Stopping Action Detected: Get Ready For A Bounce At This Support Zone

Image Source: Unsplash

Watch the video extracted from the live session on 27 Jun 2023 below to find out the following:

- Current market conditions, specifically the pullback and the support zone to watch for a potential bounce

- 1 outperformance industrial group that stood out during the market pullback.

- Using the volume spread analysis to spot the stopping action with hidden demand.

- The characteristics of a change of character wave for a trend reversal.

- And a lot more

Video Length: 00:07:28

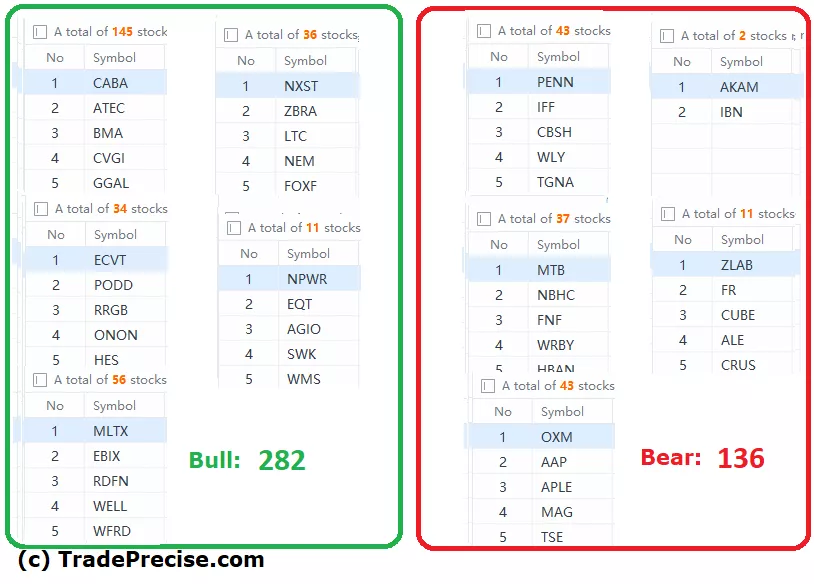

The bullish vs. bearish setup is 282 to 136 from the screenshot of my stock screener below pointing to a positive market environment. Even though the market was pulling back last week, there is still no shortage of bullish trade setups.

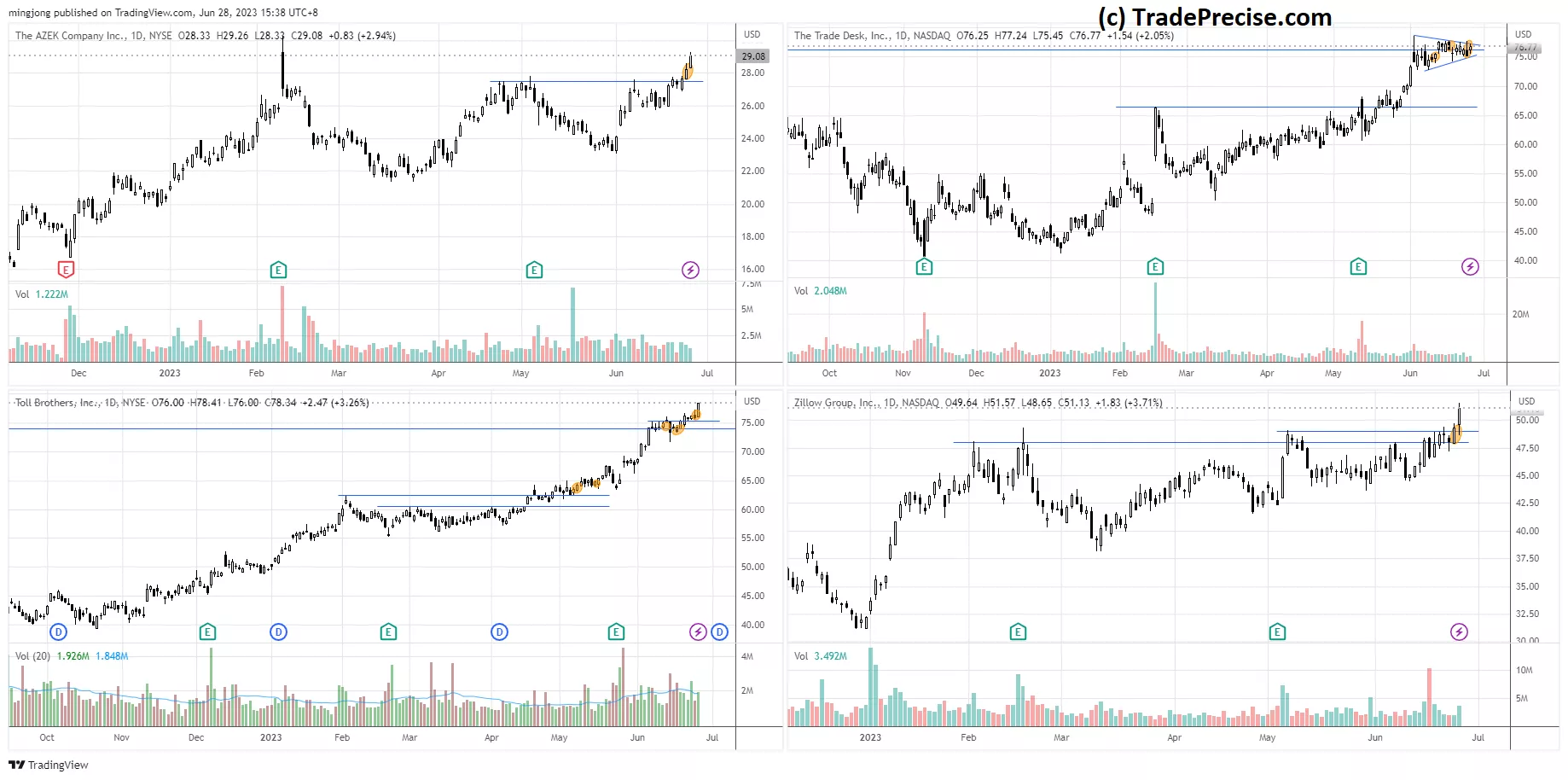

The short-term market breadth dropped below 50 confirming the market is in a pullback mode. 15 “low hanging fruits” (AZEK, TTD, etc…) trade entries setup + 28 others (TOL, Z, etc…) have been discussed during the live session.

(Click on image to enlarge)

More By This Author:

Market Breadth Signals Decoded: Crash Or Healthy Pullback?

Market Rotation Unfolding - What Nasdaq Analogue Reveals About The S&P 500's Next Move

Market Rotation Alert: Key Areas To Shift Your Attention For Potential Profits

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.