6 Preferred Stocks To Buy Right Now, And 1 To Avoid

Since COVID-19’s initial selloff around March, the overall market indices have been rallying continuously, with relatively limited volatility and strong investor confidence. During this time, the technology sector has become the new safe-haven and go-to place when one is pondering on where to allocate capital in the market.

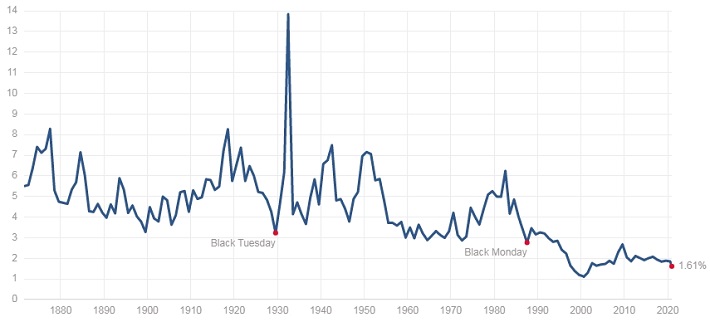

However, combining the sector’s already tiny yields, coupled with lifting the rest of the market higher, the S&P500’s dividend yield has been near all-time lows, following the general trend of declining trends. The index currently yields around 1.6%, which reflects the current scarcity of higher-yielding securities. Simultaneously, U.S. T-bills offer yields that hardly cover for inflation, leaving no margin for investors to make a return on their investment in real terms.

As a result, income-oriented investors currently have a hard time to find income-producing securities, with most of the higher-yielding ones having significant risks attached. Thankfully, another category of equities has historically been an excellent source of stable income streams, most often featuring a more balanced risk/reward investment case. These are none other than preferred stocks.

What Is Preferred Stock?

A preferred stock is a special type of stock that pays a set schedule of dividends, which are predetermined. Unless otherwise specified, it has no claim to the company’s overall net income, as is the case with common stocks.

Preferred stocks often resemble a bond, as the dividends the company pays out are almost like the coupon payments it would pay as interest on a bond. A company is not allowed to issue dividend payments on its common stock unless it has already settled its preferred stock dividends. Most of the time, preferred stocks are cumulative. This means that if a company struggles for a while and has suspended its common stock dividends while also failing to meet its preferred stock obligations, upon recovery, it first has to settle all accrued dividends on its preferreds before resuming its common stock dividends.

Consequently, preferred stocks offer higher dividend priority than common stock, adding extra layers of assurance that investors will keep receiving their dividends. Additionally, since their returns are almost entirely predetermined, they trade more like bonds, and their price is generally uncorrelated with that of the common stock. Hence, the feature considerably lower volatility levels in times of uncertainty.

In exchange for shielding themselves into the safety of preferreds, however, preferred stockholders have no claim to any potential additional rewards, no matter how well the company is doing. Overall, preferreds offer a more balanced risk/reward type of investment, which, more often than not, is able to meet investors’ income-producing needs adequately.

It’s important to note, however, that preferred stock dividends are not guaranteed. A company’s bonds will always rank higher in the event of a hypothetical bankruptcy. Therefore investors still face some levels of risk, which greatly varies from company to company. Some preferreds are perpetual, while others are not. Some have fixed rates, while others have variable rates, and some are even convertible. Hence, each case is unique. We will be explaining those in detail whenever relevant.

Preferred Stock Glossary

For your own convince on the rest of this report, we have listed the following preferred-stock-related terms and their corresponding meaning:

- Par Value: The par value of preferred stock is the amount upon which the associated dividend is calculated. For instance, if the par value of the stock is $100 and the coupon/dividend is 5%, then the issuing entity must pay $5 per year for as long as the preferred stock is outstanding (usually on a quarterly or monthly basis).

- Call date: The call date is a day on which the issuer has the right to redeem a callable preferred at par, or at a small premium to par, prior to the stated maturity date.

- Redemption date: The redemption date is the date the issuer is obligated to redeem the preferred at par, and all of its accrued unpaid dividends. Most preferred stocks are irredeemable, remaining active for long as the issuer sees fit. In other words, they are perpetual.

- Yield to call: The Yield to call (YTC) refers to the return a preferred stockholder receives if the preferred stock is held until the call date, which occurs sometime before it reaches maturity.

- Yield to redemption: The same as YTC, but for the redemption, if stated.

6 AAA Preferred Stocks To Buy Now and 1 to avoid

Below, we have listed 6 of the best-preferred stock we believe are currently available. By “best,” we define our views on how attractive each preferred stock’s risk/reward ratio is, albeit a subjective assessment, but based on objective data. Additionally, we have included a preferred stock that is better to be avoided. The list’s order is random and does not assume a particular sorting factor.

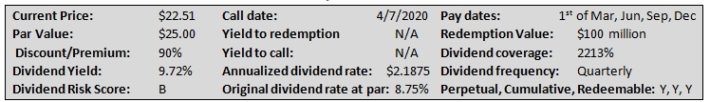

#1: GasLog Ltd. Series-A (GLOG.PA)(GLOG)

Company overview

GasLog Ltd. is the owner, operator, and manager of liquefied natural gas (LNG) carriers providing support to international energy companies. The company provides maritime services for the transportation of LNG on a worldwide basis and vessel management services. As of its latest filings it operated a fleet of 28 LNG carriers. GasLog Ltd. was incorporated in 2003 and is based in Piraeus, Greece.

Key Metrics

Preferred stock analysis

A massive dividend with ample coverage…

GasLog Ltd has issued only one series of preferred shares; it’s series A. There are 4 million shares in issue, which at a potential redemption at $25/each have a $100 million redemption value. The call date was earlier in July, though the company did not redeem its shares amid lack of such an amount of funds. For the preferred stockholders, however, this is no issue since shares are perpetual. Hence distributions will continue indefinitely unless the company eventually does redeem the shares.

Investors are currently pricing shares at a discount, pushing the stock’s yield to a hefty 9.72% to price in the possibility of a perpetual irredeemable scenario. Since the company will likely never have the funds to redeem its preferreds, such a scenario is the most likely outcome. Hence the market is pricing the stock as an annuity, expecting an annualized return equal to its dividend yield.

In terms of coverage, because Gaslog has been struggling to cover its indebtedness, it was forced to cut its common stock dividend earlier in the year. Oddly enough, this is good news for the preferred stockholders. Since the company has freed up cash to reduce its outstanding debt, interest expenses are declining, boosting its EBITDA and hence the preferred stock coverage. As a result, preferred stock dividends are currently covered by more than 22 times the company’s net cash from operations, featuring incredibly comfortable coverage.

Still, one to watch out for…

The risks that investors face in this particular case are the following: If share trade a further discount going forward, current investors may be subject to capital losses, which could result in annualized returns that are lesser than its current yield. Still, at such a high and well-covered yield, a discount would quickly raise demand for a double-digit yield, recovering the stock’s price. Another possible risk is that if the company faces bankruptcy in the medium term, preferreds will go down the drain as Gaslog has massive debt liabilities outstanding.

Still, the company can always issue more common units to take care of its debt, diluting its common stockholders while the preferred stockholders remain safe. In short, as long as Gaslog continues to be in business, its preferred stockholder should keep enjoying its current hefty dividend, powered by multiyear charter contracts.

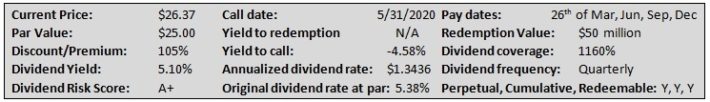

#2: Gabelli Utility Trust Series-C (GUT.PC)(GUT)

Company overview

The Gabelli Utility Trust is a closed-ended equity mutual fund managed by Gabelli Funds, LLC. The fund invests in stocks of companies providing products, services, or equipment for the generation or distribution of electricity, gas, water, telecommunications services, and infrastructure operations.

Key Metrics

Preferred stock analysis

The safest preferred stock of all…

This closed-end fund managed by the iconic investor Mario Gabelli’s outfit offers some of the safest out there that pay qualified dividends. Because the fund is focused on the predictable and low-volatility utility sector, it enjoys another layer of safety. The fund has two publicly-traded preferred series outstanding; series A and series C. They are both quite similar, and we have randomly selected its Series C in this case. GUT-C has an A1 rating from Moody’s as well.

Because CEFs have limited leverage allowances, the company can never over-borrow and fail to meet its preferred stock obligations. Combined with the additional safety of the space it invests, as well as ample coverage, it’s virtually impossible for GUT-C’s dividend to face any issues whatsoever. For this reason, this is the only company whose preferreds have been assigned an A1 rating, ever. Hence, amid creditors’ low demands, the company was able to issue its preferreds at a much lower rate than that we saw on Gaslog, this time at 5.38%.

What has probably already caught your attention is the company’s negative yield to call. Investors see GUT-C’s as an incredibly safe place to park their cash. Investors are willing to pay a premium despite the already humble initial yield. However, since the company has the option to call its shares in about 6 months, the few payments left are not enough to compensate for the $1.37 premium per share, resulting in negative returns for investors under such a scenario.

… but something to keep in mind…

Why would investors buy into the preferreds with the potential to lose money on their investment? Simple, the market bets that the company will not call its preferreds. The company can take advantage of this premium to issue additional preferred shares at the open market (ATM) – hence at a cheaper cost of “debt” equal to its current dividend yield. In other words, keeping the preferreds uncalled in this case opens a cheap borrowing vehicle for the company, which it can redeem at any point, in any case after the call date.

After some point, the quarterly dividend payments will eventually accumulate, becoming larger than the current premium, offering investors positive returns, despite the negative yield to call. For example, if the company redeems its preferreds a year after its call date, with around 6-7 quarterly payments, investors who buy at the current premium will enjoy annualized returns of around 1.77%. The more years that pass, the more the current premium will be overshadowed.

For instance, after 10 years, investors will have enjoyed annualized returns of 4.72%, converting slightly higher gradually but never above the initial coupon rate (due to the premium.) This is one unique case, highlighting an extremely safe preferred stock investment case, hence the relatively humble returns.

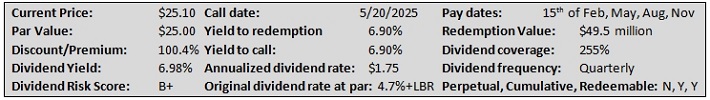

#3: Landmark Infrastructure Partners LP – Series C (LMRKN)

Company overview

Landmark Infrastructure Partners LP acquires, develops, owns, and manages a portfolio of real property interests and infrastructure assets in the United States. The company leases its real property interests and infrastructure assets to companies operating in the wireless communication, outdoor advertising, and renewable power generation industries properties, and infrastructure assets.

Key Metrics

Preferred stock analysis

Landmark Infrastructure’s preferreds are truly unique and interesting, featuring some very attractive properties. The company has issued 3 series of preferred shares, and in this case, we are examining Series C, trading under the symbol LMRKN. This preferred stock features some of the most investor-friendly covenants/features that we have ever seen. Its first unique characteristic is that its dividend is variable. Investors are subject to an original coupon rate of 4.7% + the 3-month LIBOR (London Inter-bank Offered Rate). With rates currently near 0%, LIBOR the 3-month Libor sits at a low 0.25%. While this coupon is truly low, there is a covenant that sets the minimum quarterly payment of $0.4375 on each share, regardless of how low LIBOR might fall. This guarantees investors a minimum yield of 7.0% during any quarter.

Until May 20th of 2025:

The company will trade as described above, and investors will enjoy a current yield of 6.98% (due to the slight premium.) If for any reason LIBOR increases, investors can only benefit in a clear, win-win scenario. If not, returns remain attractive. Shares then are “required” to be called, and investors who were to buy today would enjoy a YTC of 6.9%.

After May 20th of 2025:

If management does not call the stock, the dividend will become fixed at $2.25, which will attach providing a fixed-rate yield on the current stock price of 8.9%, which is an amazing benefit for preferred stockholders and a massive penalty for the company for not obliging. In fact, preferred shareholders are an even greater position of strength:

- Either they accept the $2.25 fixed coupon, or

- Exercise their right to sell his share back to the company.

- If not, investors will have another opportunity to sell the shares back to the company at $25 – and have right again every 5 years after that.

As a result, the company has a massive incentive to redeem its preferred shares, which increases preferred stockholders’ total return predictability and safety. LMRKN also has a convertible feature, but it has little relevance as of today.

With true real estate assets backing its preferred holders and a 225% coverage ratio LMRKN is one of the safest options to generate solid ~7% annualized returns.

#4: Gladstone Investment – Series D (GAINM)

Company overview

Gladstone Investment is a business development company (BDC) that primarily provides loans to lower middle-market businesses. The company has one of the best shareholder value creation track records in the space, delivering minor but gradual distribution growth over the years among various special dividends. The company is based in McLean, Virginia.

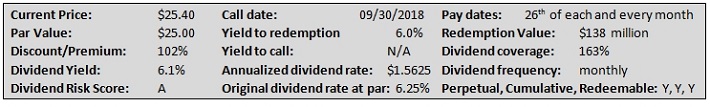

Key Metrics

Preferred stock analysis

Gladstone Investment has two preferred stock series outstanding; series D and series E. They are mostly similar, and in this report, we are examining its Series D.

Business Development Companies, or BDCs, were adversely impacted as a result of COVID-19, and the situation for Gladstone has been no different. You can see our BDC list here.

However, amid having constructed a robust portfolio of investments, the company has managed to generate resilient net investment income and retain its hefty dividend, proving the naysayers wrong. As a result, its preferred shares have also been performing stably, currently featuring a dividend coverage ratio of 163%, even after all interest and various other expenses have been settled.

The company has two truly unique properties:

- First, its dividends are paid out monthly, which greatly adds to the stability and low variance of investors’ returns.

- Additionally, not only are dividends cumulative, but shares are mandatorily redeemable. If Gladstone fails to redeem its preferreds by 8/30/2023 (it has the option to do at any point until then since shares trade past their call date), the fixed dividend will go up by 3%. In a sense, those who buy into the preferreds for their safe dividends and aim to hold them as long as possible will actually benefit under such a scenario.

GAINM is one of the safest preferreds out there that almost guarantees an annualized return of around 6% over the next few years.

As this report hopefully got across; however, there are multiple kinds of preferred stocks out there, with different structures and unique properties. Some, like LMRKN and GAINM, even offer additional rewards should something go “not-as-planned,” which further shield investors from any potential, unpredictable events and showcases the ability of preferred stocks to place their holder in powerful positions.

While preferred stocks remain equities and are not under any circumstances risk-free, we believe that investors can carefully select a diversified portfolio of preferred stocks and generate annualized returns in the range of 4-6% quite surely, consistently with minimal volatility. Preferreds offer a solution for income investors in the current economic environment.

#5: Höegh LNG Partners LP – Series A (HMLP.PA)(HMLP)

Company overview

Höegh LNG Partners LP owns, operates, and acquires floating storage and regasification units (FSRUs), liquefied natural gas (LNG) carriers, and other LNG infrastructure assets under long-term charters. The company also offers ship management services. As of its latest reports, the company had a fleet of five FSRUs.

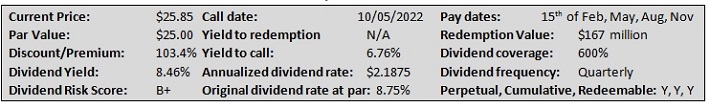

Key Metrics

Preferred stock analysis

What makes HMLP (and its preferred shares) safer compared to its shipping industry peers:

What differentiates HMLP’s fleet from traditional LNG carriers is that FSRUs do not actually transport LNG. The company’s ships are used as an “infrastructure asset,” simply resting docked, granting access to the LNG customer when needed. Because their role is “niche” in the value chain, HMLP does not necessarily share the volatility other firms may face during the different stages of production. Its storage-like services remain essential and cannot simply be “suspended.” Consequently, its cash flows can be proven reliable even under unstable economic environments, such as those of the ongoing pandemic.

Because of the company’s stable revenues backed by multi-year fixed contracts and the FSRU market being quite limited, with only 38 vessels on the water, we believe HMLP is one of the best shipping stocks, so far demonstrated in its EBITDA and distribution growth over the past few years.

More details on the preferreds:

HMLP’s common stock dividend currently yields around 11.5% and is covered by around 150% its distributable cash flows. While this high-dividend stock would flag warning signals at a first glance, the company produces some of the most reliable cash flows in the industry for the reasons mentioned earlier. Its preferred stock dividend are even safer, currently covered by 600% its EBITDA. Even if the company were to struggle at some points, resulting in cuts in its common dividends, its preferred coverage is likely to get even wider. As a result, investors have been trading HMLP.PA at a premium, in order to capture its safe income prospects.

Consequently, the yield to call has been reduced to around 6.75%. However, we believe that the company will not be calling the shares. They comprise a huge part of its financing and therefore it would be extremely expensive to do so. It is likely that investors will keep enjoying its current 8.46% yield for decades to come, as the company keeps dominating the FSRU space.

#6: Global Net Lease – Series A (GNL.PA)(GNL)

Company overview

Global Net Lease is a publicly-traded REIT listed on the NYSE focused on acquiring a diversified global portfolio of commercial properties, with an emphasis on sale-leaseback transactions involving single tenant, mission-critical income producing net-leased assets across the United States, Western and Northern Europe. The company owns 299 properties, enjoying an ample occupancy of 99.6% with a weighted average remaining lease term of 8.7 years.

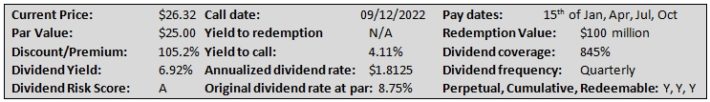

Key Metrics

Preferred stock analysis

A resilient preferred stock, backed by real assets…

Real estate investment trusts have been one of the most reliable and trustworthy strategies to generate long-term and growing income. You can see our complete REIT list here.

Preferred shares, on the other hand, have been one of the best and more stable ways to generate fixed income. Combining the two, i.e. the preferred shares of a REIT, makes for a fantastic combo in terms of dividend safety.

REITs are obliged to distribute at least 90% of their taxable income. This ensures that all dividends on the preferred share must always be settled. Since Global Net Lease generates its income from real assets preferred investors enjoy an additional margin of safety. Additionally, since the company is funded mostly by common stock and debt (as is the case with most REITs, its preferred shares only make up for a fraction of its balance sheet. Its series has a redemption value of just around $100 million.

As a result, the company needs to allocate only a small portion of its cash flows to settle its preferred dividends, hence the massive 845% payout ratio. In that regard, GNL’s preferred shares are among the safest in the market to generate a stable income.

…but with limited returns…

However, due to its robust coverage and overall safety, GNL’s preferred shares offer limited returns. It is series A (the company also has a Series B,) trades at a notable premium, which has dragged the stock’s yield to call to just 4.11%. While the preferreds may not end up getting called, which means that investors will keep enjoying its current solid 6.92% yield, it is also likely that the company will indeed refinance these preferreds at an even lower rate. Overall, GNL.PA is a very low-risk investment, which could greatly fit investors looking to generate a very resilient income in the low single-digits.

#7: Innovative Industrial Properties– Series A (IIPR.PA)(IIPR)

Company Overview

Founded in 2016, Innovative Industrial is the first (and only) publicly-traded REIT on the NYSE to provide real estate services to the medical-use cannabis industry.

As of its latest filings, the company is currently featuring a 99.3% occupancy ratio, with its 64 properties leased to state-licensed medical-use cannabis operators.

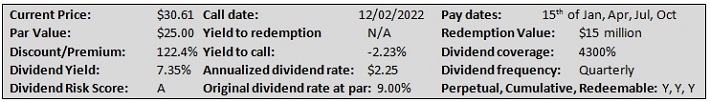

Key Metrics

Preferred stock analysis

Innovative industrial properties’ preferred shares may seem attractive at first glance but should be avoided overall. The company is currently the fastest-growing REIT in the world, spoiling its investors with rapid dividend growth and bright prospects moving forward. Since the company became public during a loophole period, it is the only publicly traded REIT in the industry, giving it a massive advantage in terms of financing opportunities. Hence the company has a fantastic moat as well.

The company’s preferred shares have a redemption value of only $15 million. The company’s latest quarterly net income alone exceeds the liquidation preference amount, while at its current growth rate, this margin should grow even larger. The company’s net income has grown so large over time that the preferred dividends are covered by a jaw-dropping 4300%.

Why would IIPR not redeem its preferred shares?

Innovative Industrial currently has a cost of debt of around 8.1%. Because of the uncertainties related to the future of cannabis (despite snowballing so far), such as potential issues with regulation, litigation, and the fact the company was quite small a couple of years back (therefore more risks attached back then), creditors have had high demands, leading to the high cost of debt.

There is a chance that IIPR will find future financing cheaper by selling preferred shares at the open market (ATM), with a cost equal to the dividend yield (e.g., the current 7.35%). The preferreds can be used as a future financing vehicle if they still offer a cheaper financing option for IIPR. Because of this, the company has an incentive not to redeem its preferreds.

What does this mean for investors?

Because of their ultra-safe coverage, investors are trading the company’s preferreds at a massive premium. Therefore, investors are subject to negative returns if they were to buy the preferred stock now, as the few dividends left to be paid until 2022 are not enough to compensate for the current premium.

In other words, investors expect that shares will not be called, for the reasons mentioned above, which means that the accumulated dividends received will compensate for the premium at some point in the future. For context:

- For investors to break even on the preferreds at their current price levels, shares would have to trade for a year + 1 quarter past their call date.

- If shares were to be called 5 years past their call date, the yield to call would be around 4.50%

- If shares were to be called at a way further date, say 15 years past the call date, the yield to call would be 6.35%.

Therefore, while there is a possibility that investors can generate positive returns in the medium to long term, the possibility of redemption on the call date is a huge risk. Additionally, even if the preferred shares don’t end up getting called, investors will enjoy very limited returns. As we discussed earlier, there are other preferred shares in the market that also offer AAA safety while not having a redemption date risk attached. Hence we would avoid IIPR’s preferred shares.

Final Thoughts

In the current ultra-low rate environment, it becomes harder by the day for investors to identify reasonably priced income stocks. COVID-19 has even accelerated this trend, with most high-yielding equities having significant risks attached to them. As a result, preferred stocks are now offering one of the best ways left to generate considerable income levels while undertaking limited risks compared to common stockholders.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more