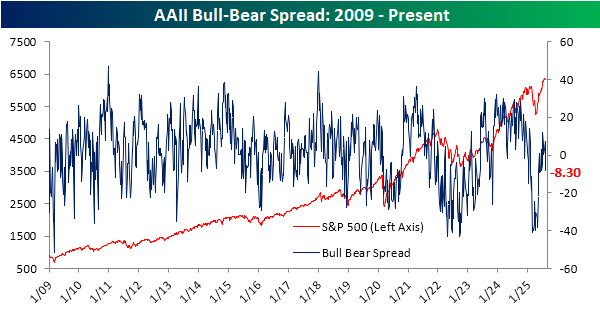

Bull-Bear Spread Tips Negative

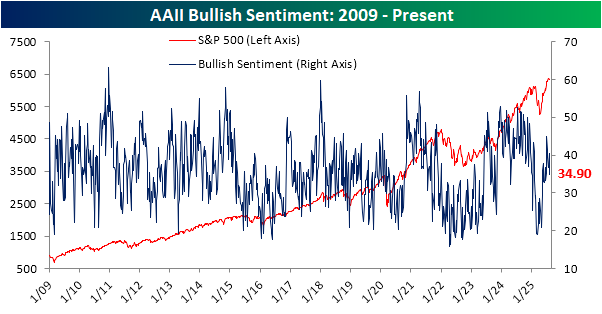

The equity market's rally has hit a bit of a snag since late July, although the S&P 500 is far from having collapsed as it remains within a couple percentage points of record highs. Nonetheless, sentiment has taken a hit. Bullish sentiment according to the weekly AAII survey peaked in the first week of July at 45%. Since then, it has fallen in four of the five weeks with the latest print of 34.9% the lowest of that stretch. That is only the lowest reading since the week of June 18th when it fell to 33.2%.

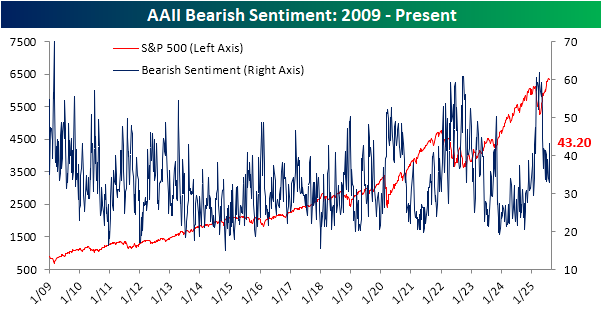

The drop in bulls corresponds with bearish sentiment picking up. Bearish sentiment has seen a more substantial increase, rising from 33% last week to 43.2% this week. That is now the highest reading for bears since the week of May 15, and the 10.2 percentage point leap week over week was the largest increase since the last week of February.

As shown below, the spread between bulls and bears has dipped back into negative territory and is at its lowest level since mid-May.

More By This Author:

Energy Sector Breaks; Gold Goes Sideways

Best And Worst Historical S&P 500 August Performers

Jobs Day In Four Charts

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more