Unmasking The Bear's Footprint - Is There Still Room For Growth?

Image Source: Unsplash

In the video, we take a look at:

- The only essential element to confirm if the bull or bear is winning.

- The outperforming sector to focus on maximizing the return

- The red flag for a trend reversal to watch out for

- The price target for S&P 500 and Nasdaq 100

- And a lot more

Video Length: 00:09:26

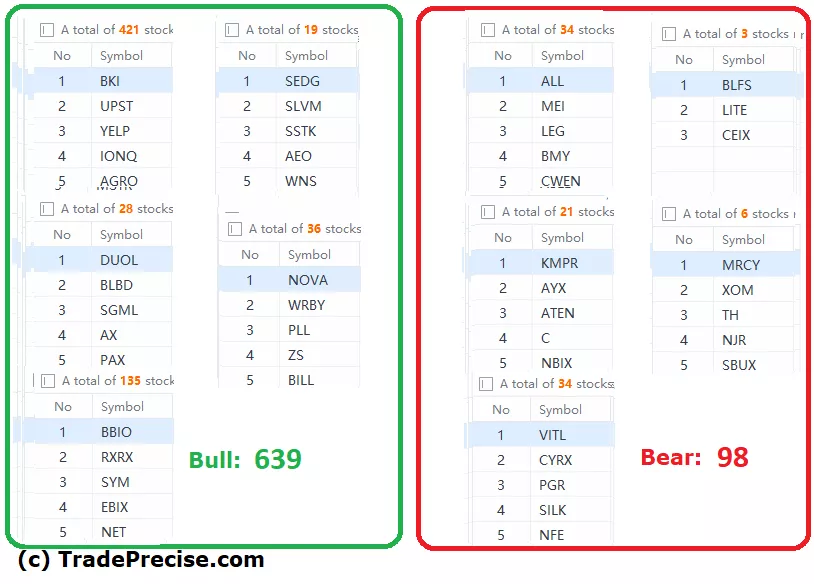

The bullish vs. bearish setup is 639 to 98 from the screenshot of my stock screener below pointing to a positive market environment.

(Click on image to enlarge)

Both the long-term and the short-term market breadth are pointing to a sustainable rally (e.g. buy on dip is back) with strength.

13 “low hanging fruits” (ACLS, UBER, etc…) trade entries setup + 25 others (U, PETQ, etc…) plus 17 “wait and hold” candidates are discussed in the video (47:04) accessed by subscribing members below.

(Click on image to enlarge)

A “Good Problem” from A Member

Below is a screenshot from a member.

And here is her problem: how to maximize the profit while only focusing on the “strongest stocks” among a few dozen of decent trade setups?

This is indeed a “good problem” to have in the current market environment.

Perhaps some would think that she could focus on the top 5 stocks and scale in to maximize the return while scaling out the rest of the stocks. This makes sense only if there are valid setups that show up in the top 5, else this will only increase the risk.

At this point, it is essential to re-assess the trading plan.

-

Short-term swing trade or long-term swing trade?

-

Are you comfortable switching to a position trade to aim for a higher target price and managing accordingly? This will involve allowing a higher drawdown if the stocks have a meaningful pullback.

-

Could you redeploy the money stuck in those underperformed stocks back to those that trigger your setup?

The answers to the questions above are different for everyone. Therefore the trading plan will be different based on the risk profile and the adopted tactics according to the market environment.

Let me know what would you do if you are the owner of the portfolio above.

More By This Author:

XRT ETF Unleashes Profits: How To Trade The Cup & Handle Breakout With Leveraged ETF RETL

Market Rotation Into One Juicy Group Could Put A Cap On Nasdaq

Market Correction Or New High? Is History Repeating Itself Or Taking A Different Path

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.