Interest Rates Are Set To Fall Again, But For How Long And By How Much?

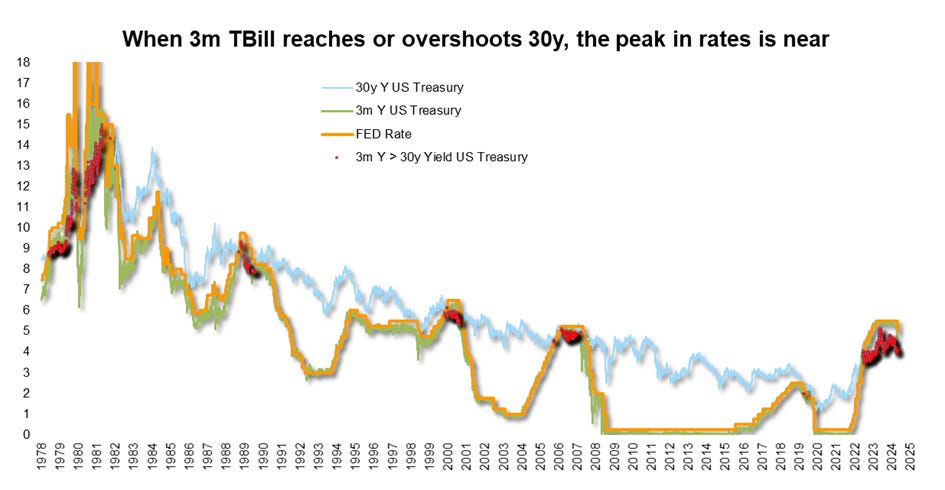

Whenever three-month US Treasury notes trade higher than 10-year US Treasuries, the interest rate cycle is near a top. This time, the market had to wait longer than usual, but the indication was confirmed again...

(Click on image to enlarge)

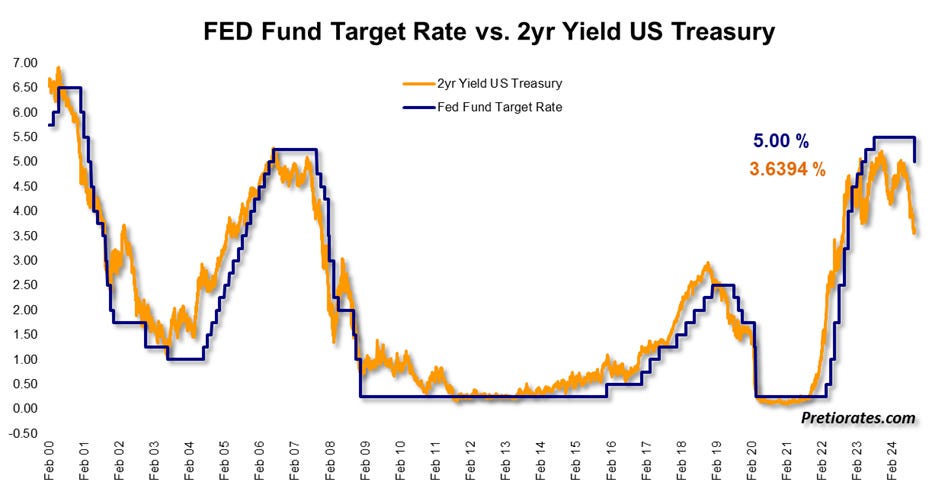

The Fed reduced the Fed fund rate by 50 basis points and indicated that another 50 basis points are possible by the end of the year. However, the US Treasury with a term of 2 years is currently pricing more than 125 basis points for the next two years...

(Click on image to enlarge)

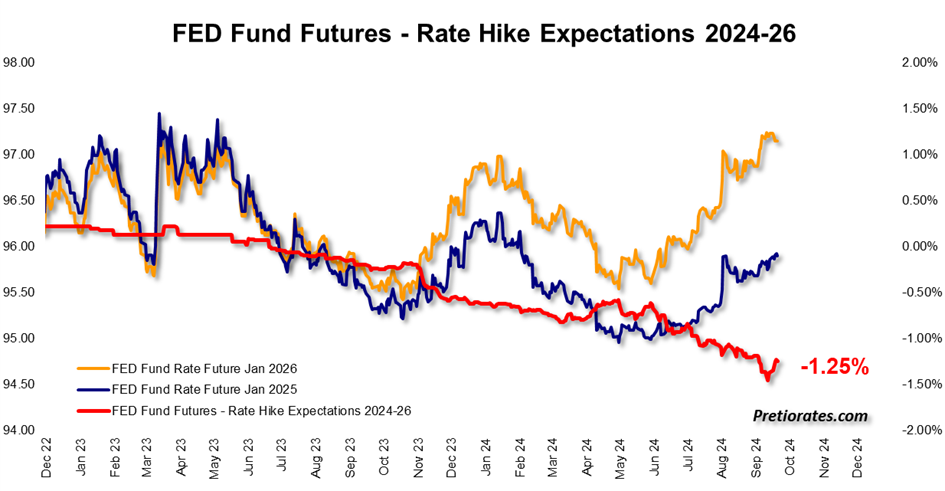

This is also confirmed by the futures...

(Click on image to enlarge)

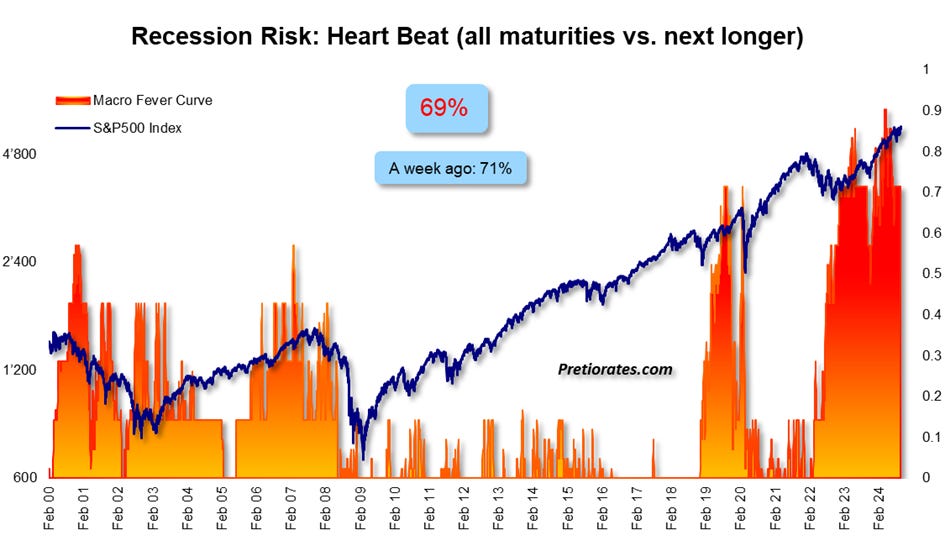

Even if the Fed does not want to talk about a recession, the Heart Beat of the US economy still sees a 69% risk of a recession. Before the Fed meeting, this was 71%, so the Fed's words have done little to calm the situation...

(Click on image to enlarge)

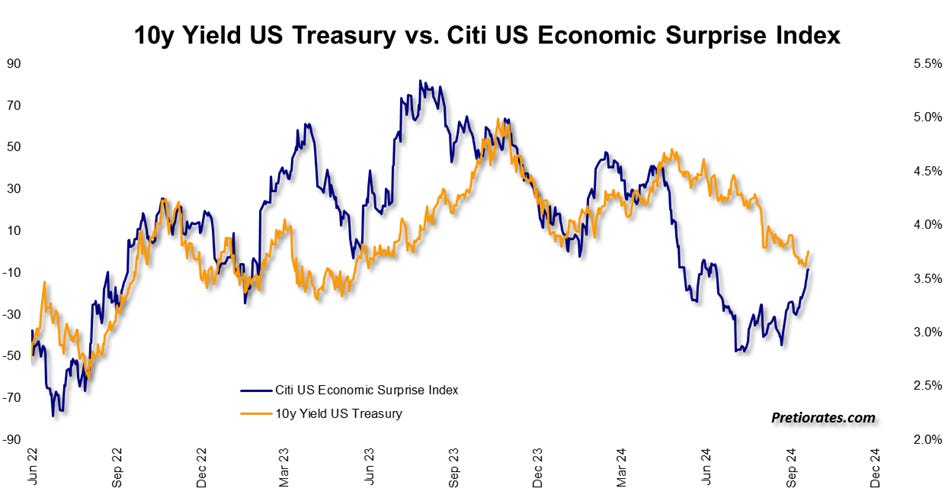

By contrast, the Citi US Economic Surprise Index rose sharply recently. This does not confirm expectations of a strong potential for further interest rate cuts...

(Click on image to enlarge)

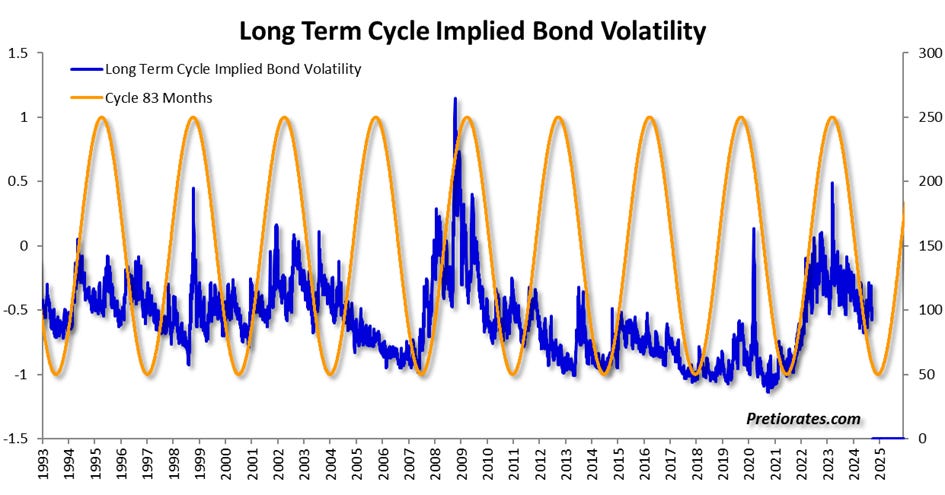

It is also interesting to note that the long term bond market volatility cycle is again pointing to the possibility of rising volatility over the next few months – which may indicate unrest in the bond market...

(Click on image to enlarge)

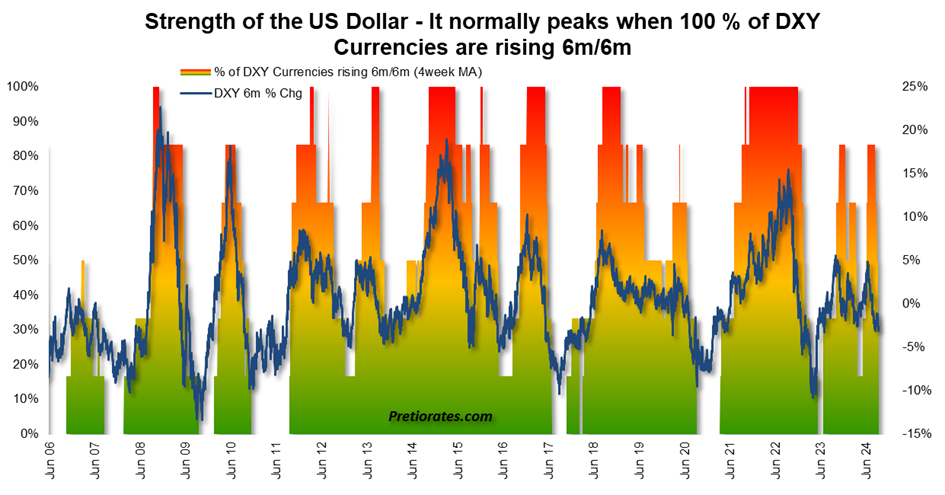

However, the US dollar is likely to come under scrutiny even before the bond markets. Its strength decreased from 83% to just 33% within a month...

(Click on image to enlarge)

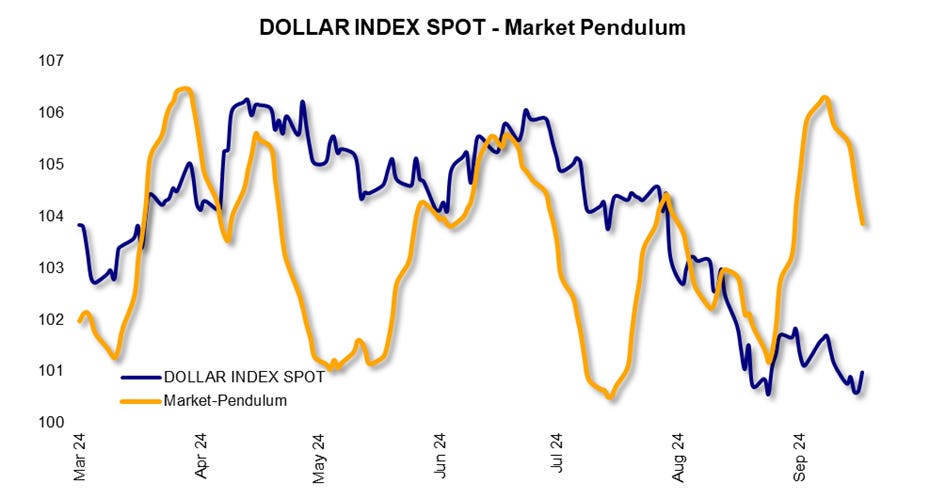

The US Dollar Index is now only just above the 100 mark and could also fall below the August low. This would be tantamount to a double sell signal. The market pendulum is also falling and a test can be expected in the next few days...

(Click on image to enlarge)

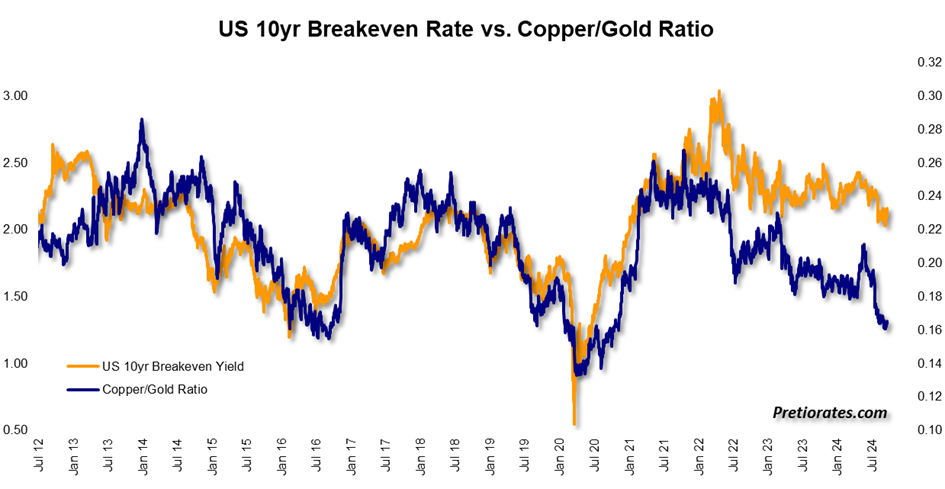

Copper rises during positive economic cycles, Gold during negative cycles (boom or bust). The Copper/Gold ratio is also very bearish for the US economy, as already shown by the heartbeat. The real market yield would therefore have to fall quite a bit, which in turn would be positive for the gold price...

(Click on image to enlarge)

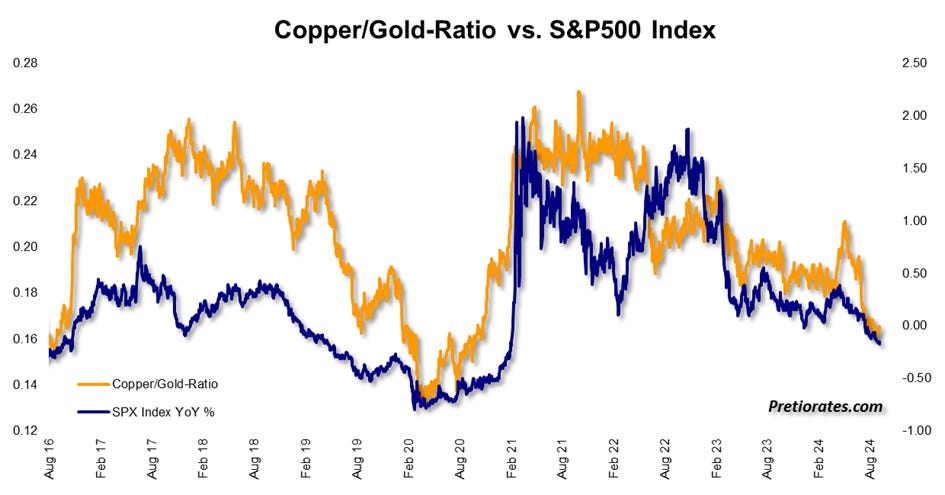

However, compared to the S&P500, it shows that it is correctly priced...

(Click on image to enlarge)

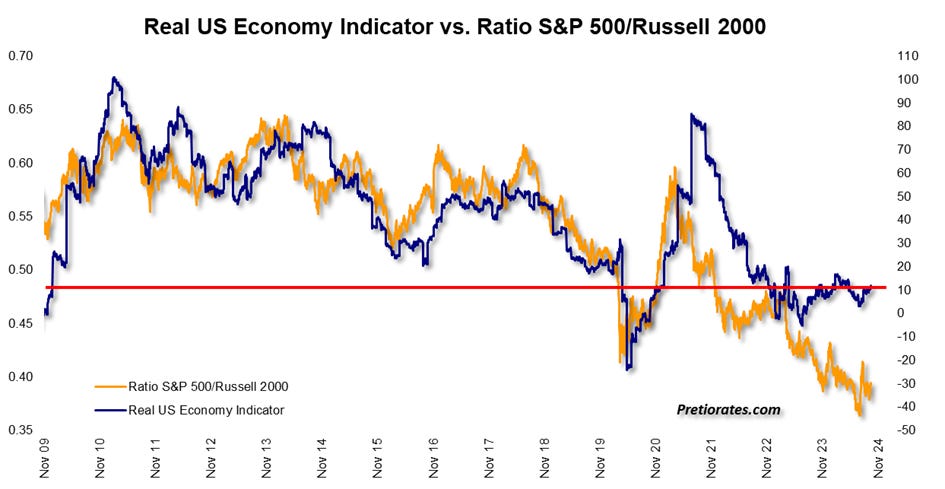

By contrast, the comparison with the real US Economy Indicator shows that small and mid-sized stocks are trading at too low a price. The Russell 2000 could outperform the S&P500 index...

(Click on image to enlarge)

More By This Author:

The Beautiful Dreams Of Lower Interest RatesThe Second Wave Of Selling On The Stock Market Has Begun

The Bond Market Should Be Careful What It Wishes For

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more