So You Think We Might Be In A Recession As Of Mid-June?

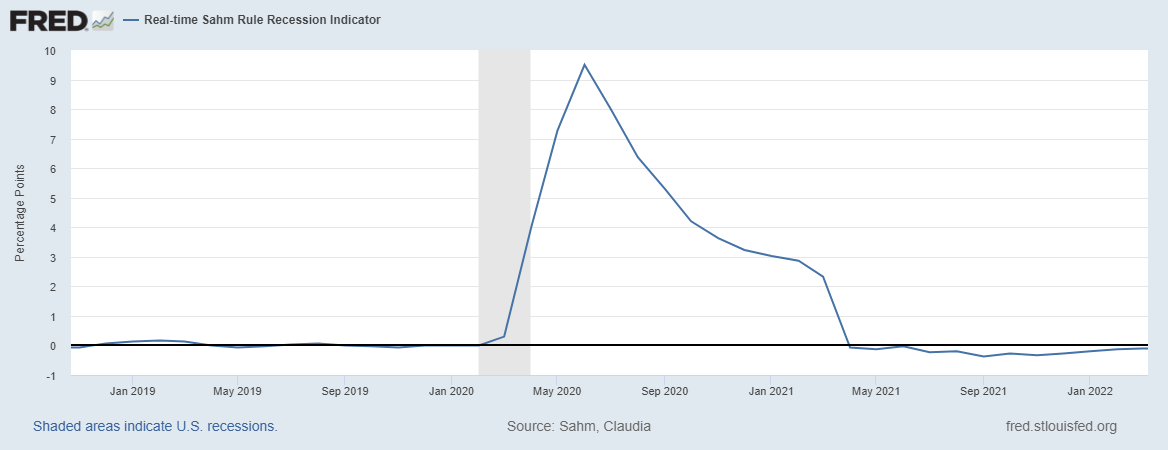

With today’s employment situation release, we have the real-time Sahm rule indicator through June:

Source: FRED, accessed 7/8/2022.

This indicator does not suggest that we were in recession as of mid-June (when the survey was taken), contra suggestions (e.g.). For other high-frequency-based indicators through June, see this post.

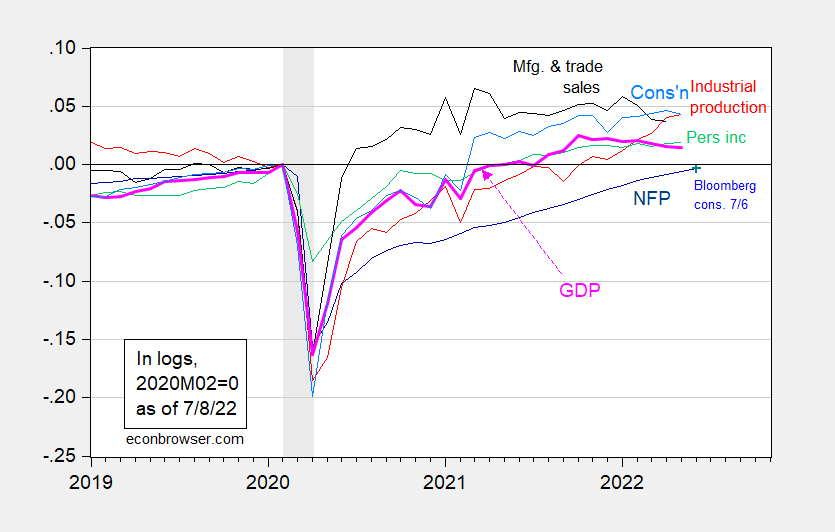

Here are some of the key indicators followed by the NBER’s BCDC:

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for NFP as of 7/6 (blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

More By This Author:

The Relative Price of Gasoline Through July, 4Inflation Expectations At The 5-Year Horizon

Gasoline Prices Today And (Maybe) Tomorrow

Disclosure: None.