Is There Real Value In These 7 Distribution Services Companies?

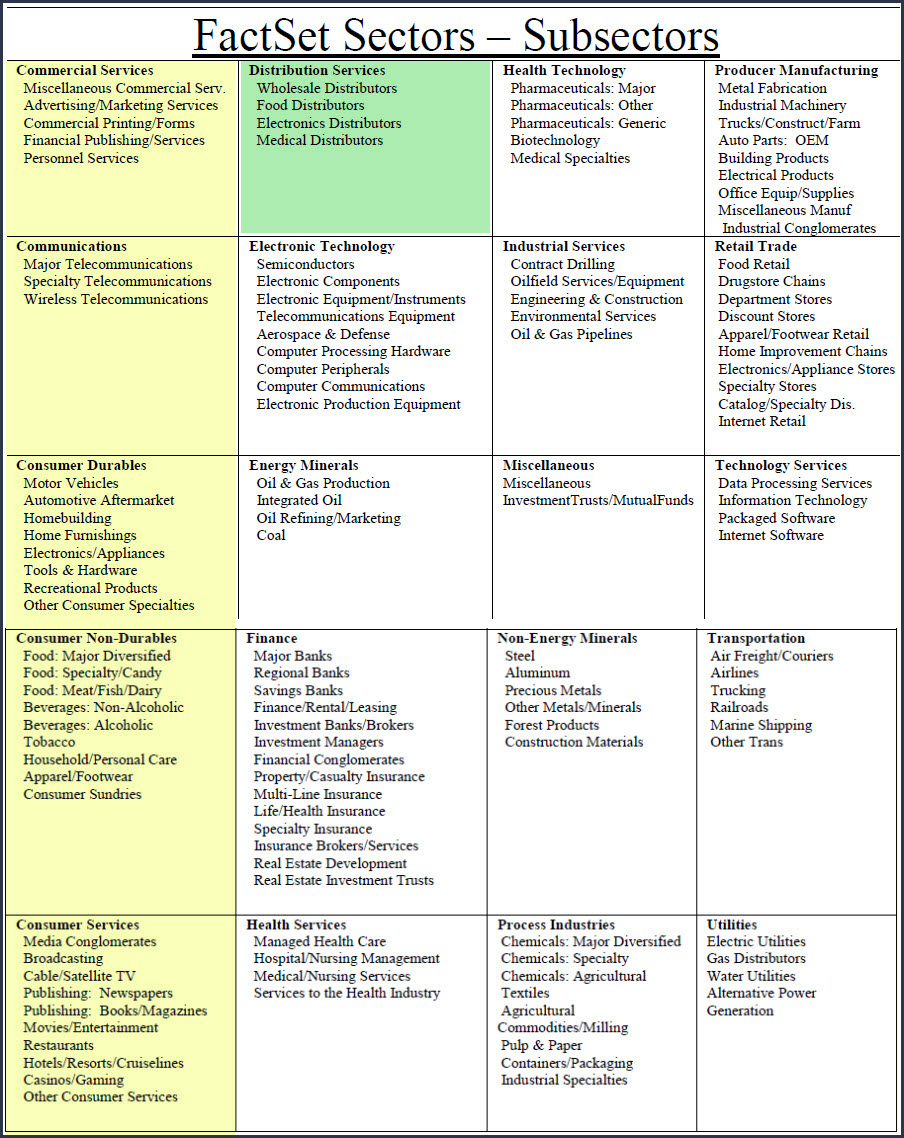

As I stated in previous articles in this series, my primary objective is to provide the reader with a clear perspective of just how different individual stocks are and how different companies operating in different sectors are. Consequently, I will be covering every sector that FactSet covers.

As different as each of these sectors are, the one common theme that I am attempting to include is identifying stocks in each sector that appear attractively valued. However, the reader should understand that valuation is a multifaceted concept. As it relates to these articles, I am simply looking at a valuation as it relates mostly to historical norms based on operating earnings and to a lesser extent on expectations of future earnings.

With that said, I believe the reader should also recognize that correctly forecasting future earnings growth is a major key to long-term investment success. On the other hand, investors should not naïvely believe that they can forecast future earnings with perfect precision. That would be impossible except by chance. The best that we can do is expect our forecasts to be within a reasonable range of accuracy. This is an important concept when evaluating various sectors and subsectors within the market universe.

My point being that some sectors facilitate forecasting accuracy better than others – and vice versa.In the case of distribution services, generally forecasting future operating results is difficult or tenuous at best. This is due to the cyclical nature of many of the companies operating in the distribution services businesses. However, even though many of the companies in this sector are cyclical, they tend to remain profitable even during weaker times. Moreover, as you will see below, the companies I am covering in this sector tend to rebound strongly when they come out of weaker economic times.

Furthermore, there were only 169 companies out of almost 19,000 that comprise the Distribution Services Sector. Moreover, there were only 7 that I considered attractively valued, and I found no companies in the subsector Food Distributors that I considered worthy of mention based on valuation.

A Sector By Sector Review

This is part 6 of a series where I have conducted a simple screening looking for value over the overall market based on industry classifications and subindustry classifications reported by FactSet Research Systems, Inc. In part 1 found here, I covered the consumer services sector. In part 2 found here, I covered the Communication Sector. In part 3 found here, I covered the Consumer Durables Sector and its many diverse subsectors. In part 4 found here, I covered Consumer Nondurables. In part 5 found here, I covered companies in the Consumer Services Sector. In this part 6 will be covering the Distribution Services Sector.

In each article in this series, I provide a listing of screened research candidates from each of the following industry sectors, the sector I’m covering in this article is marked in green:

(Click on image to enlarge)

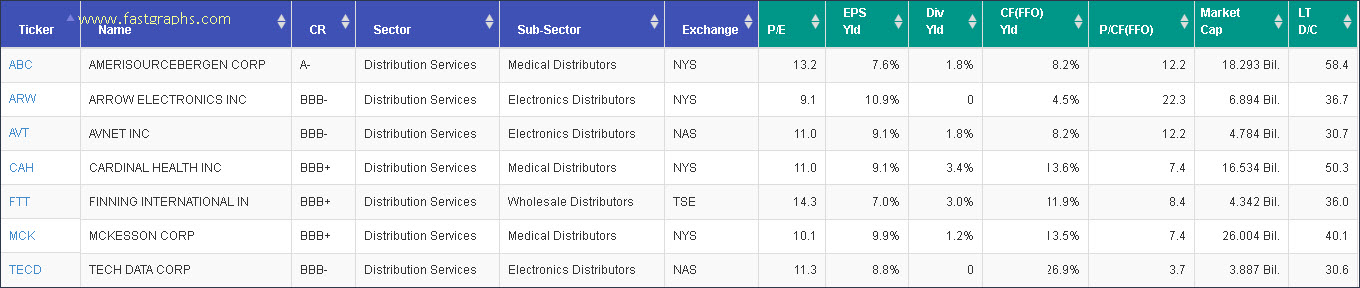

A Simple Valuation and Quality Screening Process

First, I have screened for investment-grade S&P credit ratings of BBB- or above. Next, I have screened for low valuations based on P/E ratios between 2 and 17. Finally, I have screened for long-term debt to capital no greater than 70%.

By keeping my screen simple, and at the same time rather broad, I will be able to identify attractively valued research candidates that I might have overlooked through a more rigorous screening process. In other words, I’m looking for fresh ideas that I might have previously been overlooking. Furthermore, I want to be clear that I do not consider every candidate that I have discovered as suitable for every investor. However, I do consider them all to be attractively valued. Additionally, I also believe that every investor will be able to find companies to research that meet their own goals, objectives and risk tolerances as this series unfolds.

Sector 6: Distribution Services

Wholesale Distributors

Food Distributors

Electronics Distributors

Medical Distributors

Portfolio Review: Distribution Services Sector: 7 Research Candidates

(Click on image to enlarge)

FAST Graphs Screenshots of the 7 Research Candidates

The following screenshots provide a quick look at each of the 7 candidates screened out of over 19,000 possibilities. However, there are only 169 companies categorized as Distribution Services, and these 7 were the only ones I was comfortable presenting in this article. The company descriptions are provided courtesy of the Wall Street Journal. In the FAST Graphs analyze out loud video that follows the screenshots, I will provide additional details and thoughts on the possible attractiveness as well as the potential negatives of each of these research candidates.

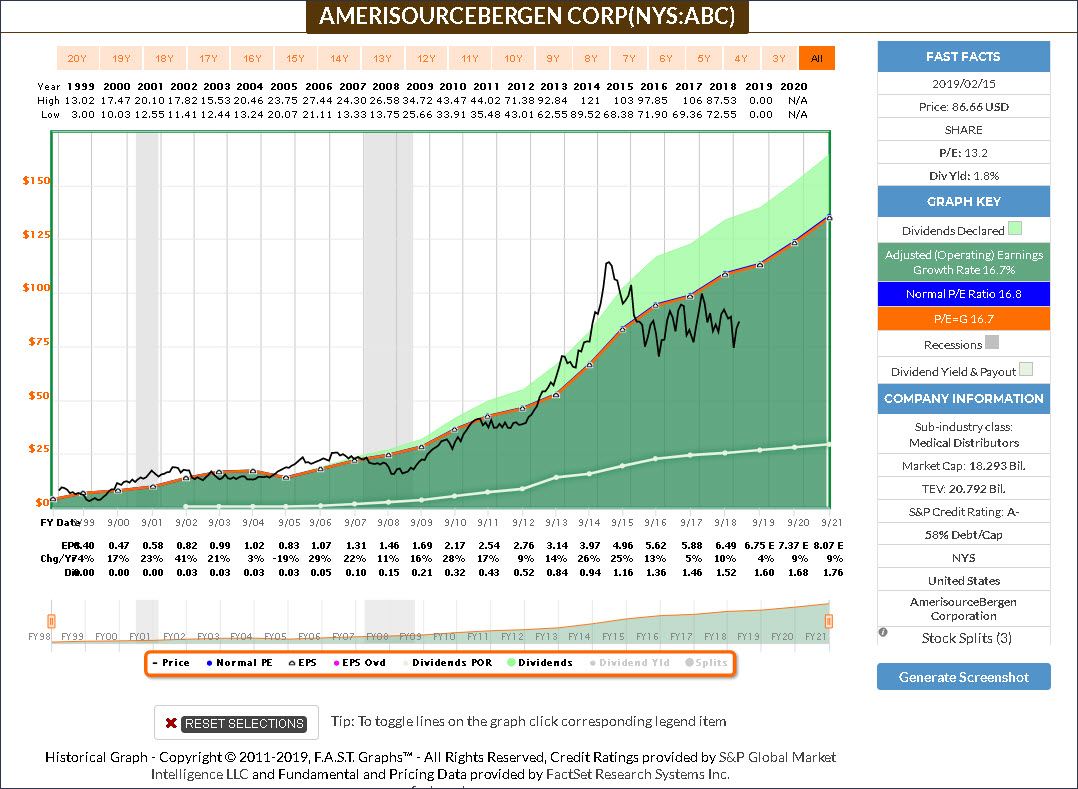

AmerisourceBergen Corp (ABC)

AmerisourceBergen Corp. engages provision of pharmaceutical products and business solutions that improve access to care. It operates through the Pharmaceutical Distribution Services and Other segments.

The Pharmaceutical Distribution Services segment distributes a comprehensive offering of brand-name, specialty brand-name & generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies & equipment, outsourced compounded sterile preparations, and related services to a wide variety of healthcare providers, including acute care hospitals and health systems, independent & chain retail pharmacies, mail order pharmacies, medical clinics, long-term care & alternate site pharmacies, and other customers.

The Other segment focuses on global commercialization services and animal health and includes ABCS, World Courier, and MWI.

The company was founded in 1947 and is headquartered in Chesterbrook, PA.

(Click on image to enlarge)

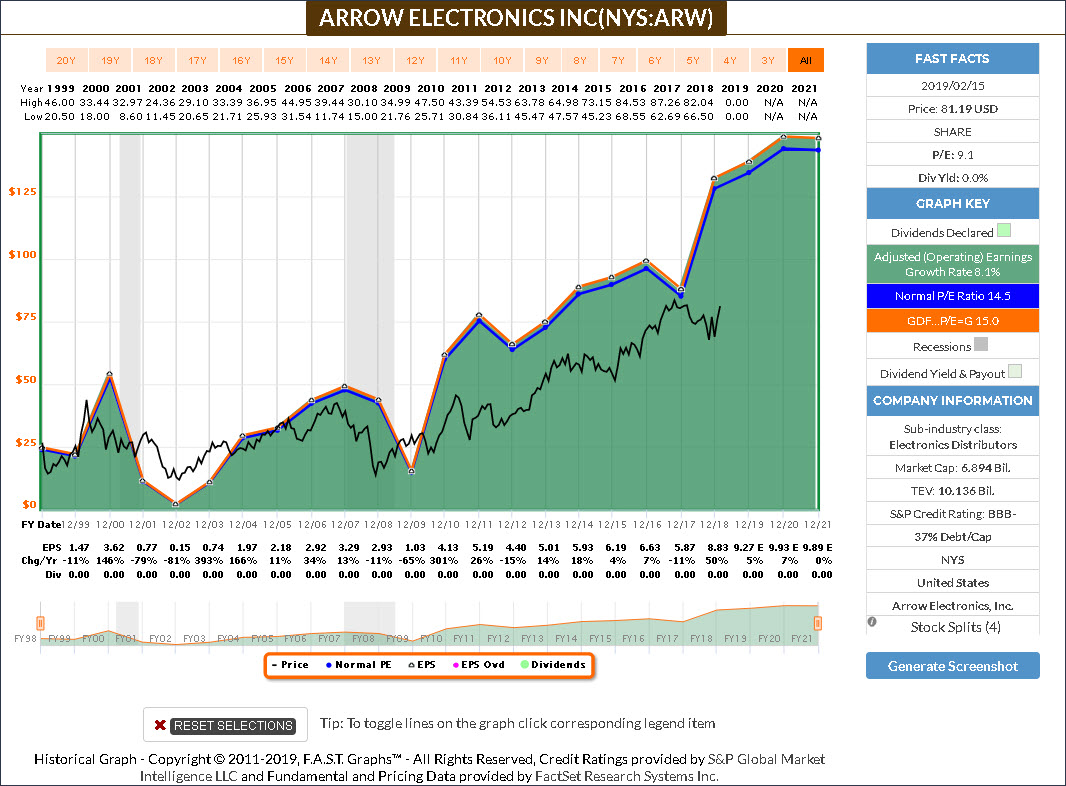

Arrow Electronics Inc (ARW)

Arrow Electronics, Inc. is a provider of products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions. It operates through two segments: Global Components Business and Global Enterprise Computing Solutions.

The Global Components segment involves in the marketing and distribution of electronic components and provides a range of value-added capabilities throughout the entire life cycle of technology products and services through design engineering. global marketing, and integration, global logistics and supply chain management.

The Global Enterprise Computing Solutions segment provides computing solutions and services which include data center, cloud, security, and analytics solutions.

The company was founded by Robert W. Wentworth and John C. Waddell in 1946 and is headquartered in Centennial, CO.

(Click on image to enlarge)

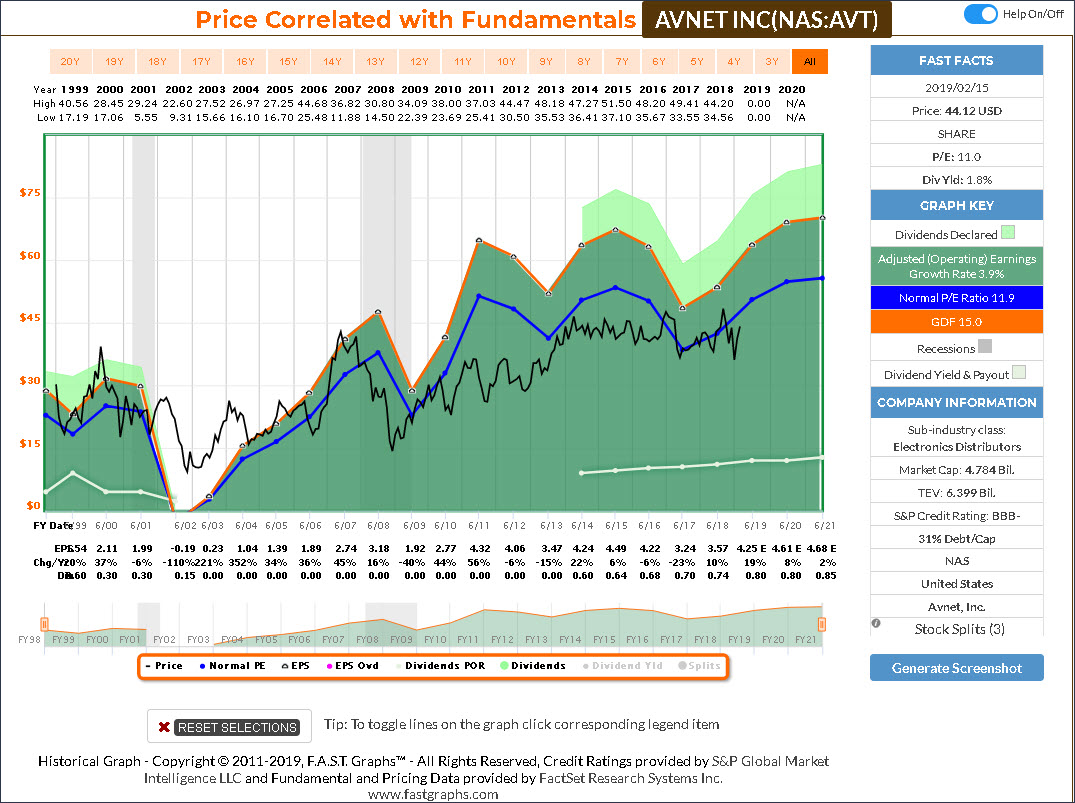

Avnet Inc (AVT)

Avnet, Inc. engages in the distribution and sale of electronic components. It operates through the Electronics Components (EC) and Premier Farnell (FC) segments.

The Electronics Components segment markets and sells semiconductors, interconnect, passive and electromechanical devices and integrated components.

The Premier Farnell segment distributes electronic components and related products to the electronic system design community utilizing multi-channel sales and marketing resources.

The company was founded by Charles Avnet in 1921 and is headquartered in Phoenix, AZ.

(Click on image to enlarge)

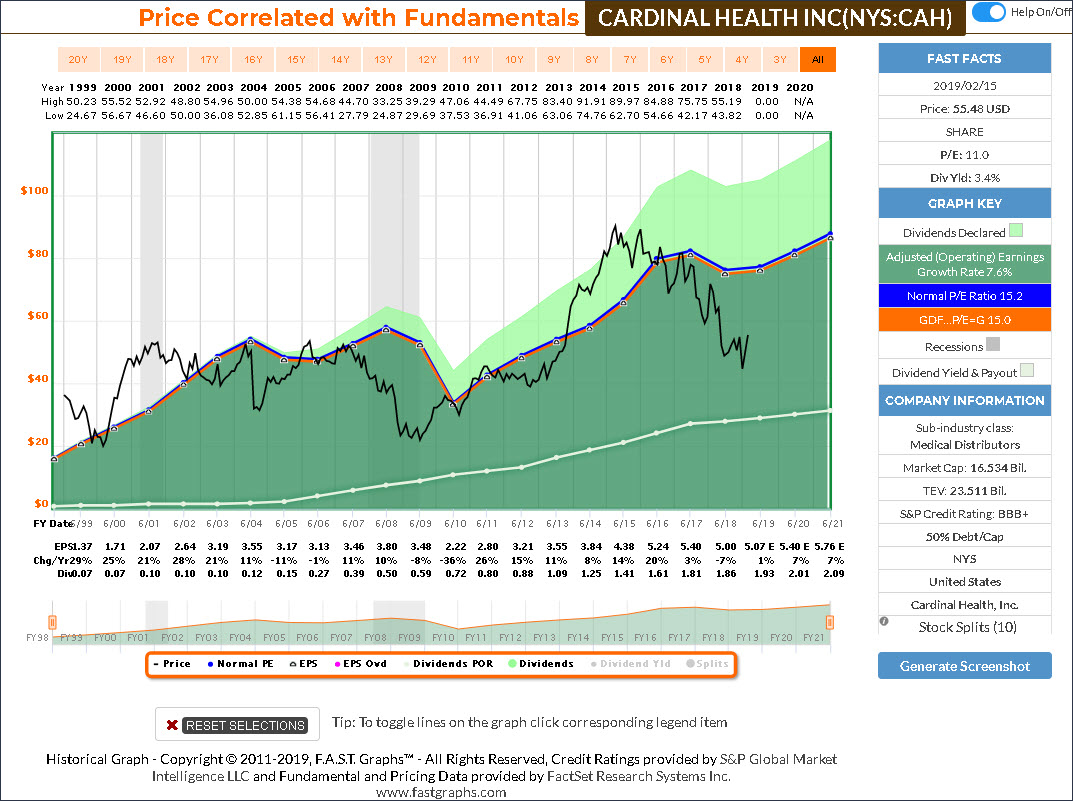

Cardinal Health Inc (CAH)

Cardinal Health, Inc. engages in the provision of pharmaceutical and medical products. It operates through the Pharmaceutical and Medical segments.

The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical, and over-the-counter healthcare and consumer products in the United States.

The Medical segment manufactures, sources and distributes Cardinal Health branded medical, surgical and laboratory products, which are sold in the United States, Canada, Europe, Asia, and other markets.

The company was founded by Robert D. Walter in 1971 and is headquartered in Dublin, OH.

(Click on image to enlarge)

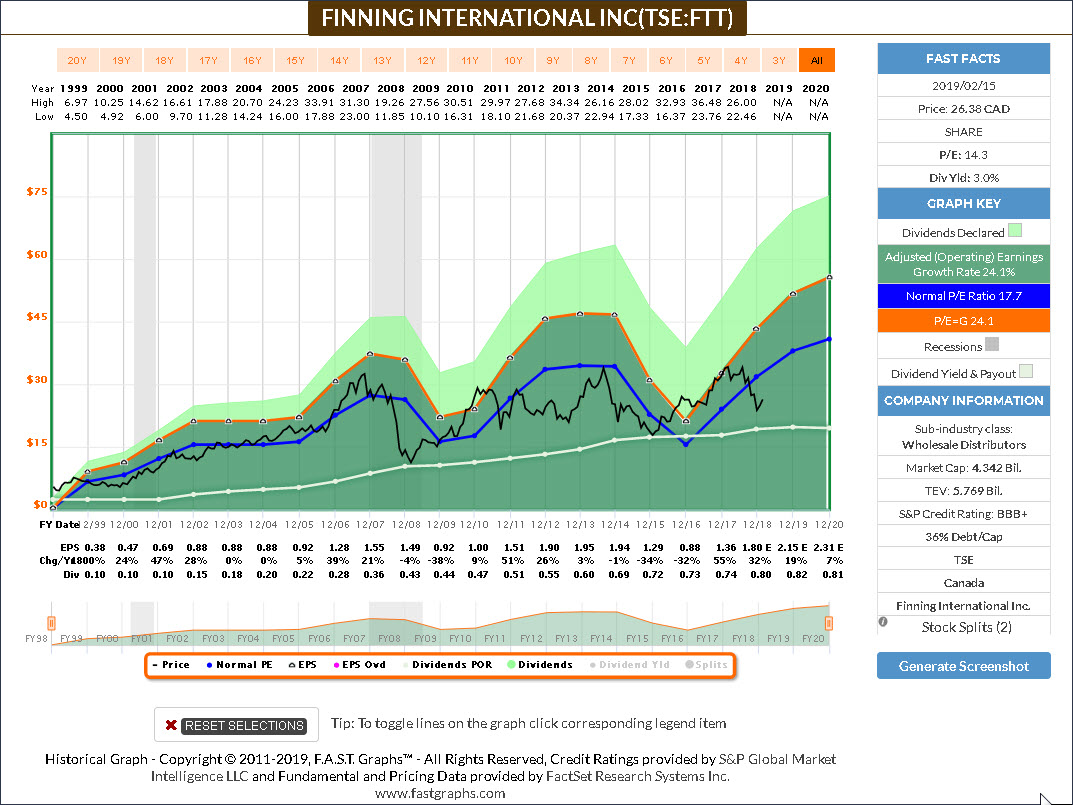

Finning International Inc (FTT.TSX)(FINGF)

Finning International, Inc. engages in the sale, service, and renting out heavy equipment, engines, and related products. It operates through the following business segments: Canadian Operations, South American Operations, UK & Ireland Operations, and Other.

The Canadian Operations segment is comprised of British Columbia, Alberta, Saskatchewan, Yukon, the Northwest Territories, and a portion of Nunavut.

The South American Operations segment includes Chile, Argentina, and Bolivia.

The UK & Ireland Operations segment handles England, Scotland, Wales, Northern Ireland, and the Republic of Ireland.

The Other segment is the corporate head office.

The company was founded by Earl B. Finning on January 4, 1933, and is headquartered in Vancouver, Canada.

(Click on image to enlarge)

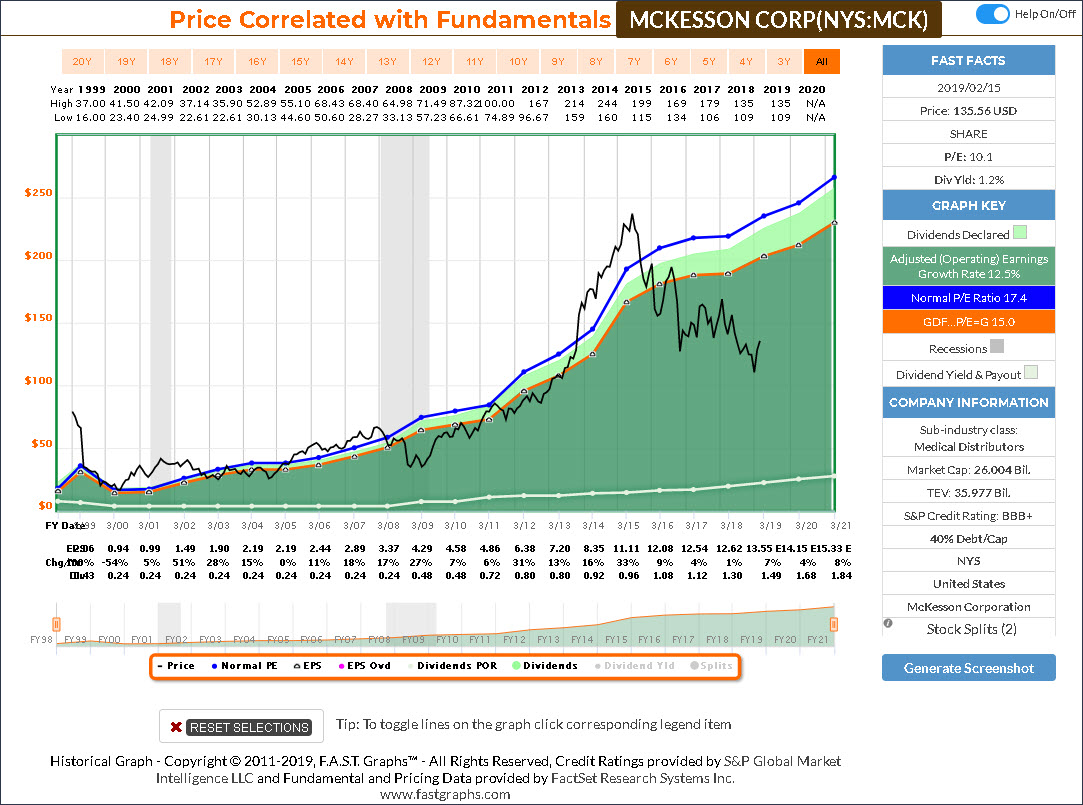

McKesson Corp (MCK)

McKesson Corp. engages in the provision of supply chain management solutions, retail pharmacy, community oncology and specialty care, and healthcare information technology. It operates through the McKesson Distribution Solutions and McKesson Technology Solutions business segments.

The McKesson Distribution Solutions segment distributes brand, generic, specialty, biosimilar and over-the-counter pharmaceutical drugs and other healthcare-related products worldwide.

The McKesson Technology Solutions segment provides clinical, financial, and supply chain management solutions to healthcare organizations.

The company was founded by John McKesson and Charles Olcott in 1833 and is headquartered in Wilmington, DE.

(Click on image to enlarge)

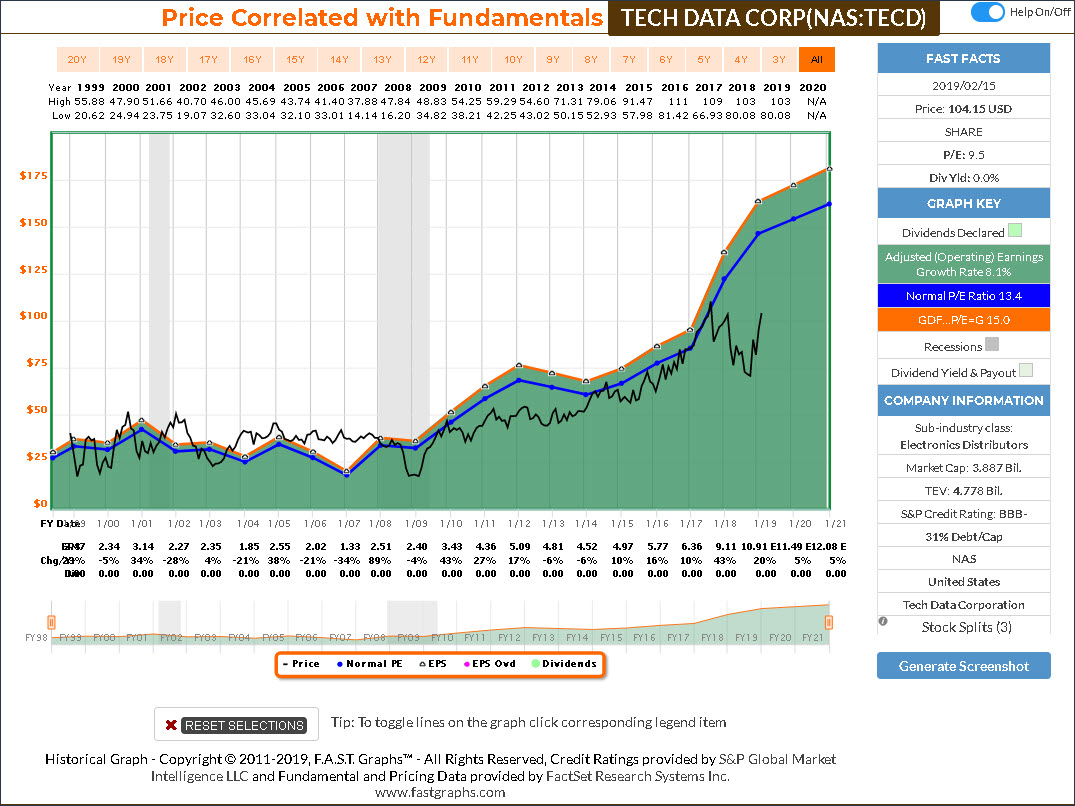

Tech Data Corp (TECD)

Tech Data Corp. distributes technology products, services, and solutions. It provides services, such as data center, e-business, private label delivery, supply chain, shipping and technical; and solutions, such as security, software, mobile, and consumer technology. It operates through two geographical segments: the Americas and Europe.

The company’s products include accessories, cameras, consumer electronics, peripherals, televisions, tablets, power devices, and software. Its customers include resellers, direct marketers and retailers.

Tech Data was founded by Edward C. Raymond in 1974 and is headquartered in Clearwater, FL.

(Click on image to enlarge)

F.A.S.T. Graphs Analyze Out Loud Video:

Video length: 00:14:38

Summary and Conclusions

The Distribution Services Sector is rather small compared to many other sectors. Consequently, I only presented 7 research candidates in this article. As previously mentioned, I found no companies in the Food Distributor subcategory that passed my valuation screen. There are good companies in the Food Distributor subcategory such as Sysco Corp (SYY). However, its valuation was too high and its debt to capital ratio exceeded my limit.

In contrast, the Medical Distributors subsector produced the most consistent operating histories, good valuations, and the best dividend yields. Consequently, these were the stocks that I favored most in this category.

Electronics distributors tended to be more cyclical and offered little in the way of dividend income. As a result, I included these companies primarily as GARP (growth at a reasonable price) candidates. However, it should also be again noted that these companies are the most difficult to forecast future earnings potential. In closing, I do hope my readers are beginning to understand what I mean when I continuously state that it is a market of stocks and not a stock market.

Disclosure: Long ABC,CAH,MCK

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the ...

more

Chuck, thanks for this excellent article. I'm interested in CAH and ARW so this was a good read. I'm aiming to do a bit more due diligence on these picks before moving forward with them.