Business Cycle Indicators - Tuesday, May 2

Monthly GDP from S&P Global Market Insights is up 0.3% in March (3.9% annualized), final sales up 6.3% (annualized). This follows on the heels of Thursday’s announcement that nominal personal income and nominal personal spending exceeded consensus by 0.1 ppts m/m. Here is a picture of the key series followed by NBER’s Business Cycle Dating Committee, augmented by monthly GDP (where the top two are real personal income excluding current transfers and nonfarm payroll employment).

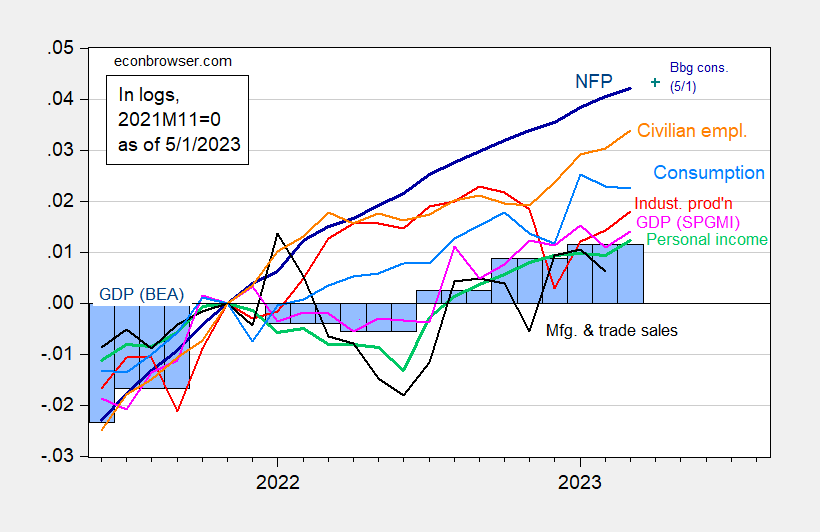

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 5/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Source: BLS, Federal Reserve, BEA 2023Q1 advance release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (5/1/2023 release), and author’s calculations.

Most series exhibit continued upward trends, asided from consumption. Employment growth as measured continue to lead the upward movement.

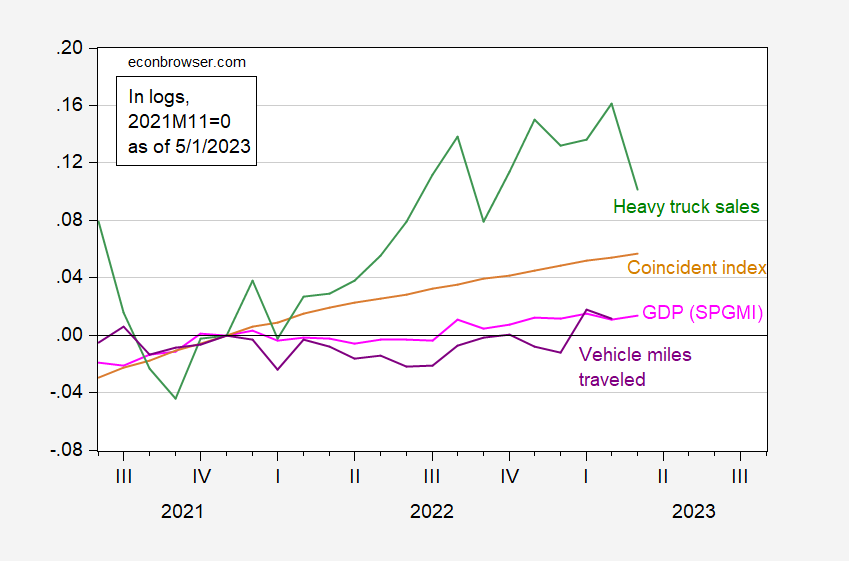

Some alternative measures have been suggested. In Figure 2, I show the Philadelphia Fed’s coincident index for the US, heavy truck sales and vehicle miles traveled, compared against monthly GDP.

Figure 2: Monthly GDP in Ch.2012$ (pink), coincident index (tan), heavy truck sales (green), and vehicle miles traveled (purple), all in logs, 2021M11=0. Source: S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (5/1/2023 release), Philadelphia Fed, Commerce, and NHTSA via FRED, and author’s calculations.

The coincident index, which largely reflects labor market measures, continues to rise faster than monthly GDP. Heavy truck sales, a particularly informative measure of business cycle movements, has outpaced the coincident index, but has dropped substantially in March. In contrast, vehicle miles traveled (a lousy coincident measure of recessions) continued to rise through February.

The foregoing suggests, in line with the advance estimate of GDP, that a recession has not yet arrived. (For more on GDP+ and final sales, see this post.)

More By This Author:

Unexpected Compression

The Godot Recession

Best Guess On The Recession Start Date