The Bond Market Should Be Careful What It Wishes For

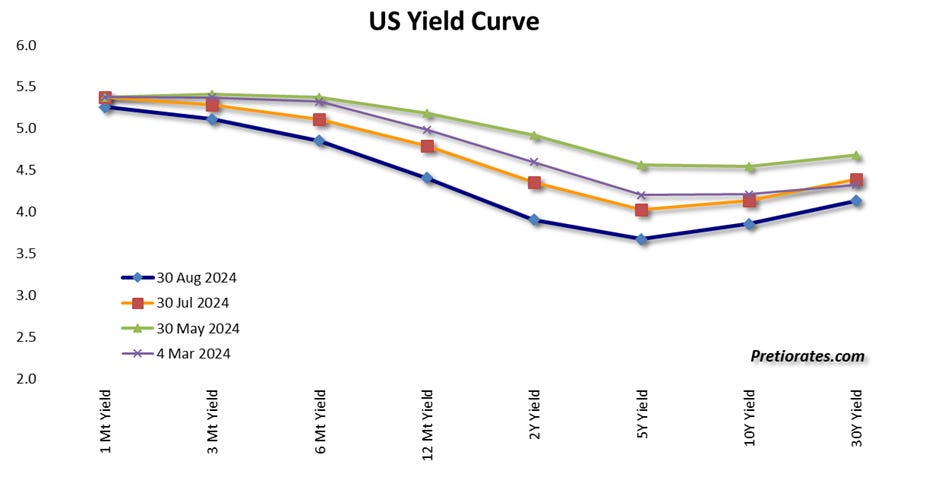

Jay Powell has now said what the market has been hoping for most of the year. Interest rates will be cut... The yield curve has reacted again, especially at the long end...

(Click on image to enlarge)

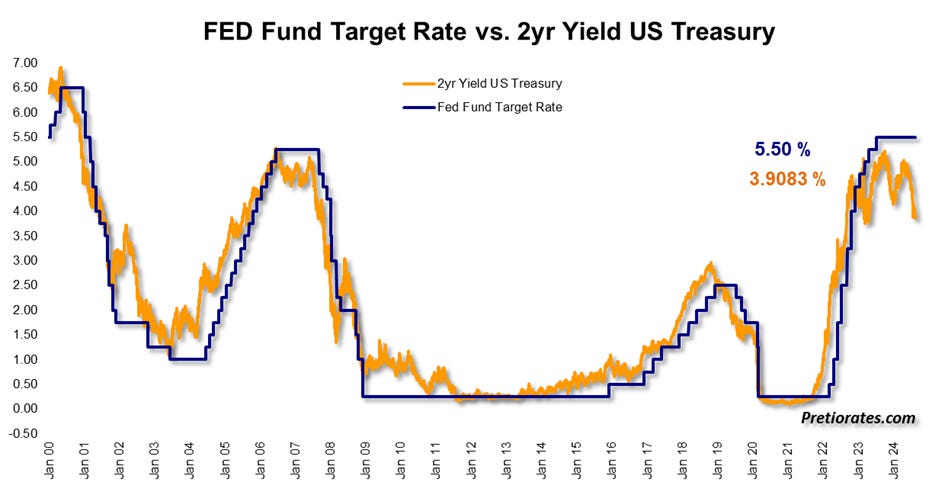

A very good indicator of the Fed's policy is the yield on the US Treasury over 2 years. This recently fell to below 4 % and has thus already priced in a potential interest rate cut of over 1.5 %...

(Click on image to enlarge)

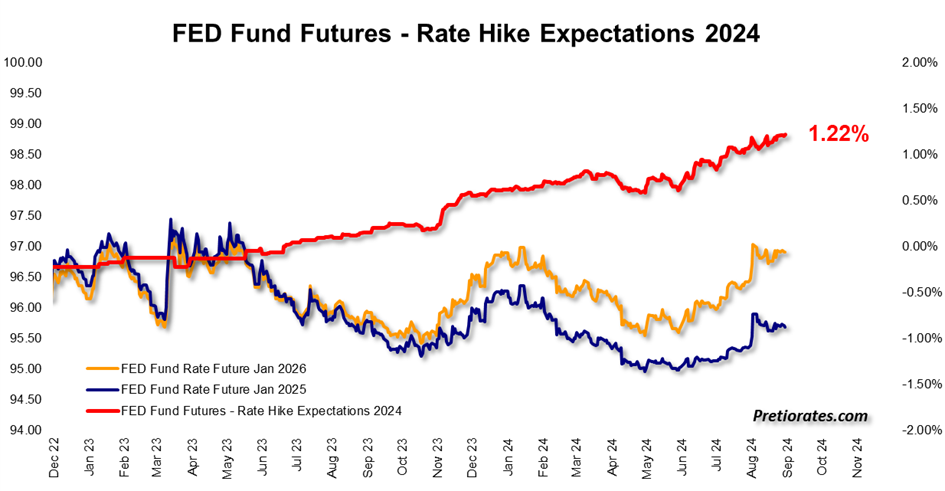

At 1.22 %, however, the futures market is indicating somewhat less...

(Click on image to enlarge)

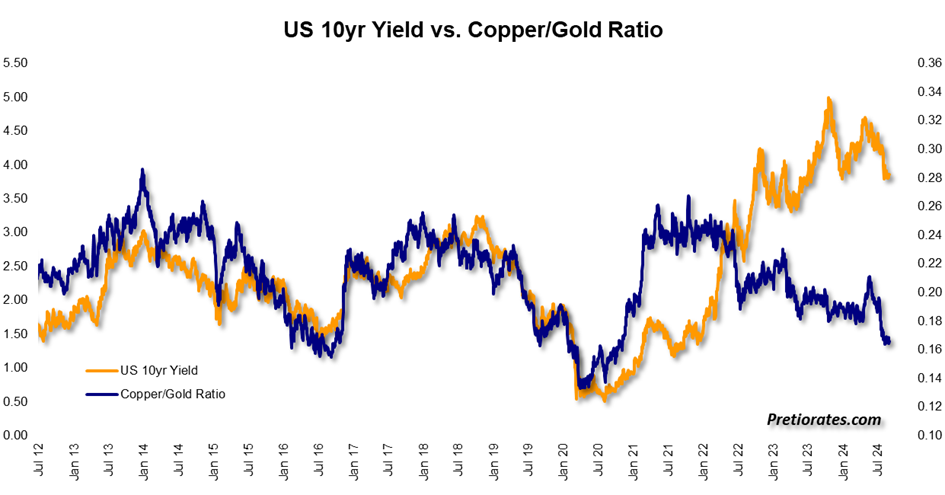

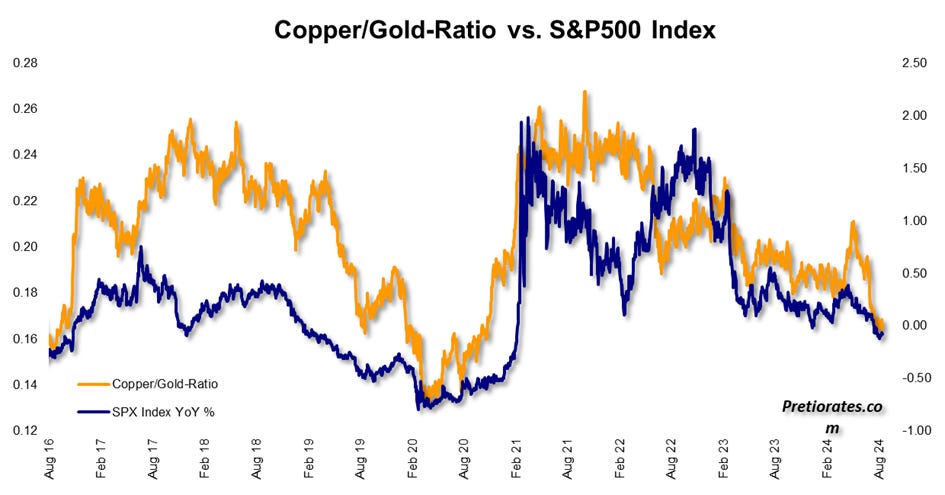

One of the relatively strong market correlations is the relationship between copper and gold and the yield on 10-year government bonds. The logic behind the predictive power of the correlation is that the copper-gold ratio reflects the relationship between economic activity and inflation (copper) and between monetary and fiscal trends (gold), which is a pretty good indicator of 10-year government bond performance. The chart shows that the ratio has indicated the potential for interest rate cuts for some time now...

(Click on image to enlarge)

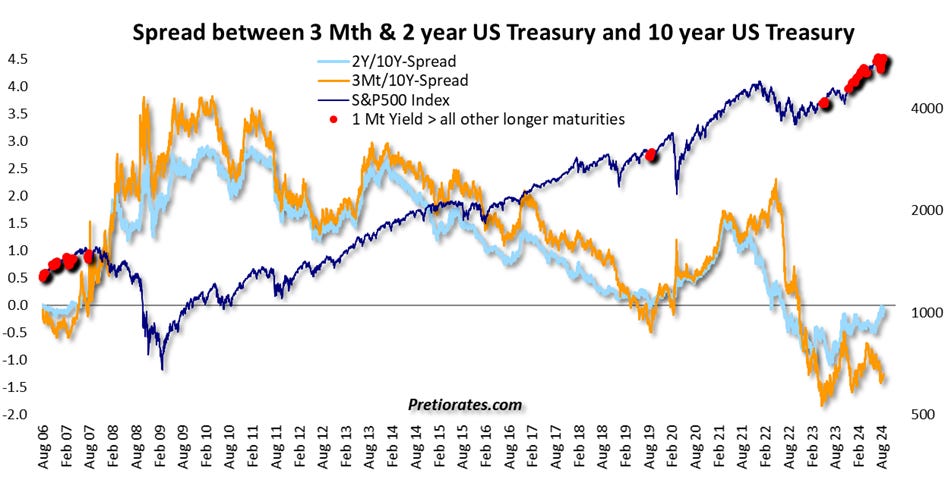

Also striking: the spread between the US Treasury over 2 and 10 years has almost completely disappeared. But not the spread between the US Treasury over 3 months and 10 years, which is more closely monitored by the FED. In addition, the market yield over 1 month remains above all other maturities - which in the past often did not bode well for the US economy (red dots)...

(Click on image to enlarge)

The gold/copper ratio also has a high correlation with the percentage performance of the stock market over the last 12 months. Currently, this indicates that the stock market (ceteris paribus) is fairly fairly valued...

(Click on image to enlarge)

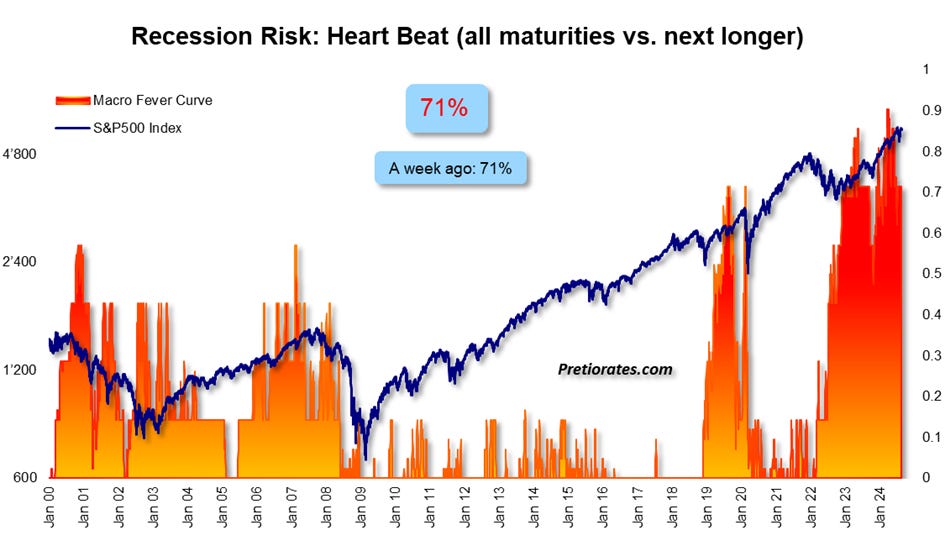

The question remains as to why the Fed sees the need for lower interest rates. In fact, the risk of recession remains high at 71%...

(Click on image to enlarge)

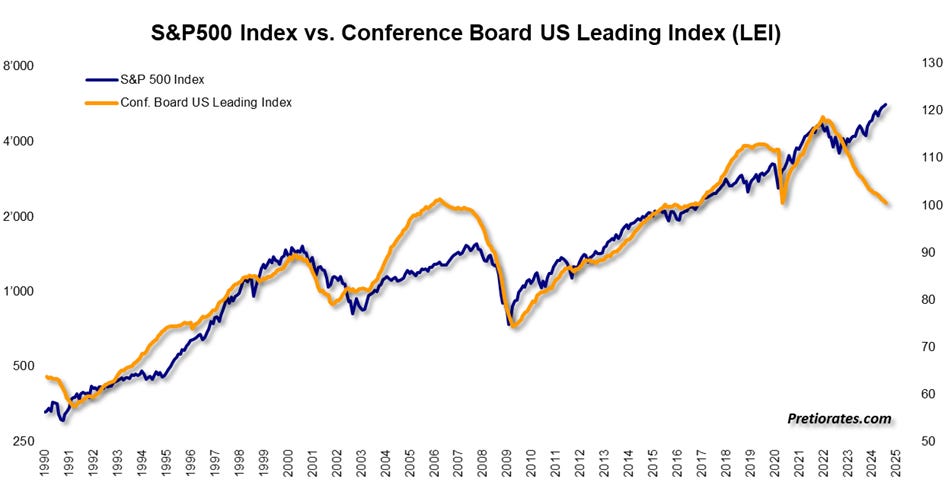

Another very good indicator for the long-term development of the US economy is the Conference Board US Leading Index (LEI). This has indicated a negative trend for over two years, in stark contrast to the performance of the stock market...

(Click on image to enlarge)

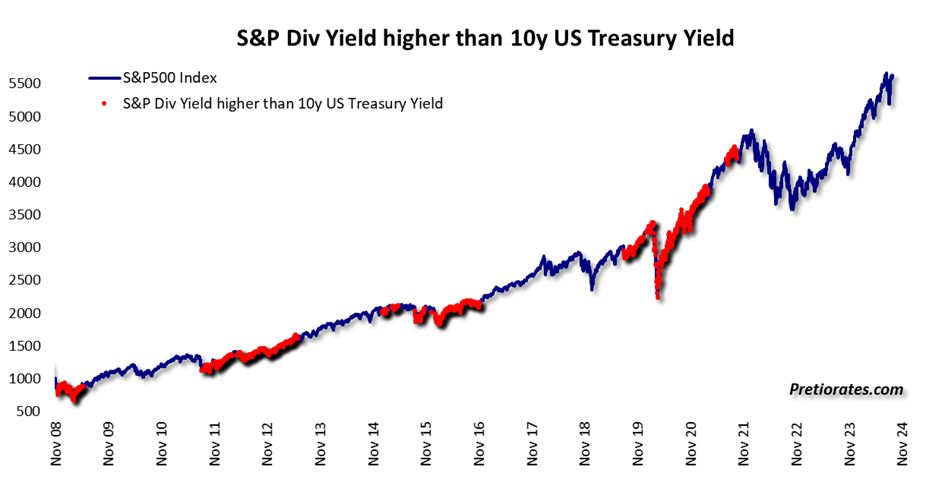

Advances in the S&P500 Index are relatively harmless if the average dividend yield is higher than that of the US Treasury with a maturity of 10 years (red dots). With the upswing in equities for almost two years now, this condition is not met... (because there is a lot of hope in IT stocks without dividends)...

(Click on image to enlarge)

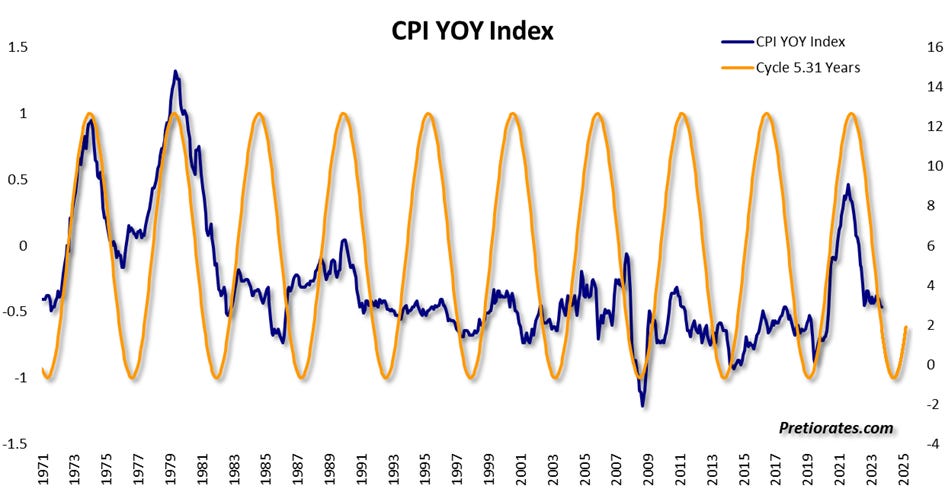

But what will happen to market interest rates if, according to the CPI cycle, inflation starts to rise again at the end of the year?

(Click on image to enlarge)

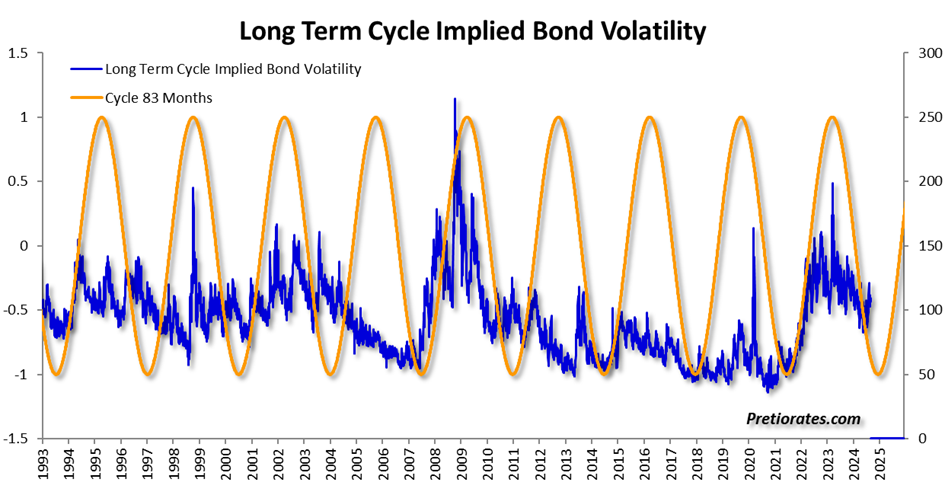

In fact, the bond market volatility cycle also indicates nervous times again in the coming months ...

(Click on image to enlarge)

Even if the market finally feels confirmed that lower interest rates are coming. Perhaps this development is not so positive...

More By This Author:

The Bulls In The Stock Market Shouldn't Feel Like Winners Yet

Gold Is Watching The Growing Possibility Of Kamalanomics

After The Turmoil, There Is Still No Green Light

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more