Market Correction Or New High? Is History Repeating Itself Or Taking A Different Path

Image Source: Pexels

Watch the video extracted from the live session on 4 Jul 2023 below to find out the following:

- Is history repeating itself in terms of market correction or will the current situation take a different path?

- The potential path of the S&P 500 in the first 2 weeks of July based on price action and the seasonality

- An emerging theme consisting of lots of aggressive growth stocks

- The key levels to watch out for

- And a lot more

Video Length: 00:14:11

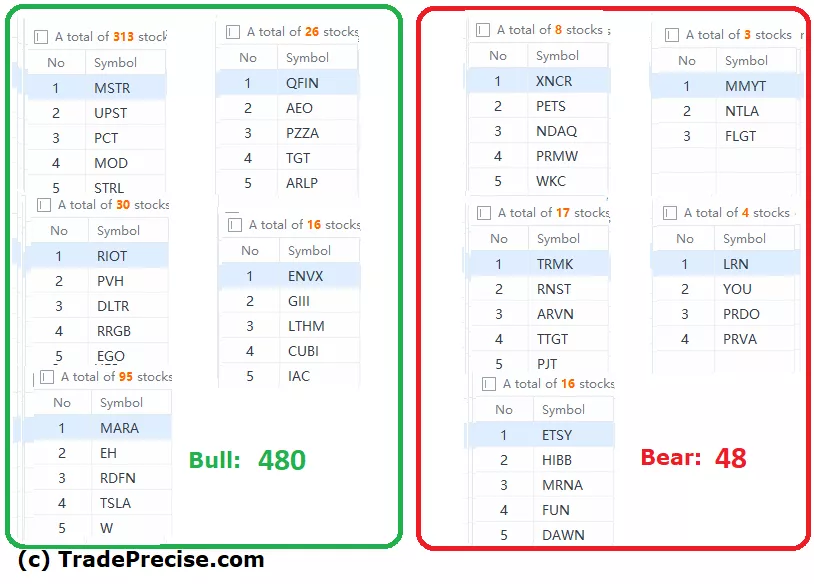

The bullish vs. bearish setup is 480 to 48 from the screenshot of my stock screener below pointing to a positive market environment.

Both the short-term and the long-term market breadth have improved significantly, which tally with the bullish vs. bearish setup as shown above.

13 “low hanging fruits” (META, APP, etc…) trade entries setup + 38 others (U, SKYW, etc…) have been discussed during the live session.

(Click on image to enlarge)

More By This Author:

Stopping Action Detected: Get Ready For A Bounce At This Support Zone

Market Breadth Signals Decoded: Crash Or Healthy Pullback?

Market Rotation Unfolding - What Nasdaq Analogue Reveals About The S&P 500's Next Move

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.