Business Cycle Indicators At September’s End

With August nominal consumption coming in above consensus (m/m +0.4% vs. +0.2% Bloomberg), and consumption and personal income continuing to rise, we have the following picture of some key indicators followed by the NBER Business Cycle Dating Committee.

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 9/30 for NFP (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (9/1/2022 release), and author’s calculations.

Manufacturing and trade sales also rebounded in July, although the shift away from goods is still apparent (although they are still 3.7% above NBER peak levels).

GDP and other indicators seem to be at variance; however, if we look at GDO, they seem more consistent.

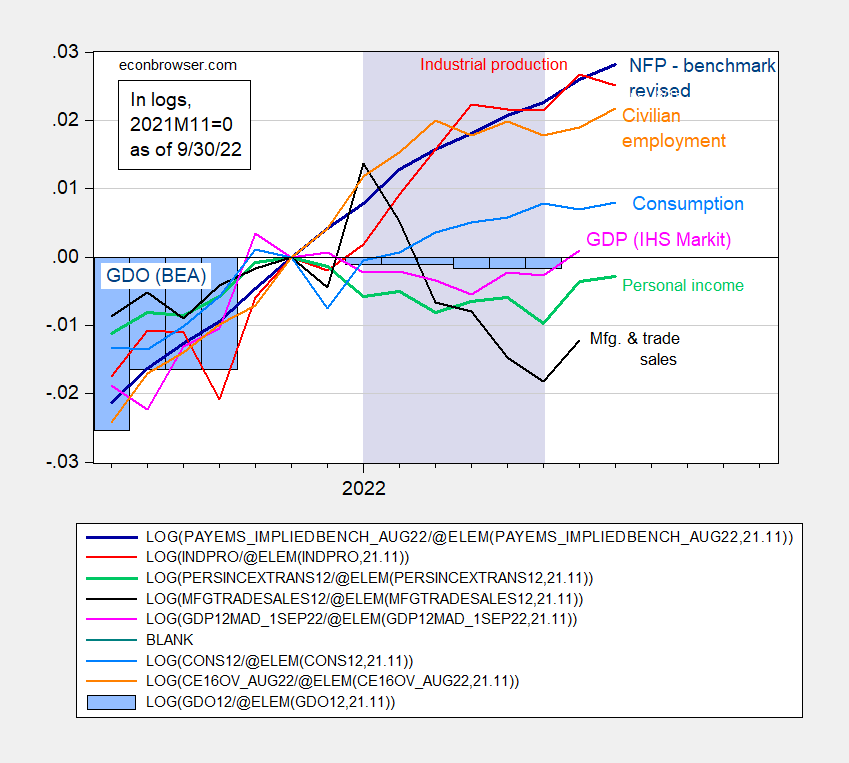

Figure 2: Nonfarm payroll employment adjusted to preliminary annual benchmark revision (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), Gross Domestic Output, GDO (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (9/1/2022 release), and author’s calculations.

For more discussion of GDP vs. GDO and other related measures, see this post from the beginning of the month, and discussion of GDP annual revision, here.

With consumption, employment and production measures rising throughout H1, and GDO trending sideways, it does not seem likely that H1 will be declared a recession, defined as a broad based and persistent decline in economic activity.

More By This Author:

UK Measured Economic Policy Uncertainty In Context

Yield Curve Inversions In The UK

Reserve Currency Status Is No Vaccination Against Recklessness – UK Edition