Tuesday Talk: Market Bubbles And Global Troubles

Just under a week into the Biden administration, the stock market seems to be staying the course. Yesterday the Dow Jones Industrial Average (DIA) closed down 37 points at 30,960. On Inauguration Day last Wednesday, it closed up 116 points at 30,930. The closes for the S&P 500 (SPX) and the Nasdaq (NDX) on Monday were 3,855 and 13,635, respectively. The S&P gained 14 points and the Nasdaq gained 93 points. Currently, futures for the 3 indices are trading light green with a twinge of red. Concern regarding COVID-19 globally and in the U.S., uncertainty regarding Biden's stimulus package and US-China trade tensions are some of the issues weighing on market makers this morning.

Another issue on the mind of TalkMarkets contributor Raymond Matison is the state of the U.S. Dollar. Writing in USD Has Crossed The “Event Horizon”, an exclusive for TalkMarkets, Matison says:

"(The) unrelenting growth of national debt, which is the basis for currency creation has reached a global inflection level such that the value of fiat currencies across the globe, with several notable country exceptions, are drawn into a whirlpool of decline that will ultimately result in its near-complete loss of value."

Matison in his long and detailed article cites several examples of just why he believes this to be the dollar's fate (UDN). A contrarian to much we have been hearing elsewhere he believes that, "The virus pandemic will continue to depress economic activity, employment, incomes, and social stability for the next several years."

Much of what Matison writes may seem alarmist, but against the backdrop of a hot stock market it can't hurt to listen to other voices. In the end he is an advocate for blockchain currency as the asset to get the world out its current currency conundrums. Below are some of his concluding thoughts:

Both the Russian and South Korean economies ended 2020 better than anticipated.

TalkMarkets Contributor and economist Dmitry Dolgin writing in Russian Industry: 2020 Ended On An Upbeat Note notes that, "According to preliminary data, Russian industrial production saw a very shallow 0.2% year-on-year drop in December 2020, which is significantly better than the -3.0% Reuters consensus and our expectations of -1.5%...the full-year drop in industrial production was limited to -2.9% YoY, which is better than the -3.5% we expected."

Dolgin writes that much of the decline in Russian industrial production in 2020 was due to a decline in commodities extraction (oil and gas) but he finds other good news which offsets this (RBL).

"The manufacturing sector managed to post 0.3% YoY growth, as the drop in oil downstream, metals processing, and car manufacturing has been offset by an increase in consumer-focused production, including food, clothes, pharmaceuticals, furniture and construction materials used in renovation. "

His outlook for the beginning of 2021 is cautious. "Industrial growth above 3.0-3.5% in 2021 would require continued recovery in the consumer and investment trend, with fiscal policy potentially playing a crucial role...We see scope for fiscal or monetary support to industrial output as limited."

действовать осторожно

Robert Carnell in his article Korea Finishes 2020 With Strong Growth says full year GDP in South Korea only declined by 1% and notes that "To finish 2020 with GDP growth only down one percent for the full year, during the worst natural global catastrophe in modern times, is actually a pretty good result for Korea."

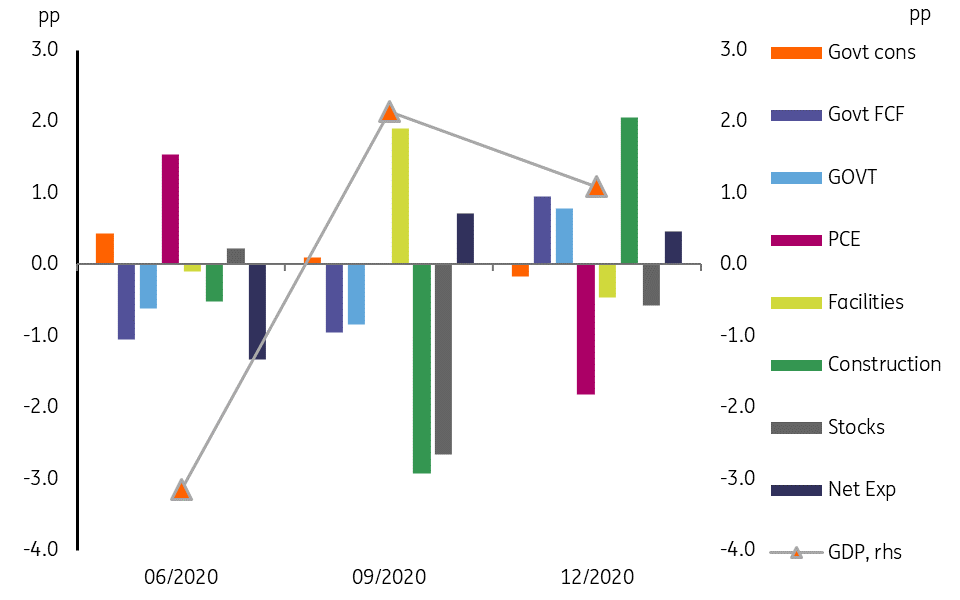

Carnell includes the following chart showing how different sectors in the economy contributed to the country's Q-o-Q growth:

Contribution to QoQ% growth

One can clearly see the contribution of government stimulus and construction as the major contributors. Carnell explains as follows:

"Government support is also evident in the contribution to growth figures, where government fixed capital formation provided about 1.0pp of the 1.1% QoQ headline total for GDP. This was more than the 0.8pp private sector fixed capital formation, and private consumer expenditure delivered a drag of around 1.8pp - reflecting the economic damage that social distancing measures deliver."

South Korea (EWY) to date has been one of the economies that has done a better job of handling the COVID-19 pandemic. With regards to 2021 Carnell has this to say:

"Assuming that we see a stronger second half in 2021 (taking the pandemic into account), then we can see Korea achieving 2.6% GDP growth for full-year 2021. This will likely be accompanied by some recovery in the rate of inflation. Headline inflation is currently only 0.5%YoY, but which could rise above 1.0% by the April release, and come close to 2.0% by July..."

Back in the U.S. TalkMarkets contributor Erik Conley writes We Are Now Officially In A Stock Market Bubble.

"It has often been said that asset bubbles can’t be identified except in hindsight. I disagree...We are now in the most overpriced market in history, bar none. We can, and probably will, go higher as the speculative juices of investors cause them to continue to buy equities with little regard for valuations..."

Using history as an example Conley notes that in 1996 then Fed Chair Alan Greenspan cautioned that the stock market was overvalued. The market continued to climb for four years.

"When this bubble finally burst in 2000, the Nasdaq (QQQ) fell 78% from peak to trough, leaving in its wake a slew of dotcom bankruptcies and the broken dreams of investors who thought we were in a new era of unending prosperity."

Conley's article continues with a look back at several historical bubbles, including the Dutch Tulip Bubble of 1636-1637 and the South Sea Company Bubble which started in 1711 and burst in 1720. As for more recent bubbles he includes the following chart of the above noted Dot.com bubble:

Chart of the NASDAQ Index from peak to trough

In conclusion Conley tells us this of the current market bubble:

"The True Believers will continue to buy every dip in the market. They have made lots of money thus far. But at some point, there will be a “Come to Jesus” moment when they realize that the game is over. The bubble has burst and everyone around them is headed for the exits. And they will suffer significant losses, due to their stubborn clinging to the ever-expanding bubble myth."

Moe Zulfiqar in a short piece entitled U.S. Economy Isn’t Out Of Danger Zone Yet; Expect Problems In 2021 has some notes of caution as well. Here are a few of them:

- "The U.S. economy remains frail. Don’t for a second think that the economic slowdown that began in 2020 is finished yet. The reality is that it’s far from over, and there could be a lot of trouble in 2021. Don’t let the stock market performance fool you into believing everything is great."

- "In the coming quarters, I suspect that the U.S. economy will slow down a bit. Currently, the Federal Reserve expects gross domestic product (GDP) to grow by 4.2% in 2021. This may be a slightly optimistic projection. "

- "What happens if the economic growth is lower than expected? Investors have bought into the idea that the U.S. economy is fine and that everything is great. If it’s not as rosy as expected, don’t be shocked to see investors sell their stocks."

Alright, enough with that, we're still here to invest...

Brad Thomas in his article 145 Million Americans Own REITs, Are You One? makes the case for real estate as a sector ripe for investment in 2021. Despite dismal news in the sector which Thomas does report on he says he is not dissuaded.

"Everyone needs to interpret that information as they see fit according to their personal risk assessments and financial positions, of course. For my part though, I’m still busily – and successfully – building up a beautiful REIT paradise in the middle of all this. That dream hasn’t even come close to dying, despite the sobering news."

To wit Thomas has found three REITs which he suggests investors look at:

- "Scotiabank upgraded Kilroy Realty (KRC) from Sector Perform to Sector Outperform and raised its price target by $10 to $67."

- "Compass Point upgraded Regency Centers (REG) from Neutral to Buy and raised its price target by $4 to $54."

- "Innovative Industrial Properties (IIPR) closed on a 295,000 square-foot industrial property in Alachua, Florida, and signed a long-term, triple-net lease there with a subsidiary of Harvest Health & Recreation to run a cannabis cultivation and processing facility."

That's a wrap for this week. I'll leave you with this quote from management guru Peter F. Drucker:

"Efficiency is doing the thing right. Effectiveness is doing the right thing.

Thanks for linking to @[Erik Conley](user:149668)'s article in this excellent round up. I had not known of him before today, but his article was quite interesting and I've added him to my follow list.