Are Hopes Of Lower Interest Rates Still Alive?

Image Source: Pixabay

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

In mid-September, we discussed in two issues the market's hopes of lower market yields in the US, which may not be entirely realistic.

Thoughts 46 - The bond market should be careful what it wishes for

Thoughts 48 - The beautiful dreams of lower interest rates

Thoughts 49 - Interest rates are set to fall again, but for how long and by how much?

A little more than a month later, not much remains of these wishes. The US market yield has since risen from 3.6% to over 4.2%. And with the higher market yield, voices are again being raised that

the interest burden in the US, with its rapidly increasing debt, could increasingly cause difficulties...

the market wants to tell us that nervousness is increasing and that there could possibly be a bond crash...

or that the US economy is stronger than assumed and the FED would therefore have to raise interest rates sooner...

etc.

It makes little sense to discuss the potential scenarios. Neither the realistic nor the extreme scenarios. Instead of listening to the individual voices, we continue to try to interpret the voice of the market. And in doing so, the only true thing emerges: Wall Street has drastically dampened its expectations regarding the Fed's upcoming interest rate cuts.

One of the most important inputs for the trend of market yields is the flow of capital into currencies. Higher interest rates can make a currency more attractive and thus cause it to rise – and vice versa. This deliberately leaves out the possibility that market yields may also rise (sharply) due to uncertainty about economic or political developments.

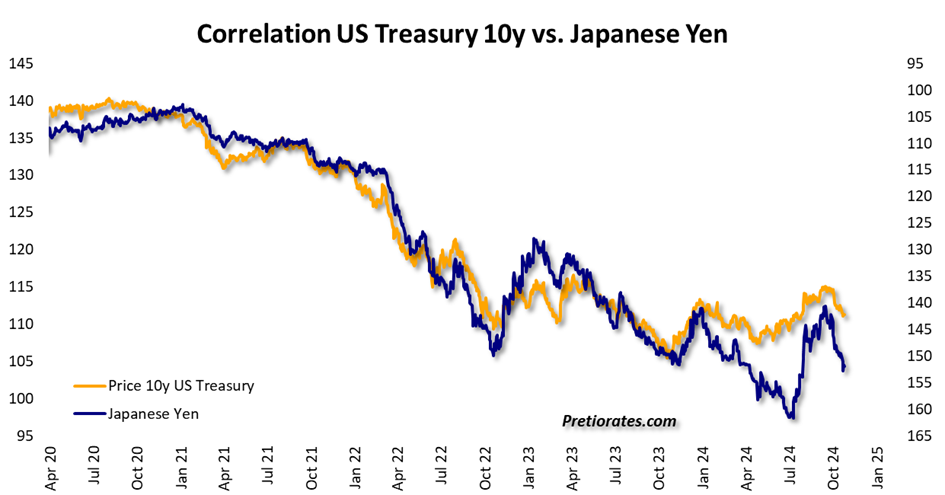

Low interest rates in Japan led investors to take out loans in Japanese Yen and invest them elsewhere with a better return. The (slight) change in the Bank of Japan's financial policy led to these so-called carry trades causing a small earthquake in the global financial markets in July/August. However, it is precisely because of these carry trades that there has been a very high correlation between the Yen and US market yields for decades.

The Japanese Yen has weakened again recently – and so US market yields rose (i.e. bond prices fell). But a glance at the chart with the correlation shows that bond prices could fall even further – which would mean even higher market yields...

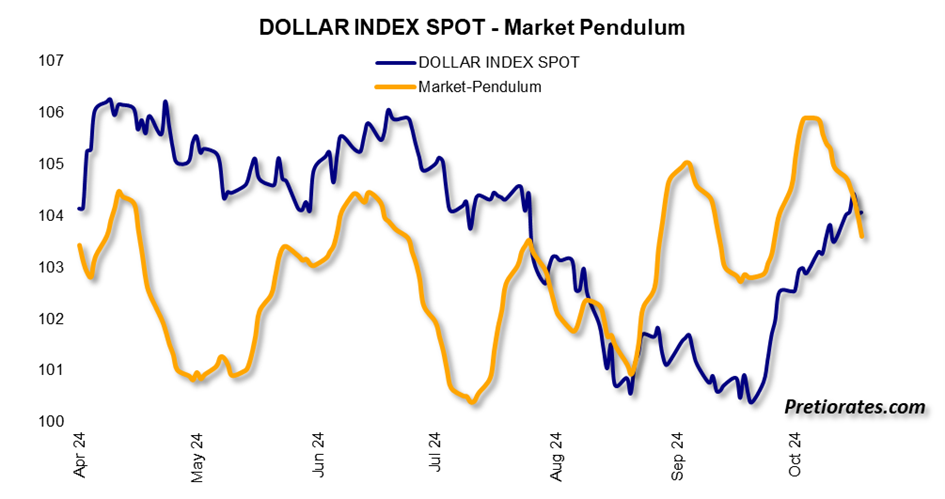

With the sharp rise in market yields, the US Dollar was able to move away from its 'cliff' at 100 points. The market movements even led to stronger short-covering in the US currency. Since the beginning of the month, it has risen again to over 104 points.

But the Market Pendulum of the US Dollar, which measures short-term strength, is already decreasing again...

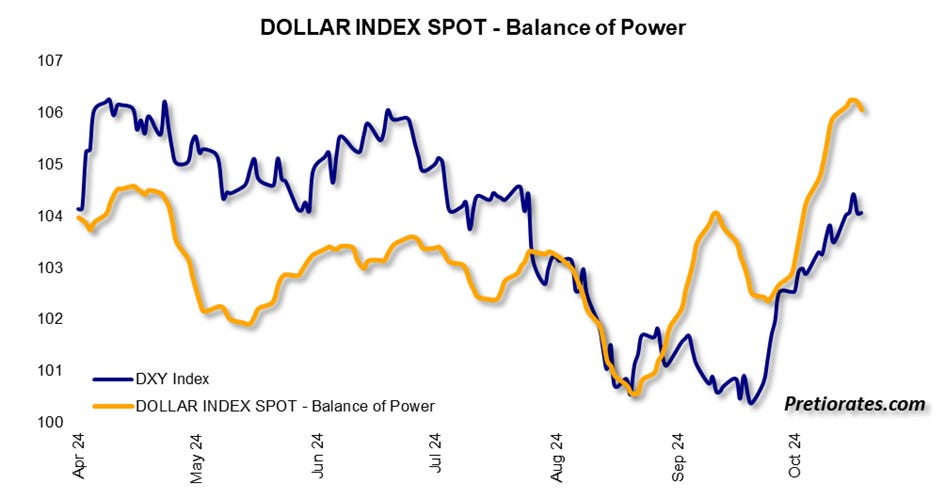

The Balance of Power, which measures the strength of the bulls and bears in the market, also tells us that the US Dollar rally is over in the short term...

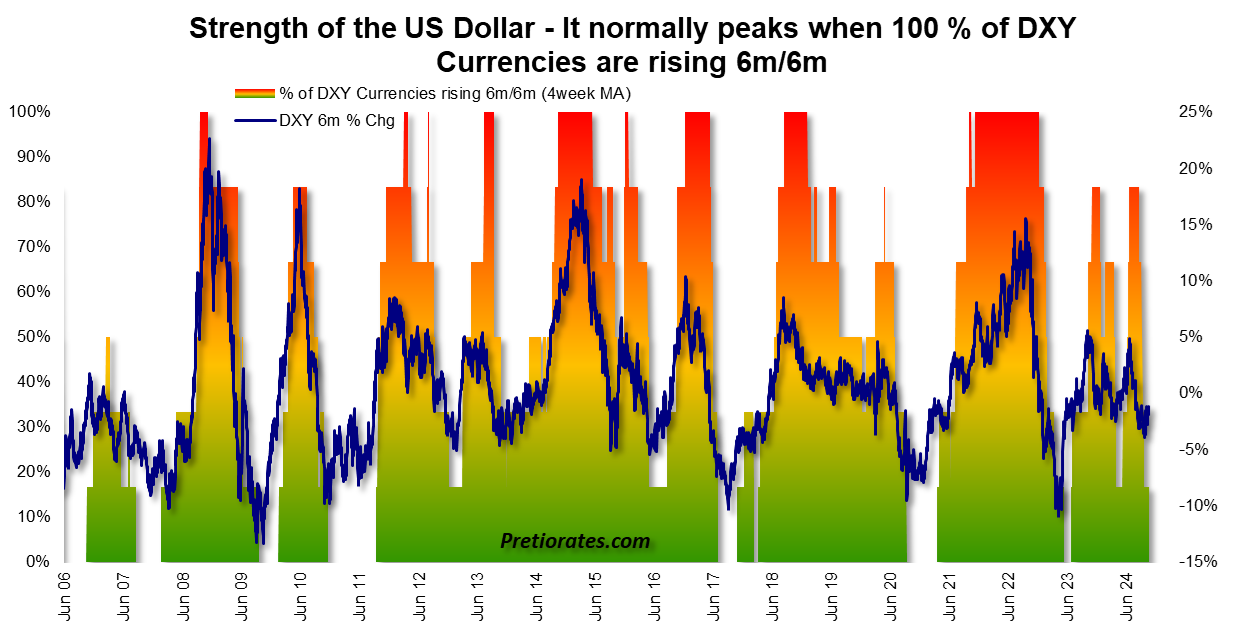

Also our indicator which measures the strength of the US currency against the other major currencies, still only shows a value of 17%. This indicates that the US Dollar was able to advance not because of its own strength, but because of short-covering and/or the weakness of the other currencies...

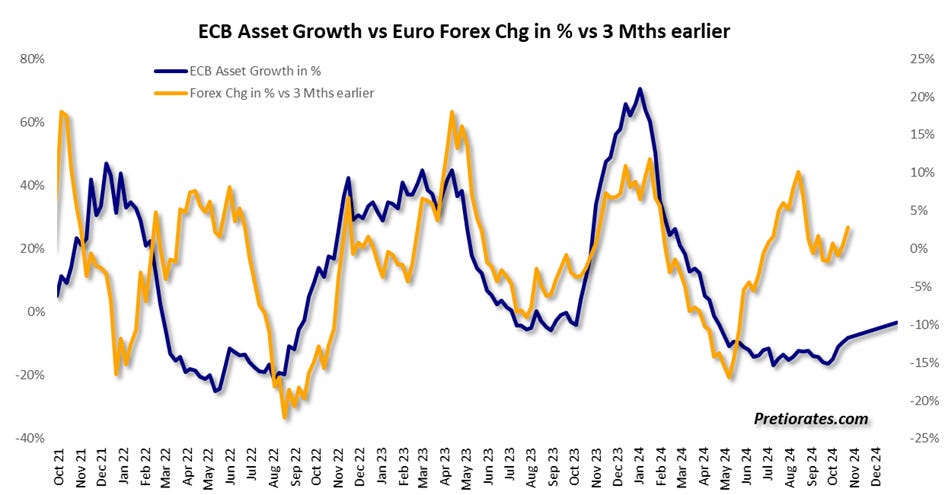

The change in the assets of the second largest currency on our planet, the European Central Bank (ECB), gives us valuable information about the development of the Euro. These appear to be bullish – making it a (another) bearish input for the US currency...

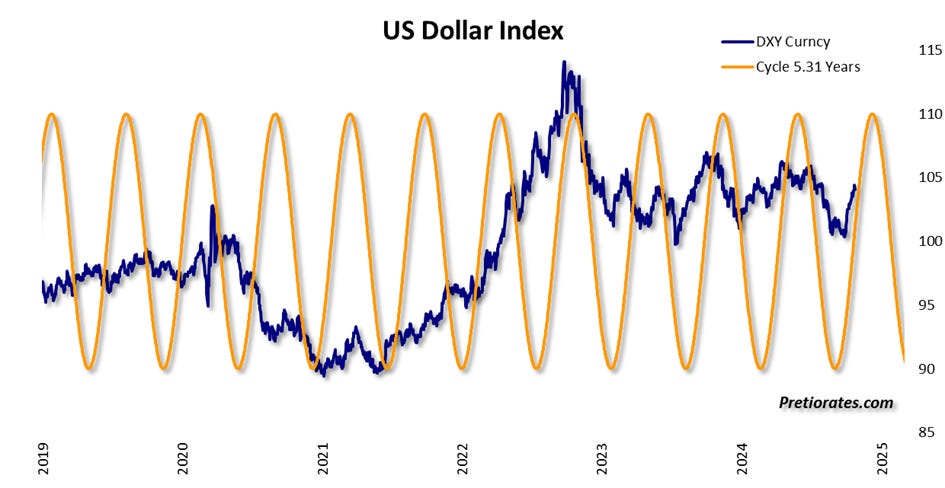

Cycles sometimes work better, sometimes less so. Most recently, the 5.31-year cycle of the US Dollar Index has provided a very good indication of a return to a positive trend. However, it will turn bearish again towards the end of the current year...

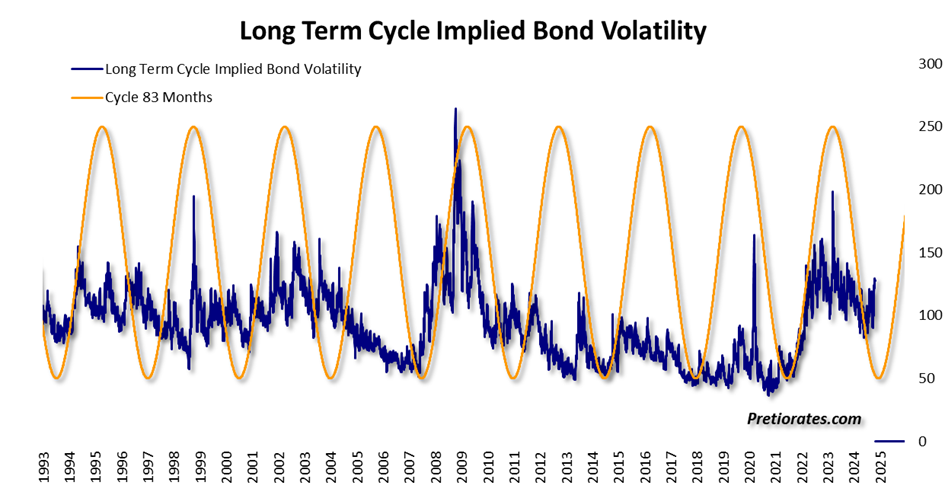

A weaker US Dollar could come about as a result of capital flowing out of the US, but this is just one of 100 reasons. However, it would mean a further rise in market yields. In fact, the 83-month cycle is telling us that volatility in the US bond market, i.e. nervousness, is likely to increase again (more) soon...

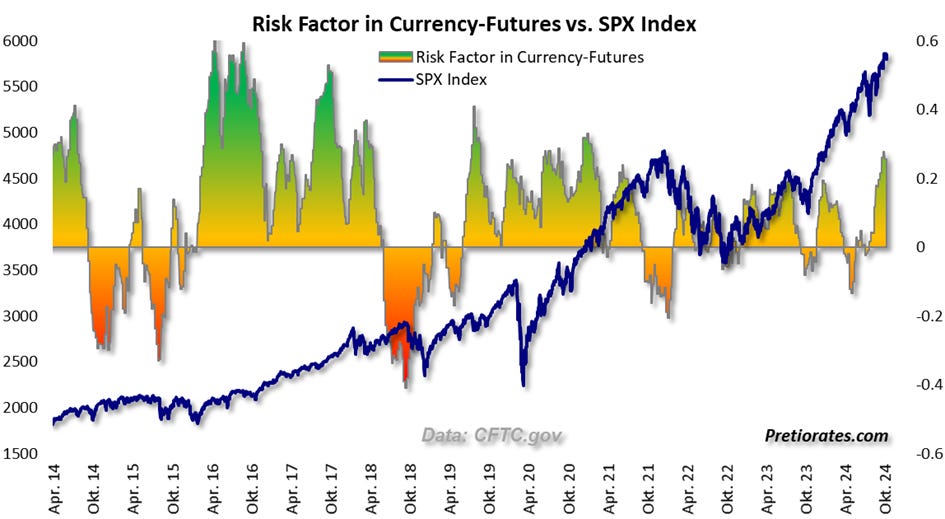

However, there is still little sign of this nervousness. The ‘Risk Factor’ measures investors' long investments in safe and unsafe currencies. A kind of 'risk-on' or 'risk-off' sentiment barometer. It becomes dangerous when investors only want to be invested in safe currencies. However, there is currently no sign of this: the risk-on sentiment is not excessive, but it is still very high. Wall Street always displays the same sentiment.

We can therefore assume that market expectations of lower interest rates are not likely to return any time soon (although the desires will). This also supports the US currency from falling below the 100 mark, which is feared. But if it did happen, the wooden beams would start to creak loudly...

BTW: Gold has reached a new all-time high despite the sharp rise in US market yields – which is a further confirmation that it is not rising on the back of hopes of lower interest rates (Pretiorates' Thoughts 44)…

That’s it for today!

More By This Author:

Believe It Or Not, The Euphoria In The Precious Metals Market Is Still Too Low

Inflation Seems To Be Dying, But It Is Not Dead

Will The Chinese Party Be Followed By A Hangover?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more