thereafter...

(Click on image to enlarge)

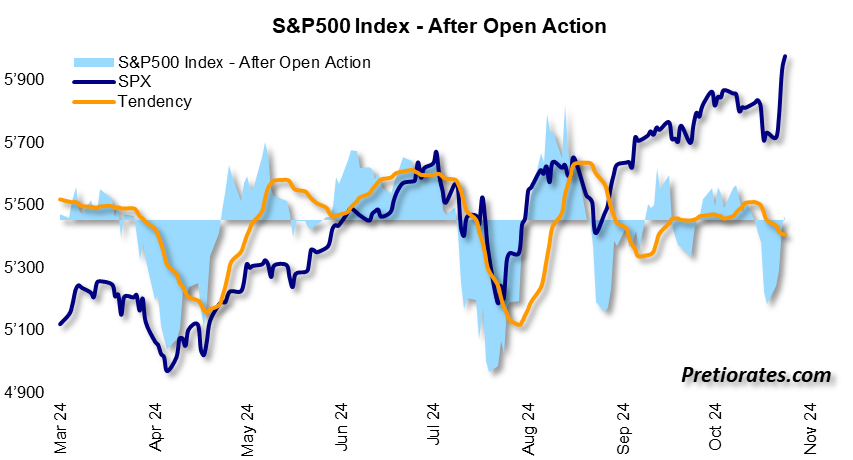

This distribution before the election was also reflected in the ‘After Open Action’, but with the countermovement, a neutral picture now emerges...

(Click on image to enlarge)

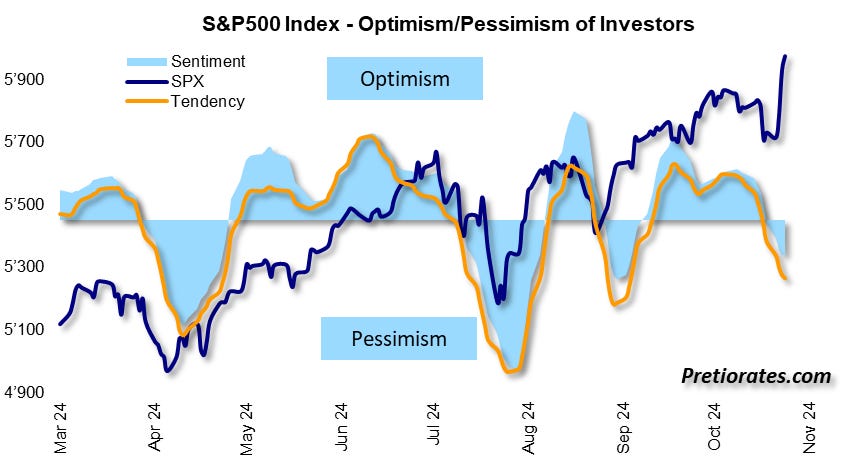

Wall Street is also showing a pessimistic side, probably also a result of the sentiment before the election. Accordingly, there is potential here that a brightening mood can be expected in the coming days as well...

(Click on image to enlarge)

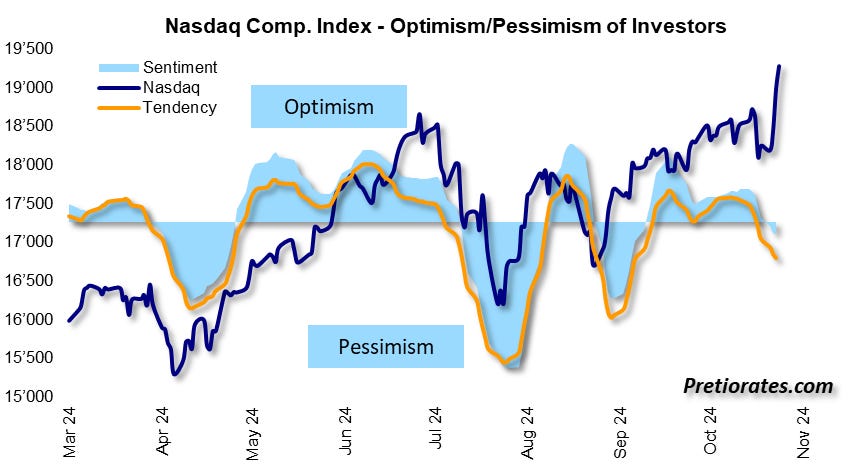

Donald Trump's policy is likely to be rather inflationary. Accordingly, the bond market has reacted with rising market yields. Higher interest rates are negative for Nasdaq stocks. In fact, sentiment has been rather pessimistic for a few days now. This can now change, as with the S&P500 stocks, but never has the same potential as with the S&P500 Index...

(Click on image to enlarge)

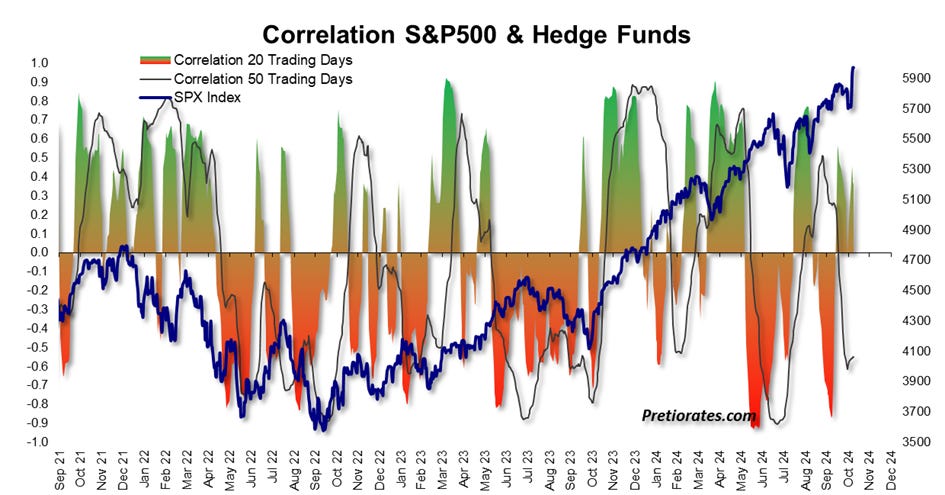

Hedge funds were slightly bullish over the past few trading days...

(Click on image to enlarge)

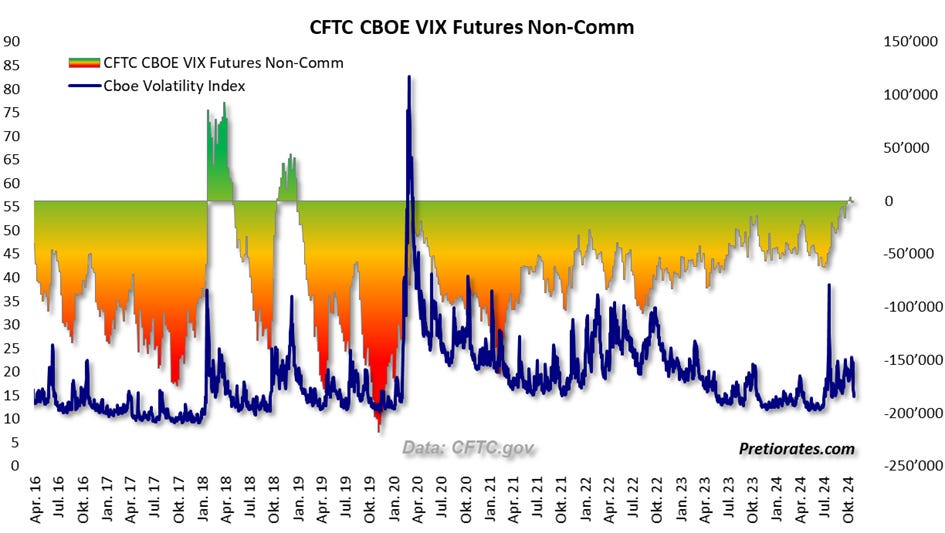

What is particularly interesting, however, is that bets on lower volatility have decreased to zero over the past few weeks. We last saw net long positions in volatility futures in 2019 and before that in 2018. It is an indication that the appetite for speculation before the election was absolutely non-existent...

(Click on image to enlarge)

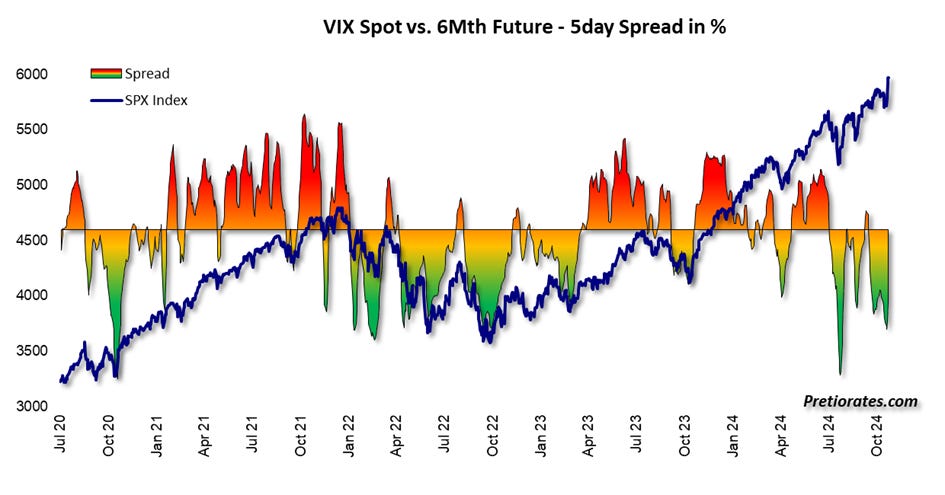

The spread between the volatility index spot trading and the future on six months even showed a bullish side during the last few weeks...

(Click on image to enlarge)

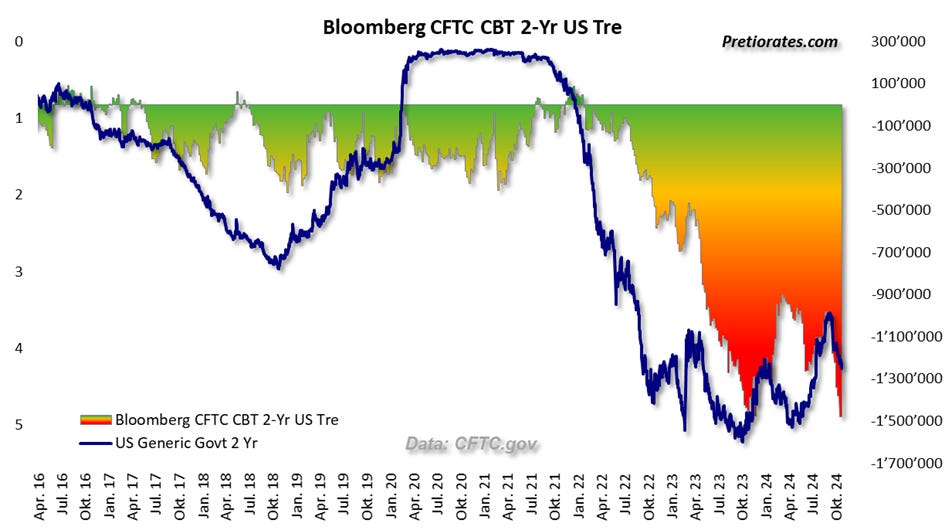

The many investors who have built up record short positions in US Treasuries with a term of two years are in the right. It will be interesting to see next week how these positions behaved after the election...

(Click on image to enlarge)

Conclusion: The indicators show a surprisingly neutral position, despite the massive movements in the trading sessions since the election. The indices, but also the volatility index, have many open gaps. And gaps are always closed, the only question is when. Without further support from the indicators, chasing the rally is a big bet. Rather, it should be expected that the open gaps will be closed sooner rather than later. This means that the Wall Street indices will fall back to their Tuesday levels – and the volatility index will rise again to a higher level.

More By This Author:

Higher Volatility Ahead

Are Hopes Of Lower Interest Rates Still Alive?

Believe It Or Not, The Euphoria In The Precious Metals Market Is Still Too Low

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more