Market Rotation Unfolding - What Nasdaq Analogue Reveals About The S&P 500's Next Move

Watch the video below to find out the potential roadmap for S&P 500 using Nasdaq 100 as an analogue and how the ongoing market rotation started on 2 June 2023 into the small and mid-cap stocks will impact the Nasdaq 100, Russell 2000, Dow Jones and S&P 500.

Video Length: 00:12:18

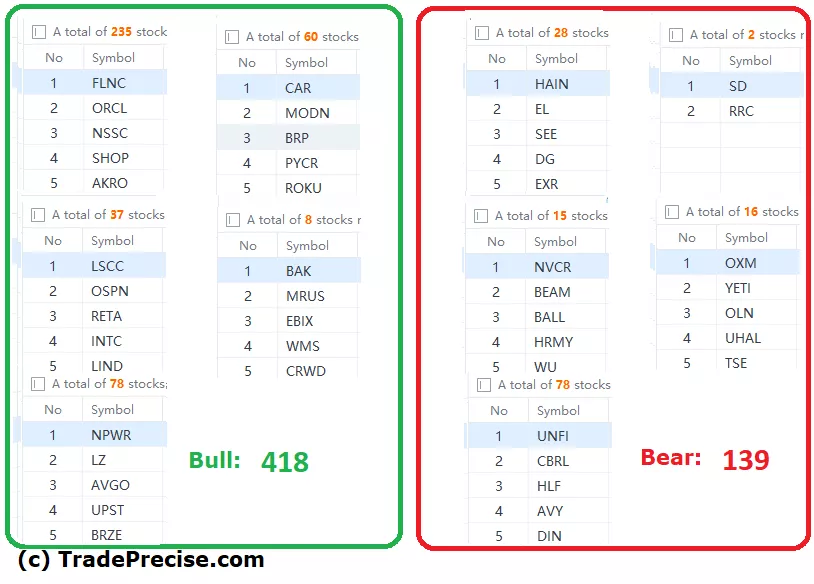

The bullish vs. bearish setup is 418 to 139 from the screenshot of my stock screener below pointing to a positive market environment.

The short-term market breadth is close to overbought suggesting strength with alert while the long-term market breadth is greater than 50 thanks to the ongoing market rotation. If the market breadth can be further improved, this will be very constructive to the bull run as there are more stocks to participate in the rally.

More By This Author:

Market Rotation Alert: Key Areas To Shift Your Attention For Potential Profits

Bifurcated Market, Lousy Market Breadth: Is A Crash Looming Or A Bull Run Brewing?

Aggressive Demand Falters In S&P 500: Will A Shakeout Follow?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.