Another Look At Friday's Nowcasts

July 8 Nowcasts

GS vs Atlanta and IHS-Markit:

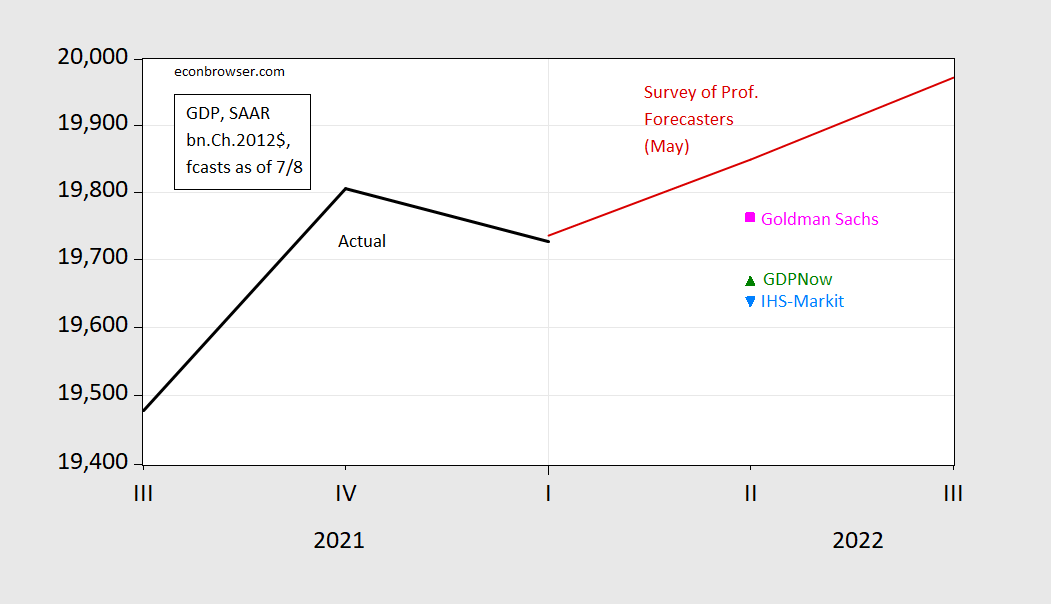

Figure 1: GDP (black), May Survey of Professional Forecasters consensus (red), Goldman Sachs (pink square), Atlanta Fed GDPNow (green triangle) and IHS-Markit (light blue triangle), in billions Ch.2012$, SAAR. Nowcasts as of 7/8/2022. Source: BEA and Goldman Sachs, Atlanta Fed and IHS-Markit, and author’s calculations.

Note that even if the advance release for Q2 growth is negative, the mean absolute revision from advance to final vintage is about 1.26 percentage points (see BEA (2021)). Given the GDPNow is at -1.2%, and IHS-Markit is at -1.8% (both SAAR), the final growth rate could end up being positive. (This is also true for Q1, since the MAR is 1.23 percentage points going from third to final). See also this discussion of GDP revisions for the period around the 2001 recession.

More By This Author:

Why I Suspect Q1 GDP Will Eventually Be Revised Up

So You Think We Might Be In A Recession As Of Mid-June?

The Relative Price of Gasoline Through July, 4

Disclosure: None.