Powell Behind The Curve Yet Again – Stocks To New Highs?

The model for today is plus or minus 0.50% and then a rally after 2pm. It’s a decent signal, but not as good after the bulls rallied stocks into the close. However, any morning weakness towards 0.50% should be bought.

Jay Powell and the FOMC are going to leave interest rates unchanged today and likely pivot to dovish with the possibility of a rate cut in May.

They SHOULD be cutting rates by 0.25% today and another 0.25% in May or June with more coming later in the year. My tune changed a few months ago because the data changed. Once again, the Fed is behind the curve which has been their theme for decades. They are worried about inflation which I said was basically dead for 2025, meaning the trend is lower.

And just for fun, all those screaming about egg prices, what say you now? They’ve crashed.

(Click on image to enlarge)

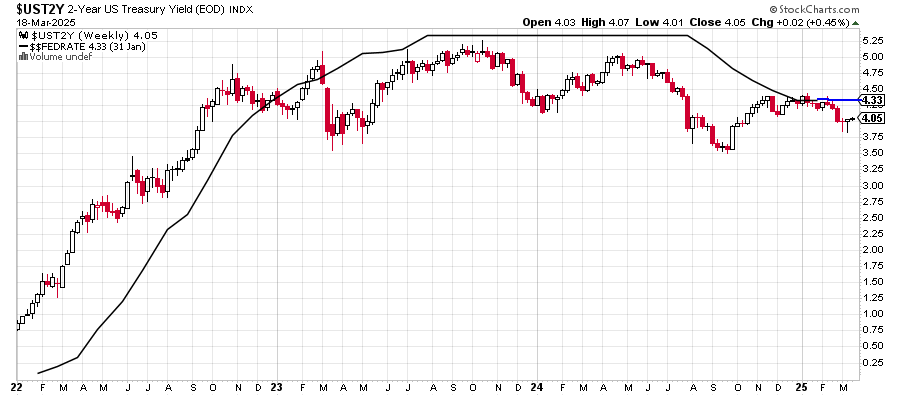

My favorite indicator of future FOMC action is below. It’s the super secret 2-Year Note, one of the most widely traded instruments on earth. With Fed Funds at 4.33% and the 2-Year at 4%, the market is expecting and asking for 0.25% to be cut.

(Click on image to enlarge)

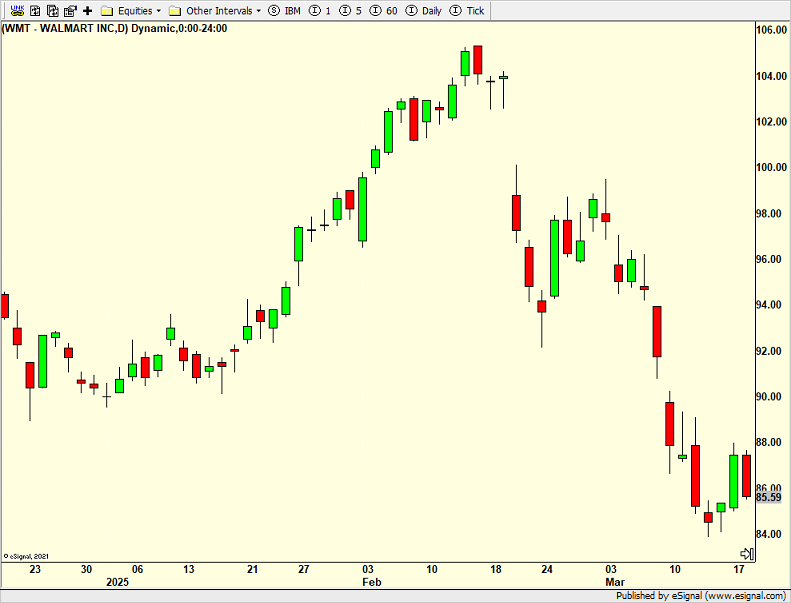

The economy is slowing. We saw that firsthand with Walmart (WMT). This is the primary reason for the stock market decline and growth scare. It is absolutely not about tariffs, noise and nonsense from DC. Walmart’s news about the consumer turned the S&P 500 from all-time highs to ruins. People can argue all they want. They are flat out wrong.

(Click on image to enlarge)

Regarding the stock market, there are two inputs to corrections, magnitude and duration. In other words, price and time. While I was looking for a 10%+ corrections in Q2 or Q3 with a smaller one in Q1, it looks like that was compressed into this decline. Although magnitude has largely been met, do not be surprised if we see one more decline towards the old lows or right through them by a few percent over the coming days or weeks. That would certainly help satisfy the two elements and make the correction look more complete.

If that scenario unfolds, that should set the stage for a big rally towards the old highs or even to marginal new highs in Q3.

On Monday we bought QID, ARRY, PCY and JAAA. We sold UWM, MQQQ and QLD. On Tuesday we bought EMB. We sold SDS and more MQQQ.

More By This Author:

“A” Low Has Been SeenStill Not About Tariffs – Zone For A Bottom – Not A Decline To Do Nothing

Bulls Need Less Momentum As Stocks Correct Lower

Please see HC's full disclosure here.