IMF Forecast For US GDP: No Recession

From the Article IV consultation:

Source: IMF, Article IV consultation report for US, July 2022.

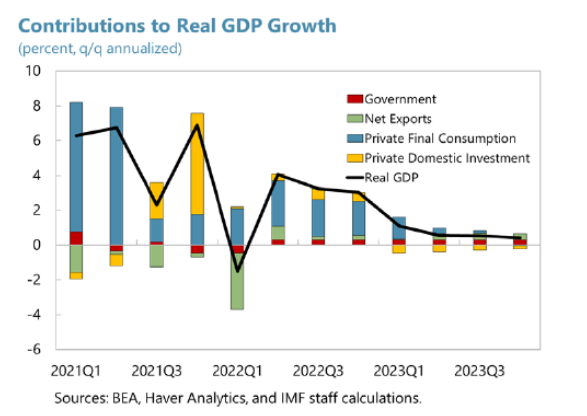

The sharp rebound in GDP in Q2 is at variance with nowcasts. A big change in the contribution of net exports accounts from big negative to small positive (in a mechanical sense) for the resumption of projected growth. The report notes:

All in all, growth is expected to fall to 0.7 percent q4/q4 by end-2023 and then pick up gradually into 2024. The U.S. is expected to narrowly avoid a recession. Nonetheless, the risk of the economy “stalling” and tipping into a short lived downturn are significant. In particular, if the economy again gets hit by a negative shock, the predicted slowdown will likely turn into a short-lived recession. PCE inflation is expected to fall steadily as activity decelerates and supply-demand imbalances are resolved, reaching 2 percent on a year-on-year basis by end-2023.

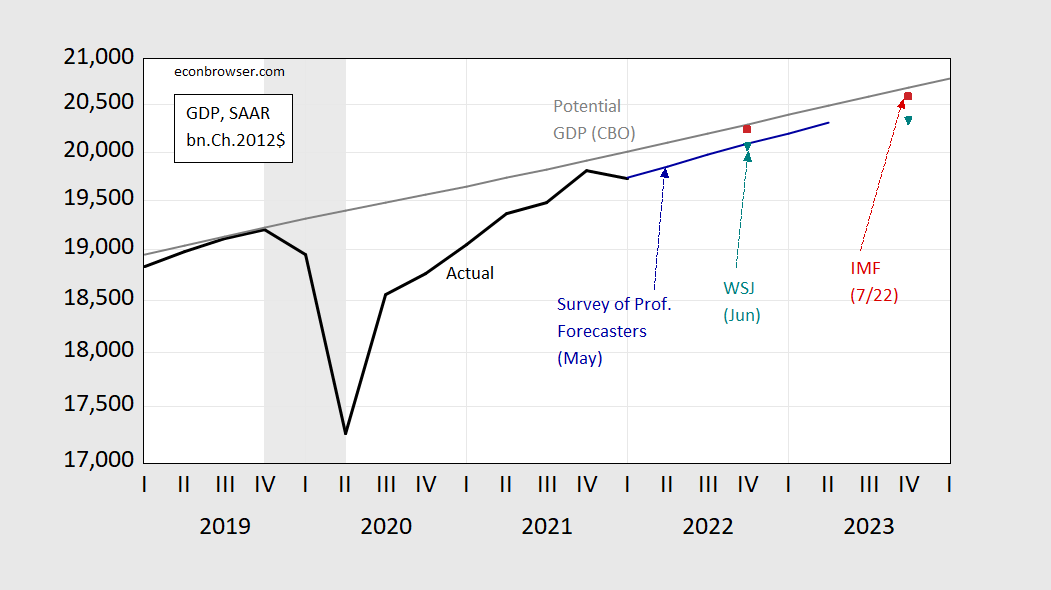

Figure 1 below shows the IMF forecast of 2.2% q4/q4 2022 (which is a downgrade from the 2.9% forecast at the end of the team visit last month) in comparison to other forecasts and potential GDP.

Figure 1: GDP (black), potential GDP (gray), Survey of Professional Forecasters May consensus (blue), WSJ June survey mean (teal), and IMF Article IV consultation forecast (red), all in billions Ch.2012$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, CBO, Philadelphia Fed, WSJ (June survey), IMF, NBER, and author’s calculations.

The IMF forecast is — in level terms — more optimistic than the WSJ June consensus, as well as the May Survey of Professional Forecasters consensus.

More By This Author:

Nonresidential Fixed Investment and Prospects for GDP Outlook and RevisionsAnother Look At Friday's Nowcasts

Gasoline Prices Continue To Fall

Disclosure: None.