Thoughts For Thursday: Market Expectation - No Change In Fed Funds Rate

The escalating conflict in the Middle East, the release of September CPI data and the House vote for Steve Scalise as Speaker are just 3 items, awaiting investors at today's market open.

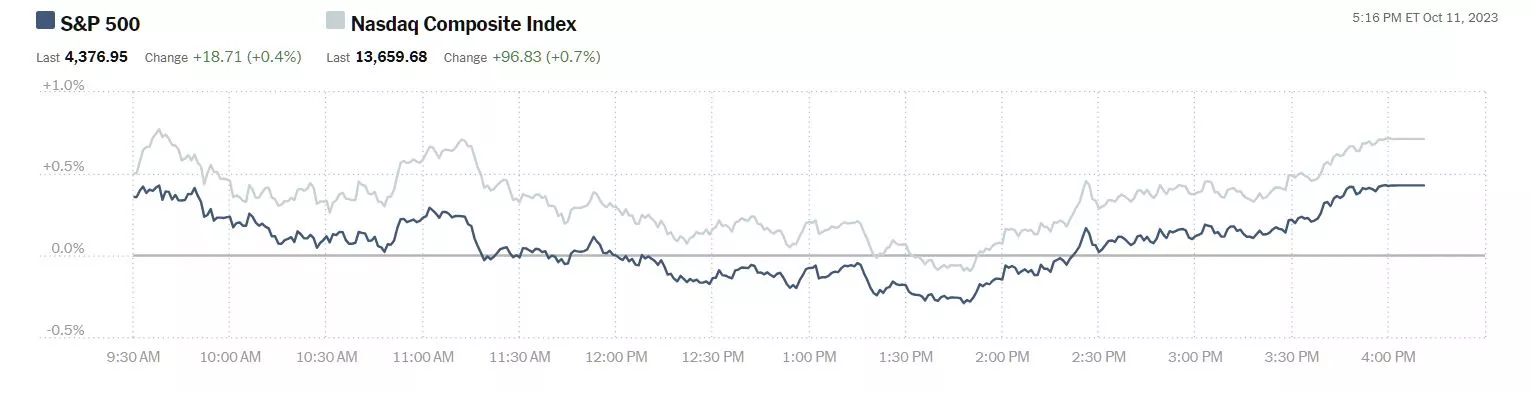

Wednesday the S&P 500 closed at 4,377, up 19 points, the Dow closed at 33,805, up 66 points and the Nasdaq Composite closed at 13,660, up 97 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), down 0.2%, followed by Exxon Mobil (XOM), down 3.6% and Advanced Micro Devices (AMD), down 0.6%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are trading up 17 points, Dow market futures are trading up 118 points, and Nasdaq 100 market futures are trading up 62 points.

TalkMarkets contributor Patrick Munnelly summarizes activity in the markets in his Daily Market Outlook - Thursday, Oct. 12.

"Asian equity markets saw gains, supported by Wall Street's rebound and dovish Fed commentary. The Nikkei 225 advanced following softer PPI data and dovish comments from BoJ Board Member Noguchi. Hang Seng and Shanghai Comp. were up, with Hong Kong leading the way by breaching the 18K handle. Chinese banks were bolstered by reports of China's sovereign wealth fund increasing its stake in domestic banks for the first time since 2015.

The latest UK GDP data indicated a modest 0.2% monthly rebound in August, mainly due to the unwinding of one-off factors that impacted July's 0.6% decline, such as inclement weather and high strike activity. Services output increased by 0.4%, while construction and industrial production fell. The data suggests Q3 growth may come in below the Bank of England's forecast of a small output rise.

The September US CPI report is the significant release today, with expectations for headline inflation to remain at 3.7%, driven by a rise in gasoline prices. Core inflation is expected to have fallen further to 4.1% from 4.3% in July, reinforcing expectations that the US Federal Reserve will leave interest rates unchanged at its November 1st monetary policy update... (Today) the European Central Bank will release minutes from last month's policy meeting, where interest rates were raised for the 10th consecutive time, and the ECB hinted that it might be the last increase."

Contributor Chris Kimble questions if Important Market Breadth Indexes Signaling Risk Off?

"When market breadth turns south, savvy investors know that it’s time to remain cautious.

And that’s been the case for the past several weeks. And it’s looking perhaps even worse today.

Below are charts of the NYSE Advance-Decline Line (upper pane) and the Equal Weight S&P 500 Index ETF (RSP).

With so many bulls in the media, it’s a bit ironic that so many seem to wonder why the market is struggling and risk-on assets not doing well.

Note that the Advance-Decline Line peaked with a double top in 2021 and RSP peaked 22 months ago.

Furthermore, risk-on investors might want to keep an eye on what is happening with RSP at (1). It’s not looking so good right now. Stay tuned!"

Changing direction slightly TM contributor Bill Conerly writes AI And The Economy: Better Marketing And Sales Good For Consumers But Not Statistics.

"Marketing and salespeople appear likely to become far more productive thanks to artificial intelligence, especially the generative AI typified by ChatGPT. In a surprising paradox, better sales and marketing won’t increase total spending in the economy by more than a tiny amount. AI will, however, increase customer satisfaction...

Some of the effects will be AI helping to write pitches. More importantly, messages will be targeted more narrowly to a prospect’s particular circumstances. Companies with long-term relationships with customers can use AI to better identify the products that a particular customer will want...

The result of AI will be consumers presented with buying options better suited to their needs and wants. Pricing may also be better. If multiple vendors can figure out what a particular consumer wants, then they will compete on price. There is also the possibility that AI will help businesses realize which customers are not price-sensitive so that they can charge them more. That’s more likely to be the case with customers who are loyal to one vendor rather than shopping around. Overall, pricing is likely to drop rather than increase.

Amazon (AMZN) was recently found to use an algorithm called Nessie to evaluate how competitors would adjust prices in response to Amazon changes. Such practices could lead to higher prices in some circumstances. In these early days of artificial intelligence applications, gains will accrue to early adopters. Eventually, though, many competitors will have access to good AI-informed applications that will lead to more competition, which will drive prices down...

Consumers will be better off because more often they will find the exact products they most prefer, without having to settle for something else. That will make them better off in terms of satisfaction. They will also likely find better prices more easily. That will enable them to buy more goods and services for the total amount of money they have chosen to spend...

The big wins come when a person spends $10 for a product that the consumer would have been willing to pay $15 for. That $5 difference economists call “consumer surplus,” and it captures how much better off the consumer is. Unfortunately, we have no reliable way to find out what the consumer really thought it was worth, so we don’t include consumer surplus in the economic statistics. But the concept is sound, even if unmeasurable. And consumer surplus will increase as companies and consumers both use artificial intelligence."

2023 has not been a good year for cryptocurrency by and large. Contributor Tim Knight writes Crypto: The Thrill Is Gone.

"A few years ago, if you were a compulsive gambler and wanted excitement, the world was your oyster thanks to meme stocks and crypto. Crypto in particular was insanely volatile, with Bitcoin (BITCOMP), for example, zooming and crashing by tens of thousands of dollars on a nearly constant basis.

These days? Not so much. Crypto is now mainly known for (1) FTX (FTT-X) (2) Caroline Ellison Halloween masks (3) Bitcoin costing pretty much $26,000 or so no matter when you look. Instead of moving up and down by tens of thousands of dollars, Bitcoin moves up and down by hundreds. No one gives a crap anymore.

See Knight's article to see a Bitcoin cluster chart for the years, 2020-2023.

In the "Where To Invest Department", TalkMarkets contributor Derek Lewis picks Bull Of The Day - Amazon.

"

Amazon (AMZN) is one of the most widely-recognized e-commerce giants, with the company also enjoying a dominant space in cloud computing thanks to AWS (Amazon Web Services).

It’s one of several stocks that have helped lead the market’s surge in 2023, being classified as one of the ‘Magnificent Seven.’

Analysts have taken their earnings expectations higher across the board, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy)...

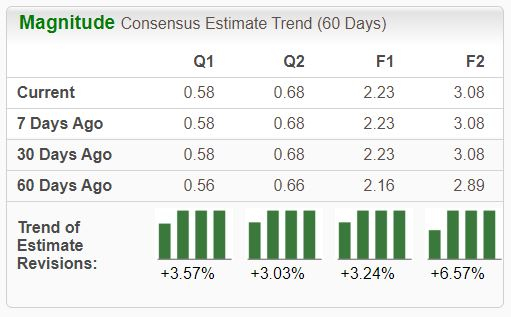

Zacks Investment Research

Amazon is scheduled to reveal its next set of quarterly results near late October. Currently, the Zacks Consensus EPS Estimate of $0.58 suggests a 190% improvement from the year-ago quarter, with our $141.9 billion quarterly revenue estimate implying growth of 11.6% year-over-year.

The revisions trend has been notably bullish for the quarter-to-be-reported, with the $0.58 per share consensus estimate up nearly 50% since July.

Zacks Investment Research

In addition, it was recently revealed that Amazon will invest up to $4 billion in Anthropic, an AI safety and research company based in San Francisco and a rival of OpenAI. We’re all aware that AI is Wall Street’s shiny new toy in 2023, constantly dominating headlines...

The top 5% of all stocks receive the highly coveted Zacks Rank #1. These stocks should outperform the market more than any other rank.

Amazon would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy)."

As always, caveat emptor.

That's a wrap for today.

Peace.

More By This Author:

Tuesday Talk: War, What Is It Good For? The Stock Market

Thoughts For Thursday: Market Pops Back, But Oil Stocks Head Down