The US Dollar Is The Main Safe Haven Currency

Image Source: Pixabay

Most of the world's main currencies are in continuous decline

I see the main currencies as being; the euro, British pound, Japanese yen, Swiss franc and US dollar. Of those only the Swiss franc and USD have remained strong over the long term and are likely to stay that way.

This is important not only for currency investors but most others as well because the value of, say, equity investments goes up and down with the currency of the market the equity is listed in. That is the case for me, an equity investor living in Switzerland but with most investments in stock markets in other countries. As it happens most of my picks are in the US as I try to avoid other countries because their currencies almost continuously weaken against the Swiss franc.

I shall go through the main ones in the above order starting with the...

Euro

I wrote extensively about the euro nearly three years ago in this linked article titled Assuming The Euro Will Recover Is “Suicidal”. Things have worsened since and I will write a separate article on that another day soon. In July 2008 the euro peaked at USD1.58. Today it is 1.07. That is a decline of 31% with no bottom likely in the foreseeable future given the history repeating itself that got us to this point.

It is not a pretty picture and I shall stay away from the euro. Likewise, I shall stay away from the...

British pound

Once the world’s strongest currency is now one of the weakest alongside the euro with prospects even worse. I will also write more on that separately. It is already declining faster with some bad news not even built in yet. In July 2008 the pound stood at two to the dollar. Today it is 1.2. That is a decline of 40% worse even than the euro’s decline.

That and more therefore eliminates another important currency for most investors. I am not encouraged either about the ...

Japanese Yen

It is easy to overlook the importance of Japan because it tends to be somewhat insular and does not make big noises but it is the world's 3rd largest economy and was the 2nd largest for a long time until China drove it out of that slot in recent times.

Taking the same period as the others above the yen was worth USD 106 in July 2008. Today it is 149. A decline of 29%. It would probably be even lower today had not foreign investors returned to the Japanese stock market this year in a big way driving it up over 20%.

Japan’s weight in the MSCI World Index has declined to around 6% from 40% back in 1987. That even after the Topix and Nikkei 225 gained over 20% this year as the investment herd rushed in believing times have changed. That gain drops back into single fingers in dollar terms given the dollar gains and those markets are still below the 1990 high.

I suspect the herd will rush out when they find things have not changed. Pay has stagnated and lagged for around 30 years according to this Aljazeera report that says, among other things; quote "Japanese workers took home an average salary of $41,509 in 2022 in purchasing power parity terms, hardly unchanged from $40,379 in 1991, according to data from the Organisation for Economic Cooperation and Development (OECD). While Japan’s wages rose by just 2.8 percent over the period, average pay across the OECD climbed by 32.5 percent. Today, Japanese employees earn only about three-quarters as much as their developed country counterparts.” End quote. In July this year, real wages fell for the 16th consecutive month. That further erodes purchasing power. The country has an aging population and has tried to attract immigrants but could not even get them from low-pay India because pay in Japan is so low!

That is hardly the basis for a strengthening yen which leaves only one other major currency, the...

Swiss franc

Over the long term, the Swiss franc has proved itself time and time again to be the world's safest currency. I wrote about it, among other things, in Parsing Swiss Stocks For Double Dividend Champions and in Switzerland - Land Of Milk And Money. In the latter, I featured the world's number one top-quality Swiss chocolate maker, Lindt & Sprüngli (LDSVF). Then - 5 years ago - the share price was $6,900. Today it is $11,422 - a gain of 65%. By comparison, the S&P 500 is up 60% plus the Swiss franc is up 7% against the US dollar. Buyers of the chocs can enjoy the taste and gain wealth - and weight! - in doing so.

That currency gain was despite a nice increase in the USD against it over the past few weeks.

I expect the franc will resume its role over time as the world's safest currency but, for now, the ...

The US Dollar is the place to be

America is enjoying an economic transformation - a new Industrial Revolution.

An excellent article in the Financial Times tells more; US economy is on the brink of a new growth cycle It mentions the nearly $3 trillion in federal funding devoted to productive investment that has yet to be spent. In addition, private sector investment is soaring with Intel being quoted as one example - it will invest up to $100 billion in building its new semiconductor manufacturing hub in Ohio, in part due to federal tax credits aimed at incentivising such projects.

Many more have been announced over the past four years encouraged in part by those things plus the political push to bring back production to the US, dubbed re-shoring. They include...

- Micron (MU) will invest up to $100B in a massive New York chipmaking plant

- Samsung (OTCPK: SSNLF) is currently building an advanced chip making plant in Taylor, Texas that will be open in 2024. The company has reportedly been considering sites for as many as 11 different factories in Texas in an investment that could be worth as much as $200B.

- John Deere (DE) is investing $29.8m to shift production from China to Louisiana.

Every major car maker is spending billions in the US to build EV factories.

- Samsung is building a $2.5 billion EV battery factory in Indiana.

- General Motors (GM) is spending $7bn to convert an existing factory to make EVs.

- Ford (F) has begun construction of a $5.6B EV-focused facility in Haywood County, Tennessee. Another similar-sized one is being built in Kentucky.

- Hyundai (OTCPK: HYMLF) will break ground in Georgia later this month on its first EV dedicated US plant worth $5.5bn.

- BMW (OTCPK: BMWYY) is making a $1.7B investment for electric vehicle production in South Carolina. BMW Group Chairman Oliver Zipse called the South Caroline EV commitment the biggest single investment the German car maker has made.

- Volkswagen (OTCPK: VWAGY) is spending $7.1B to boost EV production in the US.

- Stellantis (STLA) and Samsung (OTCPK: SSNLF) have a JV to build a $2.5 billion battery factory in Indiana.

- Quanta Services (PWR) and Hitachi will build the largest U.S. clean energy infrastructure project according to this report.

- Businesswire reported that First Solar is to Invest up to $1.1 Billion in a fifth US Manufacturing Facility

- Air Products (APD) will boost manufacturing capacity by nearly 20% with an investment in Florida

- Putin’s barbarous invasion of Ukraine has added enormous impetus to US LNG export facility building: Sempra Energy’s Port Arthur project has reached a “final investment decision”. That project alone is expected to cost $13 billion. Cheniere (LNG) went forward with its Corpus Christi expansion recently and Venture Global is going ahead with its Louisiana Plaquemines facility. Others are in the pipeline.

- Cummins Inc. has announced plans to invest over $1 billion in its US engine manufacturing network for a transition into hydrogen-fueled engines.

There are many more and probably add up to trillions in total.

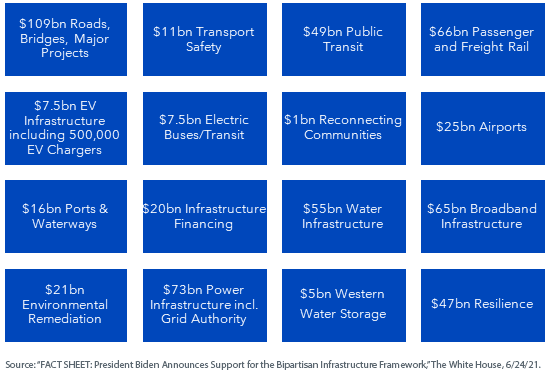

The US Infrastructure Bill shows this breakdown for spending...

(Click on image to enlarge)

The Rural Development Act which is part of the Inflation Reduction Act will put $9.7 billion in rural communities to help them build clean energy systems. That will help ensure that often neglected parts benefit from these huge investment programs.

Other factors are positive too. The US economy is heavily dependent on the consumer and since the 2008 financial crisis, Americans have cut their debt burden plus have stored up cash from pandemic stimulus programs. That may fade in the coming months but growth will be underpinned by those massive investments. Right now durable goods sales are strong and so are car sales.

The US and thus the dollar are being further strengthened by the growth of New York's stock exchanges. 100 year ago the UK was the world's main financial centre. It had a dozen or so stock exchanges around the country but by 1973 they had merged into one, the London Stock Exchange. The LSE remained the second largest in the world after New York took over the number one spot but that has faded fast since the UK left the EU. Even UK companies are deciding to list in New York as can be seen with Arm's recent flotation there that happened despite UK political leaders begging it to list in London. Others around Europe have done the same or are considering doing so.

US listed equities now account for nearly 70% of the MSCI World Index. The next five largest - Japan, UK, France, Canada and Germany - account for less than 20%. I learned those stock exchange details from an article in the Financial Times titled How the US is crushing Europe's domestic exchanges In that article it also states that non-US investors own $14 trillion of US equities. With the weaknesses growing in many other countries that is likely to increase further and push the dollar up further too.

As always in life there are...

Risks

Among these is the fact that global trade volumes fell at their fastest annual rate for almost three years - down 3.2% - according to the World Trade Monitor. China, the world's largest goods exporter, had its trade drop 1.5%, the eurozone 2.5% and the US 0.6%. Since the US is much less dependent on world trade that leaves it relatively unscathed, for now.

Perceptions of risk - whether justified remains to be seen - have seen huge amounts poured into US money market funds. The Financial Times reported that according to Bank of America Securities, $1 trillion has poured into those already this year with a record $1.5 trillion expected by year-end. Strategists there called that "one trillion dollars of doubt". Investment Company Institute figures show that around $5.6 trillion of cash now sits in these funds up from $ 2.6 trillion ten years ago. This is by both retail and institutional investors thus reflecting widespread fear of something. This money is not safe - there is no Federal Deposit Insurance of up to $250,000 per account on these - and a panic stamped out could "break the buck" as it did back in 2008 when the collapse of Lehman Brothers caused the old and well know Reserve Primary Fund to trade down to 97 cents on the dollar.

That collapse started with sub-prime mortgages and I do not see the same dangers today but we need to remain alert for such risks.

For the foreseeable future, I see a confirmation of ...

US Exceptionalism

The first reference to the concept of American Exceptionalism by name, and possibly its origin, was by the French writer Alexis de Tocqueville in his 1835/1840 work Democracy in America. It has proved to be the case many times since, for both good and bad reasons. Today I use it for a good reason - making money for investors including myself.

"Experts" who said last year the world would be in deep recession by now also have constantly said the US markets are overpriced and the best plays would be in other places such as the EU and EMs. They were sure the S&P500 would be at 3,400 now. That would have dragged the US dollar down.

Instead, the S&P500 is around 4,300 and the US economy is growing at a high rate of around 3% with the dollar getting much stronger over recent weeks.

I believe the dollar will stay strong also for reasons I will expand on soon.

The whole picture suggests that The US Dollar Is The Main Safe Haven Currency

More By This Author:

Mixed Signals Suggest Both Boom And Bust

Alexandria - A Market Ugly Duckling That Is A Stock Pickers Swan

Plug Power Has Unplugged Investors

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

More about the ever weakening Yen just reported here...

https://asia.nikkei.com/Spotlight/The-Big-Story/Japan-s-yen-dilemma-in-charts-BOJ-juggles-deflation-and-inflation?utm_campaign=IC_asia_daily_free&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link

Good news for the US dollar.

Thank you for commenting. It is certainly good news for those invested in it. That includes me. I have it via my stock market investments with US companies being around 60% of my portrfolio