Nonresidential Fixed Investment And Prospects For GDP Outlook And Revisions

One of the interesting aspects of the current recovery is the relative small rebound in nonresidential fixed investment.

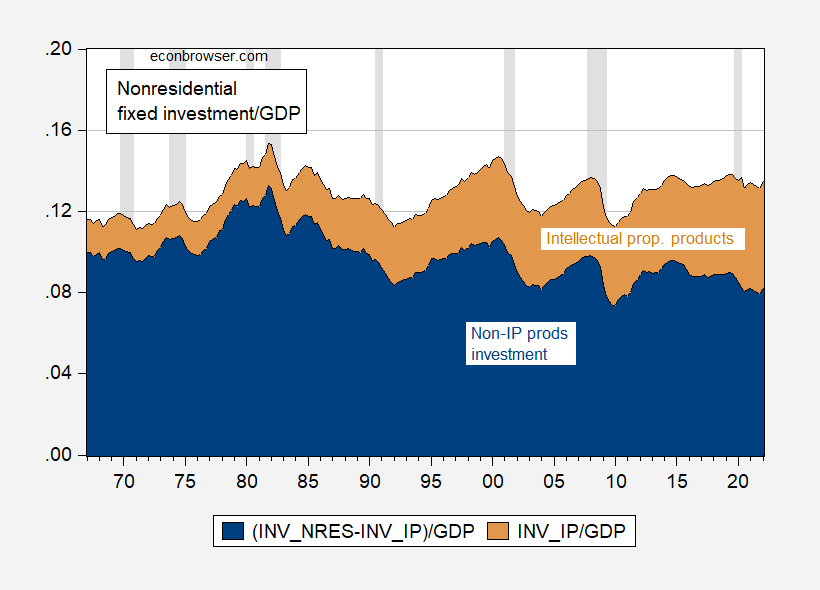

Figure 1: Non-intellectual property products nonresidential fixed investment share of nominal GDP (blue), and intellectual property products investment share of (tan), SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, author’s calculations.

Notice that the drop in nonresidential investment was fairly small, and the bounceback relatively small. Perhaps what is more interesting is that the share of IP products investment has been increasing over time. And in terms of nominal GDP growth, IP products investment has grown in importance — pre-Covid-19. In Figure 2, I show the q/q changes, but the share of GDP impact shows the same pattern.

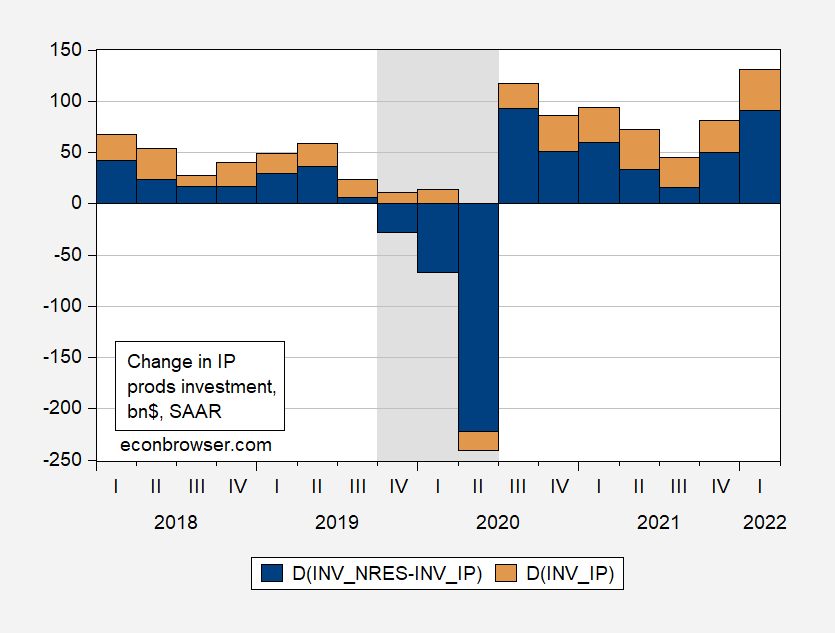

Figure 2: Quarter-on-Quarter change in non-intellectual property products nonresidential fixed investment (blue), and intellectual property products investment(tan), SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, author’s calculations.

Note that I have used the BEA aggregate series for IP products (the components are software, R&D, entertainment, and literary originals) in these figures. Detail on the heterogeneity of the IP products investment is in Fixler and de Francisco (2022).

Now, there are two implications to draw from this observation. The first relates to what the final Q1 and Q2 GDP numbers are likely to eventually look like. Investment in IP has been revised upwards substantially in certain cases.

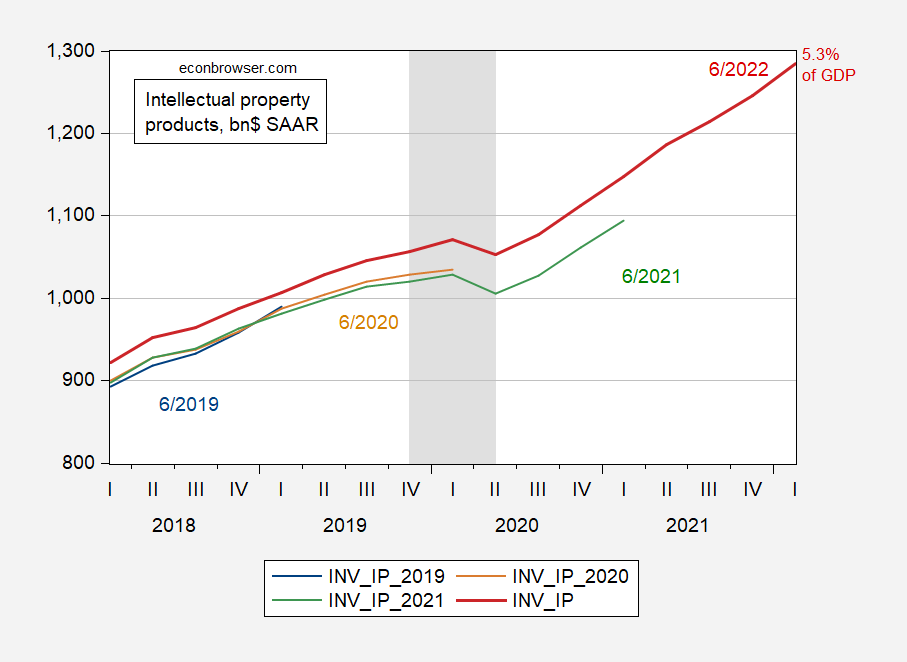

Figure 3: Intellectual property products investment from June 2019 release (blue), June 2020 (tan), June 2021 (green), and June 2022 (bold red), all in bn$, SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, author’s calculations.

Not only is the who series shifted up with the benchmark revision reported in July 2021 (by about one-quarter of one percentage point of GDP), but — what is important for GDP growth rates — the changes in IP products investment are typically revised up. Hence, an additional point for my belief that GDP growth in 2022 is likely to be revised upward as the GDP data are benchmark revised.

The second observation relates to the impact of tightening monetary policy. The view that intangible capital investment is less sensitive to interest rate changes (e.g., Crouzet and Eberly, 2019) implies that monetary policy might need to be tighter than otherwise in order to hit a given target reduction in aggregate demand.

More By This Author:

Another Look At Friday's NowcastsGasoline Prices Continue To Fall

Why I Suspect Q1 GDP Will Eventually Be Revised Up

Disclosure: None.