Alexandria - A Market Ugly Duckling That Is A Stock Pickers Swan

The photo above is of Research Triangle Park in North Carolina. Photo Source: RTI International

Research Triangle Park is the largest research park in North America and remains one of the most successful science parks across the globe. Stretching 7,000 acres across Durham and Wake counties, the park is home to 250+ businesses, ranging from Fortune 100 multinational R&D operations to entrepreneurial-driven start-ups. It is one of several owned by....

Alexandria Real Estate

Alexandria Real Estate Equities, Inc. (ARE) is a real estate investment trust. The Company owns, operates, develops and is focused on collaborative life science, agtech, and technology campuses in various cluster locations. It develops urban cluster campuses and ecosystems. Its properties are primarily located in various locations, including Greater Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland, and Research Triangle Park.

Alexandria Real Estate has been dumped in the same way as all commercial real estate but is a life science REIT not a glut office building stock. It is down nearly 30% since February alone due to that misunderstanding. It was a safe, white swan until the market herd panicked and treated it instead as an ugly duckling.

That means big games for investors buying now when the herd wakes up! Plus ARE pays a 4.0% dividend that is safe.

The crash in value started before February when companies started leave office buildings several years ago in parts of the US - such as San Francisco and New York - and head for the Sunbelt. That did not apply to ARE but the indiscriminate market herd threw out the baby with the bathwater as this Financial Times share price chart shows...

(Click on image to enlarge)

There has been an uptick in the past few days following the release of the last quarter results.

ARE invests in real estate consisting of properties that are leased to the life science industry, primarily.

Its key tenants operate in scientific research, drug discovery, medical technology development, and other activities related to life sciences and technology. The tenants use Alexandria Real Estate Equities' facilities as places to conduct scientific or technological research and experiments. Life science-focused REITs tend to be grouped together with office REITs and it is this association that has hurt the trust’s valuation since February. Since Alexandria Real Estate Equities' portfolio metrics look very robust, I think the comparison to office REITs is very inappropriate. The following shows how different it is from an office building company...

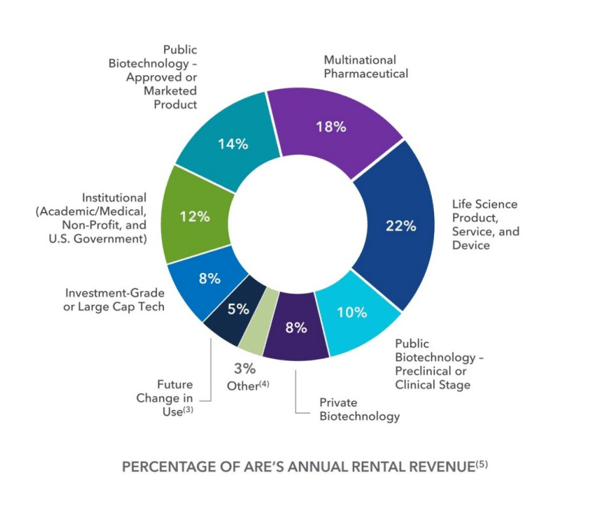

(Click on image to enlarge)

Percentage of ARE's Annual Rental Revenue (Source: ARE )

ARE's core tenants - 850 in total - are mostly large, investment grade rate pharmaceutical companies, including Bristol-Myers Squibb (BMY), Novartis (NVS) and (NVSEF) Sanofi (SNY) and (SNYNF) and Pfizer (PFE). These companies invest huge amounts in their new product pipelines for the long term and the pharmaceutical/biotech industry tends to have much less vulnerability in an economic recession than more cyclical industries.

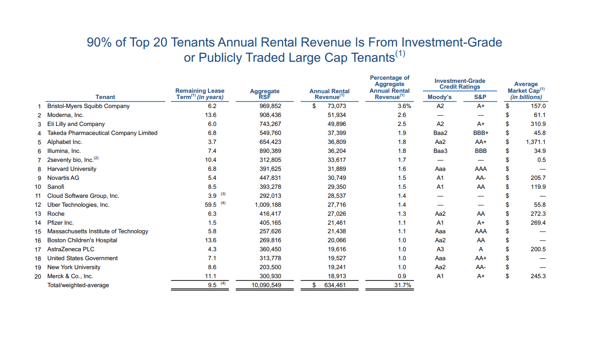

(Click on image to enlarge)

Top 20 Tenants (Source: ARE )

Safety of income is very important for long term investors such as myself and ARE's is very safe

Based on the ARE`s lease expiration table, only 3.9% of Alexandria Real Estate Equities' leases are expiring in 2023 making its long-duration leases a strong asset and that is a strong foundation generating recurring cash flow for shareholders.

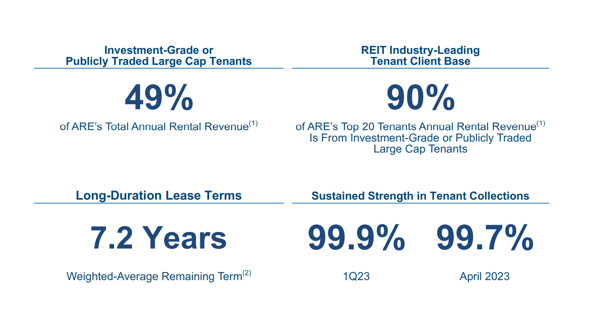

(Click on image to enlarge)

Tenant Collections (Alexandria Real Estate Equities)

That 7.2 years of income visibility is something few companies have! And with the top twenty tenants it is 9.4 years

The last results - linked in above - show more.

That is ARE's internal picture today that provides a sound foundation for the future but the world outside is key to any companies future and that picture holds much promise too...

The World Health Scene

This scene is not very healthy. That is sad for many but ensures much future business for ARE's customers meaning they will have a continuing need for its facilities for potentially decades to come.

A brief look around the world shows a disturbing picture!

The US

The population is ageing rapidly according to this report by the Urban Institute One point in there says "The number of Americans ages 65 and older will more than double over the next 40 years, reaching 80 million in 2040. The number of adults ages 85 and older, the group most often needing help with basic personal care, will nearly quadruple between 2000 and 2040."

At a younger level more and more are obese or becoming so. This Harvard report tells us that "Roughly two out of three U.S. adults are overweight or obese (69 percent) and one out of three are obese (36 percent)."

A Pentagon study last year showed that 77% of young Americans would not qualify for military service without a waiver due to being overweight, using drugs or having mental and physical health problems.

China

China has one of the fastest ageing populations on earth and that means more and more medicines will be needed. And in a slowing economy China has just reported that youth unemployment reached a record 21.3 per cent in June, with some speculating that inactivity may be far higher. Finding work for the young is of paramount importance — youth unemployment is socially corrosive as well as a blight on the economy.

Since 2021, a social phenomenon known as tang ping, or lying flat, has taken root among young Chinese. It is essentially about disillusionment and doing whatever it takes to simply get by in the face of a weak economy, low social mobility and the dearth of good jobs. Now a new term, bai lan - translated as "let it rot" is popular among the young. It conveys a deeper sense of pessimism and leads to mental illnesses such as depression.

Japan

The number of Japanese citizens has fallen in every prefecture for the first time on record, down 800,523 from a year earlier for the largest drop in data going back to 1968, the Ministry of Internal Affairs and Communications reported recently. That is also due to ageing.

Germany

It too has a rapidly ageing population.

The above are the four largest economies in the world. Similar can be said of many developed countries. Physical and mental health is essential for a nation's economic health so those people will need more and more medicines.

Globally

Climate change and associated very hot weather is causing myriad health problems. As of mid 2023, global surface temperatures have already risen by about 1.25C of the 2050 2C target maximum , according to the latest data from NASA and the US National Oceanic and Atmospheric Administration. When you push up an average, you push out the extremes. Today, Phoenix experiences four times as many days of searing heat as in the 1950s, Paris eight times as many, and London 10 times. Each one of those inhospitable days has already come at a steep price, directly causing dozens of deaths, and forcing thousands of others to opt for surviving. They will need healthcare to do so.

New technologies. A chiropractor told me she is now treating people as young as 10 years old for back problems caused by bending over while messaging on their mobile devices instead of sitting and standing straight. That can only worsen with age and they will need some form of new treatment yet to be developed.

Pandemic warning system has a funding crisis! The Program for Monitoring Emerging Diseases - ProMed - that was among the first to detect viral outbreaks such as Mers, Sars and Covid 19 is running out of money. That will place more pressure on companies to do more research and could mean more done at ARE's facilities.

Taken together those and many other things should mean...

The ARE swan will soon be flying gracefully again

The powerful drug makers' lobby is saying that reform of pricing in the US will cut investments. I doubt it as the opportunities for new developments are great and each wants to keep ahead of the competition.

While several other office REITs have recently been moving into the life science space, ARE is the pioneer of this niche and has been investing in life science properties since its founding in 1994. The cost of entry for others would be enormous.

ARE is also investing in growth that will have them flying even further ahead: Their portfolio consists of 41.1 million rentable square feet (3.81 million sq metres) of operating properties, 5.3 million rentable square feet (0. 49 million sq metres) of properties undergoing construction, 9.4 million rentable square feet (0.87 million sq metres) of development projects plus 19.1 million square feet (1.77 million sq metres) for future development projects.

How high will ARE fly?

I bought in last week and am up 3% since then. If it does that every week then my bank account health will not need any of its clients medicines!

The chart above shows it hit a high of around $220 in late 2021. Today's price is $125. A return to the high would mean an increase of 76%.

CNBC analysts suggest the following...

Analyst Consensus & Trends

First Call expects 0.88 EPS for next quarter.

The current Price Target for ARE is $158.44.

That suggests an increase of 26% plus there is the safe dividend of nearly 4%. It is worth noting too that none of those 11 analysts reporting recommends selling.

Readers views can be just as good as those of analysts and it would be useful to us all if you share those in the comments on my article.

Plug Power Has Unplugged Investors

T’Winners From The Deferred Energy Crisis

Sika: Unknown And Undervalued Swiss World Leader With Enormous Growth Potential

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Alexandria Real Estate Equities raises dividend by 2.4% to $1.27

Readers views can be just as good as those of analysts and it would be useful to us all if you share those here in comments.