The Godot Recession

Everybody’s waiting for it, but it’s still not here yet.

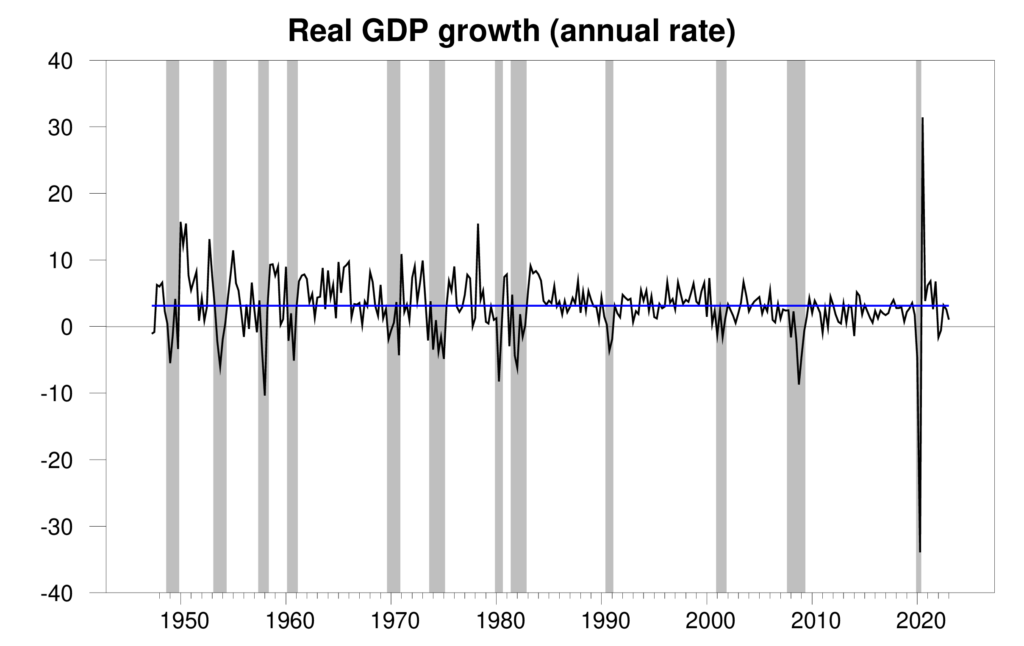

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.1% annual rate in the first quarter. The previous two quarters had been close to the historical average. Today’s numbers are much weaker.

Real GDP growth at an annual rate, 1947:Q2-2023:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

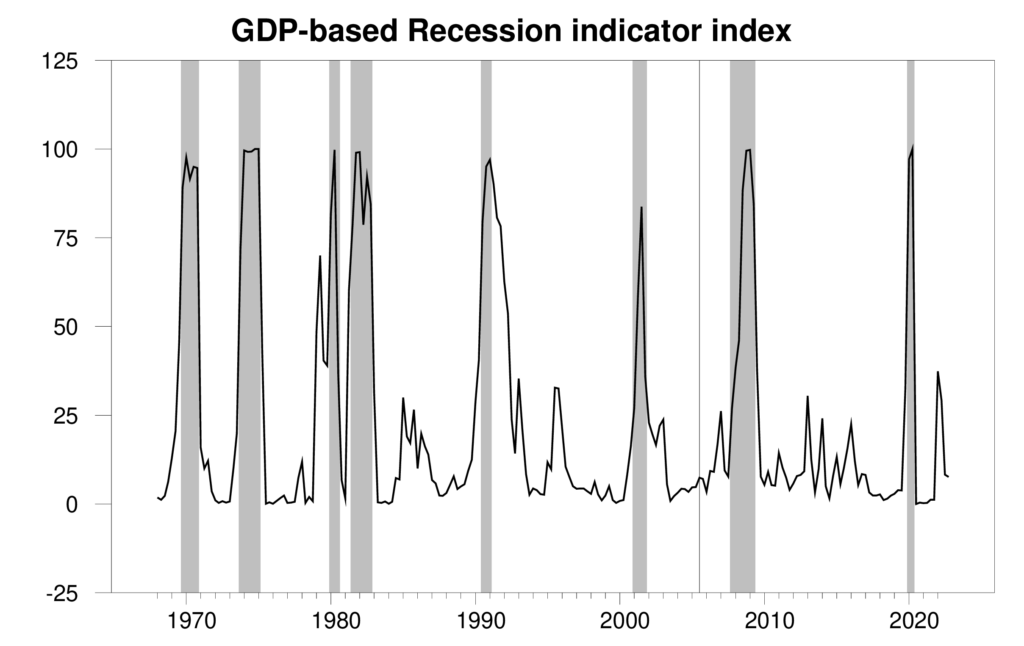

The new data put the Econbrowser recession indicator index at 7.6%, about where it had been three months ago, and well below the level that would signal that a new recession had started. Those who have been declaring for a year that a recession has already arrived will have to wait a little longer.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

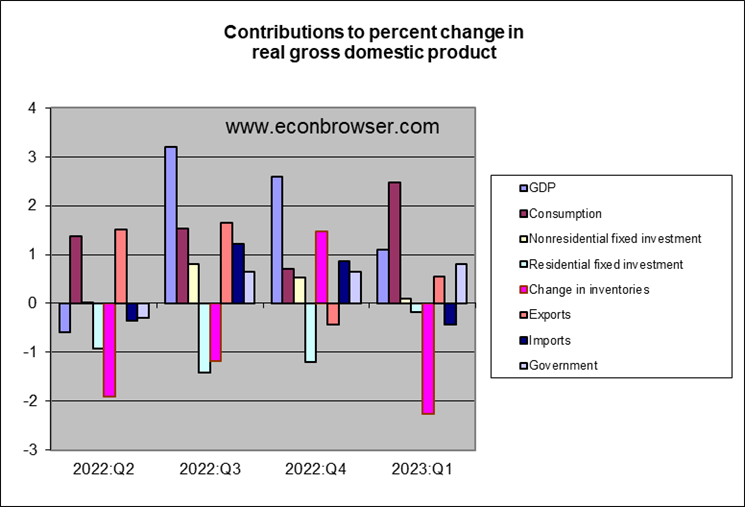

The Fed has been pushing the lever that it controls (interest rates) in the direction of trying to slow GDP growth. This shows up first in residential fixed investment, which fell in each of the last four quarters.

But by far the biggest drag on first-quarter GDP came from running down inventories. Inventory investment is one of the most volatile components of GDP and is subject to big data revisions. So this is unlikely to be the main factor holding GDP growth back in the coming quarters. But the effect of high interest rates on new home purchases and spillover from banking concerns to credit availability for small businesses will continue to be significant headwinds.

More By This Author:

Best Guess On The Recession Start DateDollar Value And The NIIP

Assessing The Cross-Taiwan-Straits Military Balance