Where To Invest In The UK Mess

This picture is typical of shop fronts on streets all over the UK. They were killed off by high Business Rates and this recent report in the Guardian newspaper titled Business rates could rise by £1.95bn in ‘bleak picture’ for UK retail and hospitality warns that more of the same is to come with the words that will be the final nail in the coffin. Such political mismanagement can be seen in the awful situation the country is in as a whole. It is not a pretty picture.

Picture source: Alamy

Britain's decline is seemingly unending making it almost un-investable due to the many negative and normally un-believable happenings that have become the norm. There are some exceptions that I am invested in and I will say more about those later in the article.

First I will expand on the reasons those exceptions prove the rule about...

Britain - Lost En Route to Empire 2

That heading is also a link to an article I wrote over five years ago prior to the UK leaving the EU. Click on it to read in full. That event came to pass but none of the grand benefits of leaving promised by the UK's political leaders did. Things have instead got even worse since! Also since then, the country is on its 3rd Prime Minister who is U-turning on many decisions made by his same party predecessors - who promised they would eventually make things better when done - on the grounds that not doing them will make things better!

Recent examples include tearing up the high speed rail link - HS2 - that was originally planned to link Scotland's capital, Edinburgh, with major cities in the north of the country down through the middle part and onto London where it would connect with HS1 - the tiny and only stretch of high speed rail in the country - that would take passengers then through the Channel tunnel and onto other high speed rail links to major cities in mainland Europe. Now it is to be a tiny costly nothingness. Some companies had invested or planned to invest, many millions in building new factories or expanding old ones based on the promise of a better transport system. Those companies have been left stranded by a single politician's autocratic and inconsistent ways. That person is the current Prime Minister.

A few months ago he spouted loudly about Britain attracting electric and battery makers to invest billions in building new factories in Britain on the grounds that Britain would stop the sale of new conventional ICE-engined cars by 2030. A few weeks ago he U-turned on that and now the year will be 2035...maybe! Those investing were not consulted and have also been left stranded.

When asked about the damage that might be done to business by Britain leaving the EU one of his predecessors replied "F..k Business". This PM is treating business likewise without using that foul word! That does nothing to help the...

British pound

Once the world’s strongest currency is now one of the weakest alongside the euro with prospects even worse. I will write separately on Where to Invest in the EU/euro Mess. The pound continues to decline faster with some bad news not even built in yet. Sky News and others have recently reported that Britain’s 2nd largest city - Birmingham - is essentially bankrupt due to debt, with several other cities in a similar state.

The central government in London cannot help because it is overloaded with debt when unfunded pension liabilities are added to the disclosed debt. The Taxpayers Alliance shows the following

- The real national debt is equivalent to more than four times the size of the UK economy, or 423 percent of forecast nominal GDP.

- On a per-household basis, the real national debt will equate to £344,216. On a per-person basis, it is £143,382.

To put that per-person figure in context, the latest (September 2023) government figures show the mean average UK weekly wage, excluding bonuses, is £617 gross - the equivalent to an annual pre-tax salary per person of around £32,000.

In July 2008 - the world financial crisis year - the pound stood at two to the US dollar. Today it is 1.2. That is a decline of 40%!

The decline has been caused by...

Myriad crises

Now that Britain is out of the dysfunctional but large EU it is now in an even worse position to get better. It has multiple self-inflicted crises to overcome yet there is no political capability to do so. They include;

- A housing crisis that started in the 1980s. All political leaders since then have promised to build more but few have been delivered. That provides one of the investment opportunities I shall talk about later - Grainger PLC.

- A healthcare crisis. According to the King's Fund the total number of National Health Service hospital beds in England has more than halved over the past 30 years, from around 299,000 in 1987/88 to 141,000 in 2019/20, while the population and thus the number of patients treated has increased significantly. The UK has a low number of hospital beds: 2.43 per 1,000 population versus 5.73 in France and 7.82 in Germany. Many used to go to France to get treated but now cannot due to Brexit so over 10% of the population is waiting for a hospital bed, some for more than a year. That is an enormous drain on the economy.

- An energy crisis. The government failed to invest in maintaining natural gas storage systems so prices soared after supplies were interrupted by Putin's barbaric attack on Ukraine. Making things worse is the declining pound that has to buy oil & gas priced in the strengthening US dollar. Making that worse, the government adds nearly 50% in tax onto car fuel prices at the pump. Those, among many other things, has led to...

- A cost of living crisis. Over the past two years, UK prices have risen over 17% compared to around 12% in the US. In a recent TV interview, I watched the PM constantly repeat his priority is lowering the high rate of inflation. He did not mention that prices will stay at all-time high levels even if the rate of inflation decreases - currently still very high at 6.7% - or that that rate YOY compounds the actual price increases. He also did not mention that the roots of the cost-of-living crisis go deeper as what are known as "real wages" haven't seen sustained growth for 15 years.

- Government building and infrastructure crisis. There has not been a main railway line built north on London since 1899! In 1900 the UK population was 41 million, today nearly 68 million. Yet now the first new build mainline rail mentioned above - HS2 - will not get built as originally planned. Roads are overcrowded with nothing new being built. Existing ones need repairs. Combined those things mean productivity only gets worse. Overcrowded schools are being closed because do the dangerous state of the buildings and there is insufficient money for repairs.

Perhaps demonstrating the neglect best of all is the decay of the Palace of Westminster that houses those UK leaders who have caused the UK mess. They have not even looked after their own workplace for decades so not the cost and time are unbelievable Parliament restoration could 'take 76 years and cost £22bn' Again that shows the unbelievable in Britain has become the norm!

IF - a big IF - anything gets done to repair and rebuild Britain it will benefit the other company I will talk about later; Ashtead Group PLC

One last point - among many others that I have no space to mention here - that also affects investors is...

The decline of London

The UK has long depended on its financial centre London to finance much of the rest of the country but companies are fleeing the London stock exchange to list on the NYSE and new listings by UK companies favour the NYSE too as evidenced by the recent listing of Arm; Arm Soars 25% in the Year's Biggest Initial Public Offering. London's market is the only developed world market to have shrunk relative to GDP over the past 20 years.

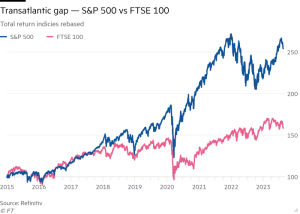

This Financial Times chart shows why investing on the NYSE is a much bet as that history is likely to repeat itself...

London kept Britain as the 5th largest economy in the world for many years. Now a lowly colony in Empire 1 days - India - has pushed it out of that 5th slot. So much for Empire 2!

That all makes it very difficult to decide on ...

Where To Invest In The UK Mess

Politicians there continue to make things worse for investors with so many policy U-turns that the initials UK for the United Kingdom could also mean the U-turn Kingdom. Nor is it very united anymore with many in Scotland wanting independence from England and a part of Scotland - the Orkneys - wanting to separate from Scotland and become part of better-led Norway. Norway invested its North Sea oil wealth via a wealth fund that would pay future pensions so today's pensioners are well off. Britain squandered that wealth so many of today's pensioners live in near-poverty conditions with their pensions funded by the unfunded government debt mentioned above. That debt will have to be paid by people yet to be born so have no vote on the matter!

Given the near-bankrupt state of the same major UK cities that I mentioned above maybe the government will need to be rescued again by the IMF as happened in 1976 when it received the largest loan ever paid out by the IMF up until then.

Whatever happens, I believe my sole UK investments have good potential. They are...

Ashtead Group plc

Ashtead Group Ltd (ASHTF) - or AHT on the London exchange where I own it - is a UK-registered machinery rental company that is the 2nd largest after US company United Rentals (URI) and the fastest-growing such company in the US via its ownership of Sunbelt. Sunbelt is its operating name there and in the UK and Canada.

It is also managed from the US by its CEO - a US citizen named Brendan Horgan - who operates from Sunbelt Inc's Head Office in Fort Mill, South Carolina. Most of its machinery is made by US companies such as (CAT) and most of the customers are there too. One could say that "British" Ashtead is as American as apple pie.

The Company rents a full range of construction and industrial equipment across a variety of applications to a diverse customer base but mainly to general industrial and construction-orientated customers. Sunbelt UK is the largest equipment rental company in the UK with 190 stores. Sunbelt US has 1,128 stores spread across all 50 states clustered in various metropolitan areas from Washington DC, and Baltimore on the Atlantic Coast through Miami, Tampa, and Orlando in Florida to Los Angeles and Seattle on the West Coast. In the Canadian market, it has 125 stores spread across Alberta, British Colombia, Ontario, Manitoba, and Saskatchewan.

I wrote recently about the billions of dollars being invested in the US by the government and companies in The US Dollar Is The Main Safe Haven Currency.

Added to that is work related to fixing the estimated $1 billion of weather-related damage in the US.

Many of Ashtead's Sunbelt customers will benefit hugely from that and thus will need equipment from those many Sunbelt stores around the country.

Next year could bring a different political power into government in the UK and that promises massive investments in fixing the UK mess.

Even before much of that has started Ashtead has performed very well over the long term.

Year on year for its last fiscal years ending March 31, 2023, Ashtead grew revenues 21.41% from $7.96bn to $9.67bn while net income improved 29.30% from $1.25bn to $1.62bn.

Margins are good.

| Gross margin | 74.90% |

|---|---|

| Net profit margin | 16.52% |

| Operating margin | 26.04% |

That is a repeat of past long-term performance as is reflected in its stock market performance...

Chart source: Financial Times.

Ashtead pays a dividend of I.65%. Not exciting but it increases annually and that is the sign of a nicely managed company. Earnings per share growth is healthy too. Year on year, both dividends per share and earnings per share excluding extraordinary items growth increased by 18.44% and 30.85%, respectively. The positive trend in dividend payments is noteworthy since only some companies in the Rental & Leasing industry pay a dividend. Additionally, when measured on a five-year annualized basis, both dividends per share and earnings per share growth ranked the highest relative to its industry peers.

More can be found on Ashtead's website

The housing crisis that started in the 1980s - that I mentioned above - provides the other UK opportunity that I am invested in...

Grainger

Grainger plc (GRGTF) or GRI on the London exchange where I own it is a home rental company.

Demand for renting in the UK has been steadily increasing for the past decade, now representing one in five households. There is a chronic undersupply of housing across the UK with demand far outstripping supply across all housing layers.

This trend is set to continue as more and more people choose to rent for longer, taking advantage of the flexibility and lifestyle benefits that renting provides. Plus many younger people are forced to rent because their incomes have failed to match home price increases for many years - another trend that will continue - and they have become known as Generation Rent.

The housing supply-demand imbalance within the UK private rented sector provides Grainger with an excellent market opportunity to help meet the growing need for good quality, professionally managed rental homes.

Currently, the build-to-rent sector accounts for just 1.5% of the total UK rental market. Meanwhile, existing supply is reducing as buy-to-let landlords exit the market due to high interest rates. That means the market is very fragmented providing growth opportunities. Grainger is the UK's largest, by far, and has 9,737 homes with 5,406 in its pipeline.

With new housing supply levels falling significantly short of the demand, Grainger is perfectly placed to help support the supply of these much-needed new homes. That supply/demand imbalance enabled Grainger to push up annual rents by 8% and sector expert; Hamptons, expects rents to rise 25% over the next four years made possible by rising incomes.

While many small suppliers of rental housing have been driven out by high interest rates Grainger has recently fixed the cost of its debt for the next five years at 3.5%. That also is a sign of its creditworthiness.

Year on year Grainger PLC grew revenues 11.37% from 257.60m to 286.90m while net income improved 109.50% from 109.50m to 229.40m.

Year on year, both dividends per share and earnings per share excluding extraordinary items growth increased by 15.92% and 91.83%, respectively. Additionally, when measured on a five year annualized basis, dividend per share growth is in line with the industry average relative to its peers, while earnings per share growth is above the industry average.

Margins are good

Gross margin 60.88%

Net profit margin 60.31%

Operating margin 89.92%

The safe annual dividend is currently 2.69%.

The share price is way below where it should be according to this Financial Times chart

More can be found on the Grainger website.

Ashtead and Grainger will be winners for investors in the UK mess

Ashtead has those enormous investments in the new US Industrial Revolution.

Grainger has an average of 25 potential tenants in the UK chasing each home when it becomes available, according to sector expert Rightmove.

Financial Times analysts have these forecasts for the next twelve months:

Ashtead

High plus 50.4% to £72.201

Med plus 38.9% to £66.67

Low plus 13.8% to £56.41

Grainger

| High | plus 54.2% | to £3.54 |

| Med | plus 22.0% | to £2.80 |

| Low plus 2.69% to £2.35 |

Now could be a good time to buy. They are among my long-term investments and my sole ones in the UK.

Readers ideas on others and opinions on my views made in the comment boxes below, will be highly appreciated by other readers and myself. We all learn more by sharing ideas.

More By This Author:

The US Dollar Is The Main Safe Haven Currency

Mixed Signals Suggest Both Boom And Bust

Alexandria - A Market Ugly Duckling That Is A Stock Pickers Swan

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Good article, thanks for sharing.

Thank you for reading and commenting

James, nice article, shame about the UK's incompetent political administrators (leaders they most certainly are not..). Their only claim to fame is the long list of squandered opportunities. In the context of military interventions, may I suggest a look at Qinetiq (QQ) might be wortwhile. Leading edge drone technology and probably interesting as an acquisition... Financials look OK and outlook also looks OK

Hello Brian,

Pity we cannot invest in the likelihood of the success or failue of future UK political decisions because that would be an easy win?

QQ looks very ok in many ways but I do not touch anything connected with the military. James

Thanks for the tip. James Hanshaw, do you agree?

Since writing this article a point has arisen that could adversely affect investors in Grainger - and that includes me - is the threat that near bankrupt local councils in the UK will impose rent controls instead of making it easier to build more properties. That will guarantee the housing crisis gets worse but we must not forget that in British politics the unbelievable has become the norm.

I shall stay with Grainger for now but will also stay on high alert.

As tensions rise in the Middle East, America is getting closer to being dragged into a world war. Do you think the UK is facing the same risks? Or would they stay out of it?

I cannot see the UK getting involved as it is near bankruptcy and cannot afford to. Interesting that such a negative can also be a positive!

Seems like the war is very much a Gaza/Israel thing. Why would the US get involved?

Hopefully the US will keep away and let those that caused these awful events on both sides sort things out for themselves.

Russia has probably little chance of getting involved much via Iran or other ways because it has lowered its might by attacking Ukraine.

There is a lot of intel anaylsts in Israel who believe Russia had a prominent role in the Hamas attack, along with Iran. Iran wanted to scuttle the imminent peace deal between Saudia Arabia and Israel. Russia wanted to distract world attention from it's war against Ukraine, and wanted to stretch US thin - they now have to support two countries, Israel and Ukraine.

It's spread beyond that. Lebanon, Syria and Yemen have all attacked Israel as well. And Iran is behind it all - fighting a proxy war. There are also indications that Russia may have had a hand in Hamas' brutal attack and Hamas was using weapons from Iran, Russia and North Korea. McCarthy has warned that Iran, Russia and China are the new axis of evil. Iran and Afghanistan have threated to invade Israel if Israel invades Gaza- which Israel has to do to end Hamas and to try to rescue the hundreds of hostages there.

The US has already moved air craft carriers to the Mediterranean and put thousands of US troops on "ready to deploy" to assist Israel. One of our aircraft carriers already engaged in a 9 hour battle shooting down attack drones and missiles fired from Yemen at Israel.

This could very easily blow up into a regional or even world war. I just don't know what the UK's stance is on all this.

All should stay away and let those countries sort out their own mess!

How can the US stay away when Hamas is getting material support from all of our enemies - Iran, Russia, North Korea, and perhaps China. They hate the US as much as Israel. All of Gaza danced in the streets on 9/11, burn US flags and chant Death to America.

Also, Syria has already attacked US bases in the Middle East. The US was right to respond by retaliating against Syria.

I said ALL

Of course, but my point was, if one side isn't staying away, how can we? We must stand by our allies, or once they are done with Israel, they will come after us next.

I don't think the the US and its allies should stay away. Hamas, like other Islamic funamentalist have publicly said that once they destroy Israel, they are come after all Jews and Christians,world wide. They will not be satisfied with anything less.

Israel is on the front lines and the only bastion of democracy in the Middle East. Supporting them is our best defense for protecting ourselves and other Western countries.

In this article I mention Britain's housing crisis. Subsequent to publication I found that the BBC has its own series on the awful situtation titled Britain's Housing Crisis - What went wrong?

That further supports my reasons for featuring Grainger, GRI, as a good investment.

I no longer trust the BBC as a credible news source. These are the same people who refused to call Hamas terrorists and immediately took their word over Israel's and incorrectly blamed Israel for the Hospital bombing, without even bothering to find out the truth. It's the epitome of lazy/biased reporting.

It is very hard to find unbiased media today. It's no longer "news" it's more "opinion" if that. And while Trump liked to decry any news outlet that was critical of him as "fake news," it was right wing media like Fox News, OANN and Newsmax who were all sued for blatantly lying to their audience.

And even though the court cases proved their guilt, they still fooled a very large percentage of viewership who still won't accept the outcome of the election.

I understand leftwing vs. rightwing bias in the media. But I do not understand why so many news outlets have been siding with Hamas. Why support baby murderers or treat them with the same level of credibilty as a legitamate government? Especially when they have been caught lying about their casuality numbers so many times?

No one said after 9/11 or the ISIS attacks, let's hear what the terrorists hace to say, maybe they aren't so bad after all? And Hamas is far worse than either Al Quida or ISIS. They didn't cut babies out of their mothers' wombs, or call facetime family members so they could watch their children being raped and tortured. Hamas is beyond evil - why do some support them?

It is sickening to even read your words about those Hamas doings. Such people are not human and nor are they animals because animals do not do such things. How we rid the world of them and those like them elsewhere I know not but a start would be for a redrawing of that awful map into countries that can live and work together and treat each other as equals.