Jobs Day In Four Charts

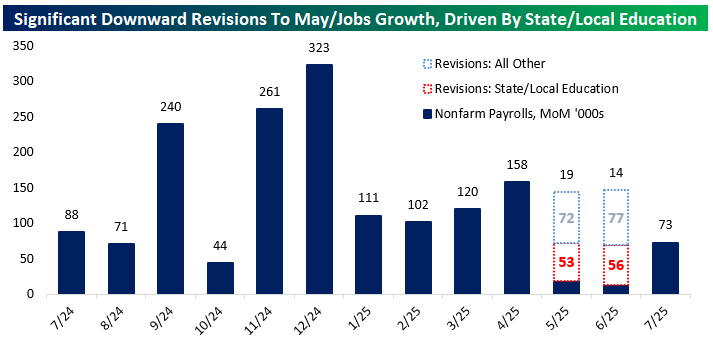

While payrolls announced by the BLS for July missed (+73k versus +104k estimated), the bigger story was revisions. A combined 258k jobs were revised out of May and June numbers, taking those months’ NFP prints to +19k and +14k respectively. Almost half of the revisions lower came from state and local government education, which accounts for less than 7% of total employment.

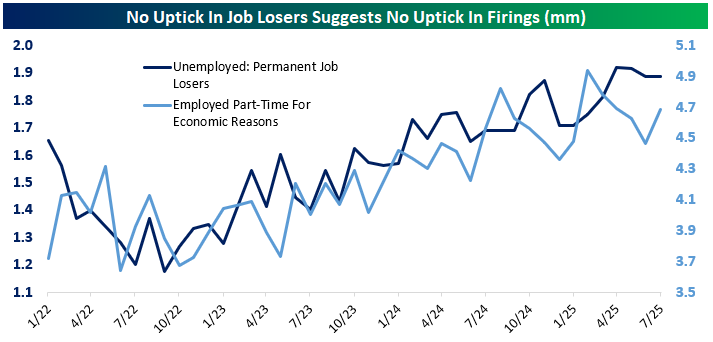

While jobs growth has slowed, there’s been no major uptick in unemployment due to job loss or more workers only part-time because they can’t find full-time work.

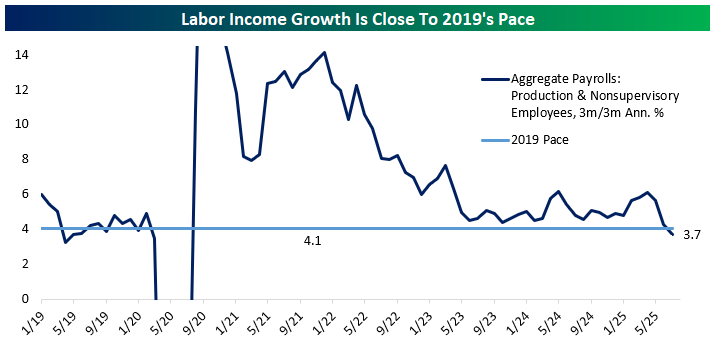

Labor income (employment times wages times hours) was also up over 7% annualized on the month and is up at 3.7% annualized on a 3m/3m basis that is similar to 2019’s nominal growth rate. Labor income has certainly slowed, but it’s not cratering in a way that would drive sharp pullbacks in spending despite the slow jobs growth.

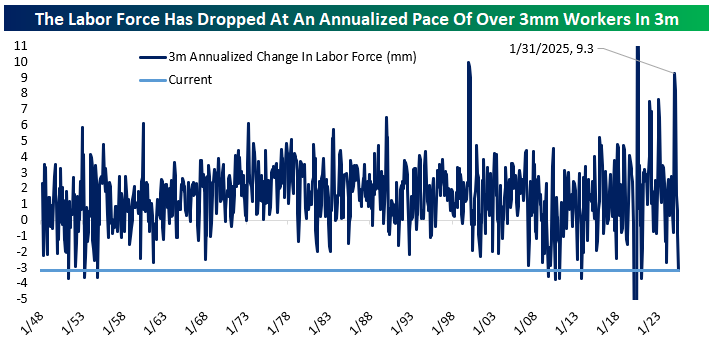

Since the Global Financial Crisis, labor market data has broadly been viewed as an insight to the demand side of the labor market. But the current context is quite different: unemployment remains low, while labor supply is falling. The last 3 months saw a 3.3mm annualized decline in the labor force, driven by immigration policy and to a lesser extent demographics. As a result, slow job creation is much less concerning than when labor supply is rising.

More By This Author:

Key ETF Asset Class PerformanceThe Carvana Comeback

New York And Chicago On Top

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more