Business Cycle Indicators At October’s Start

With September IHS-Markit (Macroeconomic Advisers) monthly GDP, we have the following picture of some key indicators followed by the NBER Business Cycle Dating Committee.

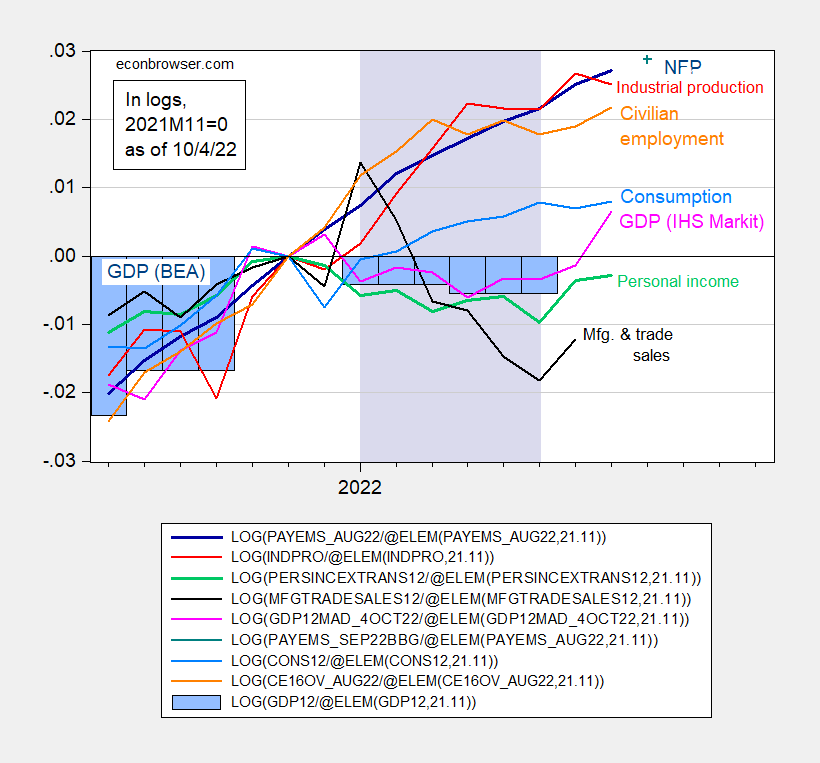

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 10/4 for NFP (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

Note that monthly GDP moved up sharply in September. From IHS-Markit:

Monthly GDP rose 0.8% in August following a 0.2% increase in July. The latter was revised lower by 0.2 percentage point. The increase in August was accounted for by large increases in nonfarm inventory investment and net exports. Final sales to domestic purchasers were

essentially flat in August. The sharp gain in inventory investment in August is likely to be reversed in September, as inventories (outside of motor vehicles and parts), by our estimation, were already somewhat overbuilt heading into August

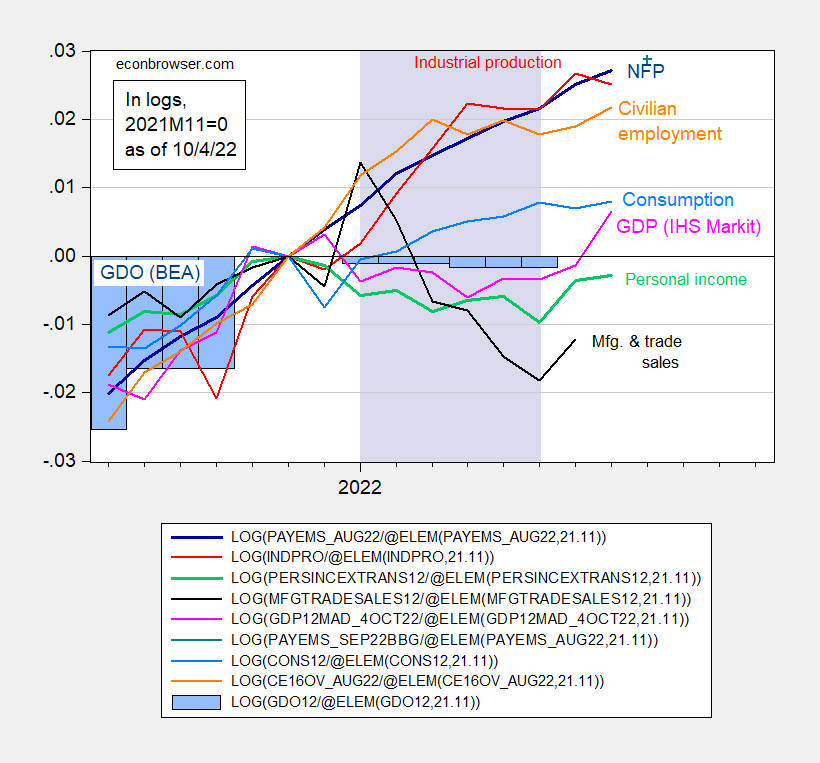

GDP and other indicators seem to be at variance; however, if we look at GDO, they seem more consistent.

Figure 2: Nonfarm payroll employment (dark blue), Bloomberg consensus of 10/14 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), Gross Domestic Output, GDO (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

For more discussion of GDP vs. GDO and other related measures, see this post from the beginning of the month, and discussion of GDP annual revision, here.

With consumption, employment and production measures rising throughout H1, and GDO trending sideways, it does not seem likely that H1 will be declared a recession, defined as a broad-based and persistent decline in economic activity.

More By This Author:

The Recent Pound Plunge In Context: 50 Years Of The Real RateGDPNow Q3 at 2.4% SAAR

Business Cycle Indicators At September’s End