Tapering Means Less Liquidity To Inflate Risk Markets

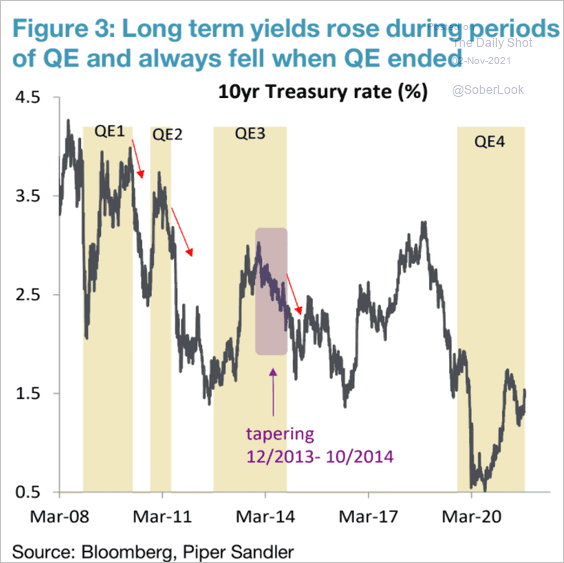

As the U.S. Fed announces a $15 billion per month tapering of its Q.E. injections into the financial system, it’s worth noting that (as shown below) past tapering periods have coincided with rising government bond prices/falling yields.

Also, with a strengthening U.S. dollar and falling commodity prices. This makes some sense since tapering is tightening and means fewer greenbacks sloshing around for financial speculation. Since May, many economically-sensitive commodity prices have already been off the boil, but highly financialized ones like oil and copper continued to levitate into October before weakening this week.

David Rosenberg called B.S. on the demand-link to crude prices in his Early Morning Note today:

“It is very interesting from my end to be seeing U.S. consumer gasoline usage still down 0.5% from the pre-pandemic level, miles driven down more than 3% and air travel down more than 20%. And yet, WTI is $83 per barrel now compared to $58 per barrel back then. So where has this demand boom come from? The answer —from the speculators on the NYMEX, seeing as their net long positions in futures and options have soared more than 20% from where we were just before COVID-19 hit hard in February 2020 (just under 500,000 net speculative long contracts at the current time).

Trillions in debt-financed emergency payments to the private sector hyped expectations of run-away inflation and insatiable demand, but that money’s now spent. The global economy is slowing into 2022, and as charted by my partner Cory Venable below, the U.S. 10-year bond yield remains lower than last March. Ditto with 20 and 30-year yields.

(Click on image to enlarge)

Central bank tapering won’t fix supply bottlenecks globally. But it does take some of the gambling money away from QE-engorged risk markets, and this should help reduce commodity speculation and its cost-push inflation in the real world.

Disclosure: None.