9 Inexpensive Consumer Services Sector Stocks

As I stated in the introduction in Part 4 of this series, my primary objective is to provide the reader with a clear perspective of just how different individual stocks are and how different companies operating in different sectors are. Consequently, I will be covering every sector that FactSet covers. As this relates to the Consumer Services Sector, it is not a sector that I am especially enthused about. For example, one of my primary screening criteria was an S&P credit rating of BBB- or better. There were only 56 companies in this sector that met that quality threshold and only 9 of which that I considered fairly-valued and worthy of presenting.

To clarify further, there were only 5 restaurant subsector constituents, and none of them were attractively valued. However, 3 of those 5, Darden Restaurants Inc., McDonald’s Corp. and finally Starbucks Corp. are all excellent businesses. However, I do not consider any of them attractive enough to invest in currently.

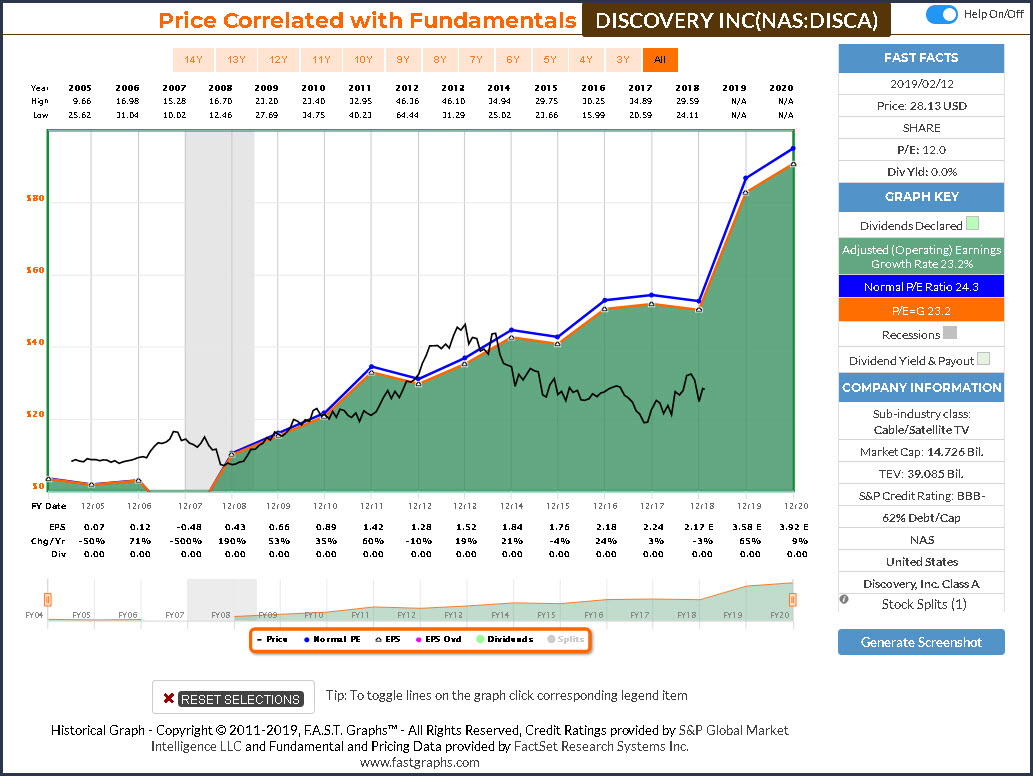

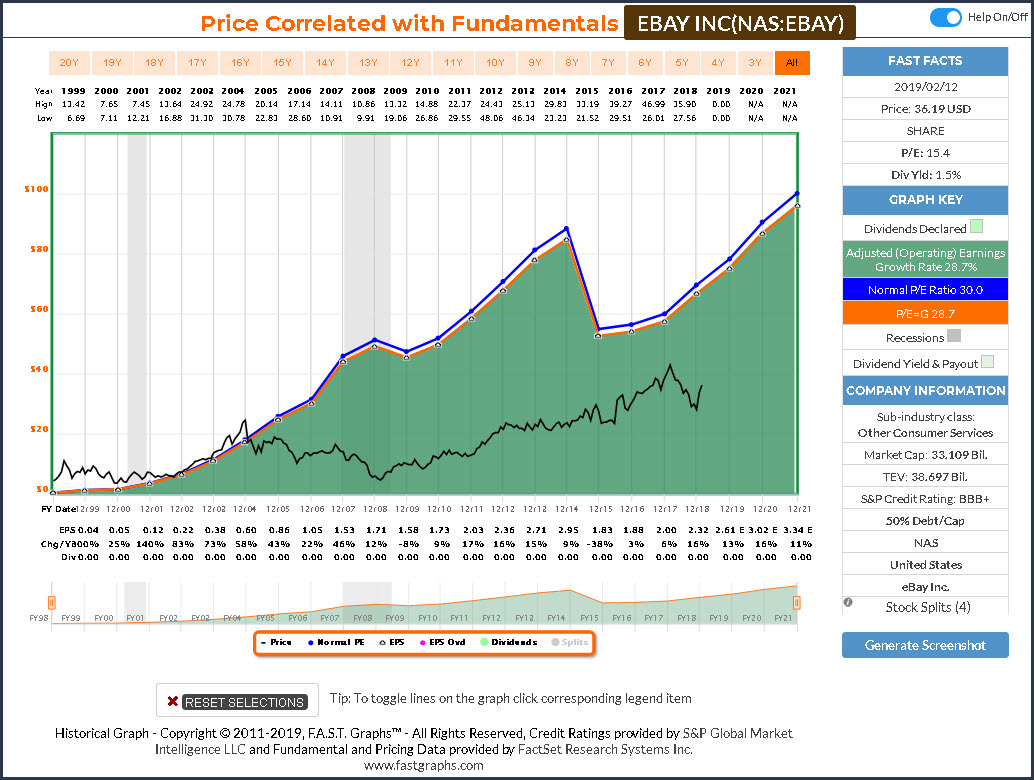

Of the 9 companies that I am reviewing in this article, 8 of them pay dividends. However, Discovery Inc. may offer the highest annualized future total return potential even though it is the only one that does not pay a dividend. The opportunity here is available as a result of very low valuation and a very high expectation of growth for the fiscal year 2019. Consequently, it might be attractive to the aggressive investor seeking a high intermediate-term total rate of return. (Note: on January 30, 2019, eBay announced the initiation of their first dividend, however, it is not yet reflected on the FAST Graph even though its dividend yield is reported in the FAST FACTS).

A Sector By Sector Review

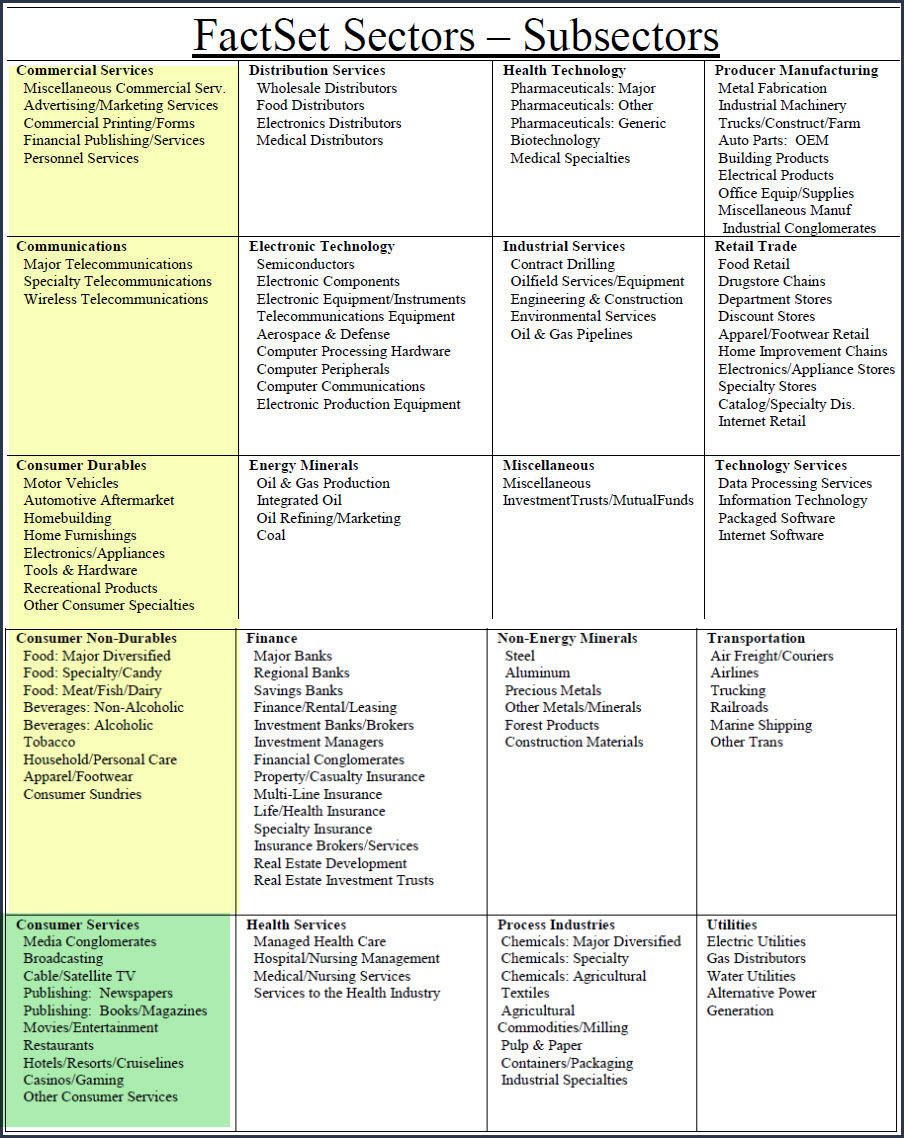

This is part 5 of a series where I have conducted a simple screening looking for value over the overall market based on industry classifications and subindustry classifications reported by FactSet Research Systems, Inc. In part 1 found here, I covered the consumer services sector. In part 2 found here, I covered the communication sector. In part 3 found here, I covered the Consumer Durables sector and its many diverse subsectors. In part 4 found here, I covered consumer nondurables. In part 5, I will be covering companies in the Consumer Services sector.

In each article in this series, I will be providing a listing of screened research candidates from each of the following industry sectors, the sector I’m covering in this article is marked in green:

(Click on image to enlarge)

A Simple Valuation and Quality Screening Process

With this series of articles, I will be presenting a screening of companies that have become attractively valued primarily as a result of the bearish market activities experienced in 2018 from each of the above sectors. I will be applying a rather simple valuation and quality-oriented screen across each of the sectors. First, I have screened for investment-grade S&P credit ratings of BBB- or above. Next, I have screened for low valuations based on P/E ratios between 2 and 17. Finally, I have screened for long-term debt to capital no greater than 70%.

By keeping my screen simple, and at the same time rather broad, I will be able to identify attractively valued research candidates that I might have overlooked through a more rigorous screening process. In other words, I’m looking for fresh ideas that I might have previously been overlooking. Furthermore, I want to be clear that I do not consider every candidate that I have discovered as suitable for every investor. However, I do consider them all to be attractively valued. Additionally, I also believe that every investor will be able to find companies to research that meet their own goals, objectives and risk tolerances as this series unfolds.

Sector 5 – Consumer Services

Media Conglomerates

Broadcasting

Cable/Satellite TV

Publishing: Newspapers

Publishing: Books/Magazines

Movies/Entertainment

Restaurants

Hotels/Resorts/Cruiselines

Casinos/Gaming

Other Consumer Services

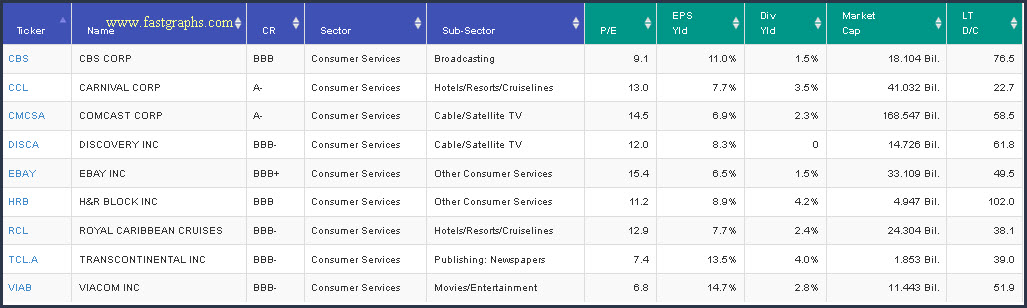

Portfolio Review: Consumer Services Sector-9 Research Candidates

(Click on image to enlarge)

FAST Graphs Screenshots of the 9 Research Candidates

The following screenshots provide a quick look at each of the 9 candidates screened out of over 19,000 possibilities. However, there are only 480 companies categorized as Consumer Services, and these 9 were the only ones I was comfortable presenting in this article. The company descriptions are provided courtesy of the Wall Street Journal. In the FAST Graphs analyze out loud video that follows the screenshots, I will provide additional details and thoughts on the possible attractiveness as well as the potential negatives of each of these research candidates.

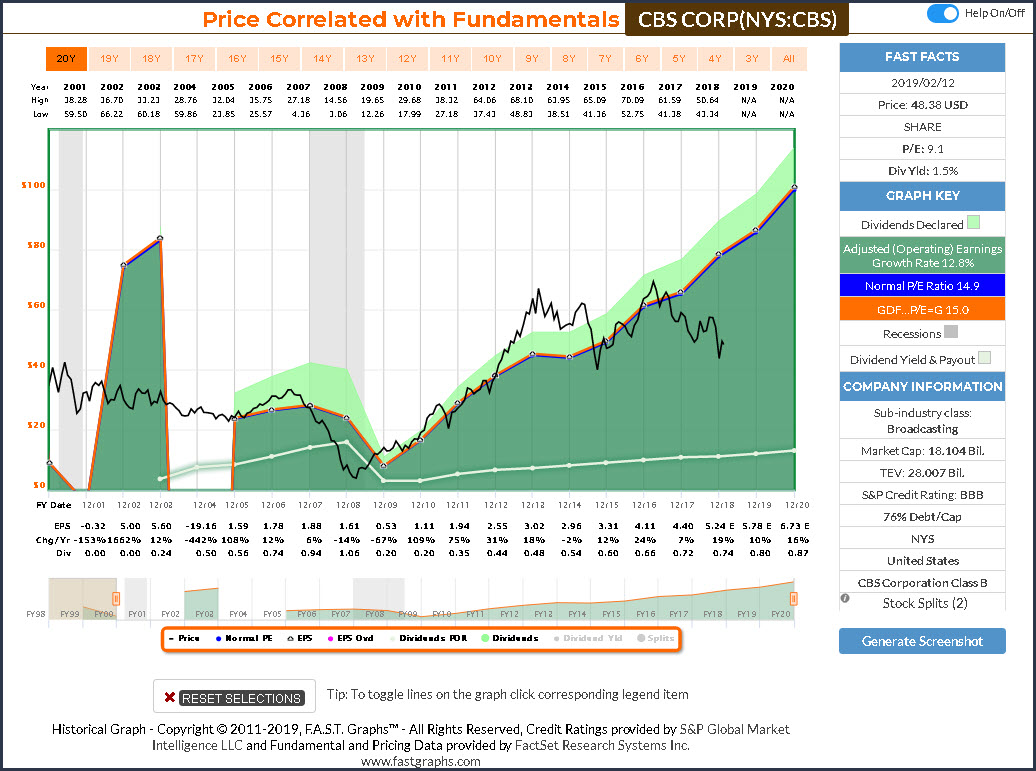

CBS Corp (CBS)

CBS Corp. operates as a mass media company, which creates and distributes content across a variety of platforms to audiences around the world. It operates its business through the following segments: Entertainment, Cable Networks, Publishing, and Local Media. The Entertainment segment is composed of the CBS Television Network, CBS Television Studios, CBS Studios International, CBS Television Distribution, CBS Interactive, and CBS Films as well as the Company’s digital streaming services, CBS All Access and CBSN.

The Cable Networks includes Showtime Networks, CBS Sports Network, and Smithsonian Networks. The Publishing segment manages the Simon & Schuster’s consumer book publishing business with imprints such as Simon & Schuster, Pocket Books, Scribner, and Atria Books.

The Local Media segment handles the CBS Television Stations, and CBS Local Digital Media, with revenues generated primarily from advertising sales and retransmission fees.

The company was founded by Sumner Murray Redstone in 1986 and is headquartered in New York, NY.

(Click on image to enlarge)

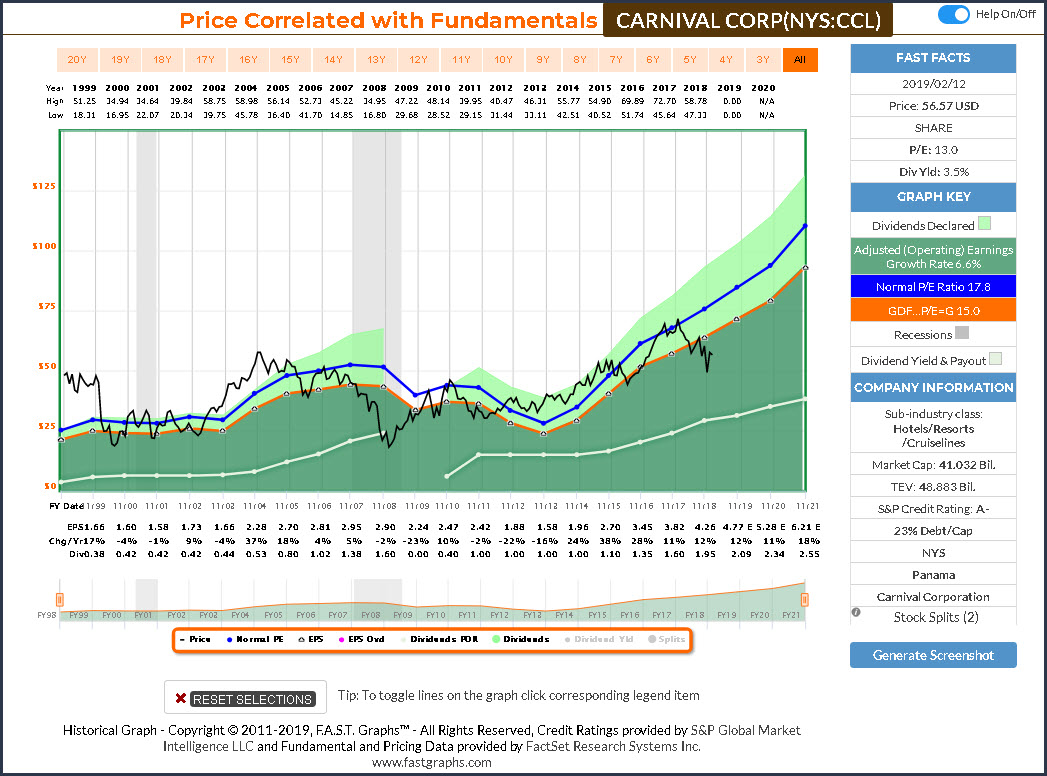

Carnival Corp (CCL)

Carnival Corp. engages in the operation of cruise ships. It operates through the following business segments: North America; Europe, Australia, and Asia (EEA); Cruise Support; and Tour and Other. The North America segment includes Carnival Cruise Line, Holland America Line, Princess Cruises, and Seabourn.

The Europe, Australia, and Asia (EEA) segment comprises of AIDA, Costa, Cunard, P&O Cruises (Australia), P&O Cruises (UK). The Cruise Support segment represents port destinations and private islands for the benefit of its cruise brands. The Tour and Other segment o[perates hotel and transportation operations of Holland America Princess Alaska Tours.

The company was founded in 1972 and is headquartered in Miami, FL.

(Click on image to enlarge)

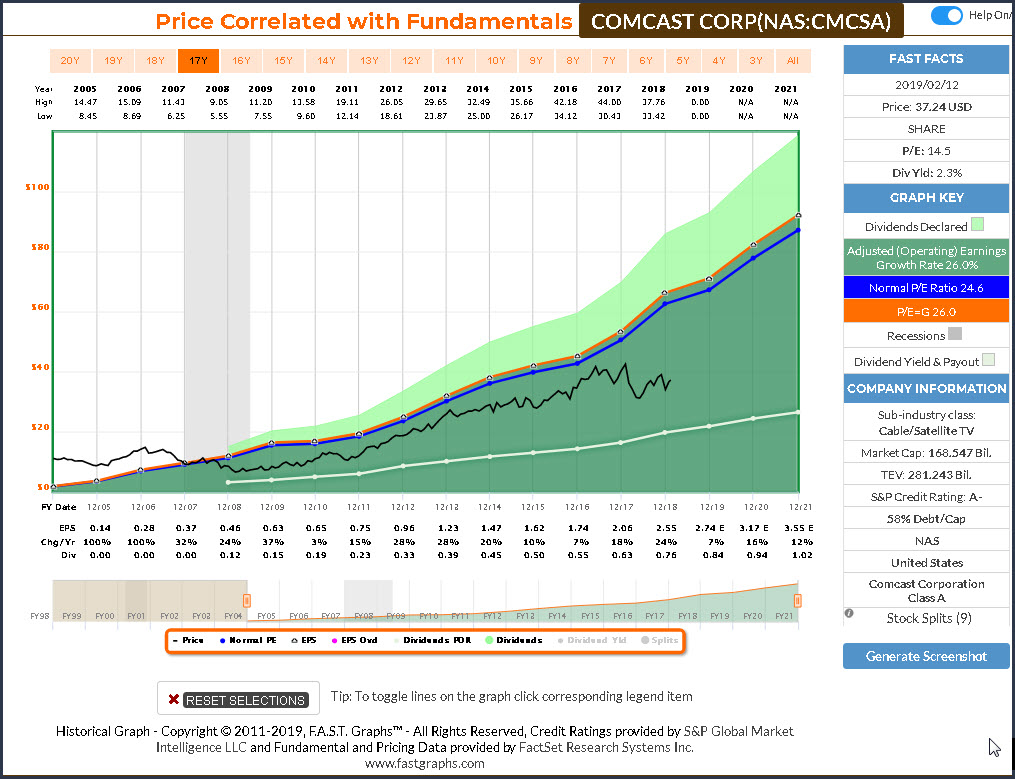

Comcast Corp (CMCSA)

Comcast Corp. is a media, entertainment, and communications company, which engages in the provision of video, Internet, and phone services. It operates through the following segments: Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Corporate and Other.

The Cable Communications segment provides video, Internet, voice, and security and automation services under the Xfinity brand. The Cable Networks segment consists of national cable networks, regional sports, news networks, international cable networks, and cable television studio production operations. The Broadcast Television segment includes NBC and Telemundo broadcast networks.

The Filmed Entertainment segment involves in the production, acquisition, marketing, and distribution of filmed entertainment. The Theme Parks segment consists of Universal theme parks in Orlando, Florida; Hollywood, California; and Osaka, Japan. The Corporate and Other segment includes operations of other business interests, primarily of Comcast Spectacor.

The company was founded by Ralph J. Roberts in 1963 and is headquartered in Philadelphia, PA.

(Click on image to enlarge)

Discovery Inc (DISCA)

Discovery, Inc. is a media company, which engages in the provision of content across distribution platforms and digital distribution arrangements. It operates through the following segments: U.S. Networks, International Networks, and Education and Other.

The U.S. Networks segment owns and operates national television networks such as Discovery Channel, Animal Planet, and Investigation Discovery and Science. The International Networks segment consists of international television networks and websites. The Education and Other segment offers curriculum-based product and service offerings.

The company was founded by John S. Hendricks on 1982 and is headquartered in Silver Spring, MD.

(Click on image to enlarge)

eBay, Inc (EBAY)

eBay, Inc. operates as a commerce company, which engages in the provision of investments and acquisitions to help enable commerce on platforms for buyers and sellers online or on mobile devices. It operates through the following platforms: Marketplace; Classifieds; StubHub, Corporate, and Others. The Marketplace platform include online marketplace located at www.ebay.com, its localized counterparts, and the eBay mobile apps.

The Classified platform focuses in collection of brands such as mobile.de, Kijiji, Gumtree, Marktplaats, eBay Kleinanzeigen, and others. The StubHub platform gives online ticket platform located at www.stubhub.com, its localized counterparts, and the StubHub mobile apps.

The company was founded by Pierre M. Omidyar in September 1995 and is headquartered in San Jose, CA.

(Click on image to enlarge)

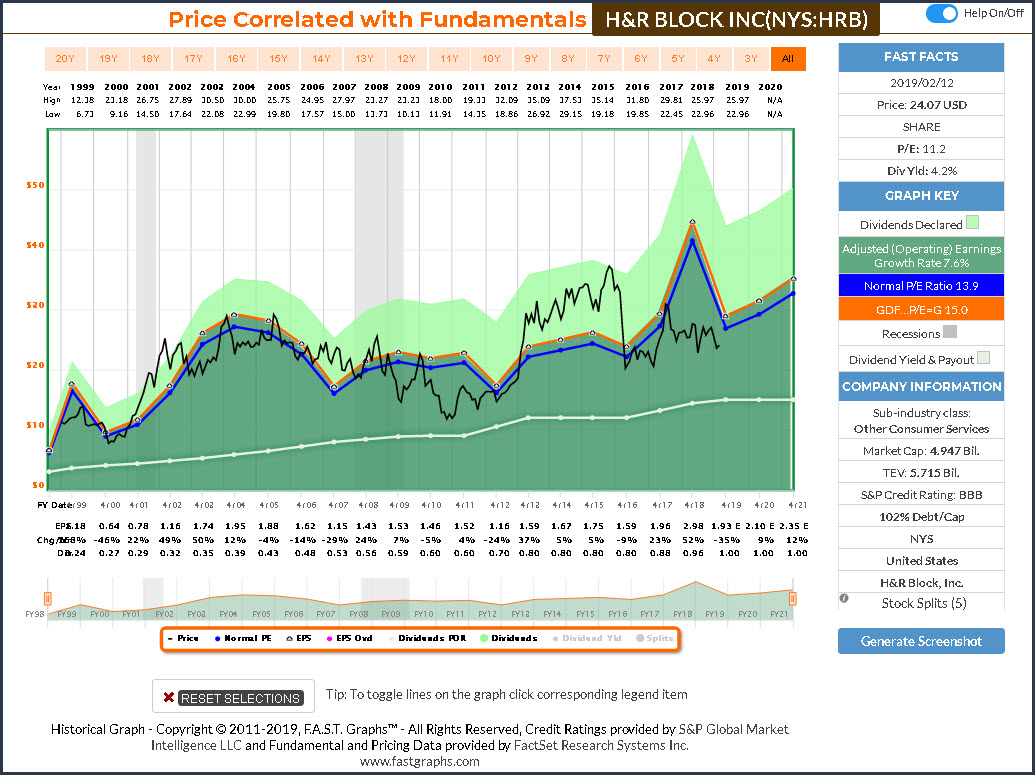

H&R Block Inc (HRB)

H&R Block, Inc. engages in the provision of tax preparation and other services. It offers assisted and do-it-yourself tax return preparation solutions through multiple channels and distribute the H&R Block-branded financial products and services, including those of its financial partners, to the general public primarily in the United States, Canada, and Australia.

The company was founded by Henry W. Bloch and Richard A. Bloch on January 25, 1955, and is headquartered in Kansas City, MO.

(Click on image to enlarge)

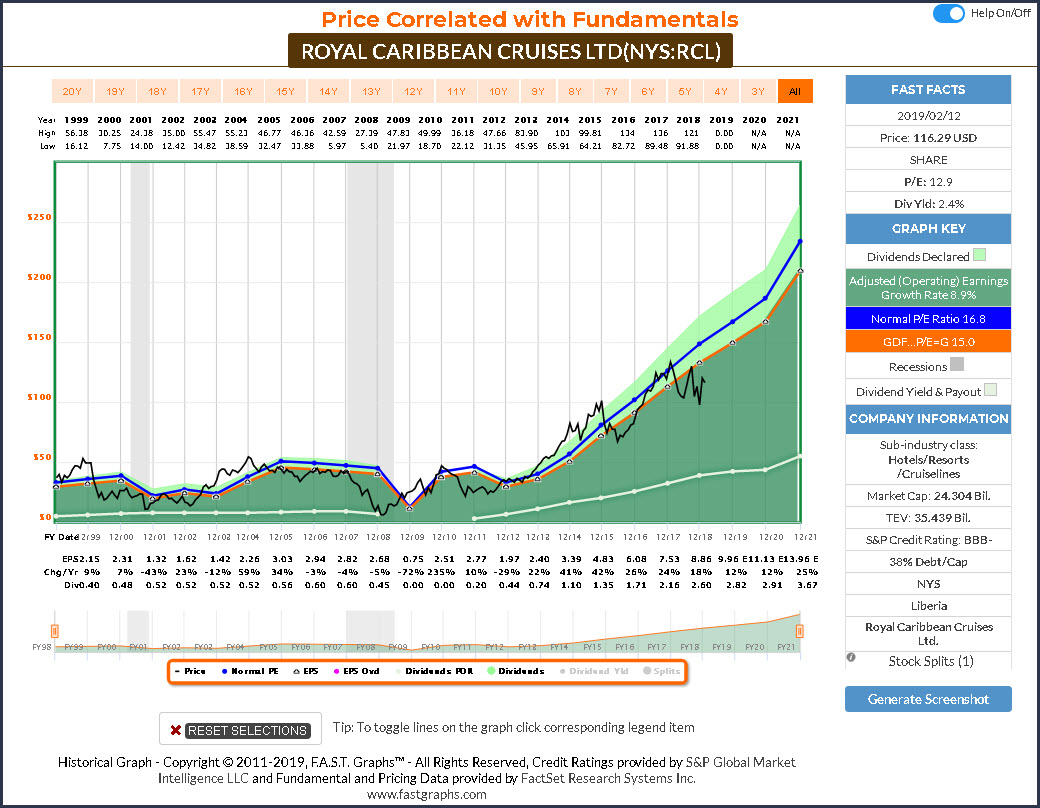

Royal Caribbean Cruises (RCL)

Royal Caribbean Cruises Ltd. is a global cruise vacation company. It owns and operates global cruise brands, namely Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises. It also holds an interest in TUI Cruises, Pullmantur, and SkySea Cruises brands.

The company was founded in 1968 and is headquartered in Miami, FL.

(Click on image to enlarge)

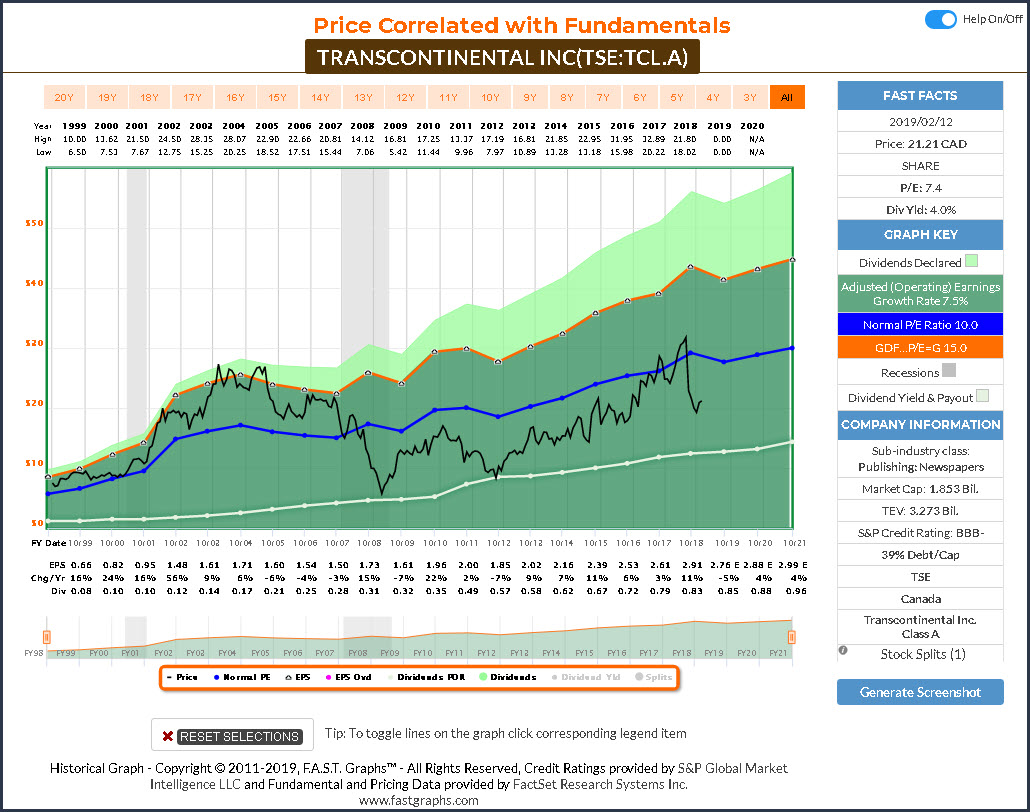

Transcontinental Inc (TCLAF)

Transcontinental, Inc. engages in the provision of print and digital media, flexible packaging, and publishing services. It operates through the following business segments: Printing and Packaging Sector; Media Sector; and Head Office and Inter-Segment Eliminations.

The Printing and Packaging Sector provides an integrated service offering for retailers, including a flyer and in-store marketing product printing, premedia services, and door-to-door distribution through Publisac in Quebec and Targeo, a pan-Canadian distribution brokerage service as well as print solutions for newspapers, magazines, 4-colour books and personalized and mass marketing products. The Media Sector segment comprises of French-language educational resources which caters financial and construction sectors.

The Head office and Inter-Segment Eliminations segment comprises of mainly cash, income taxes receivable, property, plant and equipment, intangible assets, deferred taxes, and defined benefit asset not allocated to segments.

The company was founded by Remi Marcoux in 1976 and is headquartered in Montreal, Canada.

(Click on image to enlarge)

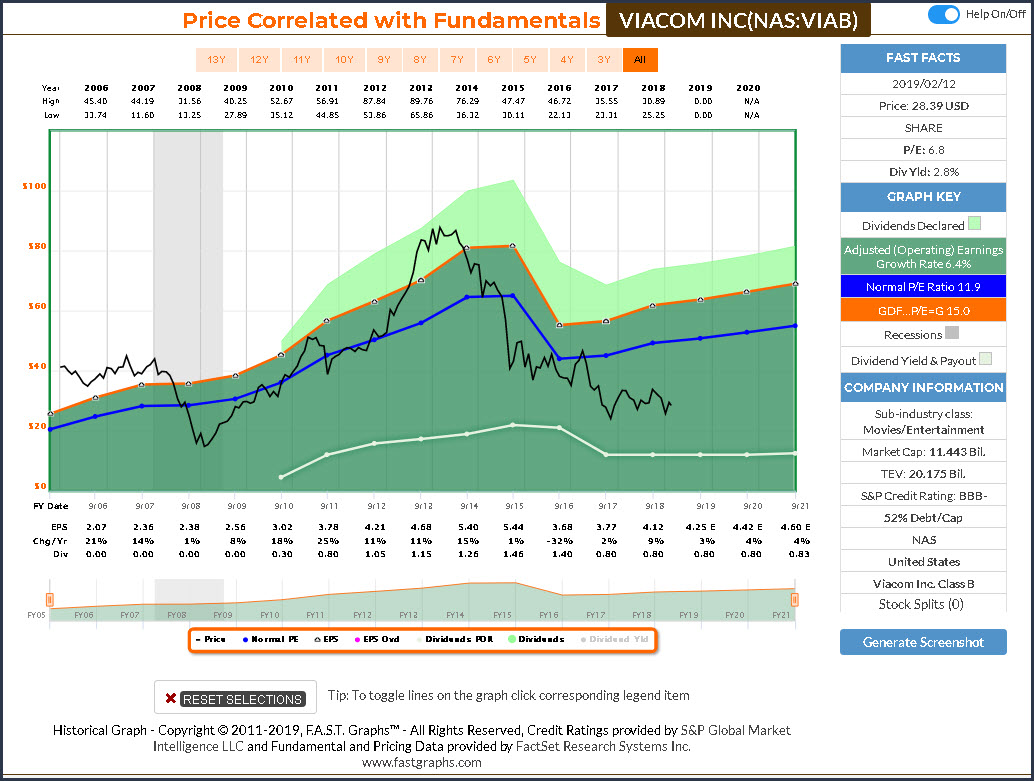

Viacom (VIAB)

Viacom, Inc. is a global entertainment content company, which connects with audiences through compelling television programs, motion pictures, short-form video, applications, games, brands for consumer products, social media and other entertainment content. It operates business through Media Networks and Filmed Entertainment segments.

The Media Networks segment provides entertainment content, services, and related branded products for consumers in targeted demographics attractive to advertisers, content distributors, and retailers. The Media Networks segment delivers advertising and marketing services under advanced marketing solutions portfolio.

The company was founded by Sumner M. Redstone on May 3, 1971, and is headquartered in New York, NY.

(Click on image to enlarge)

F.A.S.T. Graphs Analyze Out Loud Video: 9 Investable Consumer Services Research Candidates

Running length 00:18:19

Summary and Conclusions

As stated earlier, the Consumer Services sector is not a sector that I find especially attractive for long-term investing. For starters, it is difficult to find companies in this sector with high credit ratings. I also consider it difficult to predict the future operating results that many of these companies might be capable of generating. This is clear when evaluating the long-term historical performance of each of these companies as I did in the video. Most of these companies are cyclical in nature, and they tend to be very vulnerable to recessions and other economic weakness.

Furthermore, it was hard to find really strong credit ratings in this sector, and debt levels tend to be higher than found in many other sectors. On the other hand, many of these companies have smaller market caps and as a result vulnerable to mergers or acquisitions. Moreover, some of the larger constituents have histories of spinoffs and other divestitures. Consequently, the industry may be a little too spicy for my taste.

However, with all the above said, there are some interesting short to intermediate term investing opportunities presented in the 9 research candidates I covered. In a few cases such as Discovery Inc., CBS Corp., and Viacom Inc. the valuations appear compelling. On the other hand, those valuations are predicated on optimistic views of earnings growth over the next few years yet the analyst scorecards on these companies are not necessarily confidence inspiring. Therefore, I offer these research candidates for your evaluation. However, I will and by stating caveat emptor- buyer beware.

Disclosure: No positions.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the ...

more