Mixed Signals Suggest Both Boom And Bust

Photo: Melvin Nicholson/REX/Shutterstock

Is there a pot of gold at the end of the rainbow or a fogbow to punch holes in and get nowhere?

There are many mixed economic signals globally, some seemingly contradictory. At this time last year “experts” were predicting a recession in H2 of 2023 and the S&P500 would be down to 3,400. Reality? Recession, what recession? And the S&P500 is over 4,500.

This means both investing dangers and opportunities. The main opportunities, in my view, will be companies listed on the supposedly over priced US markets. I shall highlight my favourites later. It would be very helpful to us all if readers would share their views and investment picks in comments at the end of this article.

First I will expand on the many...

Mixed Signals

- Industrial production in Japan declined by 2.0% month-over-month in July 2023.

- Retail sales in Japan rose 6.8% year-on-year in July 2023.

- Germany retail sales decreased 2.20% in July of 2023 over the same month 2022.

- German factory orders dropped 11.7% in July.

- Spanish industrial production dipped 1.8% in July, 4th straight month of decline.

- France industrial production rose 0.8% in July

- UK unemployment rate rose to 4.3% in May to July 2023, the highest level since Q3 2021.

- The EU generally is dragged down by its biggest economy, Germany. The EU Commission predicts just 0.8% growth this year with inflation staying high at 6.5%. Little improvement is expected in 2024 - a classic case of stagflation.

- In another mixed signal the EU passenger car market continued to grow in July 2023, with new car registrations rising 15.2% to 851,156 units, according to the latest data released by the European Automobile Manufacturers' Association.

- China's factory activity unexpectedly expanded to 51.0 in August following efforts by Beijing.

- Taiwan’s year-long export slump eased as AI chip demand grew..

- U.S. rail traffic fell 4.9% year-over-year. “August was the third straight month in which total year-over-year U.S. rail carloads have fallen,” Association of American Railroads (AAR) Senior Vice President John T. Gray reported on Sept. 6.

- Maybe rail freight is going back onto the road as truck demand for diesel fuel is up.

- US pending homes sales in July surprised with an increase.

- US mortgage applications fell for the 7th time in 8 weeks

- U.S. Household Wealth Leapt $5.5tn In The Second Quarter according to ING Economic and Financial Analysis

- Subaru reported August U.S. sales up 12.5% to 56,407 vehicles

- Mazda North American Operations posted an 18.7% increase in August sales

- Global bellwether Caterpillar reported a strong Q2 performance with sales and revenues increasing by 22% and operating profit up 88%.

- Global air travel is booming both for business and leisure.

- Global container shipping is down.

- The IMF, in its latest Work Economic Outlook, reported that its next five year global GDP forecast has fallen from 4.6% in a previous forecast to only 3%

Conclusions?

Hard to make! But if one looks deeper into country specifics, Germany - the EU's most important economy and the world's 4th largest - is in or close to recession. If California was a country it would push Germany out of that 4th place! I see no change for several years given the weak leadership there. Also Germany's current account surplus widened sharply to Є18.7B in July 2023 from Є7.8B in the same month last year adding to the many imbalances in the EU.

The UK is also in or close to recession with little growth and very high inflation. The Bank of England has this week forecasted 2 years of stagnation for the UK and that means stagflation. Britain’s problems run deep with the crisis at local level being exposed recently when the UK’s 2nd largest city Birmingham in effect declaring itself bankrupt, with experts warning that others across the UK were now living “hand to mouth”.

China maybe growing again which will be good for exporters to China but one must be cautious about official statistics because the emperor there will be displeased with bad ones. However peak pessimism may also have been reached on China. On one hand the big negative is the property market. Land and home prices are contracting at an annual rate of around 5 per cent. Real estate investment is down and local government revenue from land sales is down 20 per cent. The financial vehicles local governments use to buy and sell land now account for nearly half of Chinese government debt, which has more than doubled in 10 years to nearly 100 per cent of GDP. On the other hand is China’s incredible lead over the US in 37 of 44 tech fields, from AI to robotics, according to a study by the Australian Strategic Policy Institute earlier this year. The crackdown on politically sensitive technologies like social media did not slow billions in new export subsidies for less sensitive ones, such as electric vehicles and solar power. This year China overtook Japan as the world’s leading exporter of EVs.

There has been an investor rush into Japan this year pushing the Nikkei 225 up 25% so opportunities there maybe limited. Maybe it is also facing an office glut like the one that gave some banks a problem in the US this year. Demand for office space in central Tokyo is slowing and while large buildings are continuing to be built the vacancy rate already stands at a 10-year high of over 6% due to more people working from home and foreign companies reviewing their operations. According to office brokerage Miki Shoji, the office vacancy rate in Tokyo's five central wards -- Chiyoda, Chuo, Minato, Shinjuku and Shibuya -- was 6.46% as of July, pushing it above 5% for 30 consecutive months. Other regions will also surpass pre-COVID levels, with Osaka at 4.6% and Nagoya at 5.5%.

I do not follow other important regions like Africa, India or South America so can offer little on those except India is growing well and may have displaced the UK as the 5th largest economy in the world.

Of all, I see the US as the safest place to invest in such times.

US Equity Exceptionalism

The first reference to the concept of American Exceptionalism by name, and possibly its origin, was by the French writer Alexis de Tocqueville in his 1835/1840 work Democracy in America. It has proved to be the case many times since, for both good and bad reasons. Today I use it for a good reason - making money for investors including myself!

Those “experts” I referred to above who last year said the world would be in deep recession by now also have constantly said the US markets are overpriced and the best plays would be in other places.

Reality tells us otherwise and begs the question that having outperformed other markets for 12 out of the last 13 calendar years, could US equities dominate for another decade? My answer is yes. Despite China’s advance in technologies the biggest tech companies are US listed ones and I expect those to maintain their leadership and values. But there are relatively unknown others that are and will continue to benefit from the...

New US Industrial Age

The first one that took the world from being based on agriculture through an age of making things to a tech age that continues and now onto another age of making things. This has been driven by political moves to reduce Chinese dominance and get more made at home plus more non-political needs to clean up our polluted environment. Added to that is low cost natural gas that is attracting some foreign companies to build factories in the US.

In an article I wrote in November last year titled Build Back Better with Ashtead/Sunbelt I listed some of the huge investments taking the US into a new industrial age.

Many more are being added, some aided by US government initiatives such as the Infrastructure Act and the Inflation Reduction Act. IRA.

They include..

- Quanta Services and Hitachi will build the largest U.S. clean energy infrastructure project according to this report .

- Businesswire reported that First Solar is to Invest up to $1.1 Billion in a fifth US Manufacturing Facility

- Air Products will boost manufacturing capacity by nearly 20% with an investment in Florida

- Putin’s barbarous invasion of Ukraine has added enormous impetus to US LNG export facility building: Sempra Energy’s Port Arthur project has reach “final investment decision”. That project along is expected to cost $13 billion. Cheniere went forward with its Corpus Christi expansion recently and Venture Global is going ahead with its Louisiana Plaquemines facility. Others are in the pipeline.

- Cummins Inc. has announced plans to invest over $1 billion in its US engine manufacturing network for a transition into hydrogen fuelled engines.

There are many more and probably add up to trillions in total.

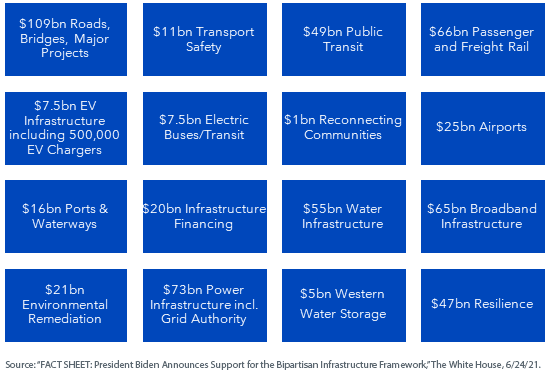

The US Infrastructure bill shows this breakdown for spending...

(Click on image to enlarge)

Added to that are the investments being made by companies with their own money.

Many companies involved in this vast buildout are already benefiting and they will continue to do so for several years to come. Those include materials companies such as Vulcan (VMC) and Martin Marietta (MLM).

I do not own those but do own both MasTec (MTZ) and Quanta Services (PWR).

MasTec

MasTec, Inc. (MTZ) is an infrastructure construction company. The Company's segments include Communications, Clean Energy and Infrastructure, Oil and Gas and Power Delivery. Its Communications segment provides engineering, construction, maintenance related to communications infrastructure. A growing segment due to US internet connection needs.

Its Clean Energy and Infrastructure segment primarily serves energy, utility, government and other end-markets through the installation and construction of power generation facilities, primarily from clean energy and renewable sources. That will benefit from the US IRA monies.

Oil and Gas segment provides engineering, construction and maintenance services for pipelines and processing facilities for the energy and utilities industries.

Its Power Delivery segment serves the energy and utility industries through the engineering, construction and maintenance of power transmission and distribution infrastructure, including electrical and gas transmission lines, distribution network systems and substations. Those systems are in a mess in the US and need massive investment in repair and upgrading.

MTZ’s finances are sound and it has a full order book. Profitability has not been good but I shall continue to hold because of the potential plus the fact the founders are executives and big shareholders too. More can be found on the company’s website.

Quanta Services

Quanta (PWR) does many similar things to MTZ but there is plenty of room for both plus PWR also operates in other countries. It is a provider of comprehensive infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline and energy industries in the United States, Canada, Australia and select other international markets.

The company's Electric Power Infrastructure Solutions segment is engaged in the design, procurement, new construction, upgrade and repair and maintenance services for electric power transmission and distribution infrastructure. The Renewable Energy Infrastructure Solutions segment provides infrastructure solutions, including engineering, procurement, and repair and maintenance for renewable generation facilities, such as wind, solar, and hydropower generation facilities and battery storage facilities.

Its Underground Utility and Infrastructure Solutions segment provides infrastructure solutions to customers involved in the transportation, distribution, storage, development and processing of natural gas, oil and other products.

The electric power and renewable energy work is the biggest growth area given the mess the power generation systems and transmission grids are in. Huge new demand is added all the time and massive investments are needed or whole systems will collapse. I wrote a lengthy article on this 5 years ago titled Pass the Candle, Please but little has been done to improve the supply side since while demand continues to increase.

That extra demand comes from population growth, electric cars, data centres, air conditioning, blockchain, quantum computing and heat pumps with the demands of artificial intelligence coming soon. The latter might fix what human intelligence has not so far!!

PWR’s finances are sound and growth prospects very strong. More details can be found on the company website.

A couple of things could be of concern; PWR’s PE is around 50 and insiders have been selling recently.

That brings me back to the article title...

Mixed Signals Suggest Both Boom And Bust

On balance I see neither extreme anywhere but I do see much of the world in a go slow time apart from the US where the points I mentioned and many more should feed into reasonable growth for at least another year. Even if a recession were to occur the many huge projects already started will not stop until completion by which time a recession could be over. That makes MTZ and PWR - that are otherwise cyclical stocks - relatively safe and, in my view, a good buy.

Threats could come from a failure to raise the US debt ceiling and from some on the Republican side of US politics wanting to dilute or repeal parts of the IRA but since both sides want more manufacturing done at home I am optimistic that a new industrial age has commenced in the US.

If so, my picks and many others will enjoy near boom times for several years to come and that will ripple out to others and into the economy generally. History shows us that.

Ideas and picks from readers will be most welcome in the comment boxes after this article. That way we can share ideas. I am eager to learn of other companies that will be part of this new age building and that could thus make worthwhile investments - pots of gold at the end of the rainbow.

James

More By This Author:

Alexandria - A Market Ugly Duckling That Is A Stock Pickers Swan

Plug Power Has Unplugged Investors

T’Winners From The Deferred Energy Crisis

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

More mixed signals from near recession EU

https://seekingalpha.com/news/4013484-eu-car-registrations-jump-21-in-august

I just came across this article that adds strength to my views...

https://talkmarkets.com/content/us-markets/the-manufacturing-construction-boom-and-nonresidential-investment?post=402510

The power of articles on Talk Markets!

My featured picks both went up nicely imediately after publication.

PWR closed up 1.23% yesterday.

MTZ up 4.16%

Fogbow???

Hello Samantha. They are rare and very beautiful. Fogbows also go by the names white rainbow, cloudbow or ghost rainbow. They're made much as rainbows are, from the same configuration of sunlight and moisture. Rainbows happen when the raindrops fill the air. You always see a rainbow in the direction opposite the sun. Fogbows are much the same, always opposite the sun.

Bye. James

Thanks for enlightening me!

A pleasure. Thank you for reading my article. James

I haven't been following the investor rush into Japan, but I think it's time to invest in the Middle East. And I'm not just talking about Dubai. Thanks to the Abraham Accords we're closer to peace in the Middle East than ever before, and the chatter is that Israel and Saudia Arabia are about to sign a treaty and normalize relations.

Good points. I do not watch those parts closely but I have an investment in Air Products, APD, that is doing big things in the new world city being built in Saudi Arabia

Dangerous times are coming. Covid is resurging, Corporations keep raising prices despite record profits. The Axis of evil (Russia, Iran, China, and I'll throw in Noth Korea) are getting aggressive. And the US is heading towards a civil war with people no longer having faith in the electoral system and Trump on trial.

Time to invest in guns and ammo. No joke. Liquor companies too. Except Bud Light ;-)

Thank you for reading and commenting. Hopefully none of those threats will come to pass. I think Covid will be suppressed this time round. Protests in Iran night oust its leaders. Russia has lost many of its young people because they don't want to go to war and the Chinese emperor does not want war with the west.

The US political scene is not healthy but the optimist in me thinks common sense normal people will prevail over the extremes. James

I hope your right, but I too fear America is the closest it has been to Civil War since the 1800's.

I agree. It is frightening and very frustrating not being able to influence change. There are no winners in wars, only losers. James

Well said.