Thoughts For Thursday: Taper Me Higher

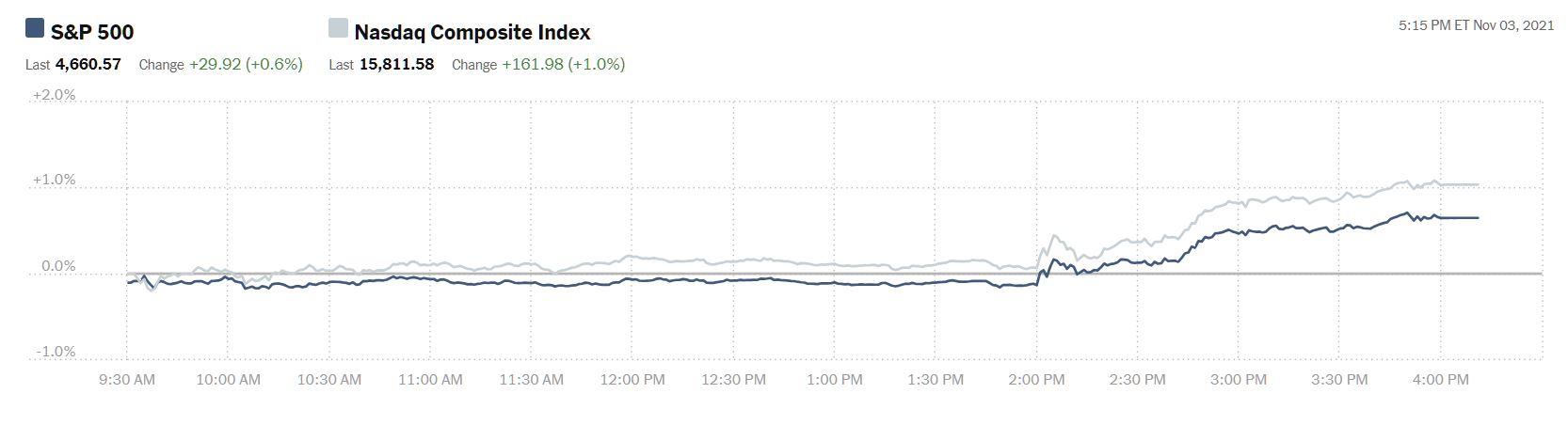

Despite generating more talk among the "talking heads" Jerome Powell's remarks about inflation were music to Wall Street's ears. The market responded to the anticipated bond taper and no change to interest rates news by closing even higher. As of Wednesday's close the S&P stands at 4,661, up 30 points, the Dow is at 36,158, up 105 points and the Nasdaq Composite stands at 15,812, up 162 points.

The below chart of yesterday's action clearly shows the positive reaction in equities to Fed Chair Powell's remarks:

Chart: The New York Times

This morning market futures are mixed. S&P futures are trading up 6 points, Dow futures are down 13 points and Nasdaq 100 futures are trading up 58 points.

TalkMarkets contributor Diego Colman reports that the Russell 2000 Explodes To Record High As Fed Taper Fails To Dent Risk Appetite.

"The Russell 2000 surged 1.8% to an all-time of 2,404 on Wednesday, supported by positive sentiment towards domestically oriented small and mid-caps following strong services and employment data. For context, the ISM non-manufacturing indicator rose to 66.7 in October from 61.9 in September, blowing past expectations and hitting its highest level on record, a sign that demand is accelerating in the most important sector for the economy. Labor market results also topped forecasts, with private businesses hiring 571,000 workers last month according to the ADP Research Institute, versus estimates of 370,000 new jobs."

"While some short-term profit-taking is possible, equities are likely to remain supported through the end of the year, but leadership could shift to cyclical plays as the recovery picks up traction, especially in the services sector. That said, the Russell 2000 (IWM), which has traded sideways since mid-March and has just staged a bullish breakout, could run higher and command strength over the medium term."

Russell 2000 Daily Chart

The Staff at contributor Bespoke Investment Group in an article entitled Love For The Taper charts market behavior on Fed policy announcement days since 1994.

"For the entire data set of Fed days since 1994 (dark blue line), the S&P has historically trended higher throughout the day with only a small dip in the immediate aftermath of the 2 PM ET announcement. Since Powell became Fed chair in early 2018, the intraday action has been quite a bit different (red line). Especially early on in Powell’s tenure, the S&P had a pattern of posting solid intraday gains prior to the 2 PM announcement but then trading sharply lower during the Fed press conference into the 4 PM ET close."

"The opposite pattern emerged today. Instead of trading higher heading into the 2 PM announcement, the S&P was in the red all day leading up to the Fed release. At 2 PM when the Fed statement came out (including the official announcement of tapering asset purchases), the S&P got an initial jolt and traded into positive territory. Then when Powell’s presser began, the S&P saw another intraday jump, and then it continued to rally into the close. Had Powell known that the taper would cause this type of reaction, maybe he would have done it sooner!"

Contributor Danielle Park explains that Tapering Means Less Liquidity To Inflate Risk Markets. Park comments as follows:

"...it’s worth noting that (as shown below) past tapering periods have coincided with rising government bond prices/falling yields. Also, with a strengthening U.S. dollar and falling commodity prices. This makes some sense since tapering is tightening and means fewer greenbacks sloshing around for financial speculation."

"David Rosenberg called B.S. on the demand-link to crude prices in his Early Morning Note today:

“It is very interesting from my end to be seeing U.S. consumer gasoline usage still down 0.5% from the pre-pandemic level, miles driven down more than 3% and air travel down more than 20%. And yet, WTI is $83 per barrel now compared to $58 per barrel back then. So where has this demand boom come from? The answer —from the speculators on the NYMEX, seeing as their net long positions in futures and options have soared more than 20% from where we were just before COVID-19 hit hard in February 2020 (just under 500,000 net speculative long contracts at the current time)."

"So look for oil to move lower or stabilize in the $70-$80 range, as other pundits are predicting (BNO).

"The global economy is slowing into 2022, and as charted ...below, the U.S. 10-year bond yield remains lower than last March. Ditto with 20 and 30-year yields.

Central bank tapering won’t fix supply bottlenecks globally. But it does take some of the gambling money away from QE-engorged risk markets, and this should help reduce commodity speculation and its cost-push inflation in the real world."

Jeffrey P. Snider asks What Does Taper Look Like From The Inside? Not At All What You’d Think. In a detailed and chart filled article Snider explains to us the history (in his view) of tapers past; citing economic events and the words and actions of Fed officials who preceded both Powell and the pandemic. The article is lengthy and requires some slogging but impatient readers can be rewarded by jumping to Snider's concluding points which I have quoted below:

"What has changed in November 2021 as taper again takes center stage, at least in the media? You can bet that five years from now we (or I) will find practically the same quotes as I’ve fished out from nearly eight years ago. I’d be shocked if most aren’t almost word for word."

"Taper is a specific kind of illusion. The Fed today wants to project confidence in the same flawed unemployment rate, and the market is betting on those same flaws along with the same technical monetary problems (starting in collateral) meaning the outcome not likely at all to be any different. At least for the FOMC, tapering in UST’s will come at a nice, pleasing $10 billion reduced pace."

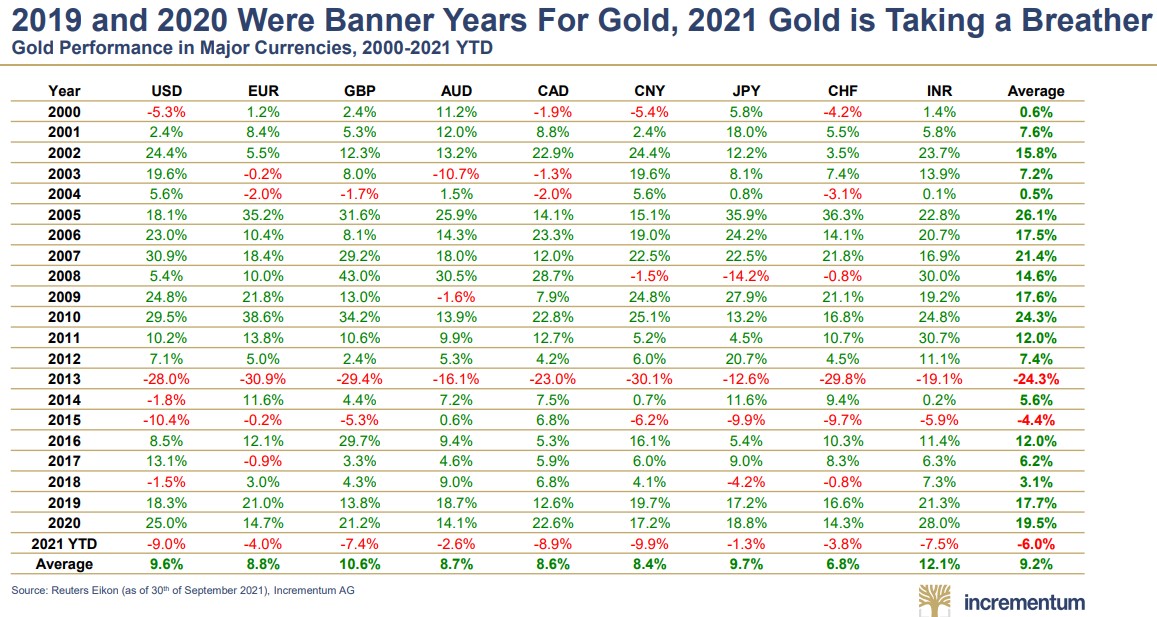

In the hedging against inflation department, contributor Mircea Vasiu asks Should You Buy Gold Now That Inflation Is Rising? Vasiu goes back 20 years and measures gold's (GLD) performance against major currencies and notes that for "2021, gold is taking a breather".

It is a good article and worth the read if you have any interest in gold as an asset, whatsoever. In conclusion Vasiu has this to say:

"Yesterday, the Federal Reserve of the United States announced the tapering of its asset purchases. One of the reasons to slow down asset purchases is rising inflation. As such, there may be scope to own some gold after all – especially if we consider the historical returns."

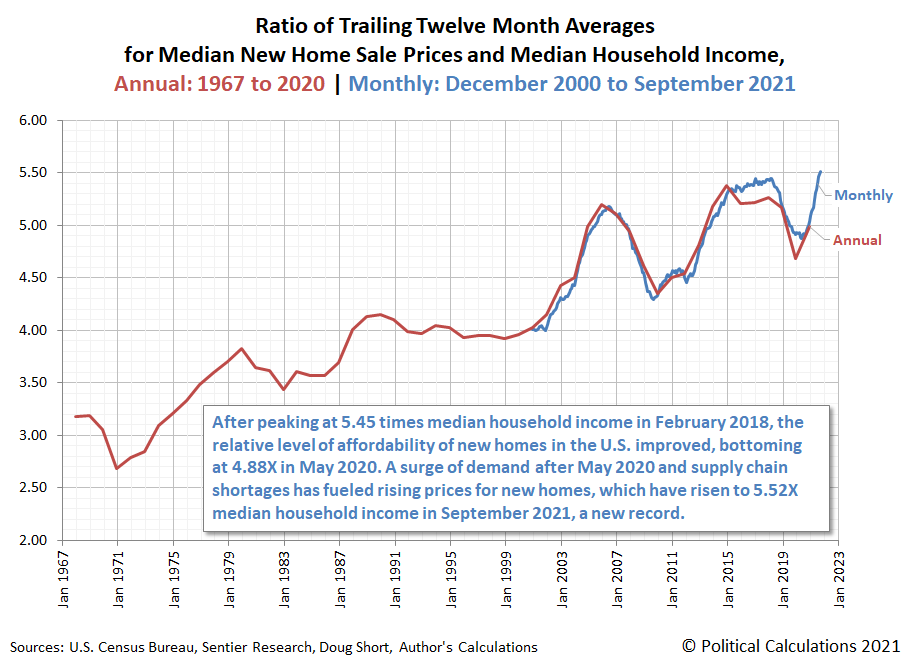

Elsewhere, TM contributor Ironman takes note that (putting discussions of inflation being transitory or persistent, aside) New Home Affordability Weakens In September 2021 and "(Through September 2021), the median new home sale price in the United States rose to cost 5.52 times the median household income, setting a new record for this measure."

The article continues with additional charts measuring the relative affordability for homes in the U.S.

To close out today's column and bring us down from the stratosphere of high stock prices and (somewhat, esoteric) asset tapers, noted economist and former Secretary of Labor Robert Reich in a short video entitled How Wealth Inequality Spiraled Out Of Control expounds on the proposition that "Wealth inequality is eating this country alive."

Put in terms that all of us can relate to Reich notes that, "Elon Musk’s (TSLA) wealth has surpassed $200 billion. It would take the median U.S. worker over 4 million years to make that much."

That is certainly something to think about. Have a good rest of the week and weekend.

Levantine Acorns - Photo: David Marshall

For those petroleum speculators: I wish them "lots of luck" and every bit of it BAD!!Driving fuel prices up is not what we need right now, or ever, for that matter.