TalkMarkets Tuesday Talk: Of Brexit And Brandade

Fresh Cod (Pixabay) and Salt Cod Hanging to Dry (Unsplash)

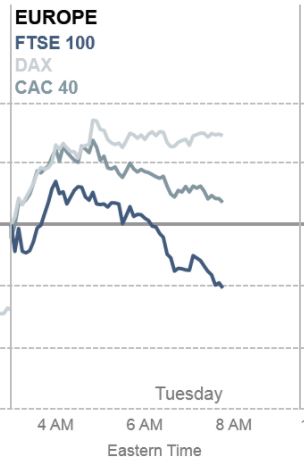

The markets continue their volatile trend upwards on optimism that there will be a Brexit deal in Europe and a stimulus package in the U.S. by year's end. Brexit hinges (or unhinges) on U.K. fishing rights, level playing fields and governance, while additional stimulus in the U.S. comes down to just plain (and complicated) old politics. Monday the S&P 500 closed at 3,647, down 16 points, the Dow closed at 29,862 down 185 points, while the Nasdaq Composite closed at 12,440, up 62 points. Currently, Nasdaq 100 futures are trading at 12,529, up 73 points, Dow futures are at 30,042, up 177 points and S&P futures are trading at 3,672, up 25 points. In Europe the markets are trading mixed, with the DAX solidly up.

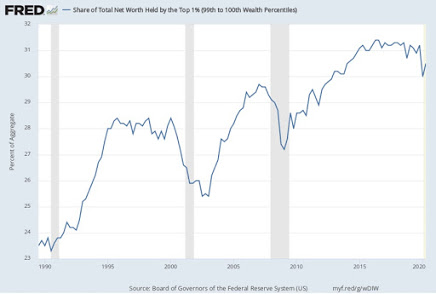

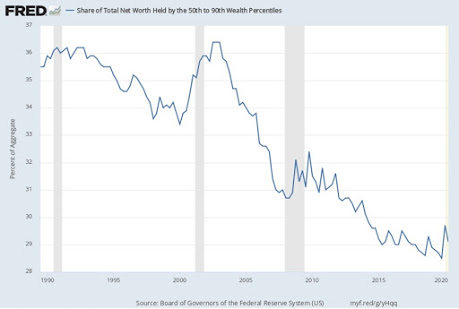

As stock market levels rise from March 2020 lows and above previous heights, indicating greater wealth creation, Timothy Taylor in his article Some Thoughts On US Wealth Patterns, takes a look at where this wealth is going and how this has changed over the last 70 years. Taylor notes that the ratio of wealth to GDP was fairly constant at around 3.6 from 1950 to 1990 and then started climbing with the rise in the stock market starting in the 1990s, after volatility stemming from the Financial Crisis of 2008, the wealth to GDP ratio is now above 5, a near all time high. What some readers may already know, this rise is benefiting the most wealthy in society at the expense of other segments of the population. Taylor notes:

"Even as the wealth-to-GDP ratio has been rising, not all groups of the wealth distribution have benefited in the same way. Lest I be accused of burying the lede here, the big story with US wealth is the growth in wealth/GDP ratio and the growing share of that wealth held by the top 1%. The share of wealth going to the top 1% shows occasional setbacks, like when the stock market fell in 2001 or in the aftermath of the Great Recession, but overall, the share of wealth going to this group has risen from about 24% of the total back in 1990 to above 30% of the total more recently. One thinks here of some of fortunes that have been made by Microsoft (MSFT), Google (GOOGL), Facebook (FB), Apple (AAPL), along with Berkshire Hathaway (BRK-A)--all benefiting from the overall run-up in the stock market prices of these companies...

The pattern for the 50th-90th percentile is where the big shift happens. This group had about 36% of total wealth in 1990 and still had about that same share in the early 2000s. But since then, its share has dropped down to about 29% of total wealth. In ownership of real estate or financial assets, this group is benefitting considerably less from the run-up in wealth/GDP than the top 1%. This group is often what is called the "middle class" in a US context."

If you missed that, Taylor is talking about Joe and Jane Investor. Some smelly fish indeed. Taylor includes the following charts (and others) for illustrative purposes:

Wealth held by top 1%, 99th to 100th Wealth Percentile

Wealth held by the "Middle Class", 50th-90th Wealth Percentile

TalkMarkets contributor David Vomund in a TM exclusive, Be An Optimist, reminds us that history reveals that over time, the stock market provides proven rewards for those willing to take properly calculated risks. His words below are certainly timed to the holiday season:

"For those 60 and younger, however, it’s important to know that there is more than 100 years of data suggesting a large portion of their portfolio should be in stocks, especially the more stable large-cap dividend payers. For those over 60, own some higher-yielding fixed-income instruments and preferreds in addition to stocks.

What about buying at the high? If you bought the S&P 500 at the top right before the 2008 financial crisis you’d be up 220 percent today, including dividends. If you bought in February 2020 right before COVID-19 you’d be up 15 percent. Every bear market ends with stocks soon hitting new highs. If your timing is bad and you buy near the top, the next bear market will make it right. It already has."

In a TalkMarkets Editor's Choice column, Robert Rapier looks at the oil industry. In The Oil Industry Is Climbing Out Of A Hole, Rapier notes what some people may have overlooked:

"Since early November the oil industry — which some had declared dead after the crushing losses earlier in the year — has gone on an impressive rally. ExxonMobil (XOM) shares are up 27% in one month. Chevron has risen 37% (CVX). Royal Dutch Shell (RDS-A) shares are up 60%. ConocoPhillips (COP) is up 49%."

The reason for the rally according to Rapier is the positive vaccine news. However he notes that the industry overall is much worse off than a year ago. The same companies that are now rallying are nonetheless down substantially for the year.

"ExxonMobil is down 41%, Chevron is down 22%, Shell is down 39%, and ConocoPhillips is down 29% over the past 12 months. The outlook is definitely improving, but these companies are still in a hole. At least at this point, there is hope that they will climb out of it in 2021."

As markets continue to recover several TalkMarkets contributors are on the lookout for where to park their cash. Nikos Sismanis finds 6 Preferred Stocks To Buy Right Now, And 1 To Avoid. You can find all the specifics in the article which starts with a short primer on Preferred Stocks, along with detailed analysis of Sismanis' picks.

"Preferred Stock Glossary

For your own convenience in reading the rest of this report, we have listed the following preferred-stock-related terms and their corresponding meaning:

- Par Value: The par value of preferred stock is the amount upon which the associated dividend is calculated. For instance, if the par value of the stock is $100 and the coupon/dividend is 5%, then the issuing entity must pay $5 per year for as long as the preferred stock is outstanding (usually on a quarterly or monthly basis).

- Call date: The call date is a day on which the issuer has the right to redeem a callable preferred at par, or at a small premium to par, prior to the stated maturity date.

- Redemption date: The redemption date is the date the issuer is obligated to redeem the preferred at par, and all of its accrued unpaid dividends. Most preferred stocks are irredeemable, remaining active for long as the issuer sees fit. In other words, they are perpetual.

- Yield to call: The Yield to call (YTC) refers to the return a preferred stockholder receives if the preferred stock is held until the call date, which occurs sometime before it reaches maturity.

- Yield to redemption: The same as YTC, but for the redemption, if stated."

Simsmanis suggests the following: 1) GasLog Ltd. Series-A (GLOG), a liquified natural gas carrier; 2) Gabelli Utility Trust Series-C (GUT), a fund which invests in stocks of companies providing products, services, or equipment for the generation or distribution of electricity, gas, water, telecommunications services, and infrastructure operations; 3) Landmark Infrastructure Partners LP – Series C (LMRKN), the company acquires, develops, owns, and manages a portfolio of real property interests and infrastructure assets in the United States; 4) Gladstone Investment – Series D (GAINM), the company primarily provides loans to lower middle-market businesses; 5) Höegh LNG Partners LP – Series A (HMLP), Hoegh owns, operates, and acquires floating storage and regasification units (FSRUs), liquefied natural gas (LNG) carriers, and other LNG infrastructure assets under long-term charters; and 6) Global Net Lease – Series A (GNL), is a publicly-traded REIT focused on commercial properties, with an emphasis on sale-leaseback transactions involving single tenant, mission-critical income producing net-leased assets across the United States, Western and Northern Europe.

Contributor Manisha Chatterjee, looking towards a 2021 recovery in 4 Top Entertainment Stocks To Watch For 2021 suggests four established communication and entertainment stocks that should be set to rebound solidly in the new year.

"Going into 2021, it is wise to consider established entertainment companies such as Walt Disney Company (DIS), Netflix, Inc. (NFLX), Comcast Corporation (CMCSA), and Charter Communications, Inc. (CHTR) that have displayed business resiliency amid these trying times and are getting ready to maintain their momentum in a post-pandemic economy."

Chatterjee includes current reviews of each of these picks.

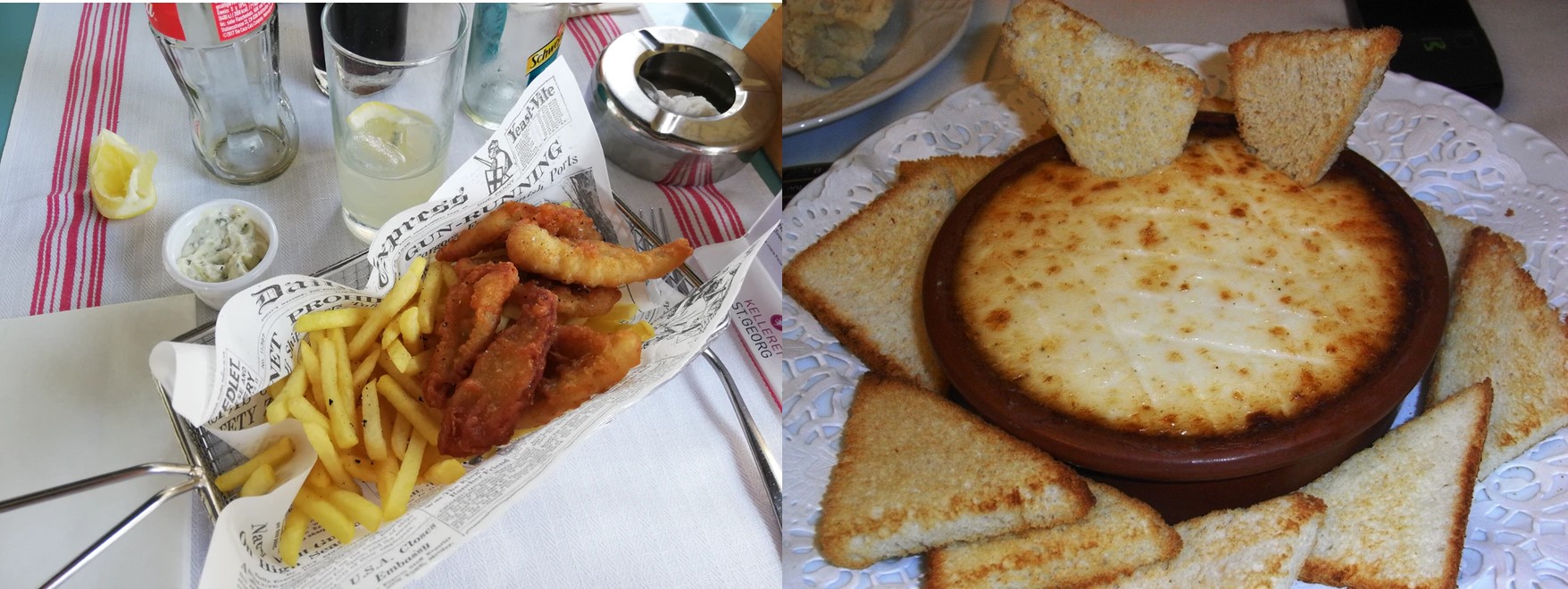

Eaten in winter Brandade is an emulsion of salt cod, olive oil, and potatoes. In France it is called brandade de morue and in Spain it is called brandada de bacalao. In Britain cod is often used to prepare fish and chips. Here's to the U.K. and the EU settling on fishing rights and all the rest by Christmas.

Unsplash and Wikipedia-JLastras

I'll leave you to try your luck at the recipe links included above.

Have a good week.

Very interesting and also quite educational. And the rich get richer because those setting the rules want to "take care of their friends." Certainly those in government know how to help themselves. AND by the way, that is NOT doing meany favors. The fact, verified by history, is that people will put up with a great deal of misery, if it is heaped on slowly. Then all at once, just a small bit more, and the revolution ignites, or even explodes. Where that level of misery that leads to revolution can only be guessed at, and what will trigger the explosion may be a very small spark that did nothing a hundred times before. Thus the government and the 1% really need to remove some of the misery occasionally.