Business Cycle Indicators, Mid-July

Industrial production and manufacturing production both came under Bloomberg consensus (-0.2% m/m vs. +0.1, -0.5% vs. +0.1, respectively). With these data, we have this picture of some key indicators followed by the NBER BCDC.

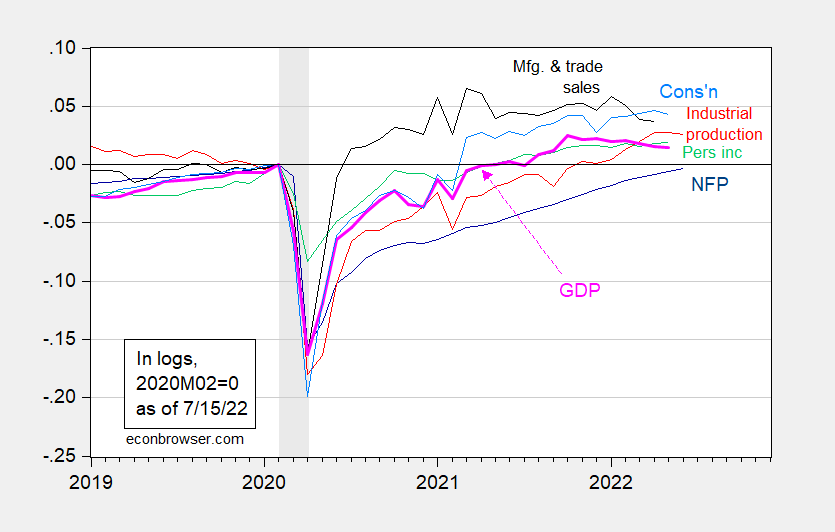

Figure 1: Nonfarm payroll employment (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

Given the rapid bounceback in all of these series, it’s getting a little difficult to see how things are evolving as we consider whether we are moving back into recession. Here I plot the last year’s worth of the data.

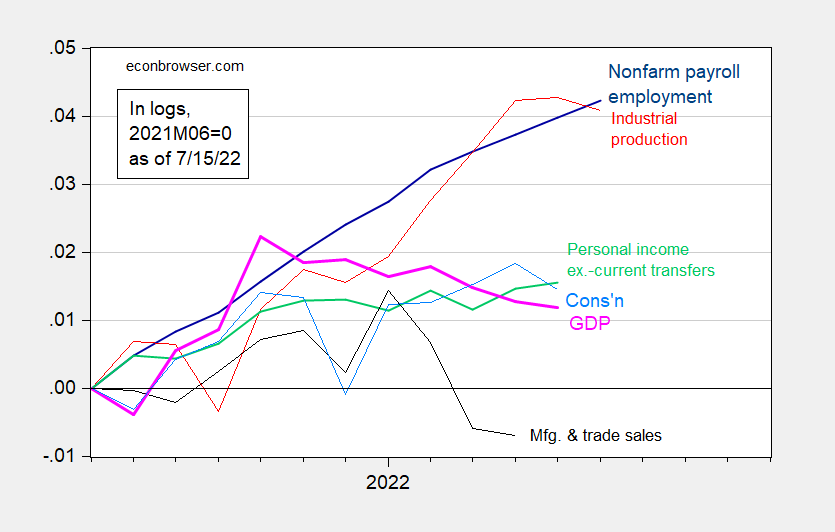

Figure 2: Nonfarm payroll employment (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2021M06=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

While some series look like they might have peaked in the past (manufacturing and trade industry sales, monthly GDP), others are clearly still rising (nonfarm payroll employment, NFP). NBER BCDC notes that of these series, a greater weight is put on NFP and personal income excluding current transfers. Both of these continue to rise, with NFP over 4% higher over the past year (in log terms). Industrial production has also risen over 4% over the past year, even if it has registered a decline over the past two months of data.

In other news, retail sales exceeded consensus (1% vs 0.8%, versus -0.1% previous, m/m).

As of today, GDPNow for Q2 is -1.5%, IHS Markit is -1.9%, Goldman Sachs tracking is +0.7. Today’s Wells Fargo forecast, +0.2, Deutsche Bank forecast as of today is -0.6%.

More By This Author:

IMF Forecast For US GDP: No Recession

Nonresidential Fixed Investment and Prospects for GDP Outlook and Revisions

Another Look At Friday's Nowcasts

Disclosure: None.