Finding Value In The Communication Sector Is Easy Today – Finding Growth Is A Different Matter

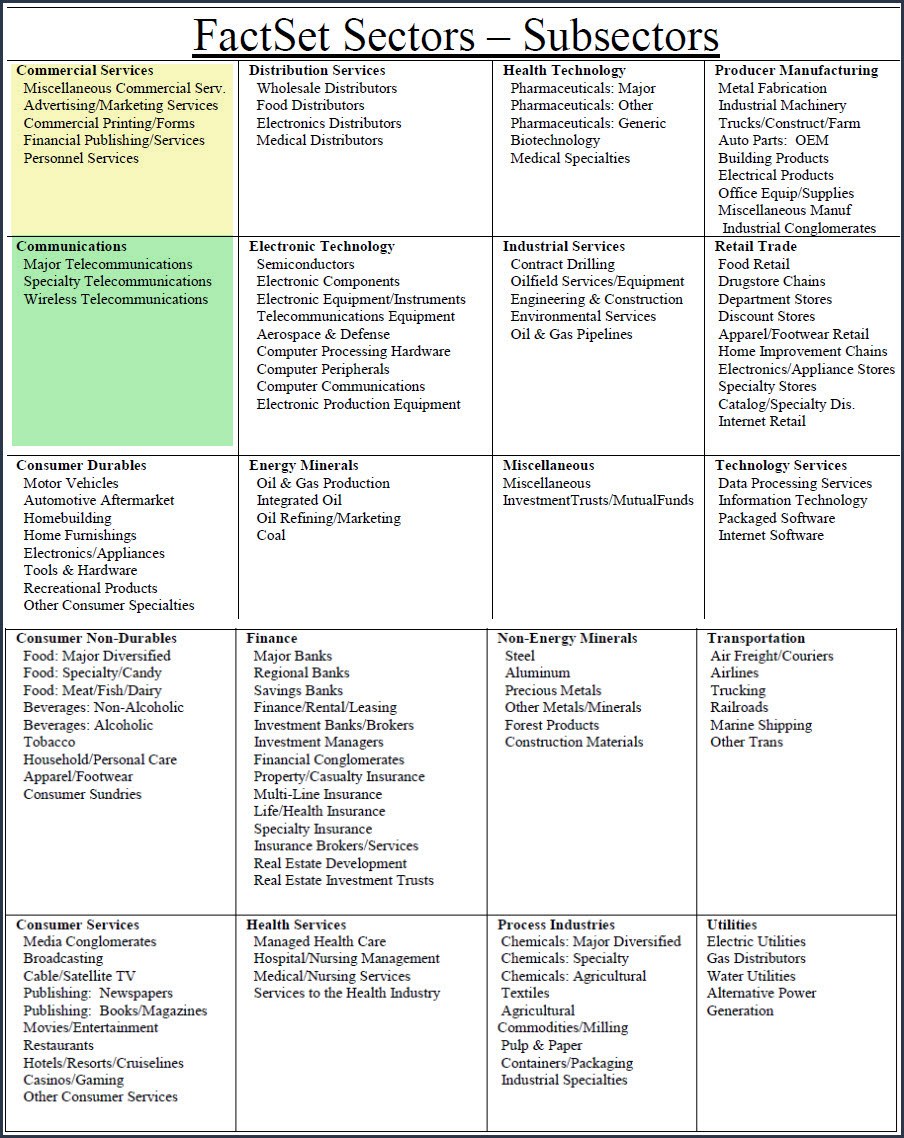

This is part 2 of a series where I have conducted a simple screening looking for value over the overall market based on industry classifications and subindustry classifications reported by FactSet Research Systems, Inc. In part 1 found here, I covered the Consumer Services Sector. In this part 2, I will be covering the Communication Sector.

In each article in this series, I will be providing a listing of screened research candidates from each of the following industry sectors:

(Click on image to enlarge)

A Simple Valuation and Quality Screening Process

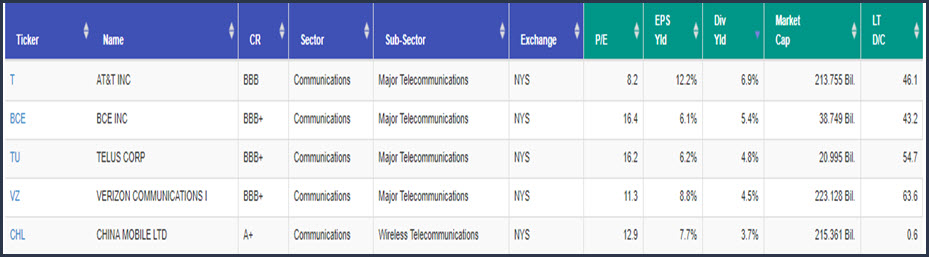

With this series of articles, I will be presenting a screening of companies that have become attractively valued primarily as a result of the bearish market activities experienced in 2018 from each of the above sectors. I will be applying a rather simple valuation and quality-oriented screen across each of the sectors. First, I have screened for investment-grade S&P credit ratings of BBB- or above. Next, I have screened for low valuations based on P/E ratios between 2 and 17. Finally, I have screened for long-term debt to capital no greater than 70%.

By keeping my screen simple, and at the same time rather broad, I will be able to identify attractively valued research candidates that I might have overlooked through a more rigorous screening process. In other words, I’m looking for fresh ideas that I might have previously been overlooking. Furthermore, I want to be clear that I do not consider every candidate that I have discovered as suitable for every investor. However, I do consider them all to be attractively valued. Additionally, I also believe that every investor will be able to find companies to research that meet their own goals, objectives and risk tolerances as this series unfolds.

In this part 2, I have found 5 research candidates from the Communications Sector as follows:

Sector 2: Communications Sector:

As I’ve often stated, I believe it is a market of stocks and not a stock market. This simply means that stocks come in all sizes, shapes, flavors, and colors. The same principle applies to sectors. Some sectors will contain a diverse set of companies of varying characteristics, whether it be growth or dividend income, etc. On the other hand, some sectors such as the Communication Sector will be comprised of companies that generally share more attributes in common than they do differences.

In the Communication Sector, I see little opportunities for growth and a lot of cyclicality. Consequently, it is not a sector (or are there subsectors within it) that I find especially attractive for long-term ownership. Moreover, where I do see growth, there is no value. The Communications Sector contains 199 companies in all. However, I only found 5 that I would be willing to cover or present as potential research candidates. Furthermore, I only offer these as opportunities to boost portfolio yield or park cash for the intermediate term. With that said, Version and AT&T also offer large capital appreciation potential over the near term through P/E expansion back to historical norms.

Portfolio Review: Communications Sector 5 Research Candidates for High-Yield

(Click on image to enlarge)

FAST Graphs Screenshots of the 5 Research Candidates

The following screenshots provide a quick look at each of the 5 candidates screened out of over 19,000 possibilities. Company descriptions courtesy of Wall Street Journal. In the FAST Graphs analyze out loud video that follows the screenshots, I will provide additional details and thoughts on the possible attractiveness, as well as the potential negatives of each of these research candidates.

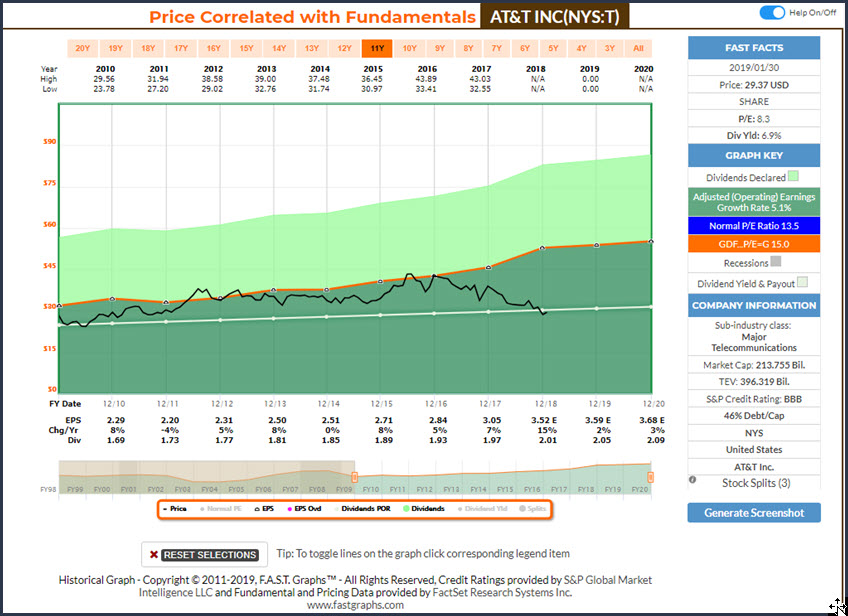

AT&T Inc (T)

AT&T, Inc. is a holding company, which engages in the provision of telecommunications and digital entertainment services. It operates through the following business segments: Business Solutions, Entertainment Group, Consumer Mobility, and International.

The Business Solutions segment provides advanced IP-based services including Virtual Private Networks (VPN); Ethernet-related products; FlexWare, a service that relies on Software Defined Networking (SDN) and Network Functions Virtualization (NFV) to provide application-based routing, and broadband, collectively referred to as strategic services, as well as traditional data and voice products. We utilize our wireless and wired networks to provide a complete communications solution to our business customers.

The Entertainment Group segment offers video, internet, voice communication, and interactive and targeted advertising services to customers located in the United States.

The Consumer Mobility segment provides nationwide wireless service to consumers and wholesale and resale subscribers located in the United States.

The International segment provides entertainment services in Latin America and wireless services in Mexico. The company was founded in 1983 and is headquartered in Dallas, TX.

(Click on image to enlarge)

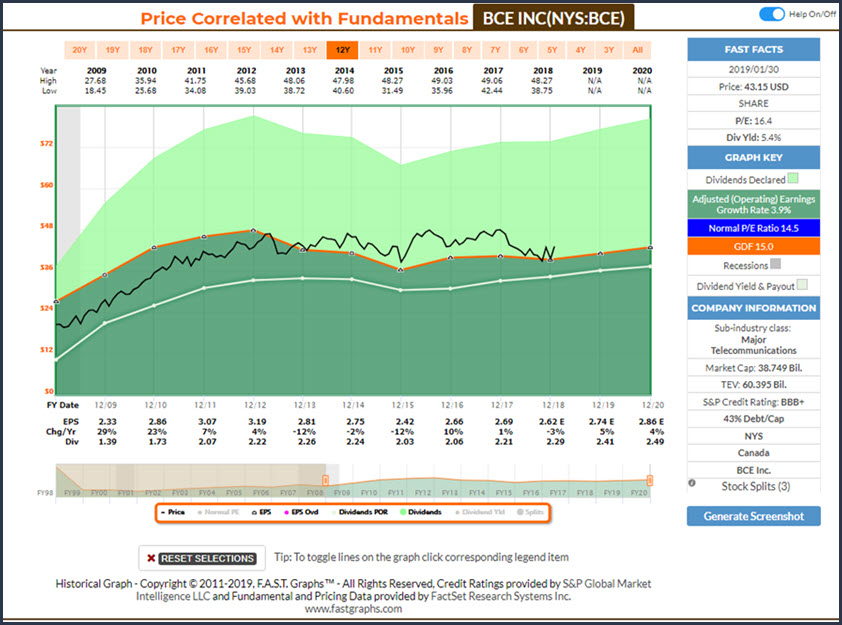

BCE Inc (BCE)

BCE, Inc. is a telecommunications and media company, which engages in the provision of communication services to residential, business, and wholesale customers. It operates through the following business segments: Bell Wireless, Bell Wireline, and Bell Media.

The Bell Wireless segment covers integrated digital wireless voice and data communications products and services to residential and business customers.

The Bell Wireline segment offers data, including Internet access and Internet protocol television, local telephone, long distance, as well as other communications services and products to residential, small and medium-sized business, and large enterprise customers.

The Bell Media segment includes conventional, specialty and pay television, digital media, radio broadcasting services, and out-of-home advertising services. The company was founded on February 25, 1970, and is headquartered in Verdun, Canada.

(Click on image to enlarge)

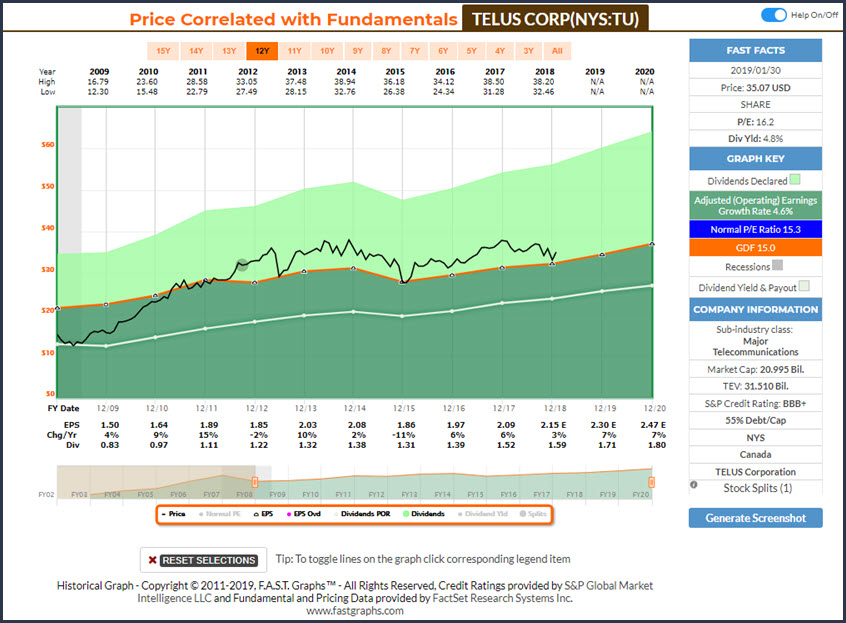

TELUS Corp (TU)

TELUS Corp. operates as a telecommunications company. The company specializes in telecommunication services and products primarily for wireless and wireline voice and data. It operates through the Wireless and Wireline segments.

The Wireless segment refers to the data and voice products for mobile technologies. The Wireline segment offers data solutions such as internet protocol, television, hosting, managed information technology and cloud-based services, business process outsourcing, certain healthcare solutions, as well as voice and other telecommunications services, and equipment sales. The company was founded on October 4, 1990, and is headquartered in Vancouver, Canada.

(Click on image to enlarge)

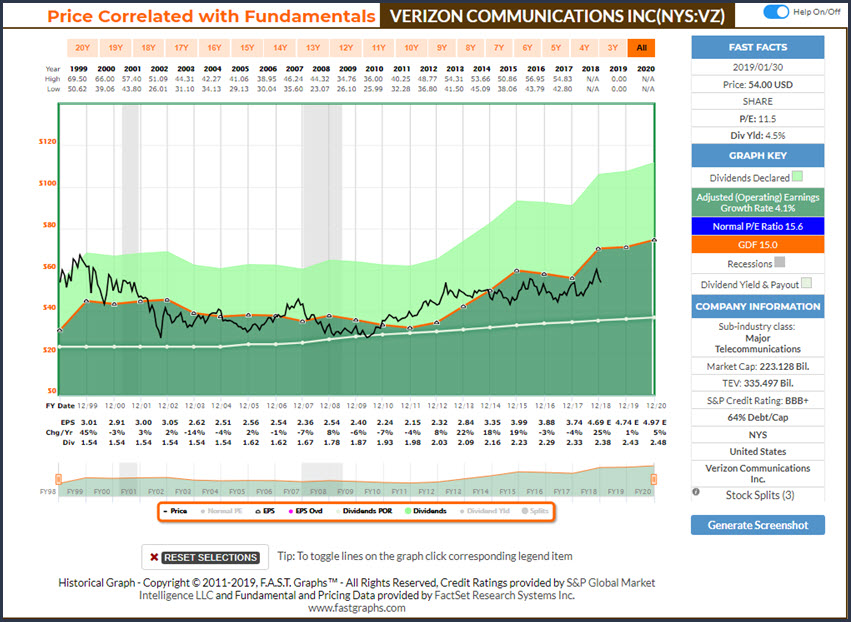

Verizon Communications (VZ)

Verizon Communications, Inc. is a holding company, which engages in the provision wireless communications products and services. It operates through Wireless, and Wireline segments.

The Wireless segment provides wireless voice and data services and equipment sales, which are provided to consumer, business, and government customers. The Wireline segment offers broadband video and data; corporate networking solutions; data center and cloud services; security and managed network services; and local and long distance voice services. The company was founded on June 30, 2000, and is headquartered in New York, NY.

(Click on image to enlarge)

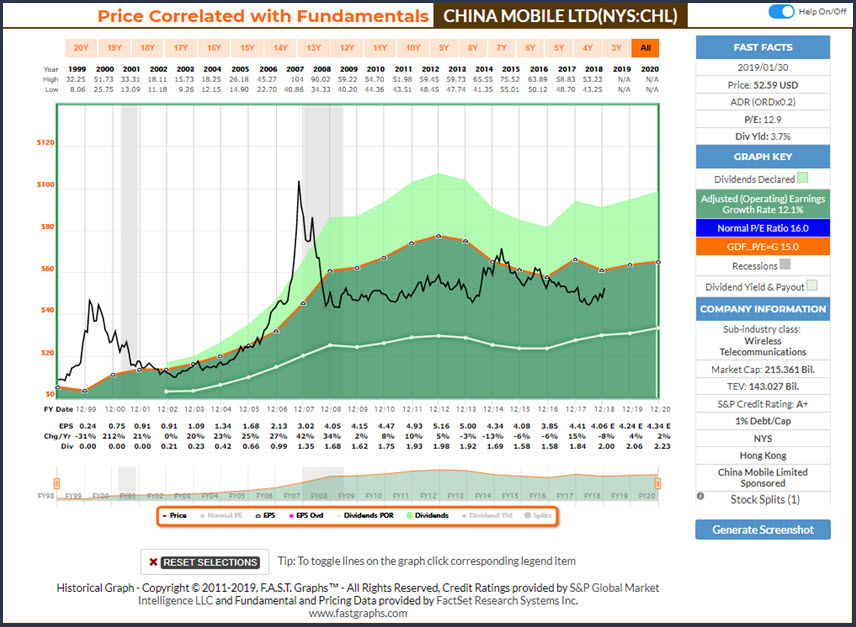

China Mobile (CHL)

China Mobile Ltd. operates as an investment holding company, which provides telecommunications and other related services in Mainland China. The company was founded on September 3, 1997, and is headquartered in Hong Kong.

(Click on image to enlarge)

FAST Graphs Analyze Out Loud Video: 5 Research Candidates In The Communication Sector

Video Length: 00:10:24

Summary and Conclusions

In my personal experience, I have come across a lot of investors that have a rather simplistic view of investing in stocks. To many investors, you only invest in a stock with the hope or idea that it will go up in price. It doesn’t occur to these people that there are many reasons why an investor might invest in a certain stock. In some cases, it might be for a belief in the company’s long-term growth potential. Or, a stock can be chosen because it is considered safe. In some cases, you may choose a stock simply because it offers an above-average dividend yield that you consider safe. My point is that there are a lot of reasons for owning a stock other than hoping that the price will increase.

As it relates to this article, this is important because the research candidates presented in this article are not expected to produce a lot of growth. Therefore, the primary allure of most of these 5 research candidates is above-average dividend income. However, dividend growth is either inconsistent, low or in some cases both. Stated succinctly, I am not very fond of investing in the Communications Sector. However, I do hold small positions in Verizon and AT&T. In both cases, I see them as higher-yielding alternatives to sitting in cash, or I am simply using them to beef up the yields in retirement portfolios.

Finally, even though I do not expect a lot of growth from either AT&T or Verizon, I do consider both significantly undervalued. Consequently, both candidates could produce exceptional short to intermediate term capital appreciation as a result of P/E ratio expansion. In other words, with their stock price reverting to a mean valuation over the next year or two. But most importantly, it should be clear that I’ve not deluded myself into believing that either of these companies can ever make me rich. Instead, I hope they continue to pay me an above-average dividend while I wait and look for better opportunities to manifest. Sometimes, those are reasons enough to temporarily own stock, at least in my humble opinion.

Disclosure: Long VZ, T.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the ...

more