Market Breadth Signals Decoded: Crash Or Healthy Pullback?

Image Source: Pexels

In this video, you will find out the following:

- The significance of market breadth in determining the stock market's health

- How to use the market breadth signals to make more informed decisions

- The trade management I am using in this ongoing volatile market to lock in profits yet still not missing out on the potential strong trend.

- The potential path of the S&P 500 for a pullback/consolidation scenario and a market correction scenario.

- And a lot more

Video Length: 00:11:19

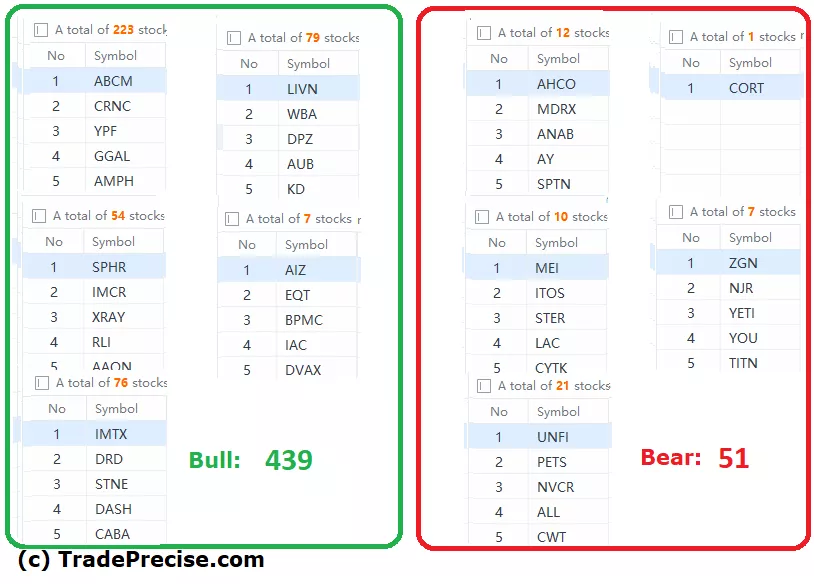

The bullish vs. bearish setup is 439 to 51 from the screenshot of my stock screener below pointing to a positive market environment.

The short-term market breadth is close to overbought suggesting strength with alert while the long-term market breadth has further improved from last week.

More By This Author:

Market Rotation Unfolding - What Nasdaq Analogue Reveals About The S&P 500's Next Move

Market Rotation Alert: Key Areas To Shift Your Attention For Potential Profits

Bifurcated Market, Lousy Market Breadth: Is A Crash Looming Or A Bull Run Brewing?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.