Eliminating One Scenario

Image Source: Pexels

Since the whole idea of tariffs and trade wars became reality this year, I have said that we will know when the market has fully priced it all in. That day comes when Donald Trump announces some new and large tariffs, but the stock market rallies. That will tell us that the market has moved on to other worries. That day is not today.

Stocks saw sharp losses on Friday that were reversed after President Trump waffled again on the breadth and scope of tariffs. Frankly, the market would have been better off had it just sold off into the weekend and then tried righting itself early this week. As I mentioned last week, when I watch our models get whipsawed around day to day, it can be frustrating. But that’s the hand we are dealt, not the one we want to play. We stick to the process and forge ahead.

I often tell folks that when I think we have an edge, we attack and play that every single time. Over the long-term that has been a rewarding strategy. When I think there is no edge, we usually stand pat with our allocations and positions. When I think we have a negative edge, we usually reduce exposure, hedge or sell. This month the edge discussion has changed almost day to day.

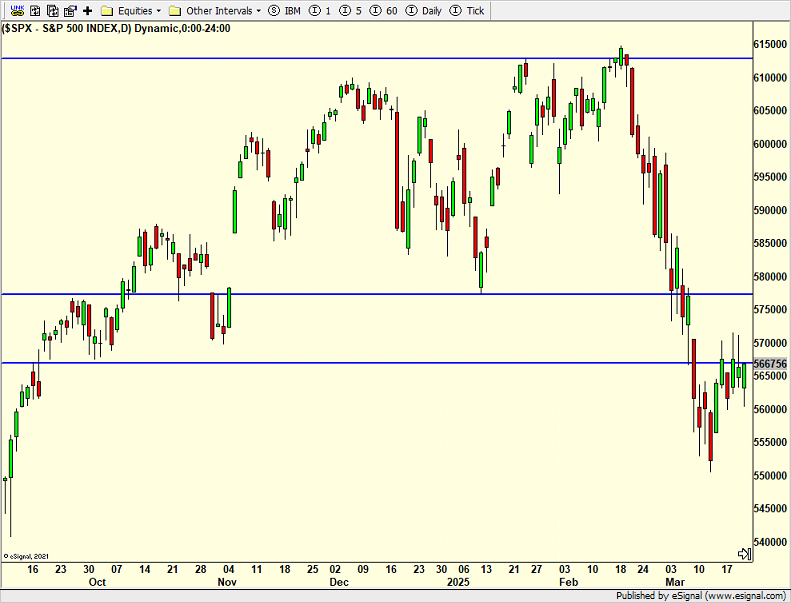

Regarding the three scenarios I offered last week, they still stand. The most likely before today is that stocks need one more decline of 2-4% before bottoming in April and climbing to new highs in Q3. Second is that the bottom is in and the rally has begin. However, stocks only recover to roughly 6000 on the S&P 500 before rolling over for a larger decline. Finally, the least likely scenario is that the bounce ends soon and stocks fall much further in Q2.

Given pre-market strength, we will have to assess scenarios one and two later this week. It should be difficult for the S&P 500 to easily regain and surmount 5800 on the first trip back up. I want to see what leads and lags as well as if the rally broadens out and includes the majority of issues.

(Click on image to enlarge)

On Friday we bought TLT, UWM, more QLD and more MQQQ. We sold QID.

More By This Author:

Three Scenarios For The Next Few MonthsPowell Behind The Curve Yet Again – Stocks To New Highs?

“A” Low Has Been Seen

Please see HC's full disclosure here.