Believe It Or Not, The Euphoria In The Precious Metals Market Is Still Too Low

In our analyses, we regularly examine current movements, identify possible influencing factors, and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

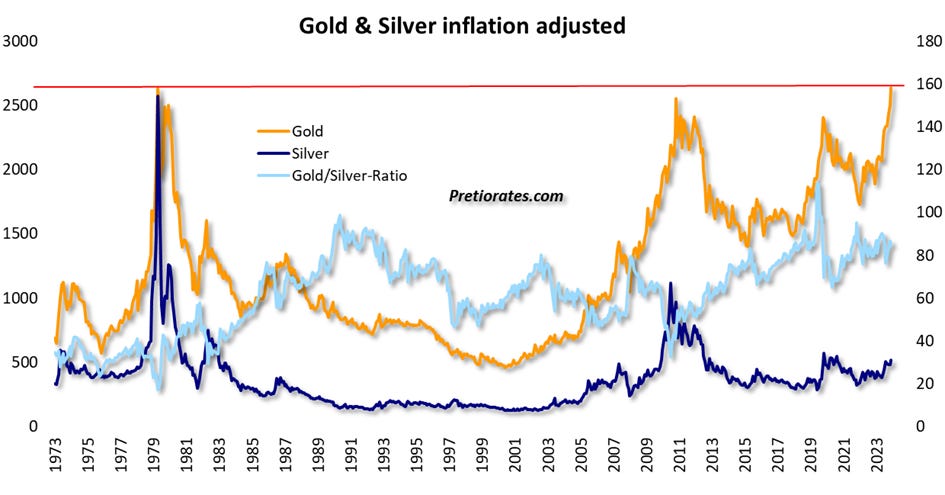

The Gold price is currently reaching a new all-time high almost every day. Even adjusted for inflation, the breakout has already been realized. Adjusted for inflation (by CPI), a high of USD 2635 was reached in January 1980 (in absolute terms in October 1980). While speculation was very high 44 years ago, there are still no excessive party feelings despite the daily records. Moreover, the Silver price is still trading well below the inflation-adjusted price of USD 154.40...

Only the professionals, who are mainly active in the futures market, have large long positions in Gold, which usually call for caution...

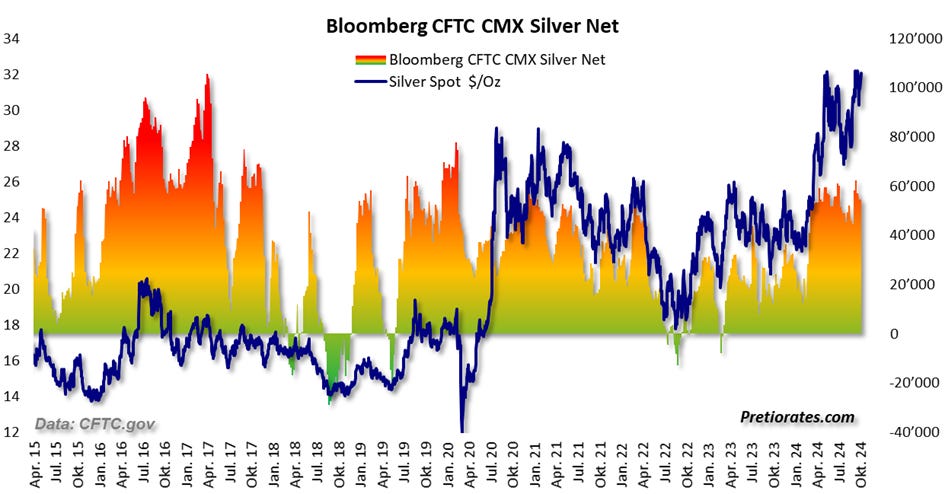

High long positions can also be seen in the Silver futures market, but we cannot (yet) speak of overheating...

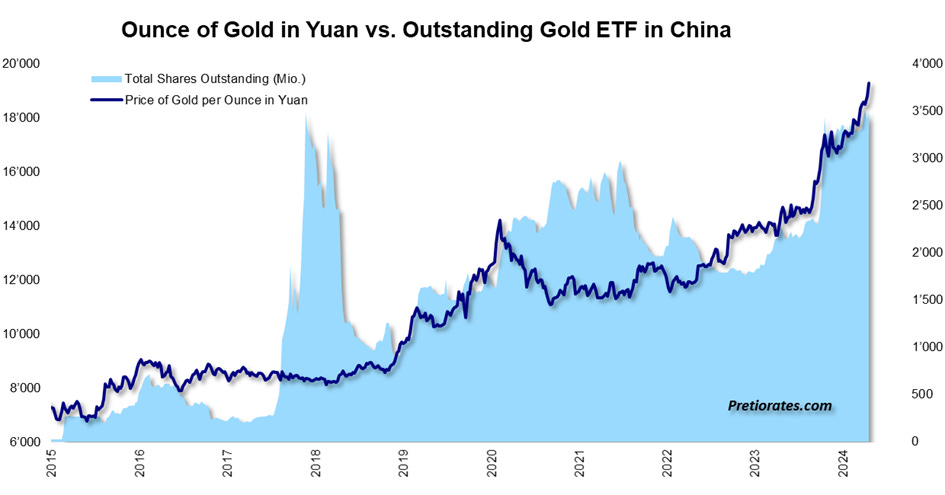

Retail investors tend to be invested in ETFs. In China, it can be seen that investments have recently been further expanded to a new record level. However, as this opportunity has only been available since 2015, a comparison with earlier phases is not really meaningful...

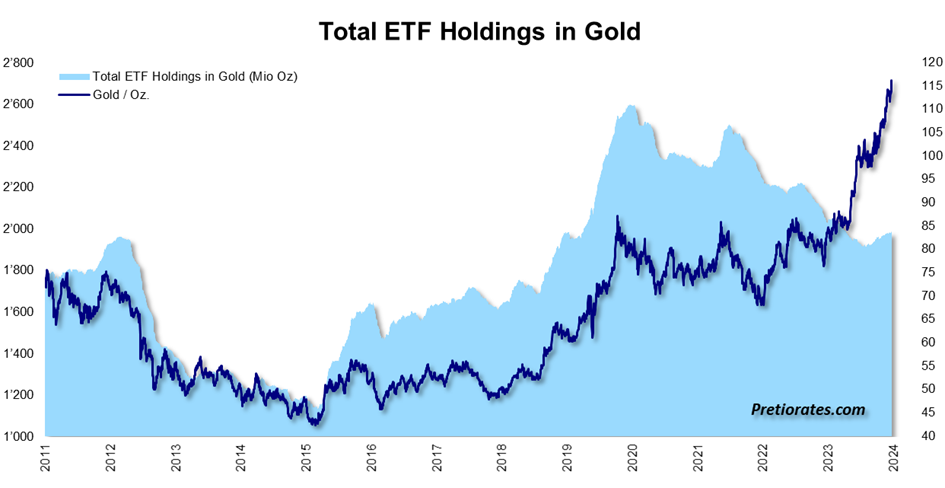

The situation is different for global ETF investments, where Western retail investors in particular are invested. And although the Gold price is setting new records every day, the number of outstanding Gold ETFs is still around 25% below the record level of 2020...

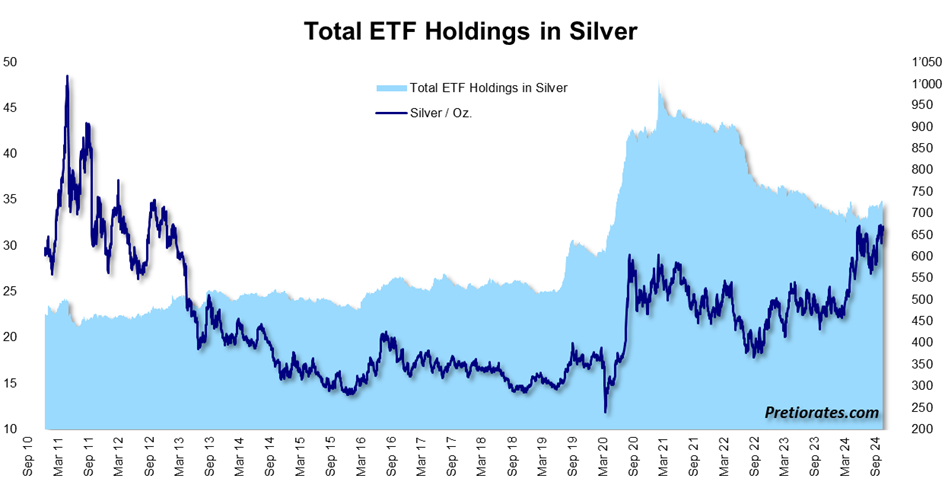

The situation is similar for outstanding Silver ETFs worldwide: Its number is also currently almost 30% below the record level of 2021...

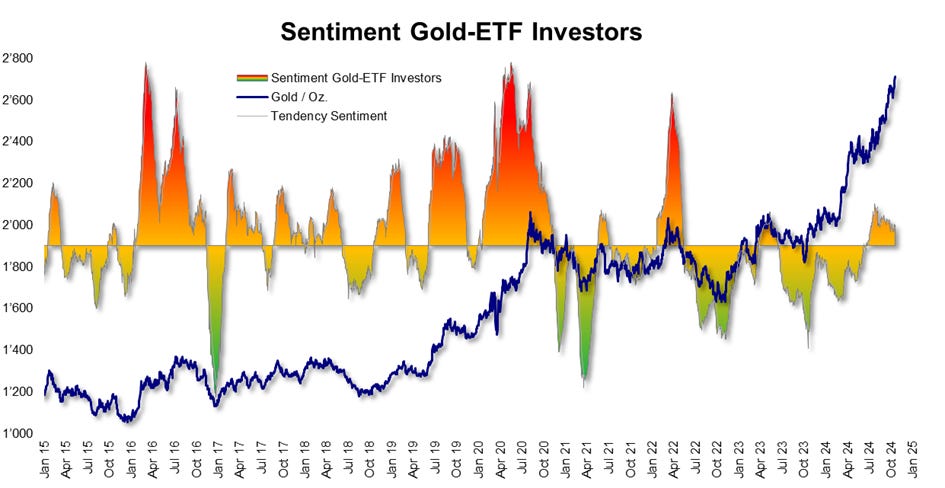

Although the long-term sentiment indicator for Gold is in positive territory, it is far from the exuberant sentiment that usually occurs at long-term highs...

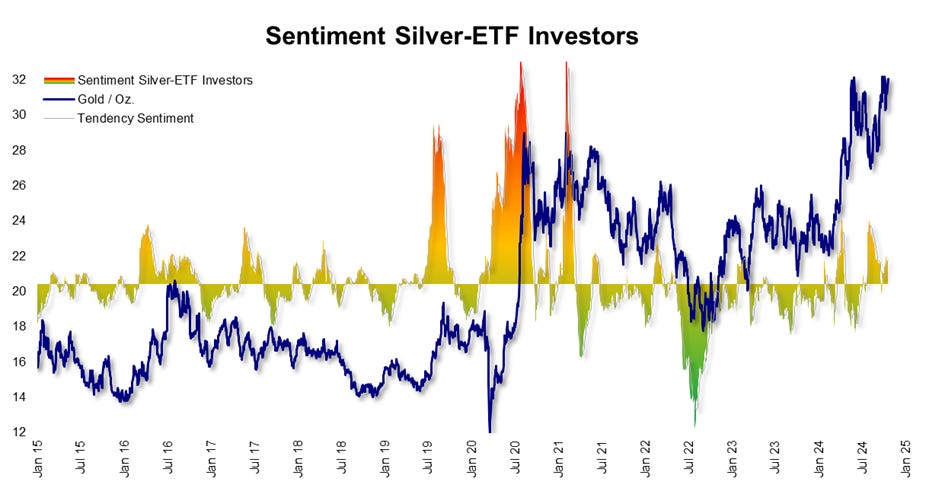

The sentiment indicator for Silver shows a similar picture. It is far from showing a similar picture as in 2020, when the Silver price more than doubled from its low within less than five months...

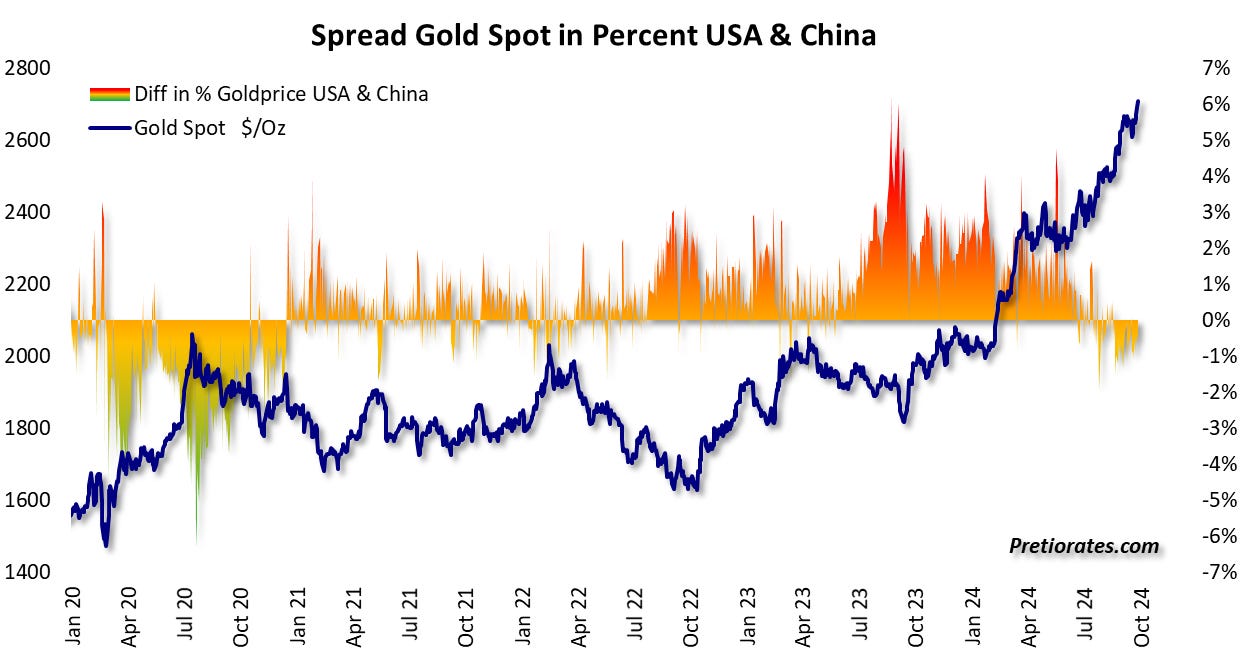

In precious metals, the Asian markets (China and India) have become a decisive factor. Smart investor action in the Shanghai market shows that accumulation is continuing, but has been very restrained for a few weeks now...

Since August 2024, no premium has been paid for physical Gold compared to the Western gold price either...

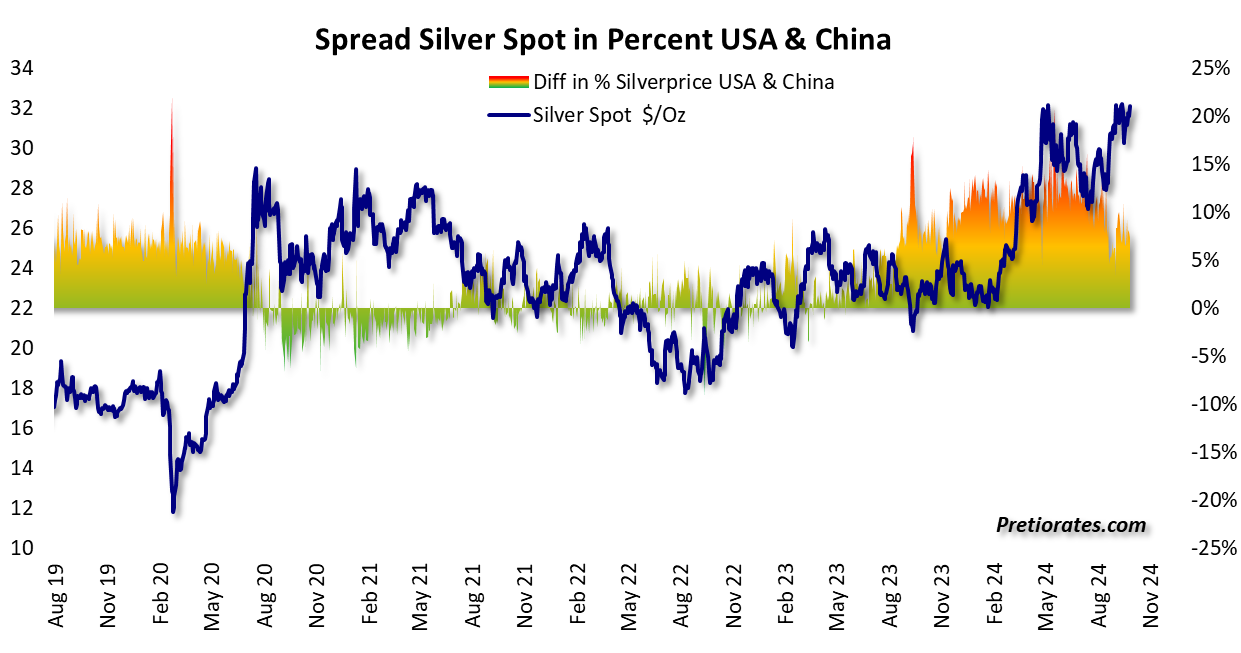

In contrast, buyers in Shanghai are still willing to pay a premium of around 6% for physical Silver... Not entirely surprising, as the industry (Solar & Batteries) responsible for the high demand is located in these regions...

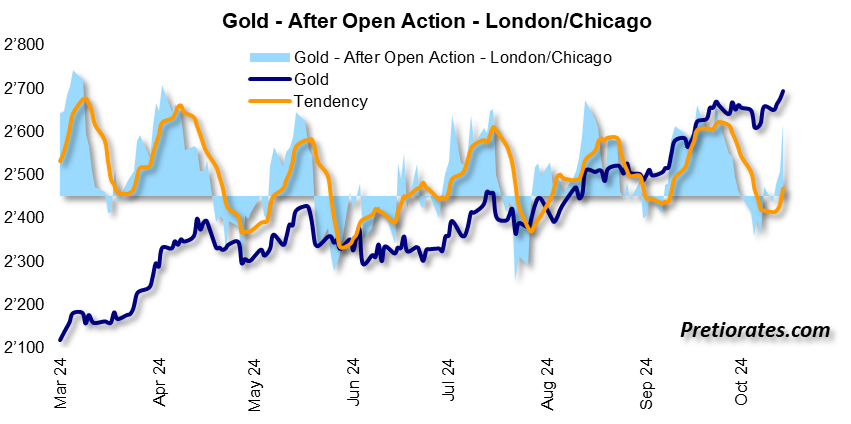

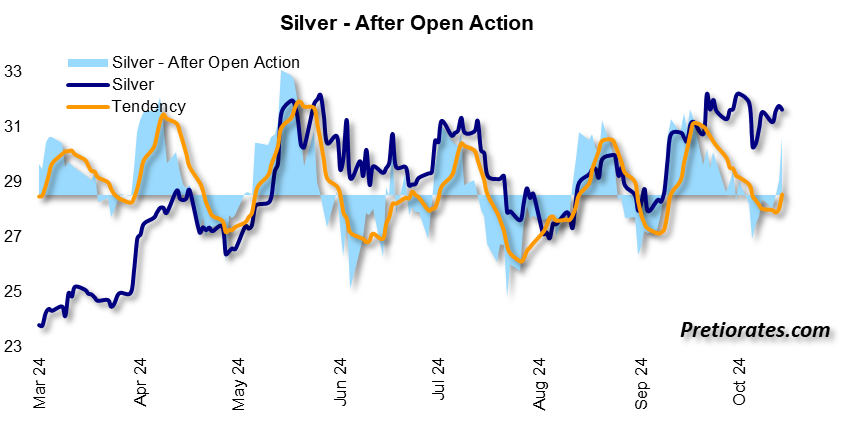

In short-term trading on Western Gold and Silver exchanges, investors appear to be ready to buy more aggressively again after a few weeks of 'consolidation'. The after-open action at least suggests this...

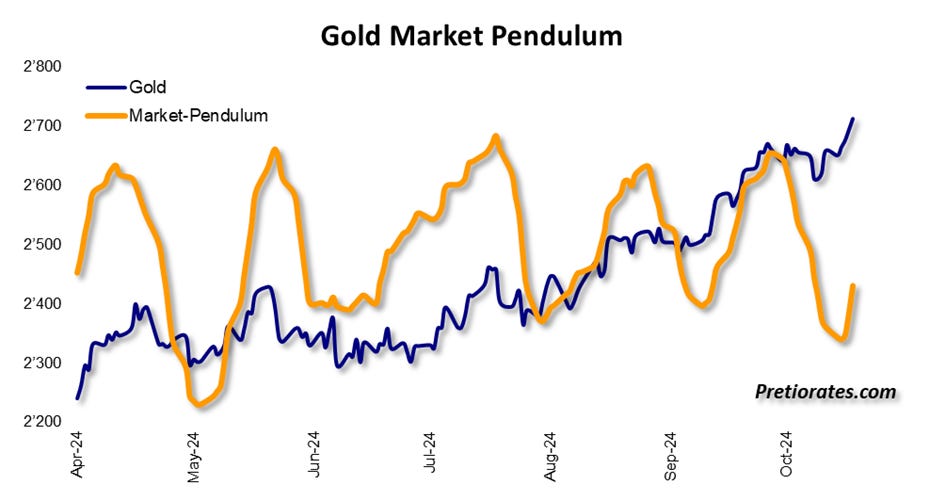

The same picture can be seen in the short-term Market Pendulum for the Gold market...

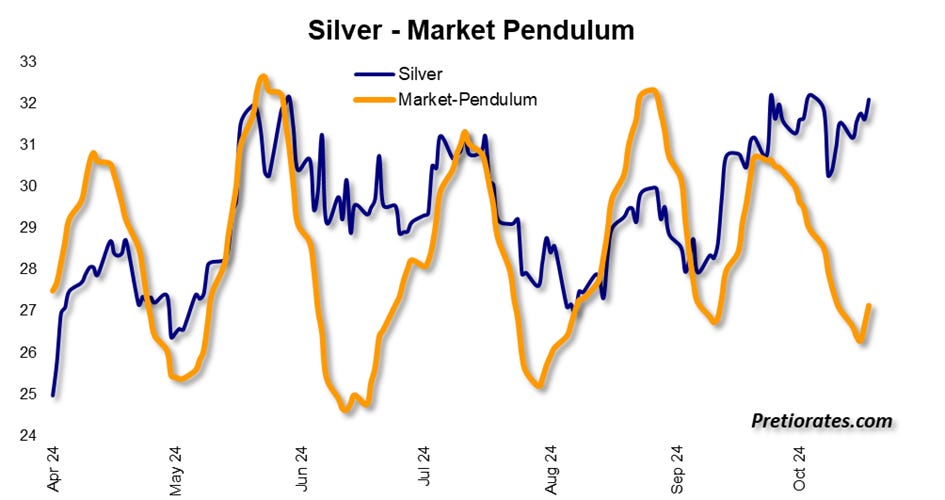

In Silver, the bears are also passing the ball back to the bulls, which should have a positive effect on prices in the coming days…

This can also be seen in the After Open Action, which monitors the activities of professional investors...

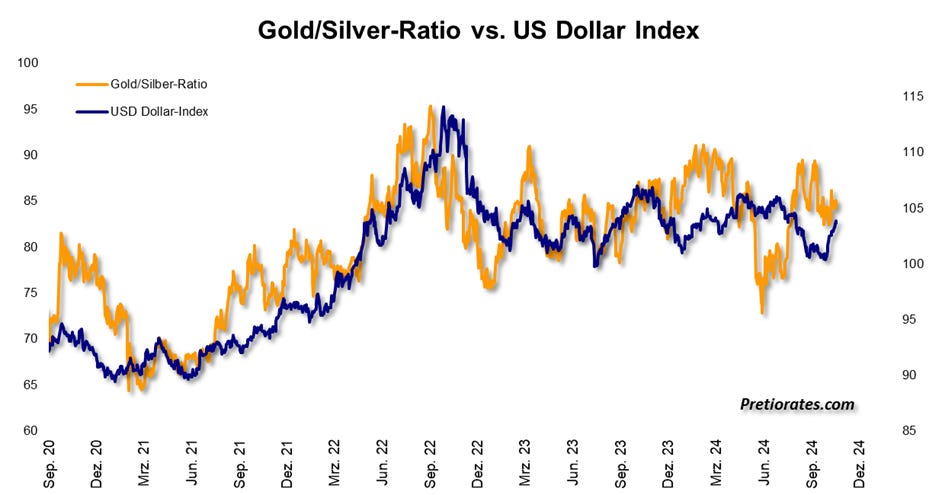

The fact that the US Dollar was recently able to recover from its 'cliff' at the 100 mark had no negative impact on the trend in precious metals. It was more of an 'adjustment' to the Gold/Silver ratio...

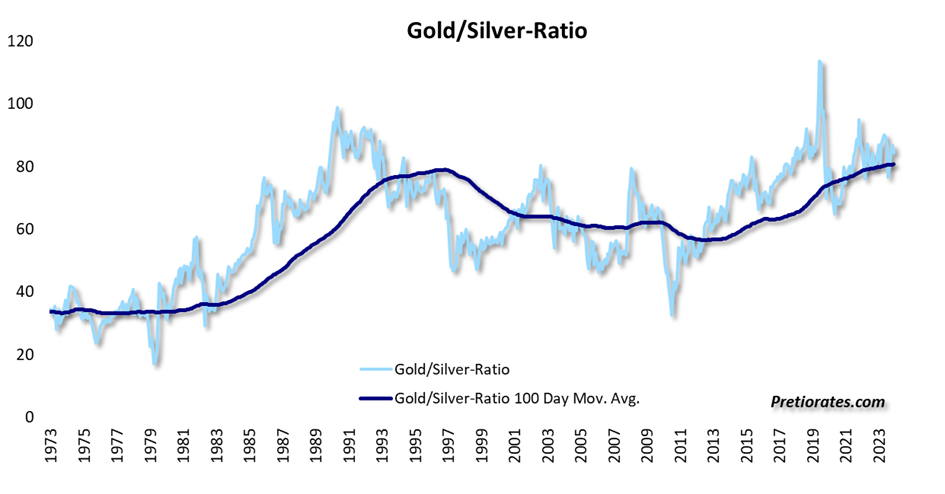

Although the Gold/Silver ratio currently seems very high at 84x, it was already at this level 30 years ago, only to fall to around 60x in the meantime...

Can the ratio fall again? Absolutely.

The industrial demand for Silver today and in the near and far future is not comparable to that of the 1990s. The Solar industry and possibly the Battery industry (SS battery) play an important role in this.

However, it must also be remembered that although many Silver bugs constantly talk about a supply/demand deficit, they ignore the fact that there are several years' worth of production stored in the world's vaults. The approximately 1.5 billion ounces of Silver alone theoretically cover an annual supply/demand deficit of 300 million ounces for the next 5 years. And as long as there is no euphoria among Western investors, the willingness to sell these stocks will remain high. This will only change when long-term sentiment improves massively when euphoria arises among Gold and Silver investors. Then the willingness to sell will fall massively - leading to the typical price explosions.

That’s it for today!

More By This Author:

Inflation Seems To Be Dying, But It Is Not Dead

Will The Chinese Party Be Followed By A Hangover?

Does The Sun Really Rise In China?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more