ADP Private NFP Growth Upside Surprise

ADP private nonfarm surprises on the upside, 296 vs 148 thousand. Using the first differences regression in this post to nowcast BLS private NFP, what does the picture look like?

First, the data as we have it now, along with Bloomberg consensus levels.

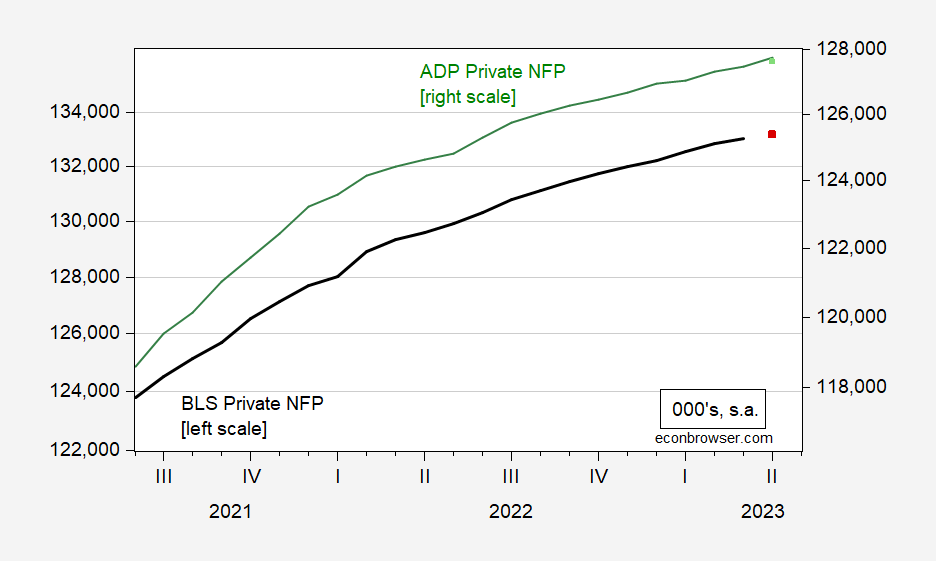

Figure 1: BLS private nonfarm payroll employment (black. left log scale), Bloomberg consensus of 5/3 (red square, left log scale), ADP private NFP (green, right log scale), and Bloomberg consensus of 5/3 (green square, right log scale), all in 000’s, s.a. Source: BLS and ADP via FRED, Bloomberg, and author’s calculations.

And here is the forecast from the regression (updated to include March data for BLS series, April data for ADP; adj-R2 =0.66)

Figure 2: Log first difference of BLS private NFP (bold black), nowcast based on ADP data through April (light blue), +/- one standard error band (gray lines), Bloomberg consensus of 5/3 (red square). Source: BLS, ADP, Bloomberg and author’s calculations.

The point forecast is for 0.14% m/m growth, or 267.2 thousand increase vs. Bloomberg consensus of 160 thousand. Note that the above graph shows the +/- one standard error band; a +/- 2 standard error band (barely) encompasses the Bloomberg consensus.

Interestingly, CME Fed funds futures indicate slightly lower probability of raising rates today, but slightly higher at the June meeting (relative to yesterday’s futures contracts).

More By This Author:

Market On Debt Default RiskFed Funds Trajectory As Viewed By The Market

Business Cycle Indicators - Tuesday, May 2