Aggressive Demand Falters In S&P 500: Will A Shakeout Follow?

Image Source: Unsplash

Find out why there could be a potential shakeout in S&P 500 due to lacking aggressive demand and how weak holders could be flushed out. Watch the video below till the end to find out how you should position yourself in this market environment.

Video Length: 00:08:00

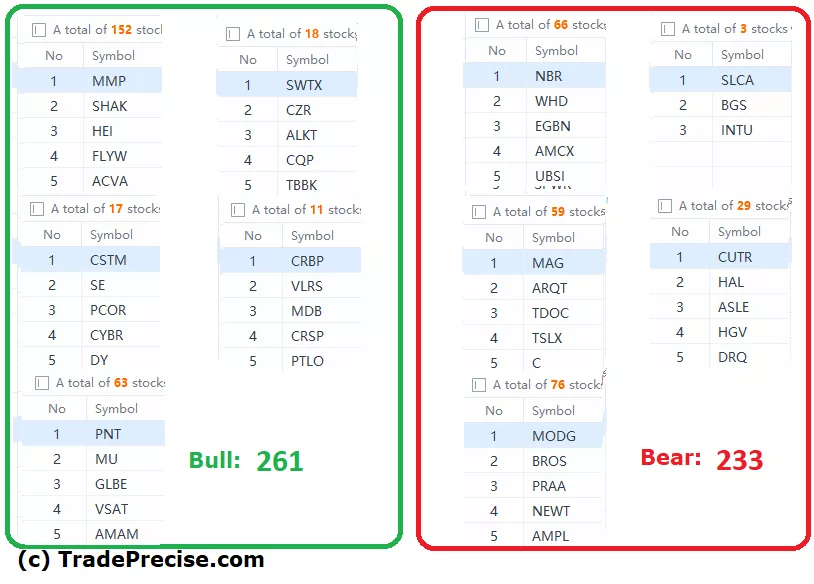

The bullish setup vs. the bearish setup is 261 to 233 from the screenshot of my stock screener below pointing to a positive market environment.

Yet the market breadth is still neutral towards positive suggested not an easy-money environment. The breakout entry setup on GOOGL and LRCX as discussed in the last session has followed through to the upside, which further proves the key to be very selective in stock picking. Big cap growth is still the dominant theme.

More By This Author:

Using Wyckoff’s Effort Vs. Result To Unlock The S&P 500 Direction Bias For Swing & Day Trading

2023 Winning Industries: These Sectors Are Dominating The Stock Market

Has The Market Bottomed In Oct 2022? Check This Hint From Bloomberg

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.