Why I Suspect Q1 GDP Will Eventually Be Revised Up

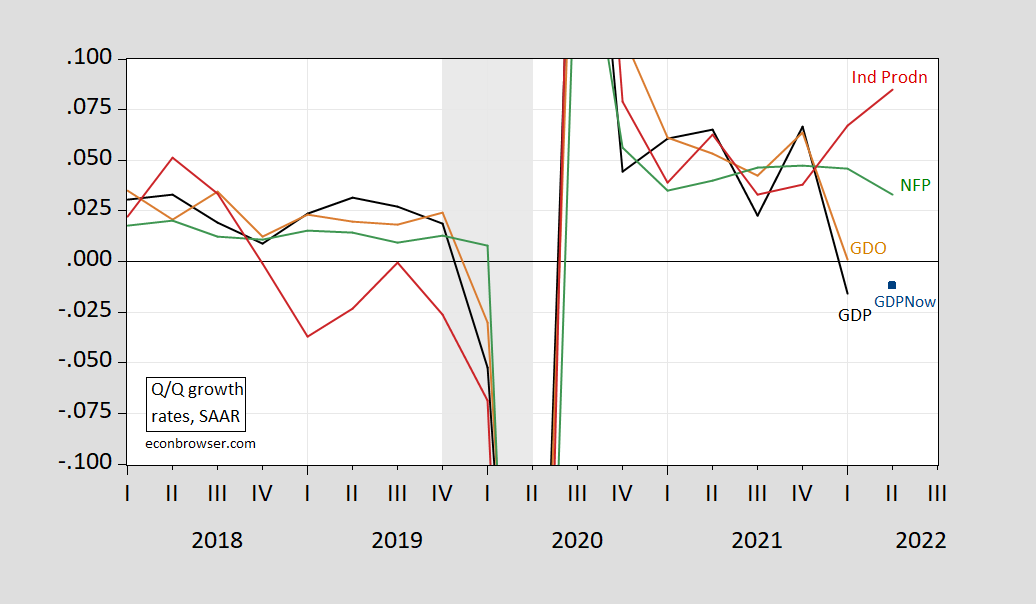

First, look at nonfarm payroll employment and industrial production, as compared to GDP (and GDO):

Figure 1: Annualized quarter-on-quarter growth rate of real GDP (black), GDPNow nowcast of 7/8 (blue square), real GDO (tan), nonfarm payroll employment (green) and industrial production (red), all calculated using log differences. 2022Q2 industrial production is for April, May. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS and Federal Reserve via FRED, Atlanta Fed, NBER, and author’s calculations.

Simply put, both employment and industrial production are growing much faster than reported GDP. If one estimates the relationship between (first log differences) of GDP on one hand and nonfarm payroll employment and industrial production on the other, (1986-2022Q1, adj.R2 = 0.83), one finds that the predicted GDP in Q1 is 1.8 ppts higher than actual reported in the 3rd release. A similar number applies to the GDPNow figure for Q2 as of 7/8.

Note that the mean absolute revision between the 3rd release and the final vintage in SAAR growth rates over the period ending 2018 is 1.23 ppts (BEA (2021)).

More By This Author:

So You Think We Might Be In A Recession As Of Mid-June?The Relative Price of Gasoline Through July, 4

Inflation Expectations At The 5-Year Horizon

Disclosure: None.