Still Not About Tariffs – Zone For A Bottom – Not A Decline To Do Nothing

Stocks continue to correct on a compressed path to what I have been discussing. In hindsight, obviously, we know that this is the 10%+ decline over 7-9 weeks I forecast was coming in Q2 or Q3 and not the mid-single decline I saw for Q1. Nonetheless, it doesn’t change anything in my view nor forecast. If you are keeping score at home, the Nasdaq 100 is down 12% since its last high on February 19th while the S&P 500 has lost the “magical” 10%. It’s harder to quote the other indices because peaked much earlier.

The S&P 500 is below. You can easily see the straight down move from the February 19th all-time high. I continue to attribute the decline to an old fashioned growth scare that came from Wal-Mart’s earnings report and comments about the consumer. It’s certainly not about tariffs. Those professionals blaming tariffs are flat out lazy. Companies now have something to hide behind where their stocks won’t be unduly punished. It is no different than when companies hid behind the elections or strong dollar. They remove idiosyncratic challenges and markets give them a pass.

Yesterday’s decline “felt” like people were finally showing some panic, even though price was just back to Tuesday’s low.

(Click on image to enlarge)

The Nasdaq 100 is below with very similar behavior to the S&P 500, just larger magnitude.

(Click on image to enlarge)

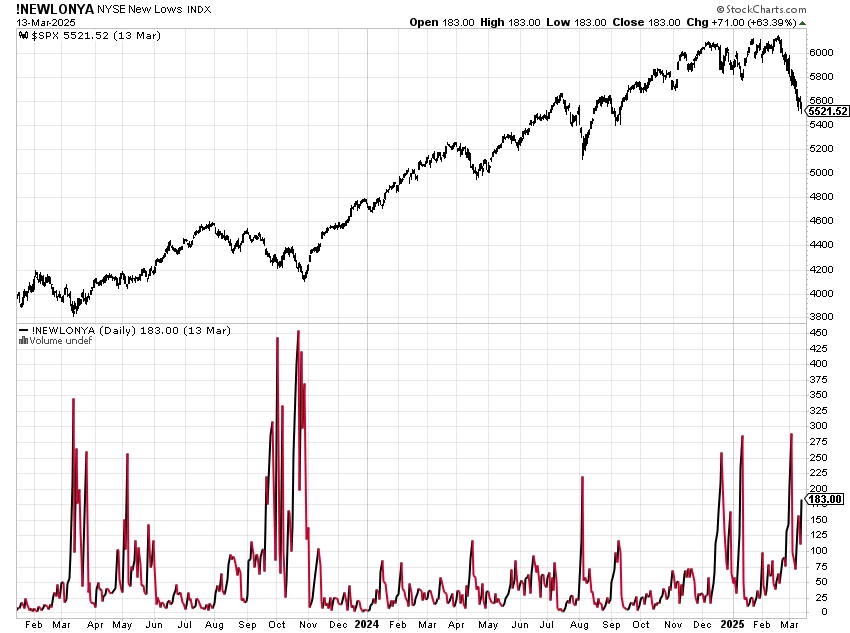

Next, take a look at new 52 week low on the NYSE. There are less this time down which means downside momentum is waning a bit.

(Click on image to enlarge)

What’s the bottom line?

The markets have now entered the zone for a bottom although I do not sense the final low is in. Rather, there should be a series of rallies and declines with the latter being on less downside momentum. Could we see a rally and decline without going much lower for the final low? Sure. We could also see a bounce and then move a few percent low than where the markets closed yesterday. Volatility is going to remain elevated.

This is not a decline to do nothing. In other words, there are plenty of trading, investing and financial planning opportunities which I have offered in several emails over the past week. Finally, as is often the case during corrections, I absolutely do not believe this a repeat of the Dotcom Bubble bursting, 2008 or COVID Crash. 10% corrections occur every 1.5 years and the last one came in 2023. Markets were due. When people ask if the market will “ever” recover, I know the damage has been done and the zone for a low is here.

On Monday we sold GDX, GDXJ, some IWF and some HYG. On Tuesday we bought more NFLX and more GOOG. We sold some BMY. On Wednesday we bought CWB, SDS and more QLD. On Thursday we sold SDS, DFRPX, EIFAX, LBDNX, AHTFX, CHZYX, QLD, IWD, FDN, some HYG and some MQQQ.

More By This Author:

Bulls Need Less Momentum As Stocks Correct LowerTariffs, DOGE And The REAL Reason Why The Markets Are Cranky

Bulls Step Up – An Opportunity Worth Playing

Please see HC's full disclosure here.