Bears Coming Out? Inflation Data Now Partisan

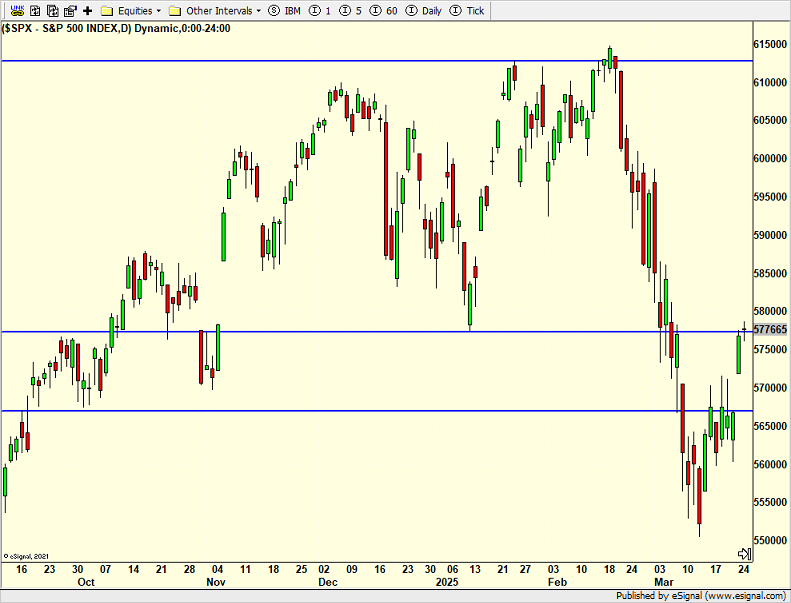

The bounce from the March 13th low continues. That’s good although it should run into some bears this week as it has retraced about 40% of what it lost since February 19th. Recall that my second most likely scenario was a weaker rally that failed somewhere around 6000. It is still too early to say which scenario will play out. We do know that the on again, off again tariff saga remains in full play with April 2nd looming.

Long-term interest rates have moved up lately, but they remain in a range for now. The dollar has barely bounced from a significant selloff. These two assets are super important to watch.

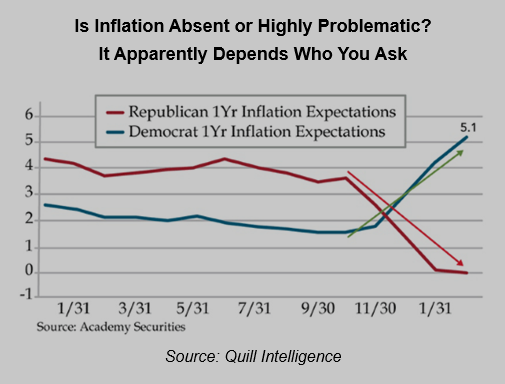

As I have discussed, inflation is basically dead. People were fixated on eggs when the data show that prices increases (not prices) were coming down. In 2022 I wrote about my amazement that economics had suddenly become partisan. The Republicans were screaming about recession because of back to back negative GDP quarters, but the Democrats were countering that the data were an anomaly. I was in the latter camp.

While perusing Twitter, I came across my friend’s chart below. Now inflation has apparently become partisan with Democrats expecting a resurgence and Republicans taking the opposite side. Once again, I am in the latter camp to a lesser degree. Regardless of your politics, I think it’s insane that economic data has become partisan. When people question my economic conclusions in political terms, I just shake my head.

On Monday we bought ITA, more XHB, more VGK and more DWAS. We sold DOW and some TAN. On Tuesday we bought RSYYX, WAHYX, more QLD, more SVARX, more MQQQ and more JHYFX. We sold SGOV and JAAA.

More By This Author:

Eliminating One Scenario

Three Scenarios For The Next Few Months

Powell Behind The Curve Yet Again – Stocks To New Highs?

Please see HC's full disclosure here.