19 Opportunities In Electronic Technology, The Future Of Everything

I feel compelled to reiterate the purpose of this series of articles. Although I am attempting to identify attractively valued stocks in each sector presented by FactSet Research Systems Inc., I am not simultaneously recommending them as attractive or proper investment choices. Therefore, just because I am featuring them in the article, it doesn’t necessarily follow that I think they are good choices. Instead, I leave it up to the reader to evaluate each selection and then decide if these research candidates are worthy of their further scrutiny or not. Moreover, my primary objective is to illustrate how different individual companies are from each other, and even how different companies operating in the same sector can be. It is a market of stocks, not a stock market.

Although some may feel that this is a superfluous undertaking, I must respectfully disagree. I am only a couple years short of 5 decades in this industry, and one of my biggest frustrations is constantly seeing how people tend to overgeneralize about the stock market. To put this into context, one of the most common questions I am frequently asked is “what do you think the stock market’s going to do?”This question frustrates me because it’s not something that matters to me. Instead, what matters to me is what I believe the businesses I am invested in can generate on an operating basis, and whether the market is valuing those fundamentals correctly or not. As I once stated in the article, “I believe in minding my own businesses.”

With that said, the Electronic Technology Sector presented by FactSet Research Systems Inc. is comprised of some of the most interesting companies in the US and Canadian stock research universe. Furthermore, as I will be elaborating on later, it is also a sector comprised of very interesting and diverse subsectors. From Broadcom (semiconductors) to Apple Inc. (smartphones) to General Dynamics (aerospace and defense), some of the most interesting and prominent names in technology are found in this sector.

Furthermore, the Electronic Technology Sector also contains constituents that would be considered pure growth as well as many intriguing dividend growth stocks. Additionally, you will find growth stocks that are now morphing into dividend growth stocks. Furthermore, this particular sector and its subsectors offer many important and vivid examples of the importance of valuation, a subject near and dear to my heart.

A Sector By Sector Review

This is part 7 of a series where I have conducted a simple screening looking for value over the overall market based on industry classifications and subindustry classifications reported by FactSet Research Systems, Inc. In part 1 found here, I covered the Consumer Services Sector. In part 2 found here, I covered the Communication Sector. In part 3 found here, I covered the Consumer Durables Sector and its many diverse subsectors. In part 4 found here, I covered Consumer Nondurables. In part 5 found here, I covered companies in the Consumer Services Sector. In part 6 found here, I covered the Distribution Services Sector.

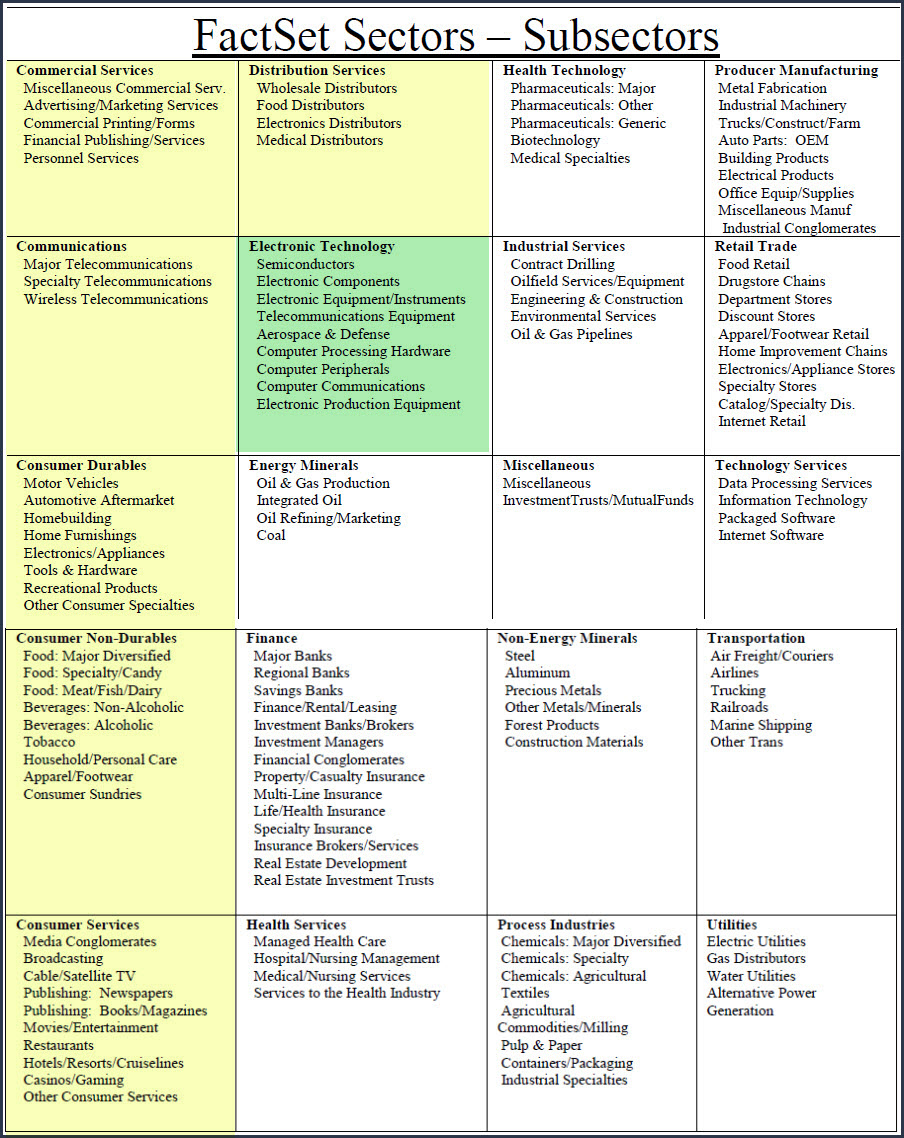

In each article in this series, I will be providing a listing of screened research candidates from each of the following industry sectors, the sector I’m covering in this article is marked in green:

(Click on image to enlarge)

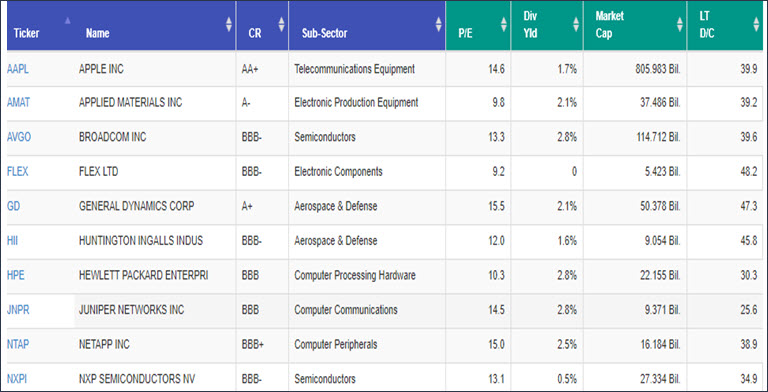

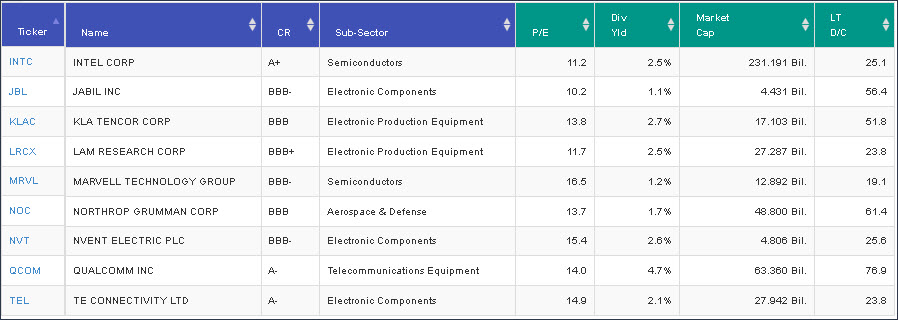

A Simple Valuation and Quality Screening Process

With this series of articles, I will be presenting a screening of companies that have become attractively valued primarily as a result of the bearish market activities experienced in 2018 from each of the above sectors. I will be applying a rather simple valuation and quality-oriented screen across each of the sectors. First, I have screened for investment-grade S&P credit ratings of BBB- or above. Next, I have screened for low valuations based on P/E ratios between 2 and 17. Finally, I have screened for long-term debt to capital no greater than 70%.

By keeping my screen simple, and at the same time rather broad, I will be able to identify attractively valued research candidates that I might have overlooked through a more rigorous screening process. In other words, I’m looking for fresh ideas that I might have previously been overlooking. Furthermore, I want to be clear that I do not consider every candidate that I have discovered as suitable for every investor. However, I do consider them all to be attractively valued. Additionally, I also believe that every investor will be able to find companies to research that meet their own goals, objectives and risk tolerances as this series unfolds.

Sector 7:Electronic Technology

Semiconductors

Electronic Components

Electronic Equipment/Instruments

Telecommunications Equipment

Aerospace & Defense

Computer Processing Hardware

Computer Peripherals

Computer Communications

Electronic Production Equipment

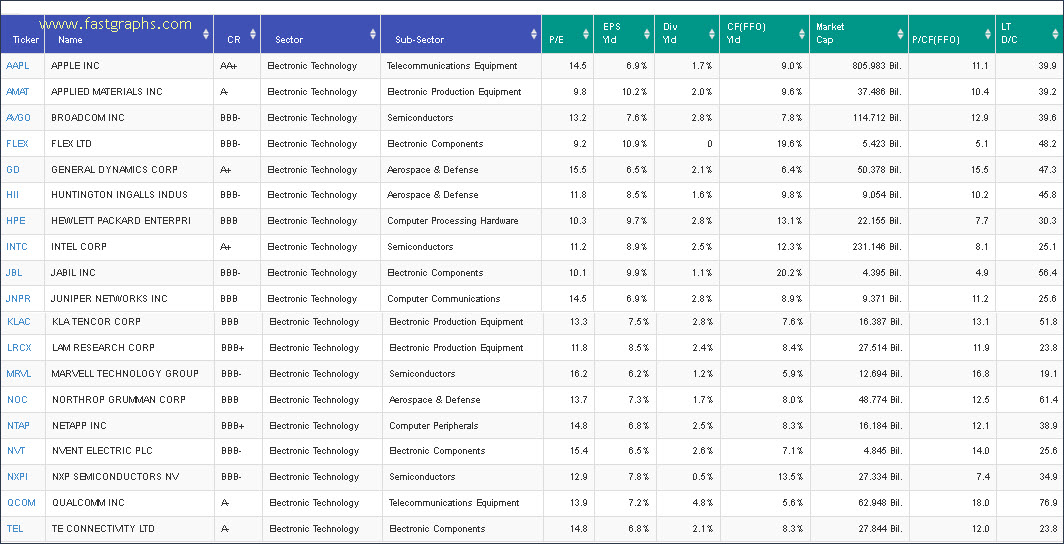

Portfolio Review: Electronic Technology Sector: 19 Research Candidates

(Click on image to enlarge)

FAST Graphs Screenshots of the 19 Research Candidates

The following screenshots provide a quick look at each of the 19 candidates screened out of over 19,000 possibilities. However, there are only 668 companies categorized as Electronic Technology, and these 19 were the only ones I was comfortable presenting in this article. The company descriptions are provided courtesy of the Wall Street Journal. In the FAST Graphs analyze out loud video that follows the screenshots, I will provide additional details and thoughts on the possible attractiveness as well as the potential negatives of my 10 favorite research candidates in this sector.

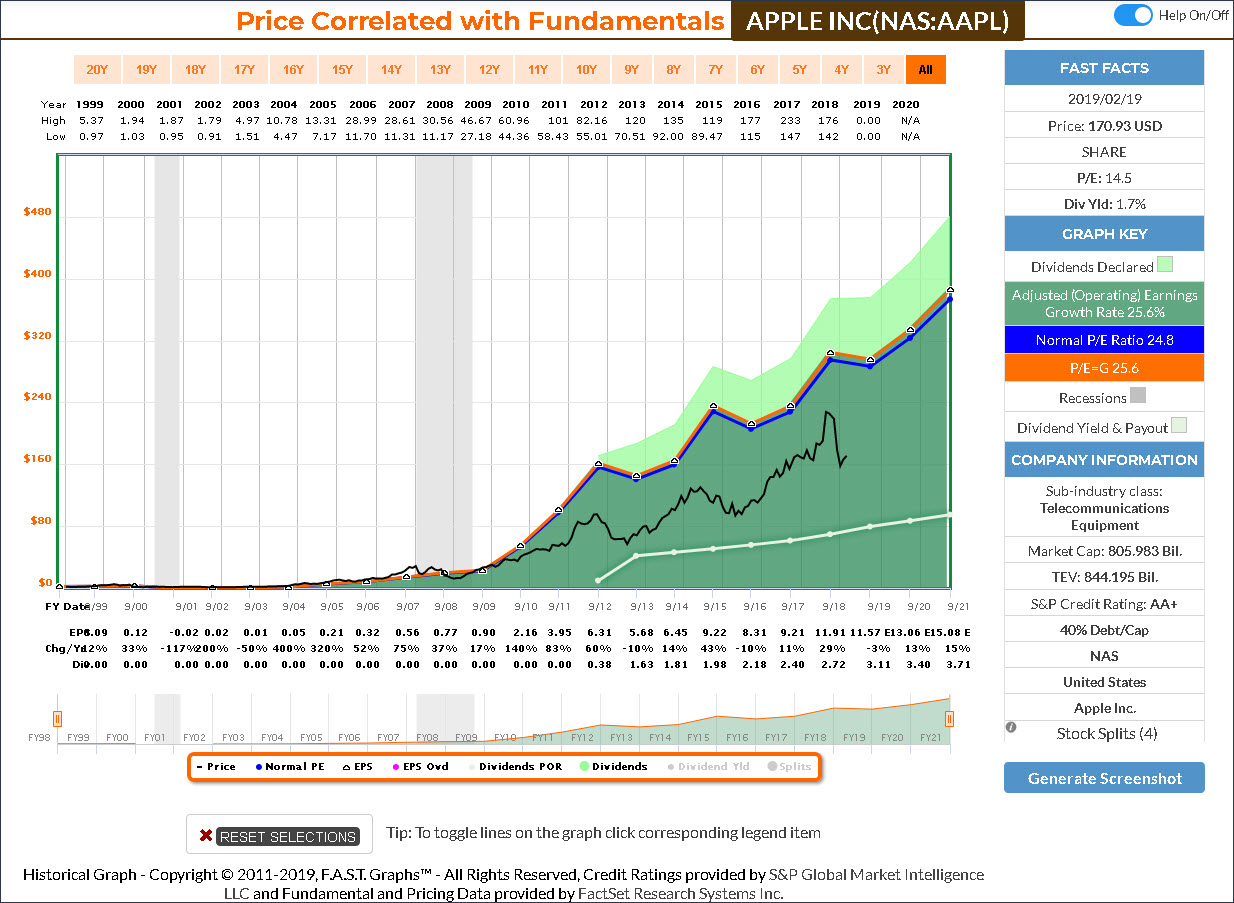

Apple Inc (AAPL)

Apple, Inc. engages in the design, manufacture, and marketing of mobile communication, media devices, personal computers, and portable digital music players. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific.

The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises of China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries.

The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak on April 1, 1976, and is headquartered in Cupertino, CA.

(Click on image to enlarge)

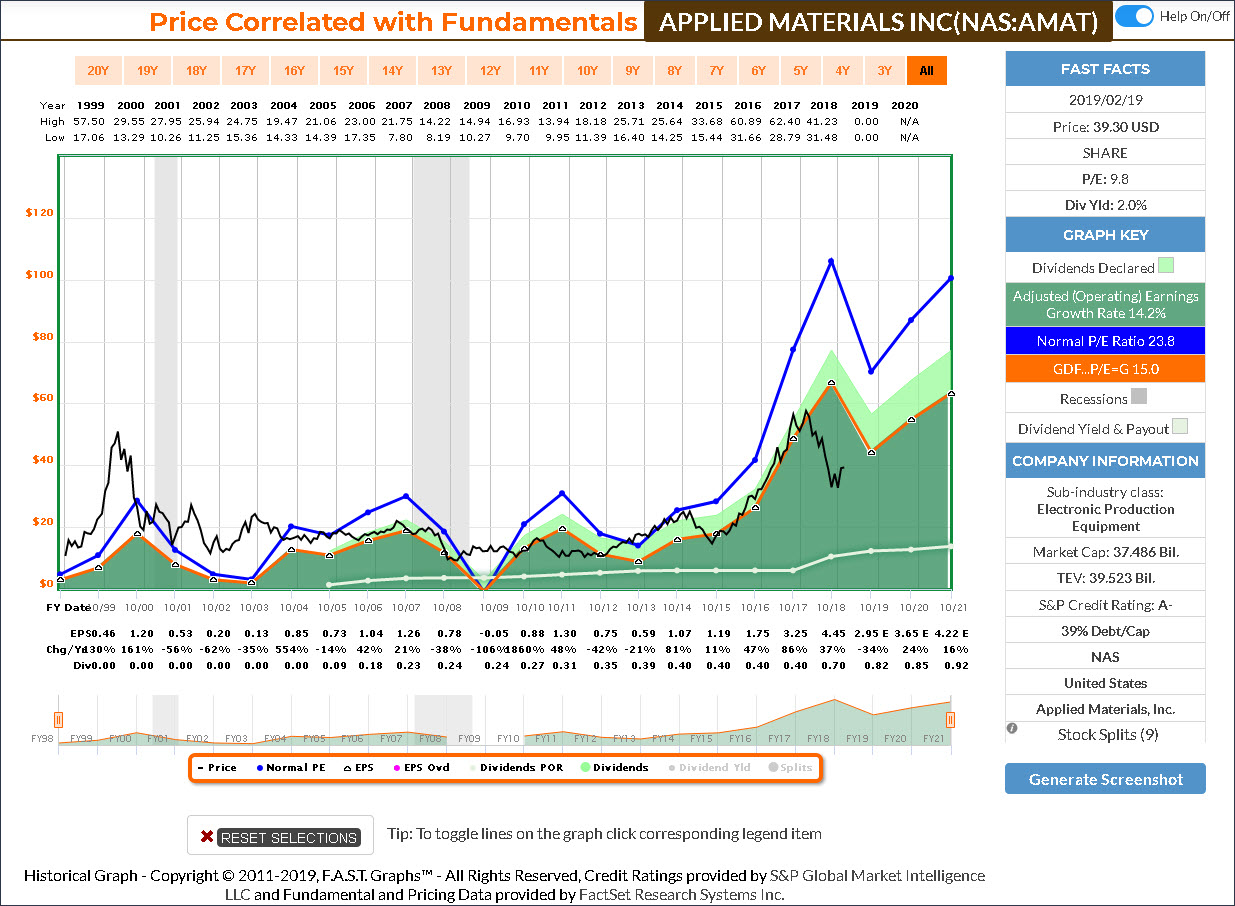

Applied Materials Inc (AMAT)

Applied Materials, Inc. engages in the provision of materials engineering solutions used to produce new chip and advanced display. It operates through the following segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets.

The Semiconductor Systems segment includes semiconductor capital equipment for deposition, etch, ion implantation, rapid thermal processing, chemical mechanical planarization, metrology and inspection, and wafer level packaging.

The Applied Global Services segment provides solutions to optimize equipment, performance, and productivity.

The Display and Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes; coating systems and display technologies for television; personal computers, tablets, smart phones, and consumer-oriented devices.

The company was founded on November 10, 1967, and is headquartered in Santa Clara, CA.

(Click on image to enlarge)

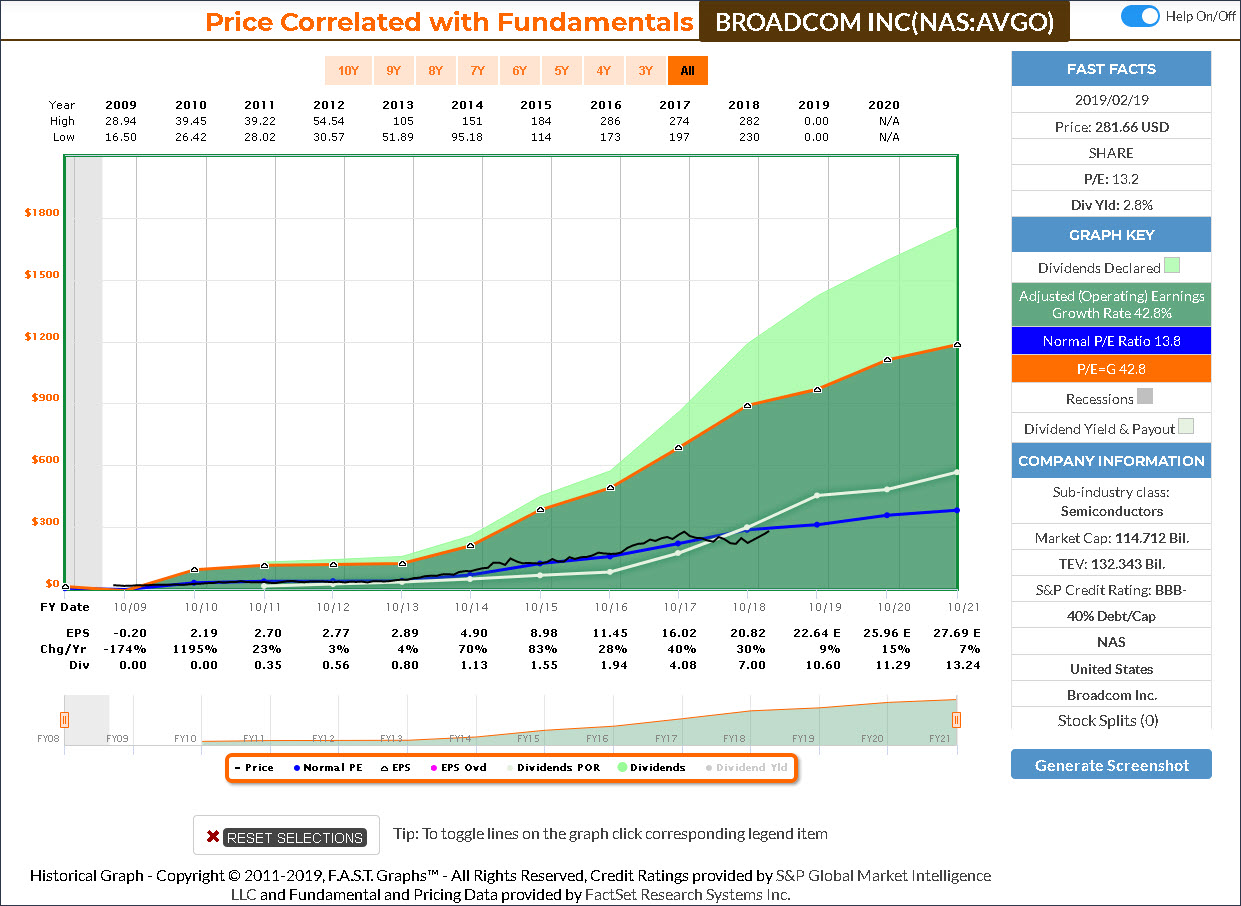

Broadcom Inc (AVGO)

Broadcom, Inc., is a holding company, which engages in the design, development and supply of analog and digital semiconductor connectivity solutions. It serves four primary end markets: wired infrastructure, wireless communications, enterprise storage and industrial & other.

Its products include data center networking, home connectivity, broadband access, telecommunications equipment, smartphones and base stations, data center servers and storage, factory automation, power generation and alternative energy systems, and displays. In April, 2018, Broadcom redomiciled from Singapore to the United States.

The company was founded in 1961 and is headquartered in San Jose, CA.

(Click on image to enlarge)

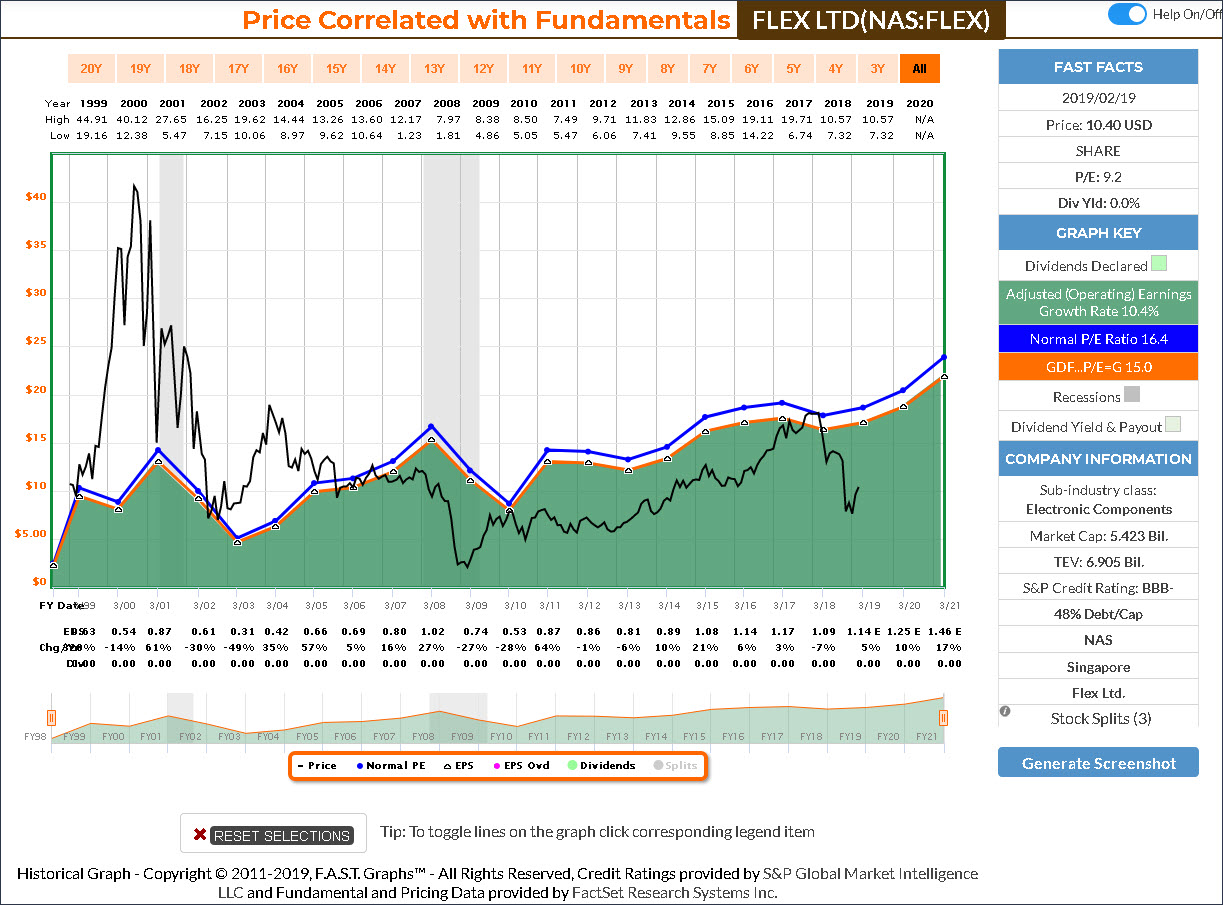

Flex LTD (FLEX)

Flex Ltd. provides innovative design, engineering, manufacturing, real-time supply chain insight and logistics services to companies of all sizes in various industries and end-markets. It operates through the following segments: Communications & Enterprise Compute, Consumer Technology Group, Industrial and Emerging Industries, and High Reliability Solutions.

The Communications & Enterprise Compute segment includes telecom business of radio access base stations, remote radio heads, and small cells for wireless infrastructure; networking business, which includes optical communications, routing, broadcasting, and switching products for the data and video networks; server and storage platforms for both enterprise and cloud-based deployments; next generation storage and security appliance products; and rack level solutions, converged infrastructure and software-defined product solutions.

The Consumer Technology Group segment includes consumer-related businesses in connected living, wearable, gaming, augmented and virtual reality, fashion and mobile devices; various supply chain solutions for notebook personal computers, tablets, and printers; and expanding business relationships to include supply chain optimization for non-electronics products such as footwear and clothing. The Industrial and Emerging Industries segment offers energy and metering, semiconductor tools and capital equipment, office solutions, household industrial and lifestyle, industrial automation and kiosks and lighting.

The High Reliability Solutions segment caters to medical business, including consumer health, digital health, disposables, precision plastics, drug delivery, diagnostics, life sciences and imaging equipment; automotive business, including vehicle electrification, connectivity, autonomous vehicles and clean technologies; and defense, and aerospace businesses, is focused on commercial aviation, defense and military.

The company was founded in May 1990, and is headquartered in Singapore.

(Click on image to enlarge)

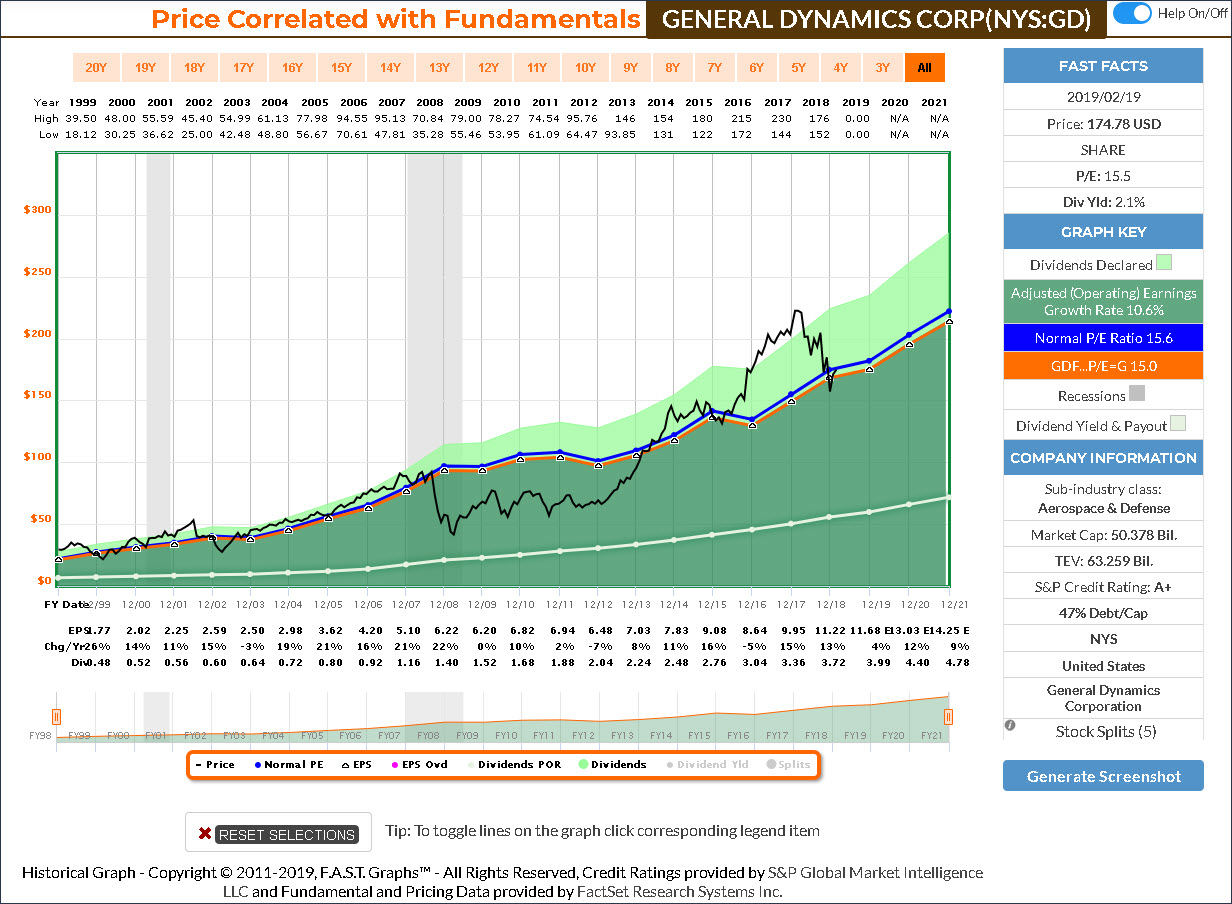

General Dynamics Corp (GD)

General Dynamics Corp. is an aerospace and defense company, which engages in the provision of tanks, rockets, missiles, submarines, warships, fighters and electronics to all of the military services. It is organized into four business segments: Aerospace, Combat Systems, Information Technology, Mission Systems and Marine Systems.

The Aerospace segment delivers a family of Gulfstream aircraft and provides a range of services for Gulfstream aircraft and aircraft produced by other original equipment manufacturers. The Combat Systems segment offers combat vehicles, weapons systems and munitions for the U.S. government and its allies around the world. The Information Technology segment provides technologies, products and services in support of thousands of programs for a wide range of military, federal civilian, state and local customers.

The Mission Systems segment provides mission-critical C4ISR products and systems. The Marine Systems segment designs, builds and supports submarines and surface ships.

The company was founded on February 21, 1952, and is headquartered in Falls Church, VA.

(Click on image to enlarge)

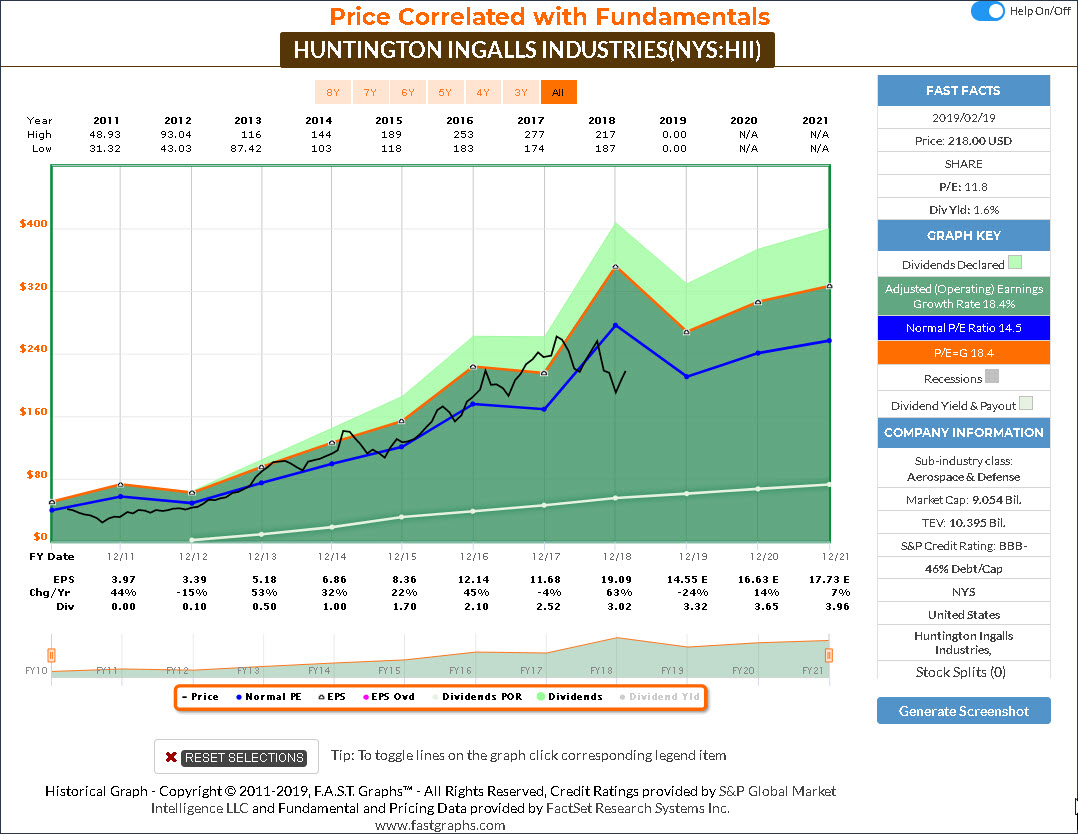

Huntington Ingalls (HII)

Huntington Ingalls Industries, Inc. engages in the shipbuilding business. It operates through the following segments: Ingalls, Newport News, and Technical Solutions. The Ingalls segment develops and constructs non-nuclear ships, assault ships, and surface combatants.

The Newport News segment designs, builds, and maintains nuclear-powered ships which include aircraft carriers and submarines. The Technical Solutions segment provides professional services, including fleet support, integrated missions solutions, nuclear and environmental, and oil and gas services.

The company was founded on August 4, 2010, and is headquartered in Newport News, VA.

(Click on image to enlarge)

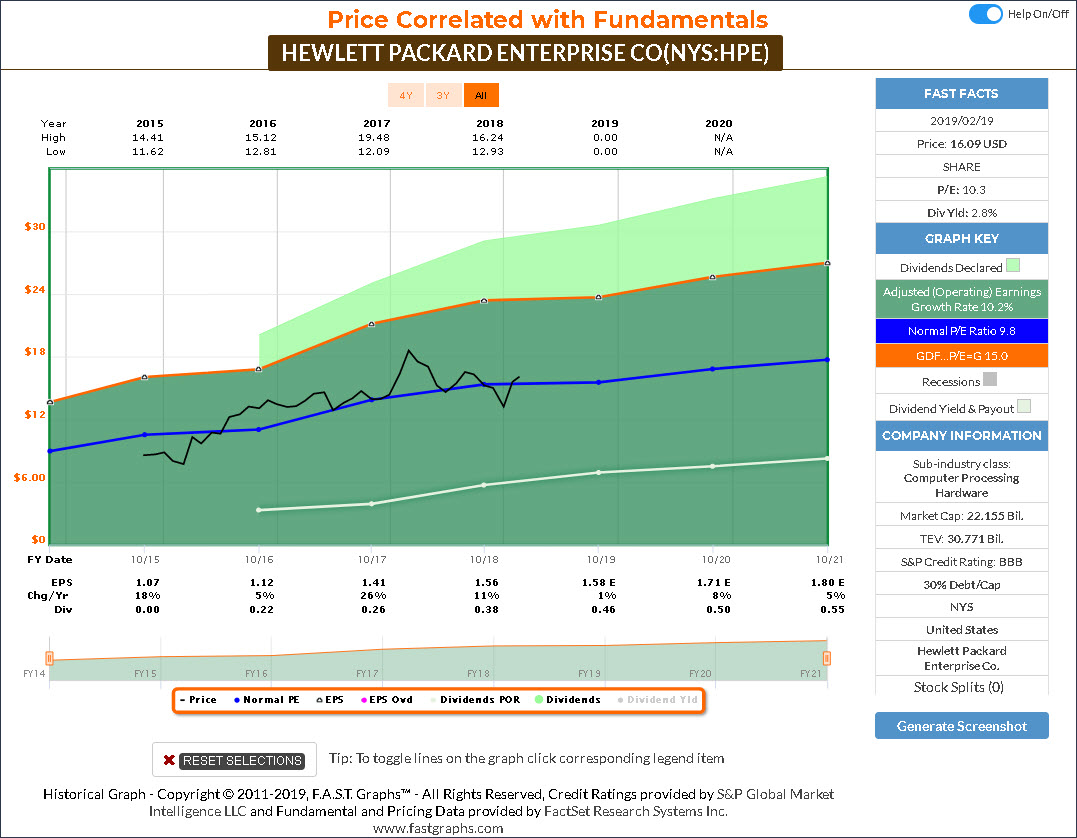

Hewlett Packard (HPE)

Hewlett Packard Enterprise Co. engages in the provision of information technology, technology and enterprise products, solutions, and services. It operates through the following segments: Hybrid IT, Intelligent Edge, Financial Services, and Corporate Investments. The Hybrid IT segment provides a broad portfolio of services-led and software-enabled infrastructure and solutions.

The Intelligent Edge segment comprises of enterprise networking and security solutions for businesses of any size, offering secure connectivity for campus and branch environments, operating under the Aruba brand. The Financial Services segment offers investment solutions, such as leasing, financing, information technology consumption, utility programs, and asset management services. The Corporate Investments segment includes Hewlett Packard Labs and certain business incubation projects.

The company was founded in 1939 and is headquartered in Palo Alto, CA.

(Click on image to enlarge)

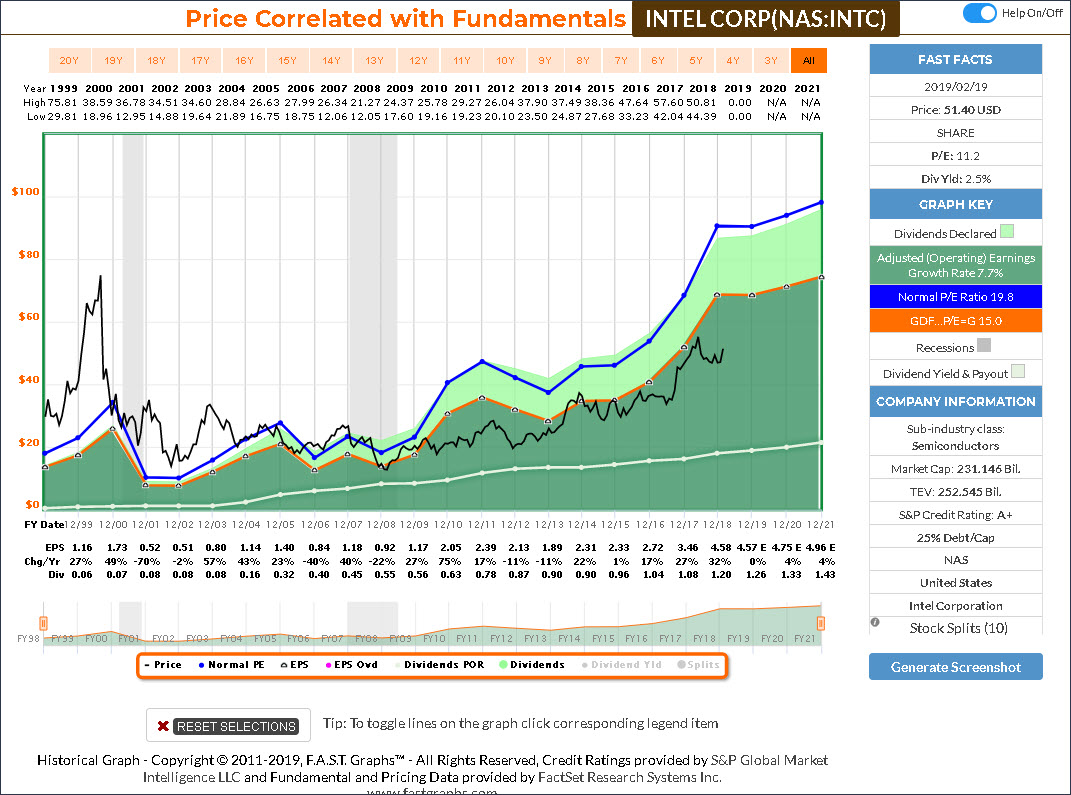

Intel Corp (INTC)

Intel Corp. engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage and communications platforms. It operates its business through the following segments: Client Computing Group, Data Center Group, Internet of Things Group, Non-Volatile Memory Solutions Group, Programmable Solutions and All Other. The Client Computing Group segment consists of platforms designed for notebooks, 2 in 1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components.

The Data Center Group segment includes workload-optimized platforms and related products designed for enterprise, cloud, and communication infrastructure market. The Internet of Things Group segment comprises of platforms such as retail, transportation, industrial, video, buildings and smart cities, along with a broad range of other market segments.

The Non-Volatile Memory Solutions Group segment constitutes of NAND flash memory products primarily used in solid-state drives. The Programmable Solutions Group segment contains programmable semiconductors and related products for a broad range of markets, including communications, data center, industrial, military, and automotive. The All Other segment consists of results from other non-reportable segment and corporate-related charges.

The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968, and is headquartered in Santa Clara, CA.

(Click on image to enlarge)

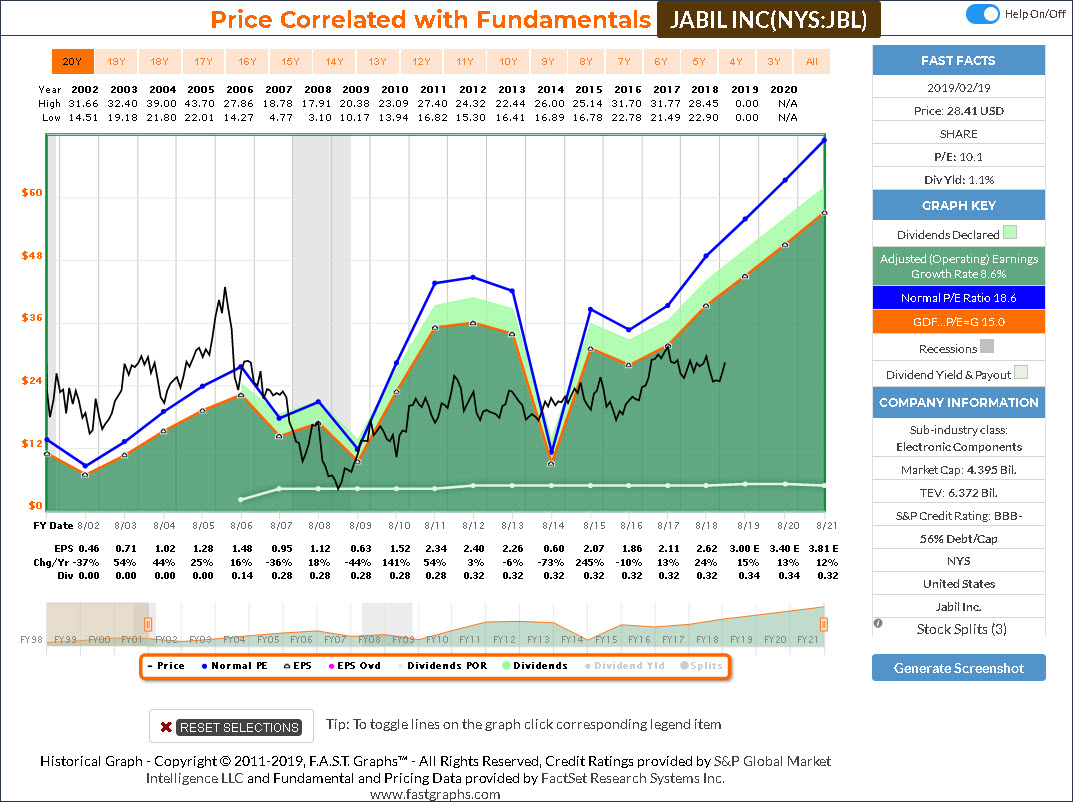

Jabil Inc (JBL)

Jabil, Inc. engages in the provision of electronic manufacturing services and solutions. It offers electronics design, production, product management, and repair services to companies in the automotive and transportation, capital equipment, consumer lifestyles and wearable technologies, computing and storage, defense and aerospace, digital home, healthcare, industrial and energy, mobility, networking and telecommunications, packaging, point of sale, and printing industries.

The firm operates through the Electronics Manufacturing Services and Diversified Manufacturing Services segments. The Electronics Manufacturing Services segment focuses around leveraging IT; supply chain design and engineering; and technologies largely centered on core electronics. The Diversified Manufacturing Services segment provides engineering solutions, with an emphasis on material sciences and technologies.

The company was founded by William E. Morean and James Golden in 1966 and is headquartered in St. Petersburg, FL.

(Click on image to enlarge)

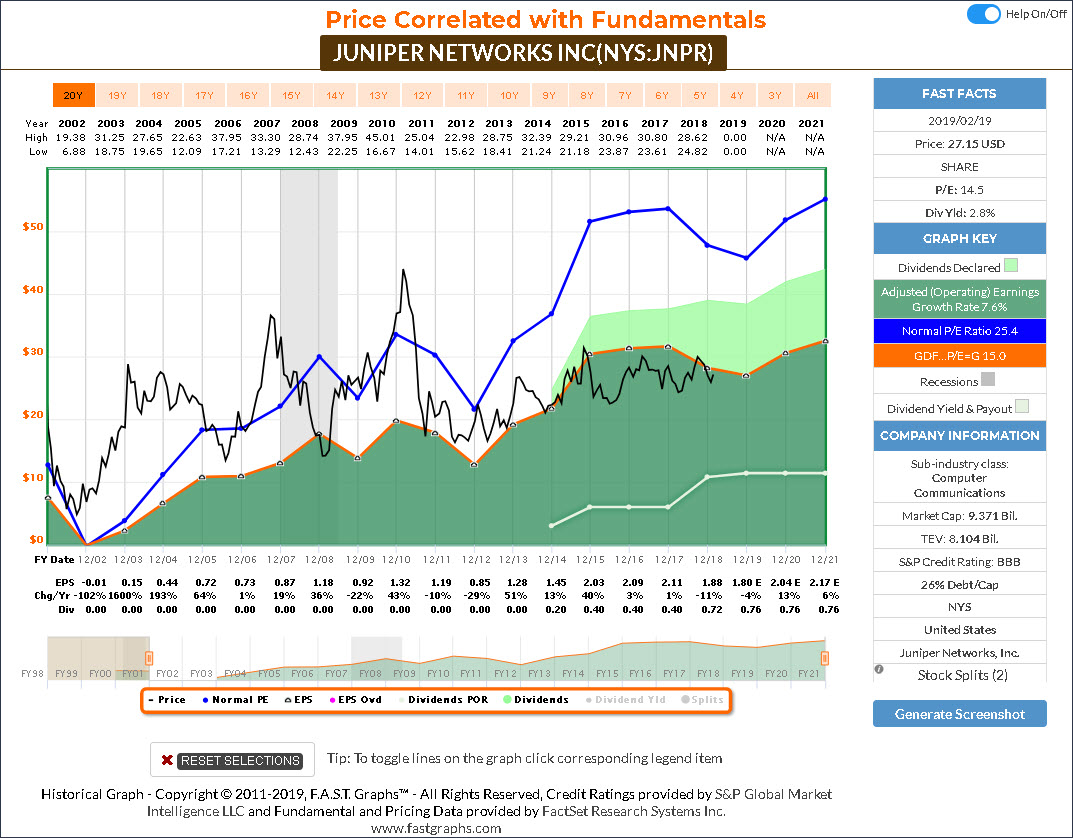

Juniper Networks Inc (JNPR)

Juniper Networks, Inc. engages in the design, development, and sale of products and services for high-performance networks. Its products address network requirements for global service provides, cloud providers, national governments, research and public sector organizations, and other enterprises.

The company was founded by Pradeep S. Sindhu on February 6, 1996, and is headquartered in Sunnyvale, CA.

(Click on image to enlarge)

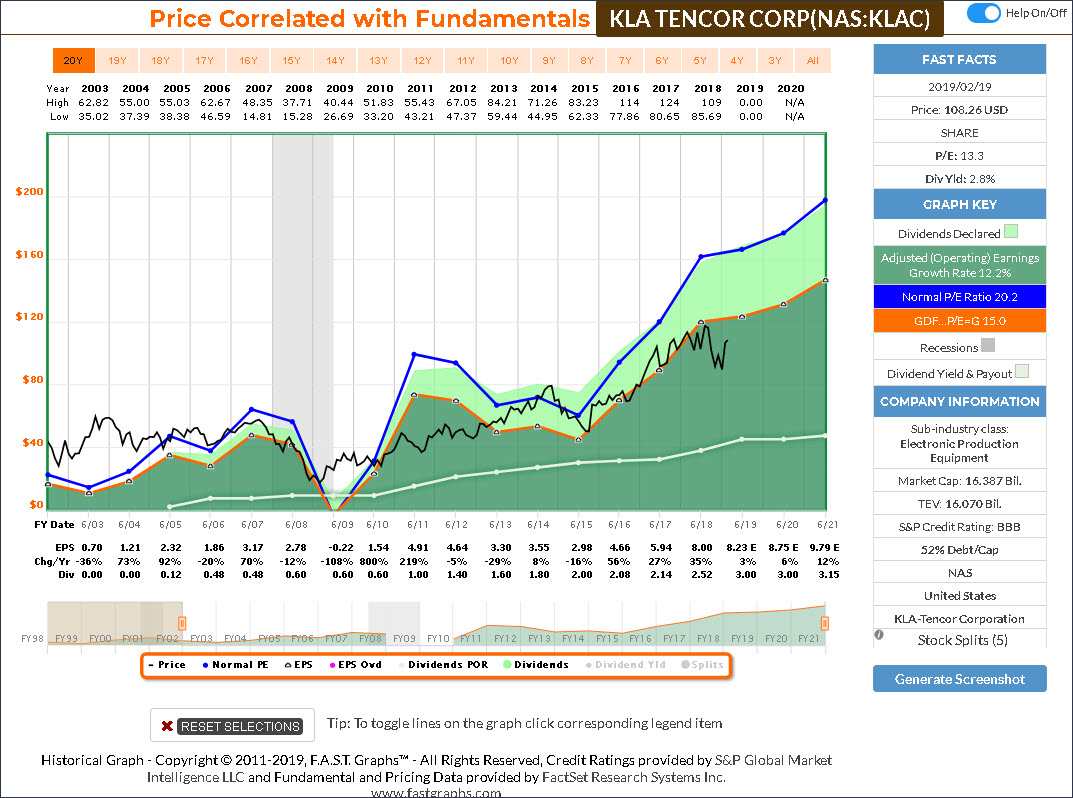

KLA Tencor Corp (KLAC)

KLA-Tencor Corp. engages in the supply of process control and yield management solutions for the semiconductor and related nano-electronics industries. Its products include manufactured chips, reticle, packaging, surface profilers, nanochemical testers, KT pro equipment, and compound semiconductors.

The company was founded in April 1997 and is headquartered in Milpitas, CA.

(Click on image to enlarge)

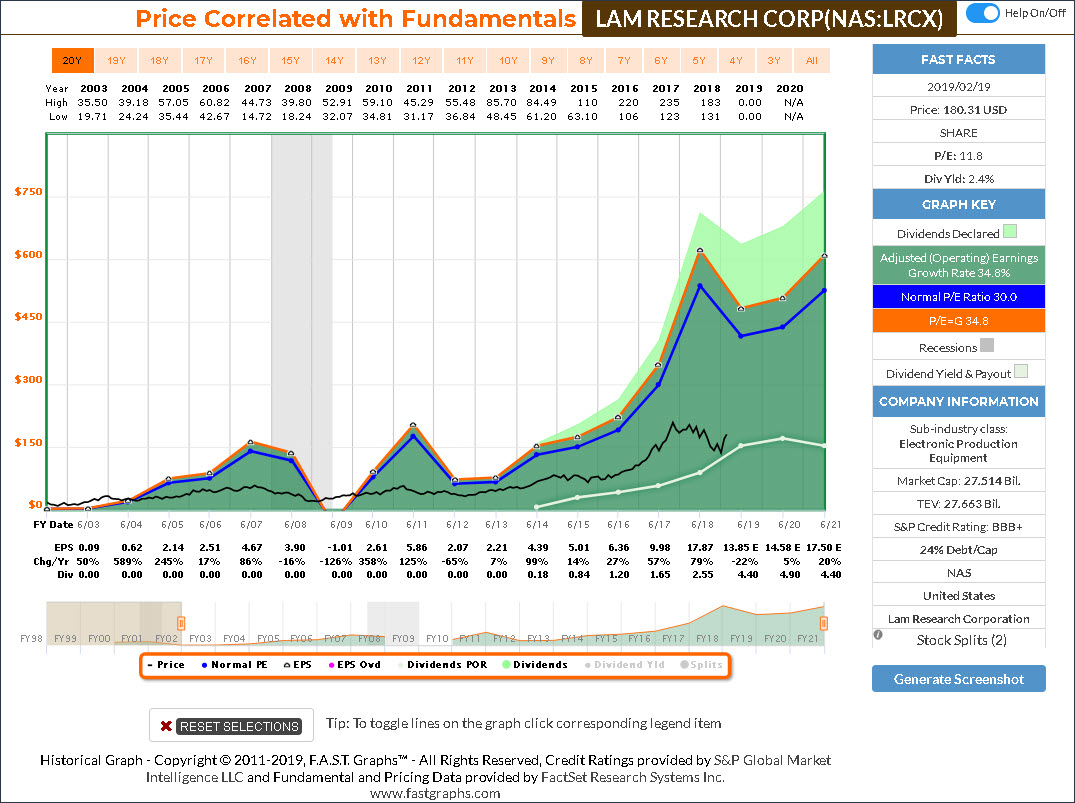

Lam Research Corp (LRCX)

Lam Research Corp. engages in manufacturing and servicing of wafer processing semiconductor manufacturing equipment. It operates through the following geographical segments: the United States, China, Europe, Japan, Korea, Southeast Asia, and Taiwan. It offers thin film deposition, plasma etch, photoresist strip, and wafer cleaning.

The company was founded by David Lam on January 21, 1980, and is headquartered in Fremont, CA.

(Click on image to enlarge)

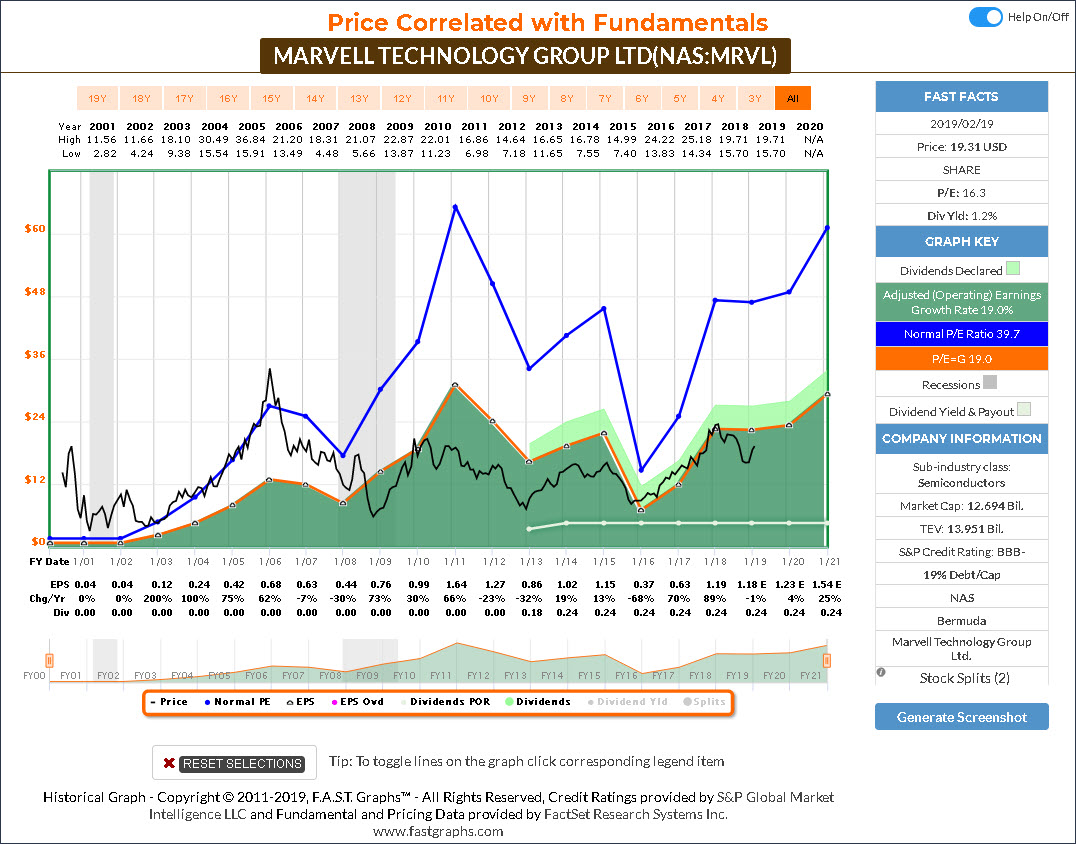

Marvell Technology Group (MRVL)

Marvell Technology Group Ltd. engages in the business of providing semiconductors to high-performance application-specific standard products. It focuses on the development of complex System-on-a-Chip devices leveraging extensive technology portfolio of intellectual property in the areas of analog, mixed-signal, digital signal processing, and embedded and stand alone integrated circuits.

The company’s product portfolio includes devices for data storage, enterprise-class Ethernet data switching, Ethernet physical-layer transceivers, mobile handsets, connectivity and other consumer electronics.

Marvell Technology Group was founded by Sehat Sutardja, Weili Dai, and Pantas Sutardja in January 1995 and is headquartered in Hamilton, Bermuda.

(Click on image to enlarge)

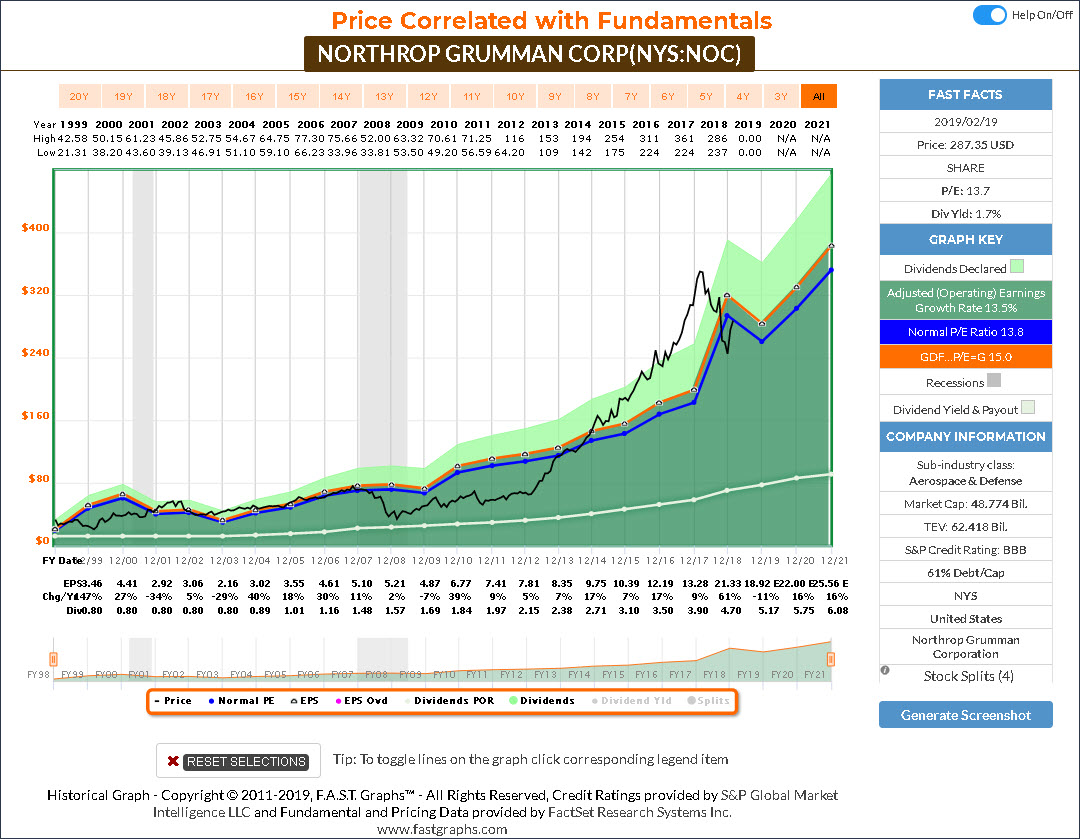

Northrop Grumman Corp (NOC)

Northrop Grumman Corp. engages in the provision of security businesses. It includes products, systems, and solutions in autonomous systems, cyber, command, control, communications and computers, intelligence, surveillance and reconnaissance, strike, and logistics and modernization. It operates through the following business segments: Aerospace Systems, Mission Systems, and Technology Services.

The Aerospace Systems segment includes the design, development, integration, and production of manned aircraft, autonomous systems, spacecraft, high-energy laser systems, microelectronics, and other systems and subsystems. The Mission Systems consists of sensors and processing; cyber and intelligence, surveillance and reconnaissance; and advanced capabilities. The Technology Services focuses on global logistics and modernization; advanced defense services; and system modernization and services.

The company was founded by John K. Northrop, Thomas V. Jones, and Kent Kresa in 1939 and is headquartered in Falls Church, VA.

(Click on image to enlarge)

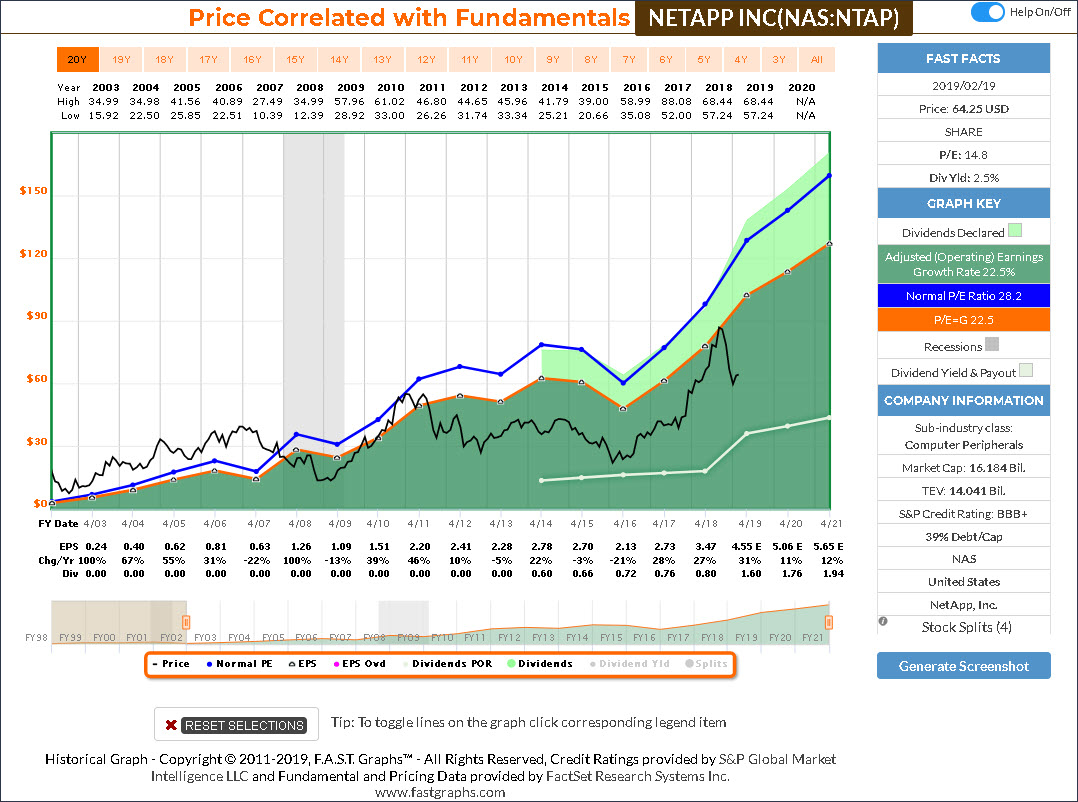

NetApp Inc (NTAP)

NetApp, Inc. engages in the design, manufacture, marketing, and technical support of storage and data management solutions. It offers cloud data services, data storage software, data backup and recovery, all-flash storage, converged systems, data infrastructure management, ONTAP data security, and hybrid flash storage.

The company was founded by David Hitz, James K. Lau and Michael Malcolm in April 1992 and is headquartered in Sunnyvale, CA.

(Click on image to enlarge)

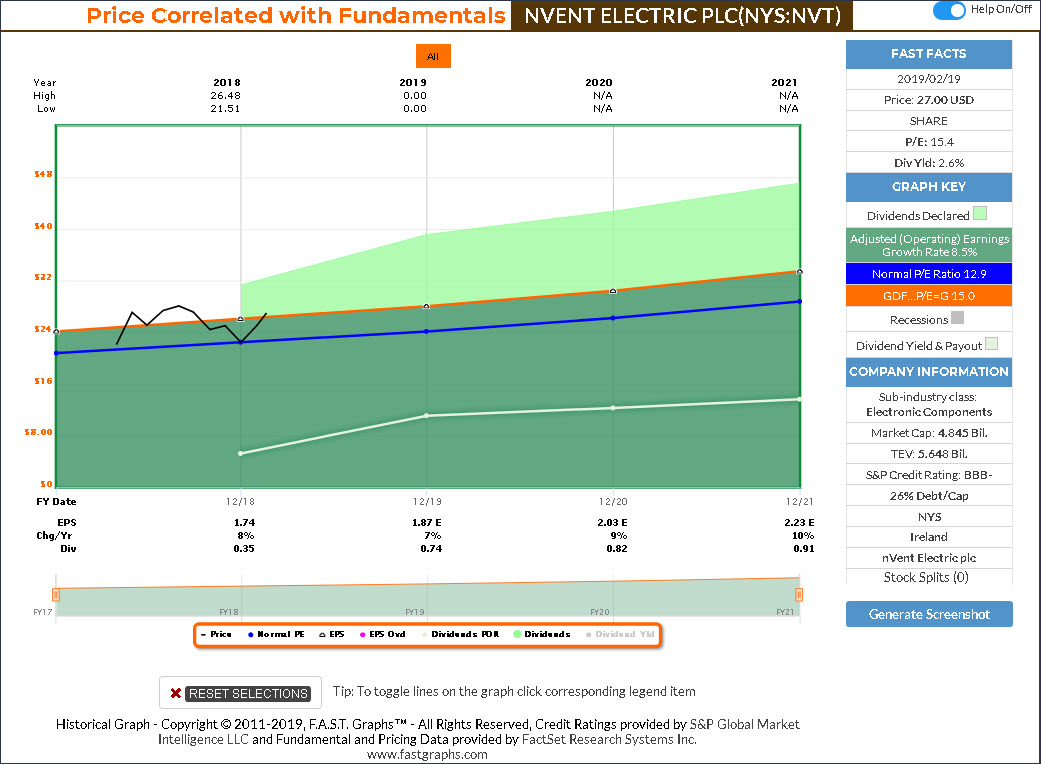

nVent Electric (NVT)

nVent Electric Plc engages in the provision of electrical connection and protection solutions. It operates through the following segments: Enclosures, Thermal Management, and Electrical & Fastening Solutions. The Enclosures segment offers solutions that protect, connect, and manage heat in critical electronics, communication, control, and power equipment.

The Thermal Management segment includes electric thermal solutions that connect and protect critical buildings, infrastructure, industrial processes, and people. The Electrical & Fastening Solution segment consists of fastening solutions that connect and protect electrical and mechanical systems and civil structures.

The company was founded on May 30, 2017, and is headquartered in London, the United Kingdom.

(Click on image to enlarge)

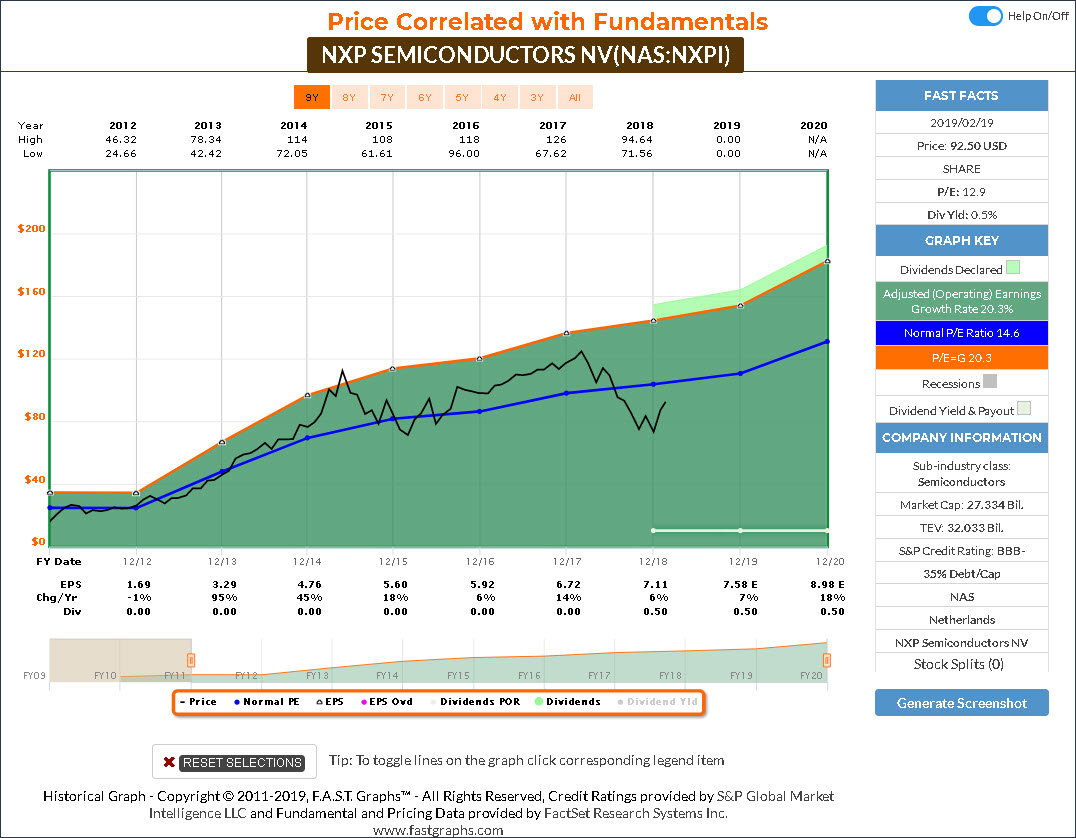

NXP Semiconductors (NXPI)

NXP Semiconductors NV is a holding company, which engages in the development, manufacture, and provision of mixed-signal semiconductor solutions. It operates through the following segments: High Performance Mixed Signal, Standard Products, and Corporate and Other.

The High Performance Mixed Signal segment designs and markets analog, power management, interface, security technologies, and digital processing systems. The Standard Products segment develops and supplies small signal and power discretes. The Corporate and Other segment manages and operates manufacturing facilities.

The company was founded on August 2, 2006, and is headquartered in Eindhovezn, the Netherlands.

(Click on image to enlarge)

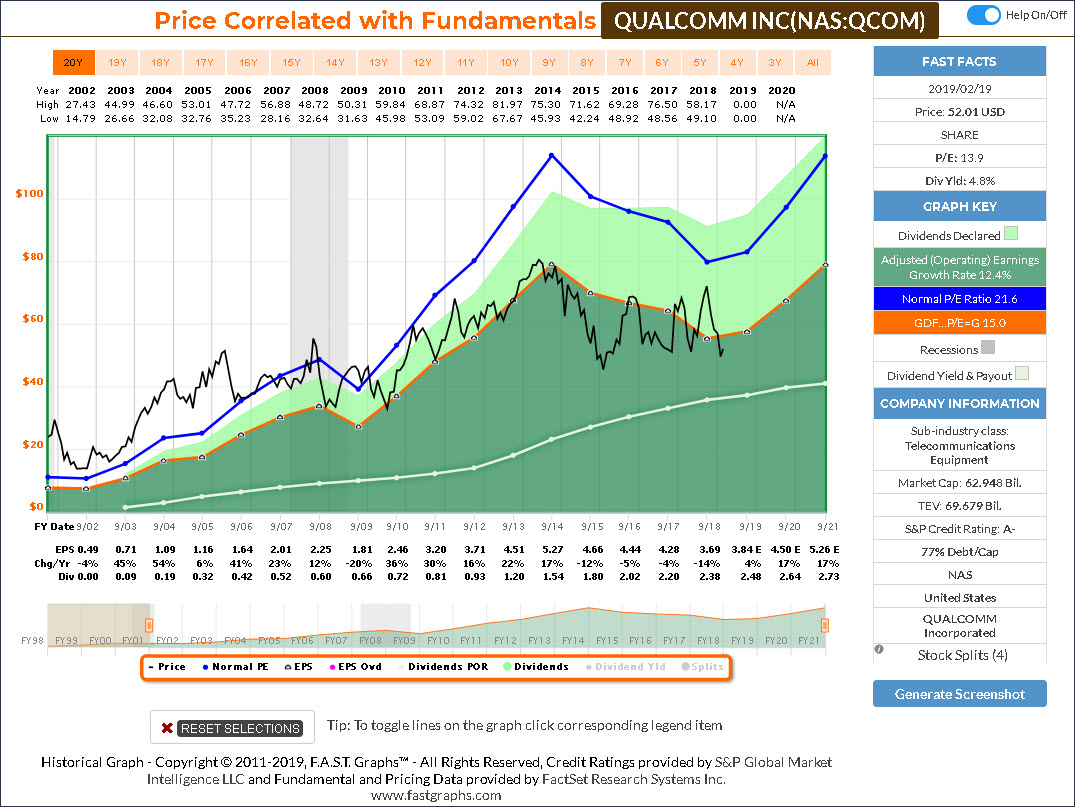

Qualcomm Inc (QCOM)

QUALCOMM, Inc. engages in the development, design, and provision of digital telecommunications products and services. It operates through the following segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on technologies for the use in voice and data communications, networking, application processing, multimedia, and global positioning system products.

The QTL segment grants licenses and provides rights to use portions of the firm’s intellectual property portfolio. The QSI segment focuses on opening new or expanding opportunities for its technologies and supporting the design and introduction of new products and services for voice and data communications.

The company was founded by Franklin P. Antonio, Adelia A. Coffman, Andrew Cohen, Klein Gilhousen, Irwin Mark Jacobs, Andrew J. Viterbi, and Harvey P. White in July 1985, and is headquartered in San Diego, CA.

(Click on image to enlarge)

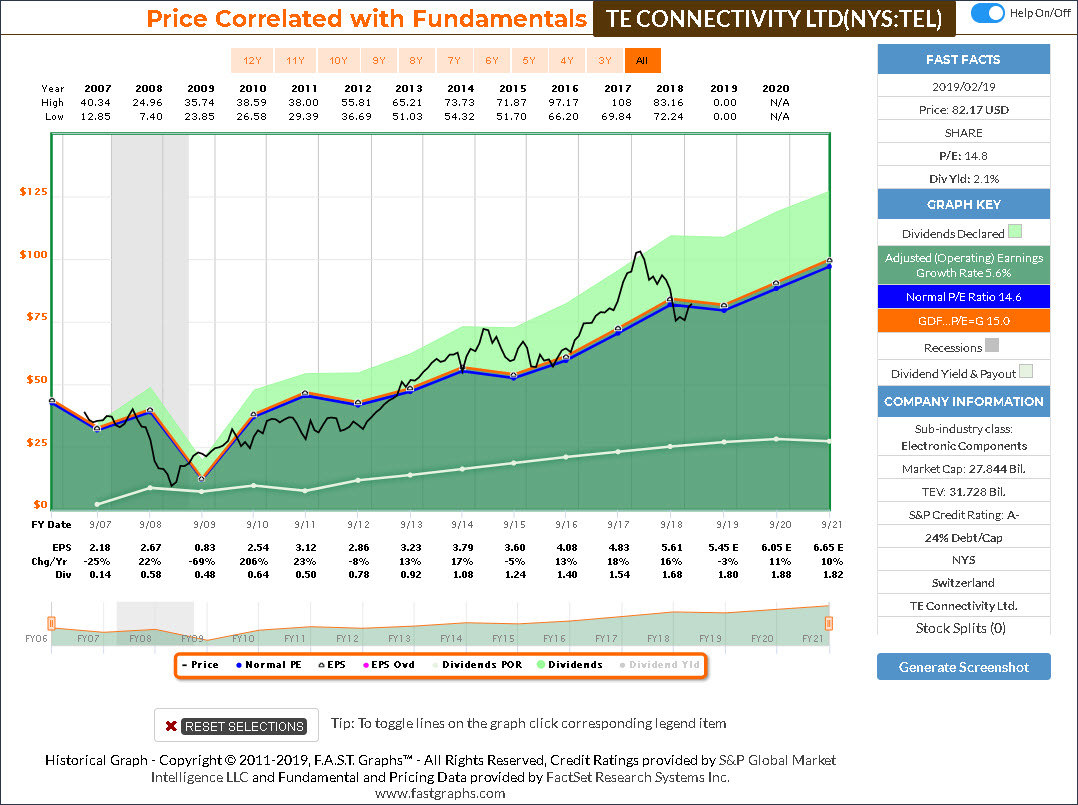

TE Connectivity (TEL)

TE Connectivity Ltd. engages in the design and manufacture of connectivity and sensors solutions. It operates through the following segments: Transportation, Industrial, and Communications Solutions. The Transportation Solutions segment offers products that are used in the automotive, commercial transportation, and sensors markets.

The Industrial Solutions segment provides products that connect and distribute power, data, and signal. The Communications Solutions segment supplies electronic components for the data and devices and appliances markets.

The company was founded in 2000 and is headquartered in Schaffhausen, Switzerland.

(Click on image to enlarge)

FAST Graphs Analyze Out Loud Video My 10 Favorite Attractively Valued Electronic Technology Research Candidates

(Click on image to enlarge)

Video length: 00:18:37

FAST Graphs Analyze Out Loud Video on the Other 9 Electronic Technology Research Candidates

(Click on image to enlarge)

Video length: 00:08:48

Summary and Conclusions

I think it’s very important that investors have a clear and learned perspective of what an investment in a given common stock might be capable of generating for them. To me, this has always been above and beyond simple statistics. Personally, I feel it’s important to have a long-term perspective and understanding of how the business has performed over time. Because, I believe this perspective -although not guaranteed – will provide an edge in determining what the business might be capable of going forward. In other words, is not just about P/E ratios or dividend yields, etc. The astute investor also wants to understand the nature of the business behind the stock.

In this article, I have presented 19 research candidates in the Electronic Technology Sector. Hopefully, readers have a better perspective of the nature of some of the more recognized and renowned companies such as Apple Inc. and General Dynamics. Additionally, I am hopeful that I have possibly introduced companies previously overlooked that investors might want to consider. But at the end of the day, I hope I illustrated that it is clearly a market of stocks and not a stock market. Just like people, every individual company possesses its own unique qualities, attributes and flaws regardless of the sector they operate in.

Disclosure: Long AAPL, AVGO, GD, INTC, JBL, QCOM.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a ...

more